Electric Metals Announces Positive PEA for the 100% US Domestic North Star Manganese Project Providing 100% U.S. Domestic Supply of HPMSM, Post-Tax NPV10% of US$1.39 Billion, IRR of 43.5%, and 23-Month Payback

Electric Metals (OTCQB:EMUSF) has announced positive results from its Preliminary Economic Assessment (PEA) for the North Star Manganese Project in Emily, Minnesota. The project demonstrates robust economics with a post-tax NPV10% of US$1.39 billion, an IRR of 43.5%, and a 23-month payback period.

The project aims to become the first fully U.S. domestic producer of high-purity manganese sulphate monohydrate (HPMSM), addressing the country's 100% import reliance on manganese. The PEA outlines a 25-year project life with initial capital expenditure of US$474.8 million, producing an average of 180,331 tonnes of HPMSM annually after expansion.

The Emily Manganese Deposit features 7.6 million tonnes of Inferred Resources at 19.1% Mn and 3.7 million tonnes of Indicated Resources at 17.0% Mn, representing North America's highest-grade manganese deposit.

Electric Metals (OTCQB:EMUSF) ha annunciato risultati positivi dalla sua Valutazione Economica Preliminare (PEA) per il North Star Manganese Project a Emily, Minnesota. Il progetto mostra solidi parametri economici con un NPV post-tasse al 10% di US$1,39 miliardi, un IRR del 43,5% e un periodo di payback di 23 mesi.

L'obiettivo è diventare il primo produttore completamente nazionale negli USA di solfato di manganese monoidrato ad alta purezza (HPMSM), rispondendo alla dipendenza totale del paese dalle importazioni di manganese. La PEA delinea una vita utile del progetto di 25 anni con un investimento iniziale di US$474,8 milioni, producendo una media di 180.331 tonnellate di HPMSM all'anno dopo l'espansione.

Il deposito di manganese di Emily presenta 7,6 milioni di tonnellate di risorse Inferred al 19,1% Mn e 3,7 milioni di tonnellate di risorse Indicated al 17,0% Mn, rappresentando il giacimento di manganese più ricco del Nord America.

Electric Metals (OTCQB:EMUSF) ha anunciado resultados positivos de su Evaluación Económica Preliminar (PEA) para el North Star Manganese Project en Emily, Minnesota. El proyecto presenta una sólida economía con un VAN post-impuestos al 10% de US$1.390 millones, una TIR del 43,5% y un periodo de recuperación de 23 meses.

El objetivo es convertirse en el primer productor totalmente estadounidense de sulfato de manganeso monohidratado de alta pureza (HPMSM), abordando la dependencia total de importaciones de manganeso del país. La PEA describe una vida del proyecto de 25 años con un gasto de capital inicial de US$474,8 millones, produciendo un promedio de 180.331 toneladas de HPMSM al año tras la expansión.

El depósito de manganeso Emily contiene 7,6 millones de toneladas de recursos Inferred al 19,1% Mn y 3,7 millones de toneladas de recursos Indicated al 17,0% Mn, representando el depósito de manganeso de mayor ley en Norteamérica.

Electric Metals (OTCQB:EMUSF)는 미네소타주 에밀리의 North Star Manganese Project에 대한 예비 경제성 평가(PEA)에서 긍정적인 결과를 발표했습니다. 해당 프로젝트는 세후 NPV(할인율 10%)가 미화 13억9천만 달러, 내부수익률(IRR) 43.5%, 회수기간 23개월로 견조한 경제성을 보여줍니다.

이 프로젝트는 고순도 망간 황산염 일수화물(HPMSM)의 완전한 미국 내 생산자가 되는 것을 목표로 하며, 미국의 망간 전량 수입 의존 문제를 해결하려고 합니다. PEA는 프로젝트 수명이 25년이며 초기 자본비용이 미화 4억7,480만 달러이고, 확장 후 연평균 180,331톤의 HPMSM을 생산할 것으로 제시합니다.

에밀리 망간 광상은 19.1% Mn의 추정자원(Inferred) 760만 톤과 17.0% Mn의 표층자원(Indicated) 370만 톤을 보유해 북미에서 최고 등급의 망간 광상으로 평가됩니다.

Electric Metals (OTCQB:EMUSF) a annoncé des résultats positifs de son étude économique préliminaire (PEA) pour le North Star Manganese Project à Emily, Minnesota. Le projet présente des fondamentaux économiques solides avec un VAN après impôts à 10% de US$1,39 milliard, un TRI de 43,5% et une période de retour sur investissement de 23 mois.

Le projet vise à devenir le premier producteur entièrement national aux États-Unis de sulfate de manganèse monohydraté de haute pureté (HPMSM), répondant à la dépendance totale du pays aux importations de manganèse. La PEA décrit une durée de vie du projet de 25 ans avec des dépenses d'investissement initiales de US$474,8 millions, produisant en moyenne 180 331 tonnes de HPMSM par an après l'expansion.

Le gisement de manganese d'Emily contient 7,6 millions de tonnes de ressources Inferred à 19,1% Mn et 3,7 millions de tonnes de ressources Indicated à 17,0% Mn, représentant le gisement de manganèse le plus riche d'Amérique du Nord.

Electric Metals (OTCQB:EMUSF) hat positive Ergebnisse seiner vorläufigen Wirtschaftlichkeitsstudie (PEA) für das North Star Manganese Project in Emily, Minnesota, bekannt gegeben. Das Projekt weist robuste Wirtschaftszahlen auf mit einem nach Steuern diskontierten Kapitalwert (NPV10%) von US$1,39 Milliarden, einem IRR von 43,5% und einer Amortisationsdauer von 23 Monaten.

Das Vorhaben zielt darauf ab, der erste vollständig in den USA ansässige Produzent von hochreinem Mangansulfat-Monohydrat (HPMSM) zu werden und damit die 100%ige Importabhängigkeit des Landes bei Mangan zu adressieren. Die PEA beschreibt eine Projektlaufzeit von 25 Jahren mit einer anfänglichen Investition von US$474,8 Millionen und einer durchschnittlichen Produktion von 180.331 Tonnen HPMSM pro Jahr nach der Erweiterung.

Die Emily-Manganlagerstätte weist 7,6 Millionen Tonnen Inferred-Ressourcen mit 19,1% Mn und 3,7 Millionen Tonnen Indicated-Ressourcen mit 17,0% Mn auf und gilt damit als die hochwertigste Manganlagerstätte Nordamerikas.

- Post-tax NPV10% of US$1.39 billion with strong IRR of 43.5%

- Rapid 23-month payback period from start of production

- Average annual after-tax cash flow of US$249.6 million

- High-grade resource with 19.1% Mn for Inferred and 17.0% Mn for Indicated

- 90% overall recovery rate of manganese to final product

- Strategic position as first fully domestic U.S. HPMSM producer

- 25-year project life with expansion potential

- Significant initial capital requirement of US$474.8 million

- Additional US$150 million needed for processing plant expansion

- Project requires 2-year construction period before production

- 3-year ramp-up period to reach full production capacity

Because the US is

TORONTO, ON / ACCESS Newswire / August 26, 2025 / Electric Metals (USA) Limited ("EML" or the "Company") (TSXV:EML)(OTCQB:EMUSF) is pleased to announce the results of its Preliminary Economic Assessment ("PEA") for the

The PEA demonstrates robust economics, confirming North Star's potential to become the first fully U.S. domestic producer of high-purity manganese sulphate monohydrate ("HPMSM"), a critical material for lithium-ion batteries. As the U.S. remains

The PEA highlights a post-tax NPV10% of US

PEA Highlights - Base Case

Base Case Economics: After-tax NPV10% of US

$1.39 0 billion, after-tax IRR of43.5% , and average annual after-tax cash flow of US$249.6 million .Updated Resource Estimate: Based on a

10% manganese cut-off, the Project reports 7.6 million tonnes of Inferred Resources at19.1% Mn and 3.7 million tonnes of Indicated Resources at17.0% Mn.Ore Grades: Average manganese grade of

18.9% during the first 5 years of production, with a Life-of-Project average grade of17.4% (10% cut-off).Project Life: 25-year Base Case, producing 4.3 million tonnes of battery-grade HPMSM. The Project may be extended through additional drilling of known mineralized zones that were originally drilled in the 1940s and 1950s and/or by utilizing lower-grade material.

Capital Expenditures: US

$474.8 million initial capital for mine and processing facilities, US$150.0 million for a processing plant expansion, and US$276.0 million for sustaining and closure costs.Ore Production: Average annual mined ore of 368 thousand tonnes, with a nominal mining capacity of 400 thousand tonnes per year.

HPMSM Production: Average annual production after expansion of 180,331 tonnes of HPMSM, with a nominal after expansion plant capacity of 200 thousand tonnes per year, based on a overall recovery of manganese to product of

90% .Pricing Assumption: Base Case assumes US

$2,500 per tonne of HPMSM held constant for LOP.Project Timeline: Total project life of 25 years from the start of capital spending, including a 2-year construction period. Mine and processing operations extend 23 years, incorporating a 3-year ramp-up to full production for both mine and the processing plant expansion.

Optimization Opportunities: Potential upside exists in geology and exploration, mining, concentration, transport, and processing.

Brian Savage, CEO of Electric Metals, commented: "The results of this PEA confirm that the North Star Manganese Project has the potential to become the first fully domestic source of high-purity manganese sulphate monohydrate in the United States. With robust economics-including an after-tax NPV of US

Technical Summary:

Updated Mineral Resource Estimate | ||||

Resource Category | Thousand Tonnes | Mn Grade % | Fe Grade % | Si Grade % |

Indicated Resource | 7,600.4 | 19.07 | 22.33 | 30.94 |

Inferred Resource | 3,725.3 | 17.04 | 19.04 | 30.03 |

Mineable Resource Estimate | ||||

North Star Mn Project | Thousand Tonnes | Mn Grade % | Fe Grade % | Si Grade % |

Mined / Shipped Ore | 8,826.2 | |||

Operating Cost | Per Tonne of Ore | Per Tonne of HPMSM | LOP Operating Cost |

Mining | |||

Transport | |||

Processing | |||

G & A | |||

TOTAL |

Capital Expenditures | Life of Project |

Initial Capital Expenditures (inc | |

Processing Plant Expansion (inc | |

Sustaining Capital & Closing Costs | |

Mining Operations (tonnes) | HPMSM Plant Operations (tonnes) | ||||

Total Production | Annual Production | Daily Production | Total Production | Annual Production | Daily Production |

8,826,000 | 368,000 | 1,143 | 4,328,000 | 180,000 | 174 |

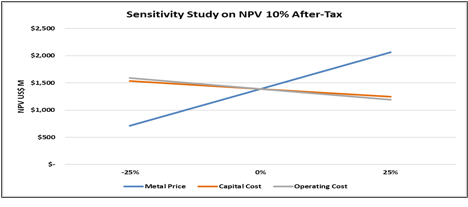

Project Sensitivities

Sensitivity Study on NPV | |||

Percent of Base Case | - | Base Case | + |

HPMSM Price | |||

Capital Cost | |||

Operating Cost | |||

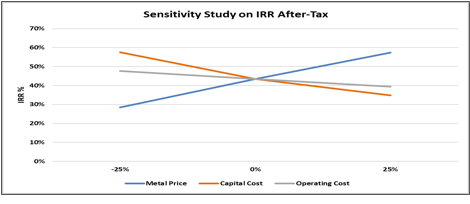

Sensitivity Study on IRR After-Tax (- or + against the Base Case) | |||

Percent of Base Case | - | Base Case | + |

HPMSM Price | |||

Capital Cost | |||

Operating Cost | |||

Project Summary

EML's North Star Manganese Project involves the mining of high-grade manganiferous iron ore from the Emily Manganese Deposit in Emily, Minnesota, and the production of high-purity manganese sulphate monohydrate (HPMSM), a critical input for lithium-ion batteries used in electric vehicles, energy storage systems, and advanced electronics. All operations will be based in the United States, providing an entirely domestic supply chain for U.S. battery manufacturers.

The Emily Manganese Deposit is located in the Emily District of the Cuyuna Iron Range in central Minnesota, approximately 230 km (143 miles) north of Minneapolis. The district is part of the Superior-type banded iron formations of the Lake Superior region, which also include the Marquette, Gogebic, Mesabi, and Gunflint Iron Ranges.

Iron-bearing deposits in the Cuyuna Range were discovered in 1904. Mining of iron and manganiferous ores occurred from 1911 to 1967, with manganese recovered as part of iron ore extraction. Although significant manganese resources were identified at the Emily Deposit as early as the 1940s by Pickands Mather Mining Company and expanded by U.S. Steel in the 1950s, the deposit itself was never mined. Later confirmation came from the U.S. Bureau of Mines, the Minnesota Geological Survey, and multiple companies up to 2020, when Electric Metals consolidated the land position.

From April to July 2023, Electric Metals engaged Big Rock Exploration of Stillwater, Minnesota, to conduct a combined confirmation and step-out drilling program. A total of 29 PQ and HQ diamond drill core holes were completed for 3,995 meters (13,107 feet). The resulting geological and assay data, validated by Forte Dynamics, were used in the PEA's Mineral Resource Estimate.

The mineralized horizons consist of manganese and iron oxides, silica, residual clays, and cherts. The deposit includes five layered to massive iron-manganese zones, containing higher-grade and lower-grade manganese oxide and manganese carbonate mineralization.

The PEA mine plan assumes mechanized underhand cut-and-fill mining, with access via two vertical shafts: an 18 foot (5.5 meters) diameter production shaft capable of hoisting 1,500 tonnes of ore and 250 tonnes of waste per day, and a spiral ramp providing access every 98 feet (30 meters) vertically. Mining targets 400,000 tonnes per year of ore.

Ore will be transported by truck and rail to an HPMSM processing facility. EML is evaluating multiple candidate sites based on chemical input costs, power rates, transport logistics, permitting, workforce availability, incentives, and proximity to U.S. battery manufacturers.

Metallurgical test work performed by Kemetco Research in Richmond, British Columbia, recovered

Pricing assumptions for HPMSM are based on independent market analysis by CPM Group (New York), with a base case long-term price of US

North Star Manganese Project - Strategic Significance

First HPMSM project produced entirely in the U.S.

Aligns with U.S. national energy security and clean energy transition goals.

Secure, low-carbon domestic source of critical manganese chemicals and metals for EVs, energy storage, defense, and advanced technologies.

Supported by strong government policy momentum favoring domestic critical mineral supply chains.

Next Steps

Proceed to Pre-Feasibility and Feasibility Study activities in 2026.

Collaborate with local communities, native tribes, and regional businesses on Project issues.

Advance permitting with the State of Minnesota regulators and U.S. federal agencies.

Engage with Tier-1 EV and battery manufacturers for offtake agreements.

Optimize extraction and processing systems, and evaluate expansion opportunities.

A National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") compliant technical report entitled "NI 43-101 Technical Report, Preliminary Economic Assessment of the Electric Metals' North Star Manganese Project, Crow Wing County, Minnesota, USA" with an effective date of August 15, 2025 will be filed on SEDAR+ at www.sedarplus.ca under the Company's profile within 45 days of this news release.

Qualified Persons

The PEA was prepared in accordance with NI 43-101 by Forte Dynamics, Inc. The scientific and technical information in this news release has been reviewed and approved by Donald Hulse, SME-RM and Deepak Malhotra, SME-RM, of Forte Dynamics, Inc., each of whom is a "qualified person" under NI 43-101.

About Electric Metals (USA) Limited

Electric Metals (USA) Limited (TSXV: EML; OTCQB: EMUSF) is a U.S.-based critical minerals company advancing manganese and silver projects that support the clean energy transition. The Company's principal asset is the North Star Manganese Project in Minnesota, the highest-grade manganese deposit in North America. The Project has been the subject of extensive technical work, including a Preliminary Economic Assessment prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Electric Metals' mission is to establish a fully domestic U.S. supply of high-purity manganese chemical and metal products for the North American electric vehicle battery, technology, and industrial markets. With manganese playing an increasingly important role in lithium-ion battery formulations, and with no current domestic production in North America, the development of the North Star Manganese Project represents a strategic opportunity for the United States, the State of Minnesota, and the Company's shareholders.

For further information, please contact:

Electric Metals (USA) Limited

Brian Savage

CEO & Director

(303) 656-9197

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions.

Such statements in this news release include, without limitation: the Company's mission to become a domestic U.S. producer of high-value, high-purity manganese products for the North American electric vehicle battery, technology and industrial markets; that manganese will continue to play a critical role in lithium-ion battery formulations; that with no current domestic supply or active mines for manganese in North America, the development of the North Star Manganese Project represents a significant opportunity for America, Minnesota and for the Company's shareholders; and planned or potential developments in ongoing work by Electric Metals.

Forward-looking information also includes statements with respect to the results of the Preliminary Economic Assessment ("PEA"), including but not limited to estimates of NPV, IRR, capital and operating costs, mine life, production, recovery rates, timelines, and pricing assumptions. The reader is cautioned that the PEA is preliminary in nature, includes Inferred Mineral Resources, and is subject to a high degree of uncertainty. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Inferred Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized.

These statements address future events and conditions and involve inherent risks, uncertainties and other factors that could cause actual events or results to differ materially from those estimated or anticipated. Such risks include, but are not limited to: failure to obtain all necessary stock exchange, regulatory, environmental and governmental approvals; risks relating to the accuracy of resource estimates; the speculative nature of Inferred Resources; risks relating to metallurgical test work, recoveries and process design; delays in or failure to advance to more detailed studies, including a Feasibility Study; the ability to secure project financing on reasonable terms; risks relating to construction, cost overruns and schedule delays; risks related to securing offtake agreements; risks relating to the availability and cost of infrastructure, reagents, power, labor and transportation; fluctuations in commodity prices and exchange rates; potential changes to U.S. government policy or support for domestic critical mineral development; general market conditions and investor appetite; and risks associated with exploration, development and mining activities.

Forward-looking information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, updated conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially. Accordingly, readers should not place undue reliance on forward-looking information.

All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Electric Metals (USA) Limited

View the original press release on ACCESS Newswire