Formation Metals Begins Trading on the OTCQB Venture Market

Formation Metals (CSE:FOMO, OTCQB:FOMTF) has begun trading on the OTCQB Venture Market effective May 15, 2025. The company will maintain its existing listings under "FOMO" in Canada and "A3D492" in Germany.

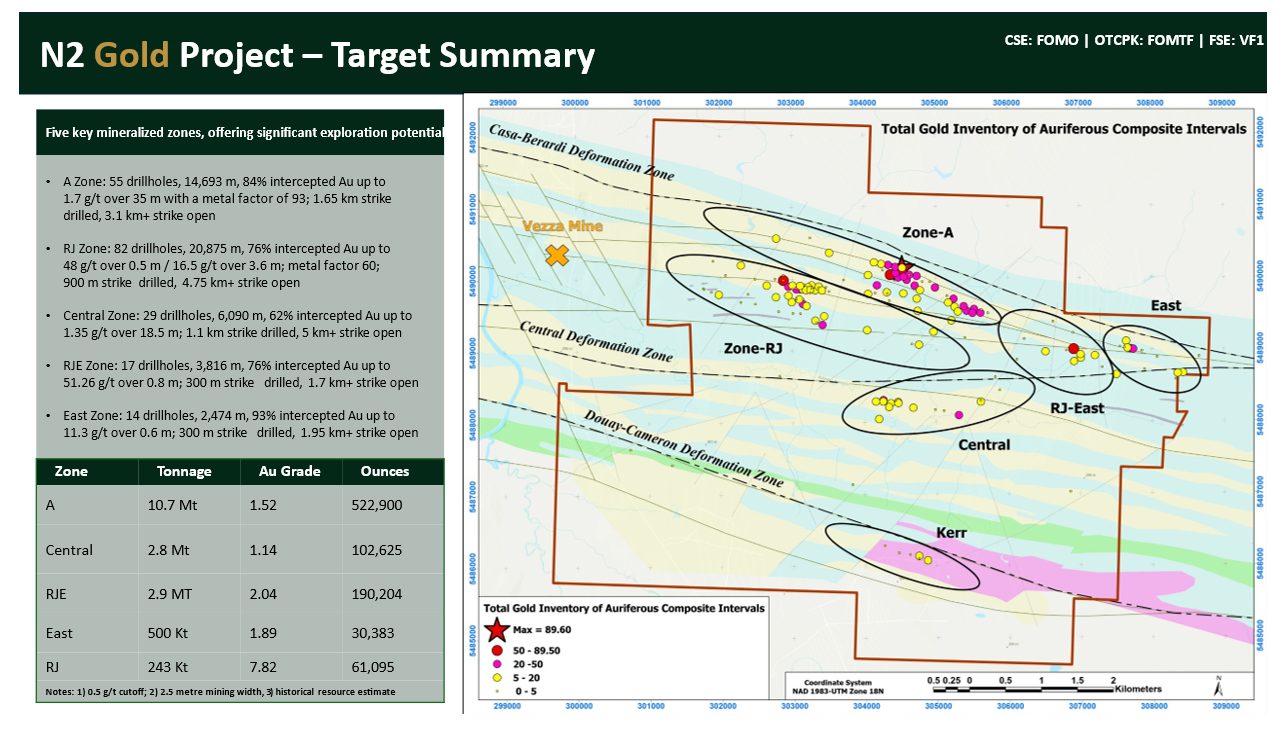

Formation's flagship asset is the N2 Gold Project in Quebec, featuring a historic resource of 877,000 ounces of gold. The project comprises 87 claims across ~4,400 ha in Northwestern Quebec's Abitibi sub province. The resource includes 18.2 Mt grading 1.48 g/t Au (~810,000 oz Au) across four zones and 243 Kt grading 7.82 g/t Au (~67,000 oz Au) in the RJ zone.

The company's upcoming maiden drill program will target the "A" zone, which shows consistent gold mineralization with intercepts up to 1.7 g/t over 35m, and the "RJ" zone, which has yielded historical high-grade intercepts up to 51 g/t Au over 0.8 metres.

Formation Metals (CSE:FOMO, OTCQB:FOMTF) ha iniziato a negoziare sul OTCQB Venture Market a partire dal 15 maggio 2025. La società manterrà le sue quotazioni esistenti con il simbolo "FOMO" in Canada e "A3D492" in Germania.

L'asset principale di Formation è il Progetto N2 Gold in Quebec, che vanta una risorsa storica di 877.000 once d'oro. Il progetto comprende 87 concessioni per un totale di circa 4.400 ettari nella sottoprovincia di Abitibi, nel nord-ovest del Quebec. La risorsa include 18,2 Mt con un tenore di 1,48 g/t Au (~810.000 oz Au) distribuite su quattro zone e 243 Kt con un tenore di 7,82 g/t Au (~67.000 oz Au) nella zona RJ.

Il prossimo programma di perforazione inaugurale della società sarà focalizzato sulla zona "A", che mostra una mineralizzazione aurifera costante con intersezioni fino a 1,7 g/t su 35 m, e sulla zona "RJ", che ha prodotto storicamente intersezioni ad alto tenore fino a 51 g/t Au su 0,8 metri.

Formation Metals (CSE:FOMO, OTCQB:FOMTF) comenzó a cotizar en el OTCQB Venture Market a partir del 15 de mayo de 2025. La empresa mantendrá sus listados existentes bajo "FOMO" en Canadá y "A3D492" en Alemania.

El activo principal de Formation es el Proyecto N2 Gold en Quebec, que cuenta con un recurso histórico de 877,000 onzas de oro. El proyecto comprende 87 concesiones que abarcan aproximadamente 4,400 hectáreas en la subprovincia de Abitibi, en el noroeste de Quebec. El recurso incluye 18.2 Mt con una ley de 1.48 g/t Au (~810,000 oz Au) distribuidas en cuatro zonas y 243 Kt con una ley de 7.82 g/t Au (~67,000 oz Au) en la zona RJ.

El próximo programa de perforación inaugural de la compañía se enfocará en la zona "A", que muestra mineralización de oro constante con intercepciones de hasta 1.7 g/t sobre 35 m, y en la zona "RJ", que ha arrojado históricamente intercepciones de alto grado de hasta 51 g/t Au en 0.8 metros.

Formation Metals (CSE:FOMO, OTCQB:FOMTF)는 2025년 5월 15일부터 OTCQB 벤처 마켓에서 거래를 시작했습니다. 회사는 캐나다에서는 "FOMO", 독일에서는 "A3D492"라는 기존 상장 코드를 유지할 예정입니다.

Formation의 대표 자산은 퀘벡에 위치한 N2 골드 프로젝트로, 역사적인 금 매장량이 877,000 온스에 달합니다. 이 프로젝트는 퀘벡 북서부 아비티비 하위지역에 약 4,400 헥타르에 걸쳐 87개의 채굴권을 포함합니다. 매장량은 4개 구역에 걸쳐 1.48 g/t Au 등급의 18.2 Mt (~810,000 온스 Au)과 RJ 구역에 7.82 g/t Au 등급의 243 Kt (~67,000 온스 Au)을 포함합니다.

회사의 첫 시추 프로그램은 35m 구간에서 최대 1.7 g/t의 꾸준한 금 광화가 확인된 "A" 구역과 0.8m 구간에서 최대 51 g/t Au의 고품위 시추 결과가 나온 "RJ" 구역을 대상으로 할 예정입니다.

Formation Metals (CSE:FOMO, OTCQB:FOMTF) a commencé à être cotée sur le marché OTCQB Venture à compter du 15 mai 2025. La société conservera ses cotations existantes sous le symbole "FOMO" au Canada et "A3D492" en Allemagne.

L'actif principal de Formation est le projet aurifère N2 au Québec, qui possède une ressource historique de 877 000 onces d'or. Le projet comprend 87 concessions couvrant environ 4 400 hectares dans la sous-province d'Abitibi, dans le nord-ouest du Québec. La ressource inclut 18,2 Mt avec une teneur de 1,48 g/t Au (~810 000 oz Au) réparties sur quatre zones, ainsi que 243 Kt avec une teneur de 7,82 g/t Au (~67 000 oz Au) dans la zone RJ.

Le prochain programme de forage inaugural de la société ciblera la zone "A", qui présente une minéralisation aurifère constante avec des intersections allant jusqu'à 1,7 g/t sur 35 m, ainsi que la zone "RJ", qui a produit historiquement des intersections à haute teneur allant jusqu'à 51 g/t Au sur 0,8 mètre.

Formation Metals (CSE:FOMO, OTCQB:FOMTF) hat am 15. Mai 2025 mit dem Handel am OTCQB Venture Market begonnen. Das Unternehmen wird seine bestehenden Notierungen unter "FOMO" in Kanada und "A3D492" in Deutschland beibehalten.

Das Hauptprojekt von Formation ist das N2 Gold Projekt in Quebec mit einer historischen Ressource von 877.000 Unzen Gold. Das Projekt umfasst 87 Claims auf etwa 4.400 Hektar in der Abitibi-Unterprovinz im Nordwesten von Quebec. Die Ressource beinhaltet 18,2 Mt mit einem Gehalt von 1,48 g/t Au (~810.000 oz Au) über vier Zonen und 243 Kt mit einem Gehalt von 7,82 g/t Au (~67.000 oz Au) in der RJ-Zone.

Das bevorstehende erste Bohrprogramm des Unternehmens wird sich auf die "A"-Zone konzentrieren, die eine gleichmäßige Goldmineralisierung mit Abschnitten von bis zu 1,7 g/t über 35 m aufweist, sowie auf die "RJ"-Zone, die historisch hochgradige Abschnitte von bis zu 51 g/t Au über 0,8 Meter geliefert hat.

- Uplisting to OTCQB Venture Market increases visibility and potential investor base

- Historic gold resource of 877,000 ounces with significant grades

- Project includes six auriferous zones, all open for expansion

- Strong historical drill results with up to 51 g/t Au over 0.8 metres in RJ zone

- Large land package of 4,400 ha with multiple untested drilling targets

- Historic resource is non-compliant with current standards

- No recent drilling since 2008

- Only 35% of strike length has been drilled in 'A' zone

- Maiden drill program yet to commence

VANCOUVER, BC / ACCESS Newswire / May 15, 2025 / Formation Metals Inc. ("Formation" or the "Company") (CSE:FOMO), a North American mineral acquisition and exploration company, is pleased to announce that the Company's common shares have begun trading on the OTCQB Venture Market ("OTCQB") effective today under the ticker symbol FOMTF. The successful uplisting is effective May 15, 2025 and the company's common shares will continue to trade under the ticker symbol "FOMO" in Canada and "A3D492" in Germany.

Formation believes the uplisting will boost visibility to a broader universe of investors and provide improved liquidity for its stock as the company advances its flagship N2 Gold Project ("N2") in Quebec, an advanced gold project with a global historic resource of 877,000 ounces: 18.2 Mt grading 1.48 g/t Au (~810,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~67,000 oz Au) across the RJ zone2,4.

Deepak Varshney, Formation's Chief Executive Officer and Director commented, "Uplisting to the OTCQB Venture Market is an important milestone for our company and reflects our commitment to improving corporate transparency, increasing share trading liquidity, and expanding the universe of potential investors."

The OTCQB is a trading platform operated by the OTC Markets Group Inc. that is designed for developing and entrepreneurial-stage companies, and is considered by the SEC to be an "established public market". Companies listed on the OTCQB are current in their SEC financial reporting and complete an annual verification and management certification process. Additional information about the OTC Markets Group Inc. and the OTCQB can be found at www.otcmarkets.com.

Project Summary

Comprising 87 claims totaling ~4,400 ha within the Abitibi sub province of Northwestern Quebec, Formation's flagship N2 Gold Project ("N2") is an advanced gold project with a global historic resource of 877,000 ounces: 18.2 Mt grading 1.48 g/t Au (~810,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~67,000 oz Au) across the RJ zone2,4. There are six primary auriferous mineralized zones in total, each open for expansion along strike and at depth. Compilation and geophysical work by Balmoral Resources Ltd. (now Wallbridge Mining) from 2010 to 2018 generated numerous targets that have not yet been investigated with diamond drilling.

Formation's maiden drill program will focus on:

the "A" zone, a shallow, highly continuous, low-variability historic gold deposit with numerous intermittent and consecutive auriferous intervals (

84% of historical drill holes intercepted Au up to 1.7 g/t over 35 m)2, of which only ~35% of strike has been drilled (>3.1 km open); andthe "RJ" zone, host to high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres2, which was expanded by Agnico Eagle Mines in 2008 in the most recent drilling at the Property.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Babak Vakili Azar, P.Geo., an independent contractor and a qualified person as defined by National Instrument 43-101. Historical reports provided by the optionor were reviewed by the qualified person. The information provided has not been verified and is being treated as historic non-compliant intercepts.

About Formation Metals Inc.

Formation Metals Inc. is a North American mineral acquisition and exploration company focused on the development of quality properties that are drill-ready with high-upside and expansion potential. Formation's flagship asset is the N2 Gold Project, an advanced gold project with a global historic resource of 877,000 ounces (18.2 Mt grading 1.48 g/t Au (~810,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~67,000 oz Au) across the RJ zone2,4) and six mineralized zones, each open for expansion along strike and at depth including the "A" zone, of which only ~

FORMATION METALS INC.

Deepak Varshney, CEO and Director

For more information, please call 778-899-1780, email info@formationmetalsinc.com or visit www.formationmetalsinc.com.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Notes and References:

Readers are cautioned that the geology of nearby properties is not necessarily indicative of the geology of the Property.

The above referenced resource estimates do not have a category, are considered historical in nature, and are based on prior data prepared by a previous property owner, and do not conform to current CIM categories.

While the Company considers the estimates to be reliable, a qualified person has not done sufficient work to classify the historical estimates as current resources in accordance with current CIM categories and the Company is not treating the historical estimates as a current resource. A 0.5 g/t Au cut-off was used in the preparation of the historical estimates with a minimum 2.5 metre mining width.

Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the historical estimates can be classified as current resources. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. The Company is not aware of any more recent estimates prepared for the N2 Property.

Needham, B. (1994), 1993 Diamond Drill Report, Northway Joint Venture, Northway Property; Cypress Canada Inc.; 492 pages.

Guy K. (1991), Exploration Summary May 1, 1990 to May 1, 1991 Vezza Joint Venture Northway Property; Total Energold; 227 pages.

Forward-looking statements:

This news release includes "forward-looking statements" under applicable Canadian securities legislation, including statements respecting: the Company's uplisting to the OTCQB and the expected benefits and timing of same; the Company's plans for the Property and the expected timing and scope of the 2025 drilling program at the Property; the Company's view that timing is perfect for a near-surface multi-million-ounce deposit the Property; the Company's view that the Property has the potential for over three million ounces of gold and the 5,000-metre drilling program marking the beginning of the Company's pursuit of that goal. Such forward-looking information reflects management's current beliefs and is based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Readers are cautioned that such forward-looking statements are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

SOURCE: Formation Metals

View the original press release on ACCESS Newswire