Nicola Mining Provides Shareholders a "Year in Review" for 2025

Rhea-AI Summary

Nicola Mining (OTCQB: HUSIF) reported a transformational 2025 marked by permitting, production starts, and balance-sheet improvements. Key 2025 achievements include a 10,000‑tonne Dominion Creek bulk‑sample structure, receipt of the Dominion final permit, a $0.28 unit private placement, elimination of the $4,481,066 current convertible‑debenture portion to $0, and transition of Merritt Mill from toll‑milling to ongoing gold and silver processing with an initial ~3,100 tonnes of Talisker millfeed. Other milestones: multi‑year permits and lease extensions at Treasure Mountain and New Craigmont, $5.0M invested in gravel/quarry/cement infrastructure, and intent to pursue a NASDAQ listing in H1 2026.

Positive

- Convertible debenture current portion reduced from $4,481,066 to $0

- Dominion bulk sample structured for 10,000 tonnes with 75% Nicola profit share

- Talisker shipment of ~3,100 tonnes of high‑grade ore to Merritt Mill

- $5.0 million invested in gravel/quarry/cement ready‑mix infrastructure

- Received multi‑year permits and 10‑year mine‑lease extension at Treasure Mountain

Negative

- None.

News Market Reaction

On the day this news was published, HUSIF declined 2.68%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers showed mixed moves, from -2.96% (AMRRY) to +4.53% (CVVUF), with no consistent direction or same-day news, indicating HUSIF’s reaction was stock-specific rather than sector-driven.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 08 | Year-in-review update | Positive | -2.7% | Summarized 2025 milestones, debt elimination, and multi-asset progress. |

| Dec 01 | Millfeed partnership | Positive | +13.3% | Start of Blue Lagoon high-grade millfeed and non-dilutive credit line. |

| Nov 10 | High-grade assays | Positive | +0.2% | Dominion assays confirmed multiple high-grade veins ahead of bulk sample. |

| Nov 06 | CEO interview | Neutral | -6.5% | Promotional CEO interview on strategy and plans via CEO.CA platform. |

| Nov 04 | Project development | Neutral | -6.7% | Dominion mine development completed; weather-driven delay to 2026 bulk sample. |

Recent news often read positively but saw mixed to negative next-day moves, with more divergences than alignments, especially around broader corporate updates and project progress.

Over recent months, Nicola Mining reported multiple operational milestones. These included Dominion Creek bulk‑sample preparations, high‑grade assay results, and commencement of Blue Lagoon millfeed deliveries, alongside Merritt Mill’s shift into gold and silver production. The company also advanced Dominion mine development and secured key permits and lease extensions at New Craigmont and Treasure Mountain. Despite these updates, price reactions ranged from a 13.28% gain on Blue Lagoon millfeed news to several mid‑single‑digit declines on other announcements, framing today’s year‑in‑review within a volatile response pattern.

Market Pulse Summary

This announcement recaps a year in which Nicola advanced five core assets, including Dominion’s 10,000‑tonne bulk-sample framework, Merritt Mill’s evolution into a gold and silver producer, and updated permits and leases at New Craigmont and Treasure Mountain. It also notes removal of the $4,481,066 current portion of a convertible debenture and about $5.0 million invested in gravel and cement operations. Investors may track Dominion extraction progress, ongoing millfeed volumes, permitting milestones, and the planned NASDAQ listing in 2026.

Key Terms

bulk sample technical

non-brokered private placement financial

convertible debenture financial

millfeed technical

mine lease regulatory

porphyry copper technical

First Nations regulatory

NASDAQ financial

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - December 8, 2025) - Nicola Mining (TSXV: NIM) (FSE: HLIA) (OTCQB: HUSIF) (the "Company" or "Nicola")

Dear Shareholders and Investors,

2025 stands as the most transformative year in the history of Nicola Mining Inc. (the "Company" or "Nicola"). It was a year defined by disciplined execution, strategic clarity, and a series of milestones that meaningfully advanced our position as an emerging precious-metal producer with multiple value-generating assets in British Columbia. Equally important, the year underscored the strength and dedication of our team, whose efforts played a central role in achieving these results.

During 2025, precious metals experienced a strong upward trajectory as investors sought stability amid persistent geopolitical uncertainty, tightening supply conditions, and renewed interest in hard-asset protection. Gold and silver benefited from rising central-bank and Tether demand, global instability driving investors towards metals, and concerns over long-term inflation to name a few. The reinforcing of precious metals' role as a strategic hedge was a clear component driver of diversified commodity portfolios and proved to be a catalyst for many juniors, including Nicola, which saw significant value accretion in share prices. While Nicola benefitted from these broader macro tailwinds, our focused remained on tangible execution across exploration, operations, and revenue-generating activities.

News flow commenced on February 20th with the Company providing drill results from its highly successful 2024 Exploration Program1. While retail investors focused on drill hole NC-24-002, which included an intercept of 53 metres of over

The existence of near surface mineralization with both skarn and porphyritic attributes reinforced that Craigmont mineralization is associated with a much larger copper system and indifferent to host rock.

Less than one month later, Nicola announced that it had received the draft bulk sample permit2 ("Draft Permit") for its Dominion Creek Gold Project ("Dominion"), a high grade gold and silver project near Smithers, British Columbia. Under the agreement with High Range Exploration Ltd. ("High Range") the two parties are to conduct a bulk sample under the following structure:

- Nicola is to fund permitting, mine engineering, reclamation bond, mine development, extraction, trucking and processing for the 10,000 tonne bulk sample.

- Unlike a generic earn-in-structure3 Nicola leverages its milling facility to create a unique and conservative acquisition structure in which it reimburses itself for all costs associated with production prior to sharing profit. For example, at Dominion, after Nicola has reimbursed itself for all costs, the two parties are to share profit (

75% Nicola and25% High Range) for the 10,000 tonne bulk sample. Upon completion of the bulk sample, Nicola will own100% of the high-grade project.

On March 12, 2025, Nicola announced that it had successfully received the Final Permit4. In the same news release, the Company announced that it had successfully closed a non-brokered private placement at a price of

In addition, the Company's balance sheet has changed significantly:

- January 1, 2025: Current Portion of Outstanding Convertible Debenture was

$4,481,066 - December 1, 2025: Current Portion of Outstanding Convertible Debenture is

$0

Another 2025 milestone was the addition of US analyst coverage via Noble Capital Markets ("Noble"), a SEC / FINRA registered full-service investment bank and advisory firm with an award-winning research team and proprietary investor distribution platform its analyst coverage on May 8, 2025. The addition of Noble to Atrium Research, a Canada-based pay-for research firm that commenced October of 2024, meant that Nicola had analyst coverage in both Canada and the United States.

July 9, 2025, proved to be a significant day for Nicola Mining Inc.

The Ministry of Mining and Critical Minerals5 had recognized the potential of Nicola's Merritt Mill as a milling hub and project generated for years. It had previously introduced to Nicola bulk samples opportunities with Blue Lagoon Resources ("Blue Lagoon"), Osisko Development, and Talisker Resources Ltd. ("Talisker"); however, on July 9, 2025, Nicola transitioned from bulk sample processing to become a gold and silver producer.

Talisker Millfeed

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4873/277142_90fc86e8d4a059fb_001full.jpg

On this day Talisker announced that it had shipped approximately 3,100 tonnes of high grade gold ore from the Mustang Mine to Nicola's Merritt Mill for processing.

The ability for Nicola to enter into multiple agreements, not only confirms the strategic significance of our M-68 Mine Permit in British Columbia, but also the province's accelerated commitment in assuring that solid and well managed products can move forward.

The same day saw Nicola participate in Blue Lagoon's official Mine Opening Event, which was attended by First Nations, Ministry of Mining and Critical Minerals representatives, the Mayor of Smithers, Gladys Atrill, investors and local supporters. The first-class two-day event was a testimony to its management's sedulous efforts to move the project forwarded and showcased its commitment to First Nations relations and the environment.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4873/277142_90fc86e8d4a059fb_002full.jpg

On December 1, 2025, Nicola announced that Blue Lagoon had commenced transporting high-grade gold and silver ore to Nicola's mill under a long-term partnership agreement.

Nicola and Blue Lagoon embrace a shared commitment to sustainability and environmental commitment, as highlighted by Blue Lagoon being the recipient of PDAC's 2026 Sustainability Award6

Unavowed to shareholders was the immense effort Nicola had undertaken all month at Dominion. During the month of July, Nicola installed a bridge, purchased and installed a 14-man camp, which includes fully furnished rooms and all required facilities, and commenced road work and mine development.

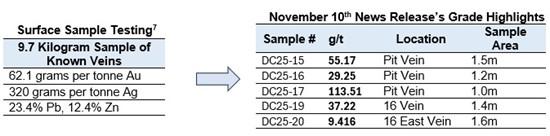

Though mine development progressed smoothly, the Company had not anticipated Dominion's veins to widen and remain open in all directions. The November 10th, 2025, news release provided clarification into Nicola's providence of opting to commit the entire season to expanded mine development in preparation for a robust 2026 focus on extraction.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4873/277142_nicolamining1.jpg

As conjectured, November 10th testing confirmed the original Surface Sample Testing; however, the emergence of new veins, such as the 16 East Vein, the widening of both the Pit and 16 Vein, and the discovery that all are open at depth and length.

ALL DOMINION WORK WAS INTERNALLY FUNDED AND WITHOUT SHAREHOLDER DILUTION

The third quarter ended with Nicola reminding shareholders of its long-term commitment to its wholly owned New Craigmont Copper Project with the announcement of having received six mining lease extensions (Mine Leases 237642 to 237647) for five years. The significance of garnering the extensions cannot be underemphasized as Nicola continues to vector towards porphyry copper mineralization at New Craigmont, which is the site of the historic Craigmont Copper Mine8. Lab results from the 2025 Craigmont Exploration Program are pending and will be released upon receipt. A more detailed exploration update will be released later this month.

As We are fully cognizant that junior miners have benefited from macro influences, uneven global growth, and bursts of safe-haven demand9. Indeed, as Q3 closed, the expansion of our gravel pit and cement ready mix plant opened. The receipt of two key permits for its wholly owned gravel pit (Permit G1519) and fully completed construction of its cement ready mix plant10 positions Nicola to reap benefits from peripheral revenue streams that support overall operations.

塵も積もれば山となる11 EVEN DUST IF PILED UP BECOMES A MOUNTAIN

Nicola defines itself as a producer and explorer but also recognizes that all revenues contribute to the bottom line and minimize dilution. Our aggregate, rock quarry and cement ready mix plant, which jointly managed with First Nations not only augments revenues but is a catalyst of solid local relations.

Completion and Final Road Work View of Gravel Storage Pads

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4873/277142_90fc86e8d4a059fb_004full.jpg

Nicola also reintroduced investors to one of its cornerstone assets, Treasure Mountain Silver Project ("Treasure Mountain")12, a high-grade silver mine that has been on care-and-maintenance since 2013. Importantly, this pause was not the result of operational or geological limitations, but rather the consequence of the severe collapse in silver prices in 2013. Silver fell from US

Momentum returned to the asset in 2025. In addition to encouraging exploration work, Nicola received a multi-year, area-based exploration permit on June 9, 2025 authorizing diamond drilling and trenching across key targets at Treasure Mountain. This development complemented the Company's August 30, 2024 news release, which confirmed receipt of a 10-year mine lease extension through April 26, 2032. Together, these advancements materially enhance the project's long-term development potential, particularly against the backdrop of record silver prices.

Summary of 2025: A Year of Disciplined Execution Across Five Strategic Assets

2025 can be characterized by a blend of persistence, adaptability, and steadfast execution. Management demonstrated unwavering commitment to advancing each of Nicola's five core assets while maintaining disciplined evaluation of new opportunities. Key achievements include:

- New Craigmont: Renewal of critical mine leases and the advancement of a robust exploration program focused on vectoring toward a porphyry center at one of North America's most historically significant copper producers.

- Merritt Mill: A transformational shift from toll-milling to long-term precious-metal production, firmly establishing Nicola as a gold and silver producer with multi-source millfeed.

- Treasure Mountain: Receipt of both a multi-year exploration permit and a 10-year mine-lease extension, significantly increasing project value and aligning with record silver prices that support the potential reopening of the mine and renewed exploration.

- Gravel / Rock Quarry / Cement Ready-Mix Plant: With approximately

$5.0 million invested in equipment, machinery, and infrastructure, the operation has emerged as a regional leader, contributing steady, diversified revenue and strengthening community partnerships. - Dominion Creek Gold Project: Completion of key milestones including permitting, mine engineering, road construction, mine development, and the acquisition of a full camp, collectively positioning Dominion as a rapidly expanding and increasingly compelling high-grade gold project.

2025 highlighted the powerful synergy created by advancing five value-generating assets within a single, politically stable jurisdiction.

"What is Nicola's strategic focus for 2026?"

The Company intends to pursue a NASDAQ14 listing in the first half of 2026, a strategic step designed to broaden institutional visibility, enhance liquidity, and position Nicola alongside its North American peers. While macroeconomic conditions will continue to influence equity valuations across the mining sector[15], Nicola's management remains focused on accelerating execution and expanding upon the operational and financial milestones achieved in 2025.

We anticipate meaningful benefit from a full year of milling operations, including consistent millfeed from Blue Lagoon and Dominion, as well as additional sources currently under discussion. These revenues will be complemented by contributions from our First Nations partnership and the potential restart of Treasure Mountain, which could serve as an additional catalyst for growth.

On the exploration front, Nicola will continue advancing toward confirmation of a porphyry copper system at New Craigmont, while also initiating drilling on the backside of Treasure Mountain through an initial three or four-hole program designed to test outcropping mineralized veins at depth.

As we extract the bulk sample at Dominion, we are optimistic that the project will continue to grow.

Qualified Person

The scientific and technical disclosures included in this release have been reviewed and approved by Will Whitty, P.Geo., who is the Qualified Person as defined by NI 43-101. Mr. Whitty is Vice President of Exploration for the Company.

On behalf of the Board of Directors

"Peter Espig"

CEO & Director

For additional information

Contact: Peter Espig

Phone: (778) 385-1213

Email: info@nicolamining.com

"Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release."

Forward-Looking Statements

Certain statements in this letter are forward-looking statements, which reflect the expectations of management regarding the Company. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future, including, but not limited to, statements regarding: (i) Nicola's near term and long term goals, specifically with regard to its priorities for 2026; (ii) Nicola's ability to move forward on its five-year exploration plan; (iii) the anticipated receipt 2025 lab analyses and as a result thereof, any effect these results may have on Nicola's diamond drilling exploration plans for both copper skarn and porphyry copper targets; (iv) the value, intrinsic or otherwise, of the Merritt Mill Site; (v) any cash flows associated with milling activities at the Merritt Mill Site; (vi) the prospects of Nicola's exploration projects, including its New Craigmont, Treasure Mountain and Merritt Mill Site; and (vii) any general statement regarding Nicola's operational and exploratory goals going forward. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements, including risks related to factors beyond the control of the Company. These risks include, but are not limited to: (i) changes in Nicola's business relationships and plans; (ii) changes in the anticipated revenue streams and operational and exploratory goals; (iii) the failure of Nicola to receive the necessary approvals for various regulatory applications and permits, as applicable; (iv) and other general business, economic, or market related risks beyond the director control of the Company and which may affect the Company's business and operations. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.

1 News Release: February 20, 2025 Link

2 Bulk Sample: An exploration and development activity conducted on a mineral claim to investigate the metallurgical properties of an ore body, to test extractive milling methods, mill equipment, and potential markets

3 A contractual agreement in which a party earns an interest in a project over time, typically four years, by meeting specific financial, exploration, or operational milestones.

4 Receipt of Final Bulk Sample Permit (MX-100000488) News Release: March 12, 2025 Link

5 The Ministry of Mining and Critical Minerals is responsible for British Columbia's strategy for mining and critical mineral projects.

6 News Release: November 5, 2025. Link

7 News Release: October 14, 2020 Link

8 The historic Craigmont Mine produced 34 million tonnes of copper at

9 World Bank Article: November 12, 2025 Link

10 Nicola Completes Construction of Cement Ready Mix Plant and Receives Key Permits: Link

11 Japanese Proverb: Link

12 News Release: October 15, 2025 Link

13 Google Search: Link

14 News Release October 27, 2025 Link

15 Investing News Network: August 19, 2025 Link and Investing Analysis: Mining Stocks October 2025 Link

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277142