Grande Portage Resources Announces Additional Offtake Study Validating the Flexibility of Offsite-Processing Configuration for the New Amalga Gold Project

Rhea-AI Summary

Grande Portage Resources (OTCQB:GPTRF) announced an independent marketability offtake study for the New Amalga Gold Project dated December 1, 2025, validating third‑party offsite processing and sales outside China. The study found New Amalga material has high payable gold content and is attractive as a copper smelter feed due to high silica, enabling strong gold recoveries and payabilities. Multiple copper smelters outside China expressed interest. The project hosts an Indicated Resource of 1,438,500 oz Au at 9.47 g/t and an Inferred Resource of 515,700 oz Au at 8.85 g/t. A NI 43‑101 PEA is expected in Q1 2026.

Positive

- Indicated resource 1,438,500 oz Au at 9.47 g/t

- Inferred resource 515,700 oz Au at 8.85 g/t

- Metallurgical recovery reported up to 98.2%

- Offtake flexibility shown with interest from copper smelters outside China

- No onsite mill development concept reduces capital and permitting needs

- LOI signed for ore export terminal 22km from project

Negative

- None.

News Market Reaction

On the day this news was published, GPTRF gained 0.15%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Gold peers were mixed, with moves ranging from -3.83% (CGLCF) to +14.71% (AAUAF). With sector scanners not flagging a coordinated move, GPTRF’s action appears more stock-specific than industry-driven.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 09 | Financing closed | Positive | +4.7% | Closed C$5M private placement to fund New Amalga and working capital. |

| Dec 04 | Strategic investment | Positive | +11.7% | Announced C$5M Eric Sprott-led placement supporting New Amalga development. |

| Dec 01 | Offtake study | Positive | +0.1% | Independent study confirmed flexible offsite processing and non-China offtake interest. |

| Nov 24 | LiDAR / project update | Positive | +2.6% | LiDAR survey and resource metrics reinforced project scale and high recoveries. |

| Nov 20 | Drill permit filing | Positive | -3.4% | Filed 2026 Plan of Operations drill permit to support permitting and studies. |

Recent operational and financing updates around New Amalga generally saw positive price alignment, with one permitting-related headline drawing a mild negative divergence.

This announcement continues a series of New Amalga Gold project de-risking steps. On Nov 20, the company filed its 2026 Plan of Operations drill permit. A LiDAR survey update on Nov 24 highlighted ~240 holes and up to 98.2% recoveries, followed by this offtake study on Dec 1. Subsequent news on Dec 4 and Dec 9 detailed a C$5M Eric Sprott-led placement and closing. Across these events, the consistent theme is advancing New Amalga’s technical, permitting, and funding foundations.

Market Pulse Summary

This announcement adds another de-risking element for the New Amalga project by validating third-party offsite processing and interest from multiple copper smelters outside China. The project already hosts an Indicated Resource of 1,438,500 oz Au at 9.47 g/t and has achieved metallurgical recoveries up to 98.2%. Together with prior LiDAR, permitting, and financing updates, investors may watch the upcoming NI 43-101 PEA in Q1 2026 and future offtake details for further clarity.

Key Terms

offtake financial

ore sorting technical

tailings storage facility technical

mesothermal veins technical

LiDAR technical

metallurgical recoveries technical

NI43-101 regulatory

Preliminary Economic Assessment regulatory

AI-generated analysis. Not financial advice.

VANCOUVER, BC / ACCESS Newswire / December 1, 2025 / Grande Portage Resources Ltd. (TSXV:GPG)(OTCQB:GPTRF)(FSE:GPB) ("Grande Portage" or the "Company") is pleased to announce an update regarding offtake studies for its New Amalga Gold property in Southeast Alaska. The current development concept for the project envisions a small-footprint underground mining operation with third-party offsite processing, eliminating the need for an onsite mill or tailings storage facility.

The company's previous news release dated October 20, 2025 discussed the receipt of indicative offtake terms from a leading global concentrate trading firm. Material from the proposed New Amalga Gold Mine would undergo size reduction and sensor-based ore sorting and then be transported for sale with no chemical processing taking place on-site. The trading firm would purchase the material for resale to a variety of third-party processors including base metal smelters, custom concentrates facilities, roasting operations, and leach plants. Many of these facilities are located in the People's Republic of China.

To validate offtake flexibility against any future geopolitical or tariff risk, the company commissioned a separate independent marketability study with H Okumura Consulting Ltd which examined opportunities for sale of New Amalga material to processing facilities outside of China. This study has shown favourable results: in addition to the high amount of payable gold content, a notable finding is that the New Amalga material is an attractive copper smelter feed due to its high silica content. This potentially enables its use as an alternative to the silica flux which many copper smelters must purchase as an additive for the metallurgical process (as necessary to remove iron from the copper-bearing material and ensure it separates into the slag).

While the New Amalga material does not contain copper in meaningful concentrations, copper smelters have gold-recovery circuits and can process this type of gold-bearing material with very high recoveries enabling favourable gold payabilities. Multiple copper smelters outside of China have expressed interest in the New Amalga material as part of this investigation.

The global copper concentrate market remains chronically undersupplied. Copper smelters are therefore seeking to better utilize available capacity through processing materials other than traditional copper concentrates. Demand for alternative feedstocks such as the gold-bearing New Amalga material is expected to increase as there is little relief forecasted in the copper concentrate supply.

Further details regarding offtake opportunities will be discussed in the Company's upcoming Preliminary Economic Assessment, expected in Q1 2026.

Ian Klassen, President and CEO comments: "The results of this study show that the New Amalga material is a very attractive feedstock for a wide variety of potential third-party processors located throughout the world. This demonstrates the flexibility of the project's offsite-processing configuration and its resiliency against future geopolitical or tariff risk."

The New Amalga Gold Project remains open to expansion in multiple directions and hosts an Indicated Resource of 1,438,500 ounces of gold at an average grade of 9.47 g/t Au (4,726,000 tonnes) and an Inferred Resource of 515,700 ounces of gold at an average grade of 8.85 g/t Au (1,813,000 tonnes). The current development concept envisions a small-footprint underground mining operation with third-party offsite processing, eliminating the need for an onsite mill or tailings storage facility.

Project highlights:

A

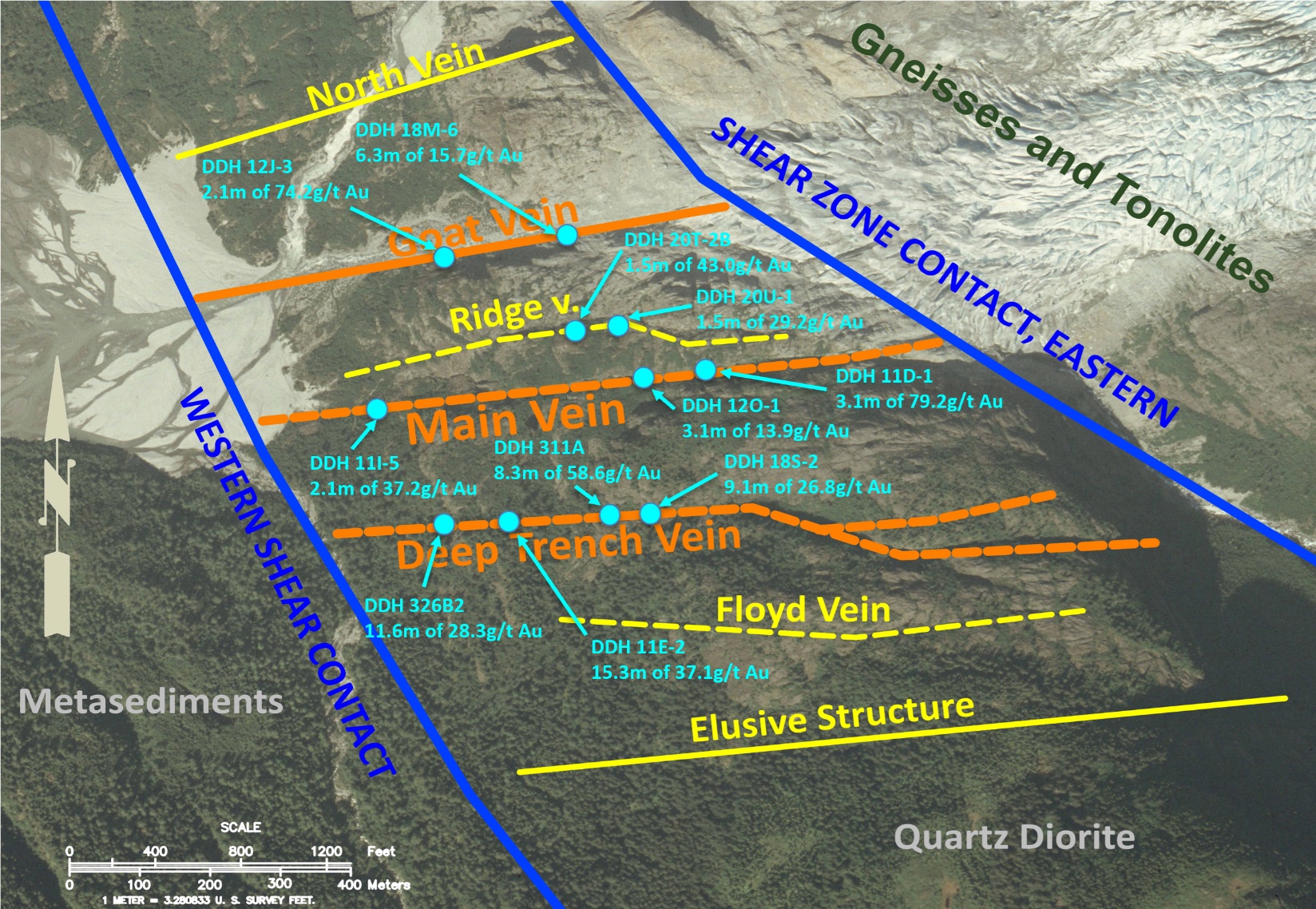

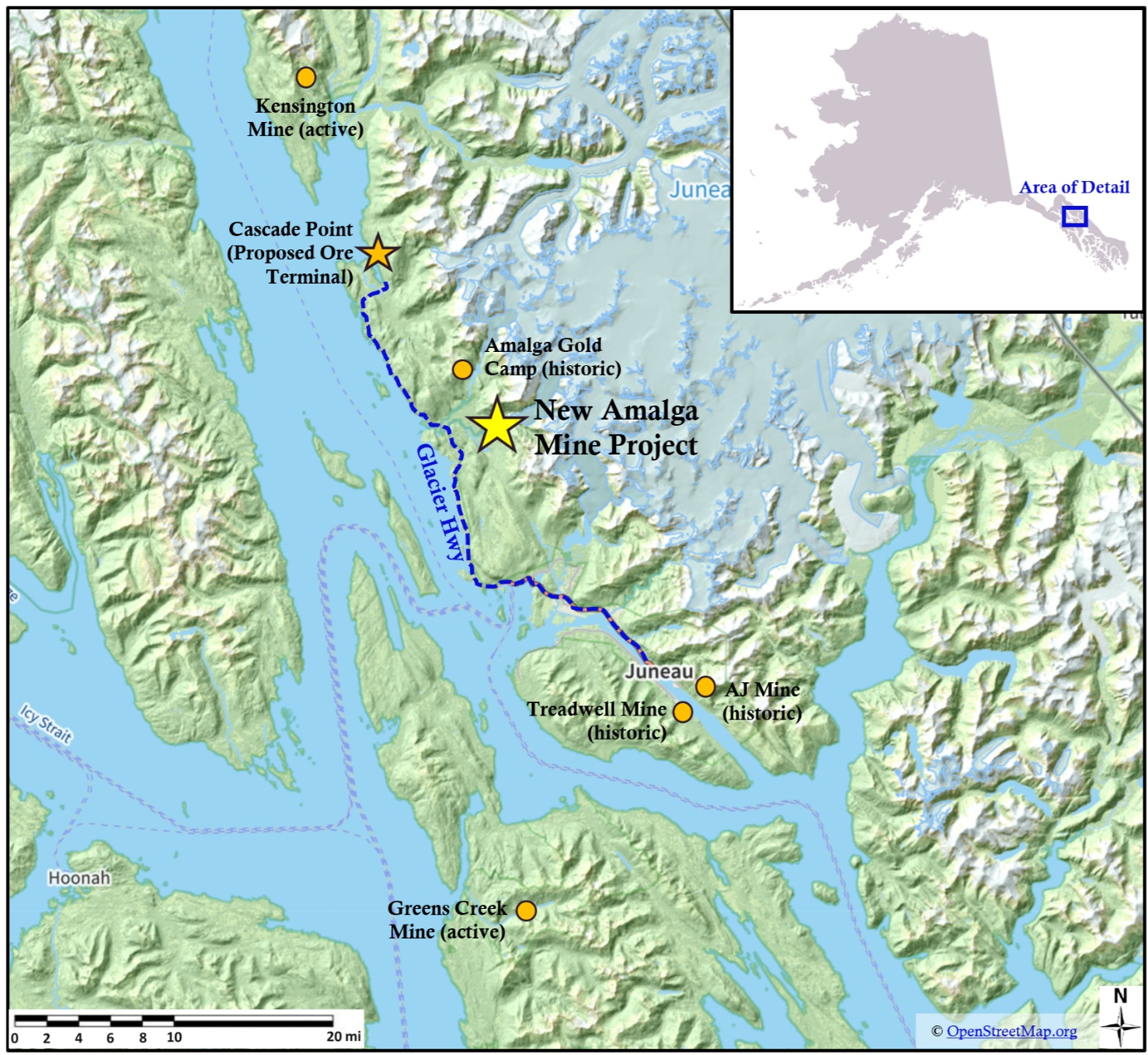

100% interest in the New Amalga Gold Project, located near infrastructure only 25km north of Juneau, Alaska and 6km from paved all-season highway (Fig. 2)The property is host to at least 8 large, long, gold bearing mesothermal veins

240 drill holes from 55 platforms totaling ~65,000 m confirm a large gold-quartz system

Past drilling produced multi-ounce assays on several veins. Select samples include:

Deep Trench Vein: 15.3m grading 37.1 g/t Au, 8.3m grading 58.6 g/t Au, 11.6m grading 28.3 g/t Au

Goat Vein: 2.1m grading 74.2 g/t Au, 6.3m grading 15.7 g/t Au

Main Vein: 3.1m grading 79.2 g/t Au, 2.1m grading 37.2 g/t Au, 3.1m grading 13.9 g/t Au

Ridge Vein: 1.5m grading 43.0 g/t Au, 1.5m grading 29.2 g/t Au

Sleeping Giant Vein: 2.1m grading 15.4 g/t Au, 3.2m grading 20.7 g/t Au

See Fig. 1 below for approximate locations of selected intercepts.

The Company's updated NI43-101 Mineral Resource Estimate (MRE) with an effective date of July 17, 2024 reported an Indicated Resource of 1,438,500 ounces of gold at an average grade of 9.47 g/t Au (4,726,000 tonnes); and an Inferred Resource of 515,700 ounces of gold at an average grade of 8.85 g/t Au (1,813,000 tonnes), as well as an Indicated Resource of 891,600 ounces of silver at an average grade of 5.86 g/t Ag (4,726,000 tonnes); and an Inferred Resource of 390,600 ounces of silver at an average grade of 7.33 g/t silver (1,813,000 tonnes).

The deposit is open to the north, south and at depth.

Goat vein surface outcrop channel samples assayed 129.02 g/t gold (3.76 opt) and 290 g/t gold (8.46 opt) with 224 g/t silver (6.53 opt)

LiDAR survey of property discovered numerous targets - the first of these tested confirmed gold discovery

Received excellent metallurgical recoveries up to

98.2% Completed 6+ years of environmental baseline water sampling

Current development strategy envisions a small-footprint underground mining operation with third-party offsite processing, eliminating the need for an onsite mill or tailings storage facility. This configuration reduces capital costs, greatly minimizes the project's environmental footprint, and facilitates permitting.

LOI signed with Goldbelt Inc (an Alaska Native Corporationorganized under the Alaska Native Claims Settlement Act) for development of an ore export terminal at Cascade Point, Goldbelt's privately-held parcel located only 22km from the project site.

NI43-101 Preliminary Economic Assessment in progress, expected completion 2026 Q1.

Fig. 1: Approximate Locations of Selected Intercepts

Fig. 2: Location of the New Amalga Gold Project

Kyle Mehalek, P.E.., is the QP within the meaning of NI 43-101 and has reviewed and approved the technical disclosure in this release. Mr. Mehalek is independent of Grande Portage within the meaning of NI 43-101.

About Grande Portage:

Grande Portage Resources Ltd. is a publicly traded mineral exploration company focused on advancing the New Amalga Mine project, the outgrowth of the Herbert Gold discovery situated approximately 25 km north of Juneau, Alaska. The Company holds a

The Company's updated NI#43-101 Mineral Resource Estimate (MRE) reported at a base case mineral resources cut-off grade of 2.5 grams per tonne gold (g/t Au) and consists of: an Indicated Resource of 1,438,500 ounces of gold at an average grade of 9.47 g/t Au (4,726,000 tonnes); and an Inferred Resource of 515,700 ounces of gold at an average grade of 8.85 g/t Au (1,813,000 tonnes), as well as an Indicated Resource of 891,600 ounces of silver at an average grade of 5.86 g/t Ag (4,726,000 tonnes); and an Inferred Resource of 390,600 ounces of silver at an average grade of 7.33 g/t silver (1,813,000 tonnes). The MRE was prepared by Dr. David R. Webb, Ph.D., P.Geol., P.Eng. (DRW Geological Consultants Ltd.) with an effective date of July 17, 2024.

ON BEHALF OF THE BOARD

"Ian Klassen"

Ian M. Klassen

President & Chief Executive Officer

Tel: (604) 899-0106

Email: Ian@grandeportage.com

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties as described in the Company's filings with Canadian securities regulators. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Please note that under National Instrument 43-101, the Company is required to disclose that it has not based any production decision on NI 43-101-compliant reserve estimates, preliminary economic assessments, or feasibility studies, and historically production decisions made without such reports have increased uncertainty and higher technical and economic risks of failure. These risks include, among others, areas that are analyzed in more detail in a feasibility study or preliminary economic assessment, such as the application of economic analysis to mineral resources, more detailed metallurgical and other specialized studies in areas such as mining and recovery methods, market analysis, and environmental, social, and community impacts. Any decision to place the New Amalga Mine into operation at levels intended by management, expand a mine, make other production-related decisions, or otherwise carry out mining and processing operations would be largely based on internal non-public Company data, and on reports based on exploration and mining work by the Company and by geologists and engineers engaged by the Company.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICE PROVIDER (AS THAT TERM IS DEFINED UNDER THE POLICIES OF THE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

SOURCE: Grande Portage Resources Limited

View the original press release on ACCESS Newswire