Grande Portage Resources Announces C$5Million Investment by Eric Sprott

Rhea-AI Summary

Grande Portage Resources (OTCQB:GPTRF) announced a non-brokered private placement of 20,000,000 units at C$0.25 for gross proceeds of C$5.0 million, to be subscribed in full by Eric Sprott through a related vehicle. Each Unit includes one common share and one-half warrant; each whole warrant is exercisable at C$0.35 for two years. The company said net proceeds will fund exploration and development of the New Amalga Gold Project and general working capital, with securities subject to a four-month plus one day hold.

The release notes an Indicated Resource of 1,438,500 oz Au at 9.47 g/t and an Inferred Resource of 515,700 oz Au at 8.85 g/t (effective July 17, 2024). Closing is subject to TSXV approval; Mr. Sprott agreed not to exercise warrants that would push his stake above 19.99% until shareholder approval for control-person status is obtained.

Positive

- C$5.0M private placement fully subscribed by prominent investor Eric Sprott

- Expected year-end working capital of approximately $10M

- Indicated resource of 1,438,500 oz Au at 9.47 g/t

Negative

- Issuance of 20,000,000 units plus warrants creates potential shareholder dilution

- Warrants exercisable at C$0.35 for two years may increase share count if exercised

- Warrant exercise restricted until shareholder approval for >19.99% control is obtained

News Market Reaction

On the day this news was published, GPTRF gained 11.65%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers showed mixed moves: CGLCF -3.83%, RDEXF +2.07%, AAUAF +14.71%, RGCCF -0.99%, USGDF -0.22%. GPTRF’s +4.67% gain alongside deal-specific news points to a company-specific reaction rather than a broad gold-sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 04 | Strategic financing | Positive | +11.7% | C$5M private placement with Eric Sprott to fund New Amalga exploration. |

| Dec 01 | Offtake study | Positive | +0.1% | Independent offtake study validated offsite processing and smelter interest. |

| Nov 24 | Technical survey | Positive | +2.6% | LiDAR survey results supporting engineering, environmental work and targeting. |

| Nov 20 | Permitting update | Positive | -3.4% | Filed 2026 drill permit for up to 4,300 m in 14 holes; shares fell. |

| Nov 18 | Marketing mandate | Positive | +18.2% | Hired Machai Capital for four‑month digital marketing program; stock jumped. |

Recent news has been consistently project-advancing, with mostly positive price reactions and only one divergence on a permitting update.

Over the past month, the company has focused on advancing the New Amalga Gold Project through technical, permitting, and marketing steps. A LiDAR survey, a 2026 drill permit filing, and an offtake study all highlighted robust Indicated and Inferred resources and preparation for a NI 43‑101 PEA expected in Q1 2026. A marketing engagement on Nov 18 coincided with a strong +18.18% move. Today’s C$5.0M strategic financing continues this pattern of de-risking and project advancement.

Market Pulse Summary

The stock surged +11.7% in the session following this news. A strong positive reaction aligns with prior responses to accretive project news, such as the +18.18% move on the marketing mandate and +11.65% on this same C$5,000,000 financing. The investment by a cornerstone holder, combined with robust resources of 1,438,500 Indicated and 515,700 Inferred ounces, supported enthusiasm. Investors would still have needed to weigh dilution from 20,000,000 new units and future warrant overhang when assessing durability.

Key Terms

non-brokered private placement offering financial

warrant financial

indicated resource technical

inferred resource technical

g/t au technical

ni 43-101 regulatory

preliminary economic assessment technical

AI-generated analysis. Not financial advice.

Not for distribution to United States newswire services or for dissemination in the United States.

VANCOUVER, BC / ACCESS Newswire / December 4, 2025 / Grande Portage Resources Ltd. (TSXV:GPG)(OTCQB:GPTRF)(FSE:GPB) ("Grande Portage" or the "Company") is pleased to announce a non-brokered private placement offering of 20,000,000 units of the Company (the "Units") at a price of

The Company intends to use the net proceeds raised from the Offering for exploration and development of the New Amalga Gold deposit as well as general working capital. The securities issued under the Offering will be subject to a four month plus 1 day hold period. Closing of the Offering is subject to customary closing conditions, including final approval of the TSX Venture Exchange (the "TSXV"). In addition, Mr. Sprott will covenant not to exercise any of the Warrants if such exercise will result in him holding in excess of

Ian Klassen, President and CEO, commented: "We are very pleased to see Mr. Sprott increase his equity position in Grande Portage, where he continues to be our largest shareholder. His ongoing support has enabled the Company to advance our high-grade gold project through successive drilling campaigns, baseline pre-NEPA studies, and preparations for next quarter's PEA. This latest capital infusion is significant, positioning the Company to end the year with approximately

The New Amalga Gold Project remains open to expansion in multiple directions and hosts an Indicated Resource of 1,438,500 ounces of gold at an average grade of 9.47 g/t Au (4,726,000 tonnes) and an Inferred Resource of 515,700 ounces of gold at an average grade of 8.85 g/t Au (1,813,000 tonnes) with an effective date of July 17, 2024. The current development concept envisions a small-footprint underground mining operation with third-party offsite processing, eliminating the need for an onsite mill or tailings storage facility.

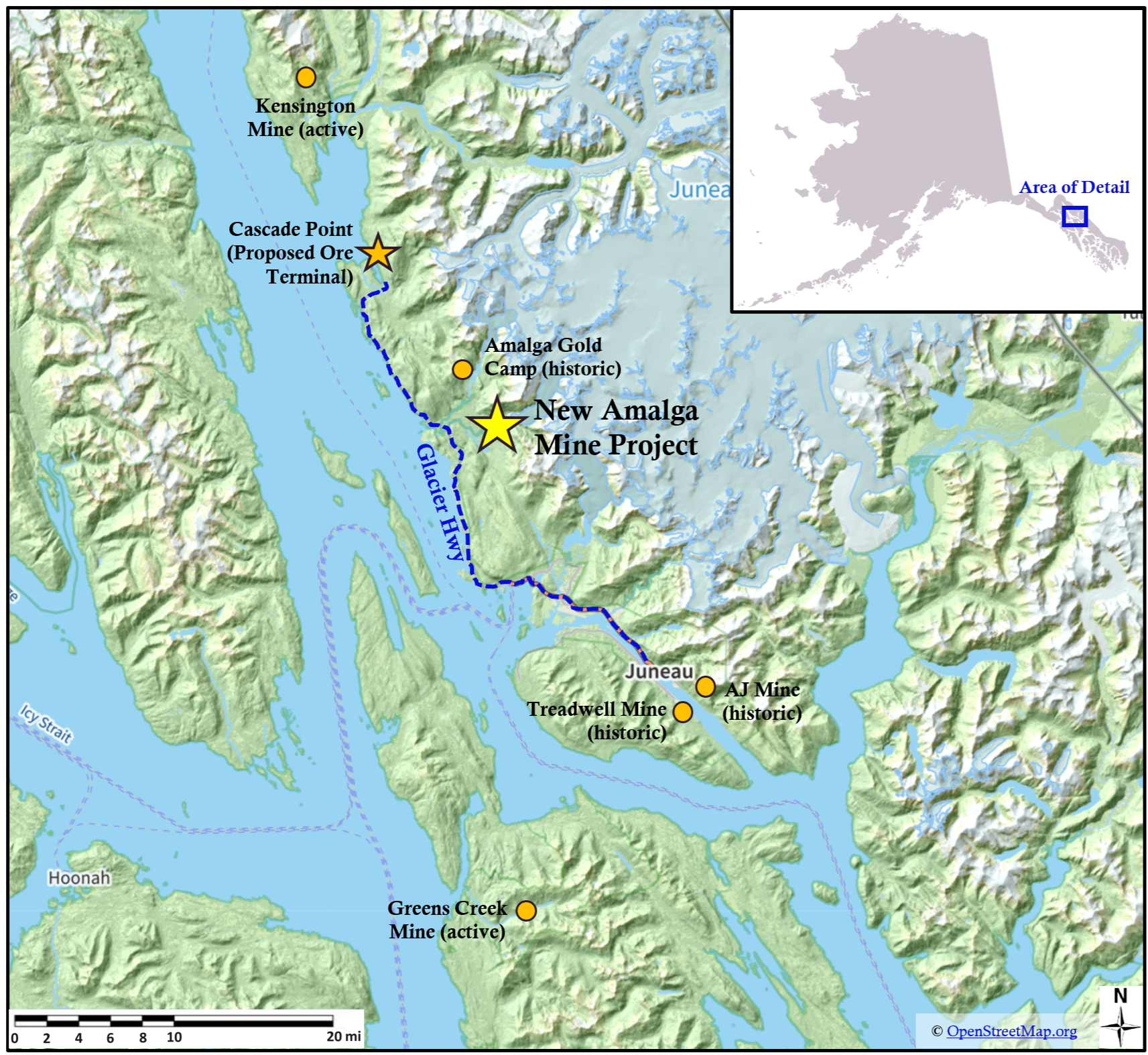

Fig. 1: Location of New Amalga Mine Project

Kyle Mehalek, P.E.., is the QP within the meaning of NI 43-101 and has reviewed and approved the technical disclosure in this release. Mr. Mehalek is independent of Grande Portage within the meaning of NI 43-101.

About Grande Portage:

Grande Portage Resources Ltd. is a publicly traded mineral exploration company focused on advancing the New Amalga Mine project, the outgrowth of the Herbert Gold discovery situated approximately 25 km north of Juneau, Alaska. The Company holds a

The Company's updated NI 43-101 Mineral Resource estimate reported at a base case mineral resources cut-off grade of 2.5 grams per tonne gold (g/t Au) and consists of: an Indicated Resource of 1,438,500 ounces of gold at an average grade of 9.47 g/t Au (4,726,000 tonnes); and an Inferred Resource of 515,700 ounces of gold at an average grade of 8.85 g/t Au (1,813,000 tonnes), as well as an Indicated Resource of 891,600 ounces of silver at an average grade of 5.86 g/t Ag (4,726,000 tonnes); and an Inferred Resource of 390,600 ounces of silver at an average grade of 7.33 g/t silver (1,813,000 tonnes). The mineral resource estimate was prepared by Dr. David R. Webb, Ph.D., P.Geol., P.Eng. (DRW Geological Consultants Ltd.) with an effective date of July 17, 2024. Additional information on the New Amalga Mine project is available in the technical report titled "Technical Report of the Herbert Gold Property, Juneau District, Southeast Alaska" dated July 17, 2024, which is available under Grande Portage's SEDAR+ profile at www.sedarplus.ca.

ON BEHALF OF THE BOARD

"Ian Klassen"

Ian M. Klassen

President & Chief Executive Officer

Tel: (604) 899-0106

Email: Ian@grandeportage.com

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Forward-looking statements or information contained in this release include, but are not limited to, statements or information with respect to: the Offering, including timing, ability to meet the applicable closing conditions and completion thereof, statutory hold periods, ability to obtain shareholder approval for a new Control Person, and the use of proceeds, and expectations regarding the New Amalga Mine project, including the Company's mineral resources. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties as described in the Company's filings with Canadian securities regulators. These risks, uncertainties and other factors include, among others, the ability to complete the Offering, including the timing and ability to meet the applicable closing conditions, including all necessary approvals, the final use of proceeds of the Offering, the ability to obtain shareholder approval for a new Control Person and risks associated with the exploration and development of the New Amalga Mine and our mineral resources. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Please note that under National Instrument 43-101, the Company is required to disclose that it has not based any production decision on NI 43-101-compliant reserve estimates, preliminary economic assessments, or feasibility studies, and historically production decisions made without such reports have increased uncertainty and higher technical and economic risks of failure. These risks include, among others, areas that are analyzed in more detail in a feasibility study or preliminary economic assessment, such as the application of economic analysis to mineral resources, more detailed metallurgical and other specialized studies in areas such as mining and recovery methods, market analysis, and environmental, social, and community impacts. Any decision to place the New Amalga Mine into operation at levels intended by management, expand a mine, make other production-related decisions, or otherwise carry out mining and processing operations would be largely based on internal non-public Company data, and on reports based on exploration and mining work by the Company and by geologists and engineers engaged by the Company.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any securities in the United States. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICE PROVIDER (AS THAT TERM IS DEFINED UNDER THE POLICIES OF THE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE

SOURCE: Grande Portage Resources Limited

View the original press release on ACCESS Newswire