Dolly Varden Silver Intersects 14.50 g/t Gold over 21.18 Meters, Including 113 g/t Gold and 997 g/t Silver over 0.68 Meters at Homestake Silver Deposit

Rhea-AI Summary

Dolly Varden Silver (DVS) reported drill results from the Homestake Silver deposit on December 4, 2025 that expand a shallow northerly-plunging high-grade gold trend. Step-out hole HR25-475 intersected 14.50 g/t Au and 75 g/t Ag over 21.18 m, including 113 g/t Au and 997 g/t Ag over 0.68 m and 121 g/t Au and 279 g/t Ag over 0.63 m, within a 48.38 m envelope grading 7.01 g/t Au and 35 g/t Ag. Estimated true widths range from 65%–75% of core length and further modelling is required. The 2025 program drilled 56,131 m in 86 holes, with ~40% at Homestake Ridge focused on step-outs and infill along the Homestake Silver zone.

Positive

- HR25-475 step-out of 42 m extends high-grade plunge

- Primary intercept 14.50 g/t Au over 21.18 m

- High-grade cores of 113 g/t Au and 121 g/t Au

- 56,131 m drilled in 86 holes during 2025 season

Negative

- True widths not final; estimated at 65%–75% of core lengths

- Very narrow high-grade shoots (0.63–0.68 m) within broader zone requiring modelling

News Market Reaction

On the day this news was published, DVS declined 0.87%, reflecting a mild negative market reaction. Argus tracked a peak move of +3.6% during that session. Our momentum scanner triggered 19 alerts that day, indicating notable trading interest and price volatility. This price movement removed approximately $4M from the company's valuation, bringing the market cap to $454M at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Before this release, DVS was down 1.29% while peers were mixed: SVM +2.89%, EXK +2.84%, AG +4.41%, MAG -1.96%, NVDSF 0%, suggesting stock-specific factors rather than a uniform silver-sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 08 | Merger announcement | Positive | -6.0% | Merger-of-equals to form Contango Silver & Gold with combined assets. |

| Dec 04 | Drill results | Positive | -0.9% | Homestake Silver step-out hole HR25-475 with high-grade Au-Ag intercepts. |

| Nov 10 | Drill results | Positive | +8.1% | High-grade Homestake Silver gold intercepts extending main zone along plunge. |

| Oct 17 | Program update | Positive | +9.6% | Completion of 2025 Kitsault Valley drill program totaling 56,131 m in 84 holes. |

| Oct 01 | Equity financing | Neutral | +2.8% | $30M bought-deal financing to fund Kitsault Valley exploration and drilling. |

Over the last five events, exploration updates have often aligned with positive price reactions, while the latest drill release and the merger announcement coincided with negative moves, indicating occasional divergence even on constructive news.

Recent news shows Dolly Varden advancing both corporate strategy and exploration. On Oct 1, a $30 million bought-deal financing was announced. Through Oct 17 and Nov 10, the company reported a 56,131 m, 86-hole 2025 program and multiple high-grade Homestake Silver intercepts, with generally positive price reactions. The Dec 4 Homestake Silver results and the Dec 8 merger announcement each saw negative next-day moves, showing that strong technical or strategic news has not always translated into immediate price strength.

Market Pulse Summary

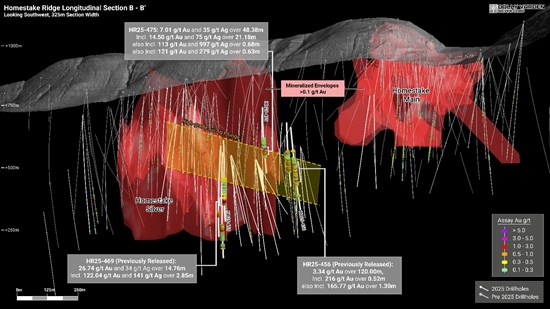

This announcement detailed step-out drilling at Homestake Silver, highlighted by HR25-475 with 14.50 g/t Au and 75 g/t Ag over 21.18 m within a broader 48.38 m mineralized interval. The results extend a shallow, high-grade plunge that has now been traced for more than 300 m vertically and over 1,000 m along plunge. Investors may monitor future assays from the 56,131 m 2025 program, ongoing modelling of true widths, and how these intercepts feed into updated resource interpretations.

Key Terms

epithermal vein stockwork technical

vein breccia technical

Inductively Coupled Plasma Mass Spectrometry technical

ICP-MS technical

fire assay technical

metallic screen technical

Quality Assurance and Quality Control technical

NI 43-101 regulatory

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - December 4, 2025) - Dolly Varden Silver Corporation (TSXV: DV) (NYSE American: DVS) (FSE: DVQ) (the "Company" or "Dolly Varden") is pleased to report results from drilling that expands the high-grade gold mineralized plunge within the Homestake Silver deposit. Drill hole HR25-475 is a step-out 42 meters to the north and on the upper edge of the shallowly northerly plunging, high grade trend. The intercept grades 14.50 g/t Au and 75 g/t Ag over 21.18 meters, including 113 g/t Au and 997 g/t Ag over 0.68 meters and 121 g/t Au and 279 g/t Ag over 0.63 meters. The high-grade mineralization in HR25-475 is hosted within a broader mineralized zone grading 7.01 g/t Au and 35 g/t Ag over 48.38 meters.

Homestake Silver Deposit step-out:

HR25-475: 14.50 g/t Au and 75 g/t Ag over 21.60 meters, including 113 g/t Au and 997 g/t Ag over 0.68 meters and 121 g/t Au and 279 g/t Ag over 0.63 meters within a total mineralized envelope grading 7.01 g/t Au and 35 g/t Ag over 48.38 meters.

* Intervals shown are core length. Estimated true widths vary depending on intersection angles and range from

"The expansion of the wide, high-grade gold and silver mineralization in the Homestake Silver Deposit continues to demonstrate the continuity and robustness of the potentially bulk underground minable zone. We will continue to release results from the 2025 program as they are received." said Shawn Khunkhun, President and CEO of Dolly Varden."

Drill hole HR25-475 is in 42 meters step-out to the north from HR24-448 (February 3, 2025 release) along plunge of the main gold and silver zone at the Homestake Silver deposit. The high-grade core of the Homestake Silver Deposit has been traced for over 300 meters vertically and extends for over 1,000 meters along plunge. The intercept occurs at the upper edge of the high-grade trend.

Figure 1. Longitudinal Section of the Homestake Silver Deposit with mineralization envelope in red. Shallow northerly plunging trend of broad mineralization with multiple narrower high grade gold veins and vein breccias within shown in yellow. Mineralization in drill hole HR25-475 intersected high grade gold mineralization at the upper edge of the modelled zone. Previously released 2025 intersects are included (October 1 and November 10, 2025 releases).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/276901_b24c2114645468bd_002full.jpg

Figure 2. NQ size drill core from Homestake Silver hole HR25-475 showing 21.18m interval grading 14.50 g/t Au with higher grade intervals in red. Au and Ag mineralization occurs in multi-phase vein and vein breccias with pyrite, galena, sphalerite and visible gold.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/276901_b24c2114645468bd_003full.jpg

Homestake Silver

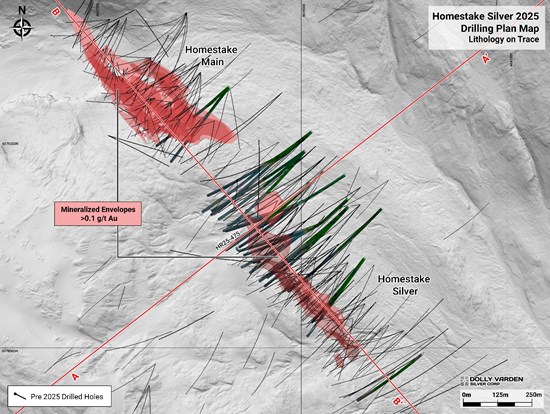

At total of 56,131 meters were drilled in 86 drill holes during the 2025 season by Dolly Varden with approximately

The Company is using directional drilling technology to precisely target areas for step-out and infill holes at Homestake Silver. Drill hole HR25-475 was drilled as a single hole utilizing directional drilling to precisely intercept the target within the mineralized zone.

The Homestake Ridge Deposits are interpreted as structurally controlled, multi-phase epithermal vein stockwork and vein breccia system hosted in Jurassic Hazelton volcanic rocks. Mineralization consists of pyrite, +/- galena and sphalerite, with visible gold in a silica breccia matrix. The northwest trending structural corridor hosts multiple subparallel structures that control high-grade gold and silver shoots within a broader mineralized enveloper.

Although historically considered a silver-rich gold deposit, recent drilling at Homestake Silver has define a shallow north plunging dilation zone that is defined by a wide mineralized interval with increased frequency of high-grade gold veins and vein breccias which shows a shift towards a gold-rich system towards the north. The deposit remains open along plunge and at depth.

Figure 3. NQ drill core from hole HR25-475 at the Homestake Silver Deposit of sample intervals ranging in grade from 6.68 g/t Au to 70.80 g/t Au from <1.0m individual samples in typical mineralization style from the upper portion of the Homestake Silver main Zone. Multi-phase epithermal vein and vein breccias with high temperature quartz-sericite-pyrite alteration strong pyrite, and visible gold.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/276901_figure3.jpg

Figure 4. Plan of Homestake Ridge >0.1g/t Au mineralized zones (in red) highlighting all 2025 drilling completed with lithology on drill trace. The focus in the 2025 drilling was at Homestake Silver.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/276901_b24c2114645468bd_005full.jpg

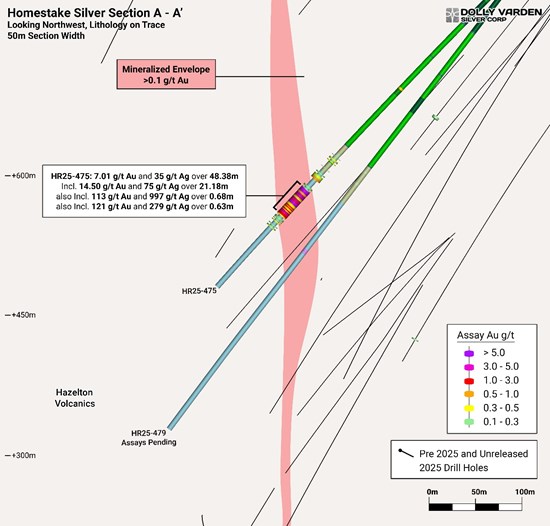

Figure 5. Cross section including drill hole HR25-475 at Homestake Silver deposit with projected mineralized zone (in red).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/276901_b24c2114645468bd_006full.jpg

Table 1: Drill Hole Assays from Homestake Silver

| Target | Hole ID | From (m) | To (m) | Length (m)* | Au (g/t) | Ag (g/t) | Base Metals (%) |

| Homestake Silver | HR25-475 | 358.81 | 407.19 | 48.38 | 7.01 | 35 | |

| Main min. zone | 360.00 | 381.18 | 21.18 | 14.50 | 75 | ||

| including | 360.00 | 370.51 | 10.51 | 21.60 | 132 | ||

| with | 362.72 | 363.40 | 0.68 | 113 | 997 | ||

| with | 366.60 | 367.23 | 0.63 | 121 | 279 | ||

| and including | 374.50 | 381.18 | 6.68 | 11.40 | 28 |

*All intervals shown are core length. Estimated true widths vary depending on intersection angles and range from

Table 2: Drill hole data for Homestake Silver hole reported in this release

| Hole ID | Easting UTM83 (m) | Northing UTM83 (m) | Elev. (m) | Azimuth | Dip | Length (m) |

| HR25-475 | 463535 | 6179103 | 843.7 | 227 | -45 | 504 |

Quality Assurance and Quality Control

The Company adheres to CIM Best Practices Guidelines for exploration related activities conducted on its property. Quality Assurance and Quality Control (QA/QC) procedures are overseen by the Qualified Person.

Dolly Varden QA/QC protocols are maintained through the insertion of certified reference material (standards), blanks and field duplicates within the sample stream. Drill core is cut in-half with a diamond saw, with one-half placed in sealed bags and shipped to the laboratory and the other half retained on site. Third party laboratory checks on

Analytical testing was performed by ALS Canada Ltd. in North Vancouver, British Columbia. The entire sample is crushed to

Qualified Person

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden, the "Qualified Person" as defined by NI 43-101 has reviewed and approved the scientific and technical information contained in this news release. Rob van Egmond, P.Geo. is not independent of the Company in accordance with NI 43-101.

About Dolly Varden Silver Corporation

Dolly Varden Silver Corporation is a mineral exploration company focused on advancing its

Forward-Looking Statements

This release may contain forward-looking statements or forward-looking information under applicable securities legislation that may not be based on historical fact, including, without limitation, statements containing the words "believe", "may", "plan", "will", "estimate", "continue", "anticipate", "intend", "expect", "potential", "prospective" and similar expressions. Forward-Looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Dolly Varden to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements, including, without limitation, risks associated with the speculative nature of exploration and development of minerals; the anticipates substantial future capital expenditures associated with the exploration and development of its assets and there can be no assurance that debt or equity financing will be available; inherent competition in the mining industry; risks associate with volatility in mineral prices; risks inherent in the estimation of mineral resources; environmental risks associated with the exploration and development of mineral properties; the Company is reliant on key personnel; risks associated with working in remote regions; risks associated with maintaining positive community relations; and the other risks disclosed in the Company's annual information form ("AIF") dated April 30, 2025 for the year ended December 31, 2024, which is available on SEDAR+ at www.sedarplus.ca, and in the Company's Form 40-F registration statement as filed with the U.S. Securities and Exchange Commission, which is available on EDGAR at www.sec.gov. The risk factors identified in the Company's public filings are not intended to represent a complete list of factors that could affect the Company. Forward-looking statements are based on management's current expectations and beliefs and assume, among other things, the ability of the Company to satisfy the requirements of listing and registration, and to successfully pursue its current development plans, that future sources of funding will be available to the Company, that relevant commodity prices will remain at levels that are economically viable for the Company and that the Company will receive relevant permits in a timely manner in order to enable its operations, but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward-looking statements or information. The Company disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

For further information: Shawn Khunkhun, CEO & Director, 1-604-609-5137, www.dollyvardensilver.com.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276901