Genius Group Acquires Entrepreneur Resorts, Expands Genius City Model with 50% Increase in 2025 Revenue Guidance

Rhea-AI Summary

Positive

- All-share acquisition valued at $21.5 million expands Genius Group's physical presence in three countries

- 50% increase in 2025 revenue guidance from $10M to $15-18M

- ERL demonstrated strong growth with 23% revenue increase to $5.9M in 2023

- Resolution of two-year trading restriction issue for US-based shareholders

- Integration supports Genius Group's high-tech Genius City model combining AI, Bitcoin, and Community education

Negative

- Transaction subject to regulatory approvals from NYSE and U.S. federal securities laws

- Significant share dilution with 50 million new GNS shares being issued

- Additional $1M debt taken on for improvements and rebranding

News Market Reaction

On the day this news was published, GNS declined 3.95%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

SINGAPORE, June 10, 2025 (GLOBE NEWSWIRE) -- Genius Group Limited (NYSE American: GNS) (“Genius Group” or the “Company”), a leading AI-powered, Bitcoin-first education group, today announced that it has signed a binding asset purchase agreement with Entrepreneur Resorts Ltd (“ERL”), for the purchase and re-integration of ERL’s entrepreneur cafés and resorts into Genius Group, expanding its Genius City model and increasing by

ERL operates its entrepreneur café and resort model in Singapore, South Africa and Bali, Indonesia, combining co-working, retreats and accelerators in paradise locations. ERL had previously been a part of Genius Group and was spun off in September 2023, with the intent of providing all Genius Group investors shares in ERL in a special dividend, with the shares tradeable on Blockchain-based Upstream Exchange, part the Seychelles MERJ licensed Securities Exchange. Based upon a regulatory outcome that US investors could not trade shares on Upstream Exchange led to the Company’s US-based investors holding restricted shares for the last two years.

During this time, ERL has focused on achieving profitable growth, with audited revenues growing

Over the last two years, Genius Group has also evolved its business model, with the highest revenue growth potential coming from its high-tech, high-touch Genius City model. In this model, students join free online courses and then upgrade to educational experiences including in-person mentoring, accelerators and entrepreneur retreats teaching the ABCs of the future: AI, Bitcoin and Community.

The acquisition of Entrepreneur Resorts’ profitable, revenue generating locations supports Genius Group’s growth plans whilst also providing a solution for the Company’s shareholders who received restricted shares in ERL in 2023.

A summary of the asset purchase agreement include:

- Genius Group is purchasing ERL’s revenue generating operations in Singapore, Indonesia and South Africa, expected to increase from approximately

$5 million to$6 million in revenue in 2025. - The asset purchase is an all-share transaction, in which the Company will pay ERL 50,000,000 shares of Genius Group (Currently valued at

$21.5 million based on the per common share closing price on June 9, 2025), which shall be subject to registration under SEC regulations. - Once registered, ERL shareholders will receive shares in Genius Group equivalent to 3 GNS shares for each ERL share.

- Genius Group will also provide debt financing of

$1 million to ERL for improvements related to the acquisition, and to rebrand ERL as Genius Resorts as part of the Genius City model. - The asset purchase agreement has been approved by both boards and signed by the parties. Closing is subject to approval to all regulatory requirements and processes including from both the New York Stock Exchange (NYSE) and under U.S. federal securities laws.

- Further to the agreement, Genius Group has increased its revenue guidance by

50% from$10 million to$15 million -$18 million for 2025.

Jeremy Harris, CFO of Entrepreneur Resorts, said “We are delighted to be reintegrating with Genius Group. The synergies between our companies are greater than ever. In addition, our intention has always been to enable all Genius shareholders who received ERL shares to have freely trading shares. This transaction enables us to address this issue while building on the success that ERL has been experiencing.”

Roger Hamilton, CEO of Genius Group, said “Following our recent legal successes, we are pleased to be able to proceed with our M&A activity, and this transaction with ERL is an exciting start to Genius’ growth plans for 2025. Following the spin-off, Genius Group retained a

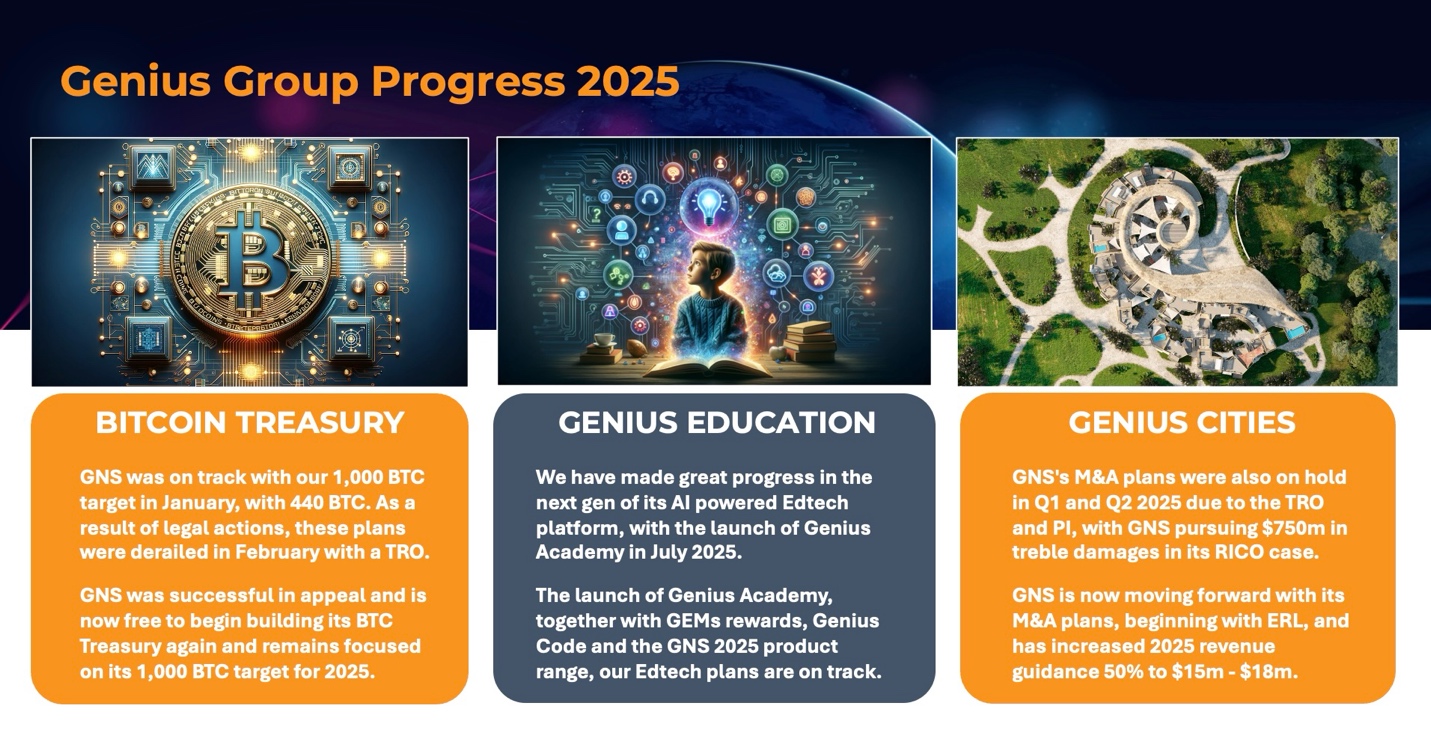

“We reiterate our three pillars of growth for 2025: Building our Bitcoin Treasury, growing our Genius Education model and launching our Genius Cities. We’re excited to be getting all three growth paths back on track, with today’s news being integral to our Genius Future.”

Genius Group and ERL will be holding a joint meeting and Q&A for shareholders at 8.30am on Thursday 19 June to discuss the transaction and answer questions. For meeting details, visit https://ir.geniusgroup.net/.

About Genius Group

Genius Group (NYSE: GNS) is a Bitcoin-first business delivering AI powered, education and acceleration solutions for the future of work. Genius Group serves 5.8 million users in over 100 countries through its Genius City model and online digital marketplace of AI training, AI tools and AI talent. It provides personalized, entrepreneurial AI pathways combining human talent with AI skills and AI solutions at the individual, enterprise and government level. To learn more, please visit https://www.geniusgroup.ai/.

About Entrepreneur Resorts

Entrepreneur Resorts (MERJ: ERL) is a unique group of Entrepreneur resorts and entrepreneur beach clubs, where entrepreneurs co-work, co-learn, co-live and co-give in paradise locations around the world. To learn more, please visit https://entrepreneurresorts.com/.

Forward-Looking Statements

Statements made in this press release include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the use of words such as “may,” “will”, “plan,” “should,” “expect,” “anticipate,” “estimate,” “continue,” or comparable terminology. Such forward-looking statements are inherently subject to certain risks, trends and uncertainties, many of which the Company cannot predict with accuracy and some of which the Company might not even anticipate and involve factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors under the heading “Risk Factors” in the Company's Annual Reports on Form 20-F, as may be supplemented or amended by the Company's Reports of a Foreign Private Issuer on Form 6-K. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise. No information in this press release should be construed as any indication whatsoever of the Company’s future revenues, results of operations, or stock price.

This announcement is not an offer to sell securities, and consummation of this transaction is subject to all requirements including, but not limited to, effectiveness of any registration statements required under U.S. federal securities laws and compliance with all U.S., Singapore and Seychelles laws and regulatory requirements.

Contacts

For enquiries, contact investor@geniusgroup.ai.