Prospera Energy Announces Operations and Financing Update

Rhea-AI Summary

Prospera Energy (OTC: GXRFF / TSXV: PEI) provided an operations and financing update highlighting multiple successful well reactivations at Luseland and an amended non-brokered unit offering. The Offering targets $3,000,000 CAD at $0.035 per unit with three-year warrants exercisable at $0.05. The company also agreed to settle $79,532.98 of trade payables by issuing 1,590,660 shares at a deemed $0.05 per share; the offering is subject to TSXV acceptance and targets close by March 15, 2026.

Positive

- Non-brokered Offering of $3,000,000 CAD to fund reactivations and working capital

- Warrants exercisable at $0.05 for three years, providing committed upside financing

- Shares-for-debt settlement of $79,532.98 via 1,590,660 shares at $0.05

- Multiple Luseland wells successfully reactivated, including a well with >10 JOF available

Negative

- Potential shareholder dilution from $3.0M unit offering and attached warrants

- Finder fees up to 3% cash plus 3% warrants increase issuance cost

- Offering remains subject to TSXV acceptance and may not close by March 15, 2026

Calgary, Alberta--(Newsfile Corp. - February 15, 2026) - Prospera Energy Inc. (TSXV: PEI) (OTC Pink: GXRFF) ("Prospera", “PEI”, the “Company”, or the "Corporation") is pleased to provide an operational update highlighting the continued success of our corporate reactivation strategy in Luseland. Recent field operations and production engineering initiatives have successfully reactivated numerous wells, now delivering strong reservoir oil production rates. Ongoing technical learnings and optimization efforts are driving measurable production growth from currently active wells while enhancing execution efficiency and capital effectiveness across additional reactivation candidates.

Luseland Update

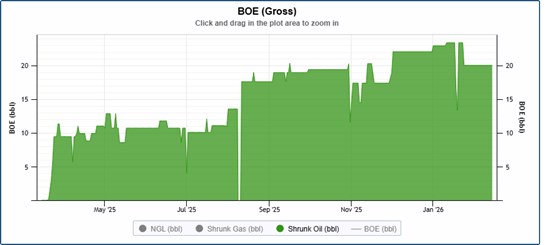

10-07 continues to be our star well and a model of consistency. After more than seven months of steady output with stable oil cuts, it still holds significant optimization potential. We are confident that with further adjustments, we can unlock even more value from this reliable producer while carefully balancing total fluid production to prevent water coning.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/12143/284008_241d0d7c5467b84d_001full.jpg

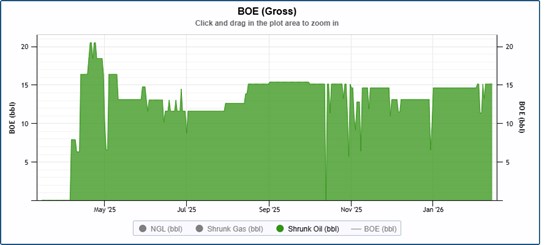

10-08 is a strong testament to the effectiveness of our optimization strategy. Through careful operational management and incremental RPM increases, we have successfully increased oil production while reducing water cut. We will continue to closely monitor performance to maximize output as oil cuts improve and oil viscosity decreases through ongoing incremental wormhole propagation.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/12143/284008_241d0d7c5467b84d_002full.jpg

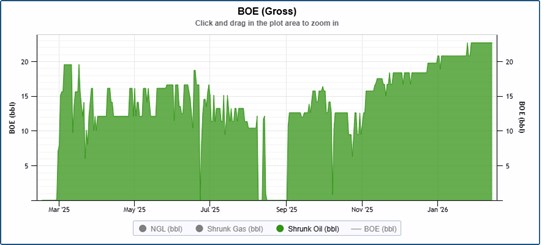

01-17 continues to be another standout performer, producing at a very low water cut and generating exceptional netbacks. Strategically positioned on the updip erosional edge of the Luseland pool, it represents a key asset and further validates production potential in Section 17, where numerous legacy wells have each produced more than 400,000 barrels and continue to deliver strong output. We are actively managing sand production to support sustained performance and ensure long-term, profitable operations.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/12143/284008_241d0d7c5467b84d_003full.jpg

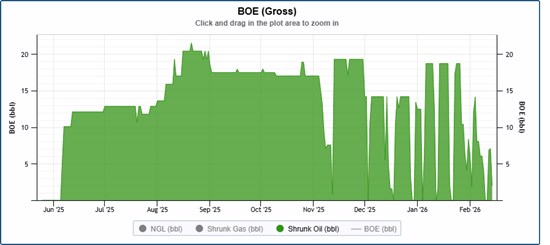

16-07 is a powerful example of our core reactivation strategy in action, with more than 10 JOF (joints of fluid) still available for optimization. After being shut-in for over 20 years, the well was successfully reactivated and is now a meaningful contributor to Luseland production. Its performance reinforces our confidence that numerous other long-term shut-in wells across our portfolio hold similar upside potential, representing a substantial and capital-efficient growth opportunity for Prospera.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/12143/284008_241d0d7c5467b84d_004full.jpg

03-09 has been successfully reactivated and further optimized through the implementation of a recycle pump strategy. The well's performance since reactivation has been exceptional, delivering some of the highest and most stable initial production rates in the field. A 5 RPM increase was completed in early January, with additional 5 RPM adjustments planned to drive incremental production through the upgraded 8-1500 CHOPS pump equipped with a soft nitrile elastomer for enhanced sand handling. The well is currently producing with approximately

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/12143/284008_241d0d7c5467b84d_005full.jpg

07-33 represents another strong case study of our optimization strategy, having exhibited a recovery factor of less than

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/12143/284008_241d0d7c5467b84d_006full.jpg

Equity Offering

The Corporation is pleased to provide an update to its previously announced unit offering dated January 19th, 2026. The Corporation has amended the terms of the offering to extend the term of the associated warrants by one year. The warrants will now be exercisable at a price of

| Issuer: | Prospera Energy Inc. ("Prospera" or the "Corporation"). |

| Issue: | Non-brokered offering (the "Offering") of units ("Units"). Each Unit will consist of (i) one common share of the Company and (ii) one common share purchase warrant (the "Warrant"). Each Warrant shall entitle the holder to acquire one additional common share of the Company at an exercise price of |

| Issue Price: | |

| Offering Amount: | |

| Underlying Shares: | Common shares of the Company listed on the TSX Venture Exchange under the symbol PEI (the "Common Shares"). |

| Use of Proceeds: | Net proceeds of the offering may be used for well reactivations, production optimization, and working capital. The Offering is intended to support near-term production growth, increase working capital and liquidity, and further strengthen the Company's balance sheet. |

| Dividend Adjustment and Anti-Dilution: | The Warrant exercise price will also be subject to standard anti-dilution adjustments upon, inter alia, share consolidations, share splits, spin-off events, rights issues and reorganizations. |

| Offering Basis: | Non-brokered private placement offering. |

| Target Close Date: | On or before March 15, 2026. |

| Finders Fees | The Company may pay qualified finders a fee of |

Monthly Conference Call

Prospera Energy's commitment to transparency continues through its recurring monthly conference call series. Senior management provides updates on operations across the Company's core heavy oil properties, including field-level insights, specific well performance, key financial metrics, and forward-looking development plans. Our next call will be held on Wednesday, February 18th, at 10 AM MST. Additionally, each monthly conference call will be audio hosted on X Spaces through the official Prospera Energy account with a recording available after the call. Register Here.

Shares for Debt Settlements

Prospera has entered into agreements with twelve vendors to settle a total of

About Prospera

Prospera Energy Inc. is a publicly traded Canadian energy company specializing in the exploration, development, and production of crude oil and natural gas. Headquartered in Calgary, Alberta, Prospera is dedicated to optimizing recovery from legacy fields using environmentally safe and efficient reservoir development methods and production practices. The company's core properties are strategically located in Saskatchewan and Alberta, including Cuthbert, Luseland, Hearts Hill, and Brooks. Prospera Energy Inc. is listed on the TSX Venture Exchange under the symbol PEI and the U.S. OTC Market under GXRFF.

Prospera reports gross production at the first point of sale, excluding gas used in operations and volumes from partners in arrears, even if cash proceeds are received. Gross production represents Prospera's working interest before royalties, while net production reflects its working interest after royalty deductions. These definitions align with ASC 51-324 to ensure consistency and transparency in reporting.

For Further Information:

Shawn Mehler, IR

Email: investors@prosperaenergy.com

Chris Ludtke, CFO

Email: cludtke@prosperaenergy.com

Shubham Garg, Chairman of the Board

Email: sgarg@prosperaenergy.com

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the future operations of the Corporation and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will," "may," "should," "anticipate," "expects" and similar expressions. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding future plans and objectives of the Corporation, are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

Although Prospera believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Prospera can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), commodity price and exchange rate fluctuations and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of Prospera. As a result, Prospera cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and Prospera does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

Neither TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/284008