Canamera Acquires Great Divide Basin Uranium Project in Wyoming

Rhea-AI Summary

Canamera (CSE:EMET | OTCQB:EMETF) entered an option agreement to acquire up to a 90% interest in the Great Divide Basin uranium project in Fremont and Sweetwater counties, Wyoming, covering 104 claims (~2,080 acres).

Earn-in is staged: initial 51% requires 500,000 shares, $130,000 cash and $750,000 exploration spend within 18–24 months; steps to 71% and 90% require additional share issuances (~$250,000 each), cash of $75,000 each, and $1.0M exploration spends per stage within 3–4 years. Property carries a 1.25% NSR. The project adjoins Premier American Uranium’s Cyclone project and includes historical roll-front drilling and identifiable 1970s drill pads.

Positive

- Up to 90% earn-in available through three staged options

- 2,080 acres (104 claims) in a prolific Wyoming uranium district

- Adjoins Cyclone project, improving district-scale potential

- Extensive historical drilling and identifiable 1970s drill pads

Negative

- Property subject to a 1.25% NSR

- Earn-in requires cumulative exploration spends of at least $2.75M

- Transaction includes share issuances (500,000 + two $250k issuances), causing potential dilution

- Multiple cash payments totaling $355,000 across earn-in stages

News Market Reaction

On the day this news was published, EMETF gained 5.81%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

No peer stocks or sector data were flagged in momentum or headline scanners, suggesting the setup before this announcement was company-specific rather than part of a broader sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 08 | Uranium project option | Positive | +5.8% | Option to earn up to 90% of Wyoming uranium project with staged spending. |

| Dec 04 | Flow-through financing | Negative | -8.2% | Non-brokered flow-through placement to raise up to $1.12M at $0.56 per unit. |

| Dec 02 | New claims staked | Positive | +7.9% | Staking of 85 mining claims near Teck’s Iron Hill deposit in Colorado. |

Across the last three announcements, price moves aligned with the nature of the news: asset expansions saw positive reactions, while a financing coincided with a decline.

Over recent days, Canamera reported several growth-oriented updates. On Dec 2, it staked 85 new claims in Colorado, and on Dec 4 it announced a flow-through private placement of up to $1.12M, which coincided with a -8.21% move. The Great Divide Basin option, allowing up to a 90% interest over staged spending, previously aligned with a +5.81% reaction, reinforcing a pattern of positive responses to project expansion news.

Market Pulse Summary

The stock moved +5.8% in the session following this news. A strong positive reaction aligns with the company’s recent pattern of constructive responses to asset expansion, as seen with prior claim staking and this uranium option, which previously coincided with moves of +7.89% and +5.81%. Investors have tended to reward growth in project pipeline, though elevated spending commitments and financing needs—such as the recent flow-through placement—could temper sustainability if capital markets support weakens.

Key Terms

option agreement financial

net smelter royalty financial

roll-front mineralization medical

Bureau of Land Management regulatory

Qualified Person regulatory

National Instrument 43-101 regulatory

AI-generated analysis. Not financial advice.

EDMONTON, AB / ACCESS Newswire / December 8, 2025 / Canamera Energy Metals Corp. (CSE:EMET)(OTCQB:EMETF)(FSE:4LF0) (the "Company" or "Canamera") announces that it has entered into an option agreement (the "Option Agreement") to acquire up to a

The Project comprises 104 unpatented mining claims covering approximately 2,080 acres in Wyoming's Great Divide Basin, a prolific uranium-producing region with historical production and ongoing exploration by multiple operators. The acquisition represents Canamera's entry into uranium exploration in the United States and provides the potential for exposure to a commodity with strengthening market fundamentals.

"The Great Divide Basin represents an attractive opportunity to expand our critical minerals focus into uranium," said Brad Brodeur, Chief Executive Officer. "With historical drilling, roll-front mineralization [ and proximity to advanced-stage projects in the district, GDB provides a strong foundation for systematic exploration."

Option Agreement Terms

Under the Option Agreement with Clean Nuclear Energy Corp., a wholly-owned subsidiary of Nexus Uranium Corp. (CSE:NXSU), Canamera may acquire up to a

First Option (in order to earn a

Issuance of 500,000 common shares of Canamera to Nexus within 5 days;

Cash payment of

$30,000 within 5;Cash payment of

$100,000 within 18-months;Exploration expenditures of

$250,000 within 18-months; andAdditional exploration expenditures of

$500,000 within two years.

Second Option (in order to earn an additional

Issuance of

$250,000 worth of Canamera shares to Nexus;Cash payment of

$75,000 ; andAdditional exploration expenditures of

$1,000,000 , all within three years.

Third Option (in order to earn an additional

Issuance of

$250,000 worth of Canamera shares to Nexus;Cash payment of

$75,000 ; andAdditional exploration expenditures of

$1,000,000 , all within four years.

The Property is subject to a

Great Divide Basin Project

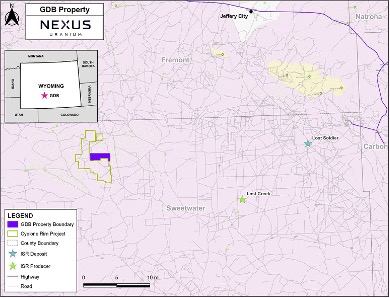

The GDB project is located southwest of Jeffrey City and northwest of Wamsutter, Wyoming. The property adjoins Premier American Uranium's Cyclone Project and is readily accessible by gravel and maintained roads administered by the Bureau of Land Management ("BLM").

Mineralization on the GDB property is hosted within typical roll-front deposits, the primary deposit type in Wyoming's uranium districts. The project benefits from extensive historical drilling dating back to the 1970s, with many drill pads still identifiable on the western portion of the claims. Historical drilling by Tournigan Energy on adjacent ground reported a number of holes drilled 500 to 1,000 feet southwest of the Project.

Figure 1: Claims Map

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Warren Robb, P.Geo. (British Columbia), Vice-President, Exploration of the Company and a "Qualified Person" as defined by National Instrument 43-101..

About Canamera Metals Corp.

Canamera Energy Metals Corp. is a critical minerals exploration company building a diversified portfolio of interests in energy metals and rare earth element projects across the Americas, including options in the Great Divide Basin uranium project in Wyoming, and the Turvolândia and São Sepé rare earth element projects in Brazil. In Canada, the Company's portfolio includes the options to purchase

FOR FURTHER INFORMATION PLEASE CONTACT:

Brad Brodeur, Chief Executive Officer

brad@canamerametals.com 780-238-7163

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation, including statements regarding: the Company's planned exploration activities on the Project; the anticipated timing and completion of the earn-in milestones under the Option Agreement; the Company's ability to make required cash and share payments and incur required exploration expenditures; the geological prospectivity of the Project and the potential to identify mineral resources; the formation of a joint venture following exercise of the options; and the Company's exploration strategy.

Forward-looking information is based on assumptions, estimates, and opinions of management at the date the statements are made and is subject to a variety of risks and uncertainties that could cause actual results to differ materially from those anticipated or projected. These assumptions include, without limitation: the Company's ability to raise sufficient capital to fund its exploration programs and option payments; favourable regulatory conditions; continued access to the Project; and general economic conditions.

Important risk factors that could cause actual results to differ materially include, but are not limited to: uncertainties related to raising sufficient financing; the inherently speculative nature of mineral exploration; title risks; environmental and permitting risks; and fluctuations in uranium prices. Additional risk factors affecting the Company can be found in the Company's continuous disclosure documents available at www.sedarplus.ca .

Readers are cautioned not to place undue reliance on forward-looking information. The Company does not intend, and expressly disclaims any obligation, to update or revise any forward-looking information whether as a result of new information, future events, or otherwise, except as required by applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Canamera Energy Metals Corp

View the original press release on ACCESS Newswire