Headwater Gold and Centerra Gold Sign US $25 Million Earn-In Agreement to Explore the Crane Creek Gold Project in Idaho

Rhea-AI Summary

Headwater Gold (OTCQB: HWAUF) entered a definitive earn-in with a Centerra Gold subsidiary allowing Centerra to earn up to 70% of the Crane Creek project in Idaho via staged exploration funding up to US$25,000,000 and completion of a PEA.

Key terms include a US$2.5M minimum commitment in the first three years, Stage 1 of US$10M for 51% within four years, Stage 2 of US$15M to reach 60% plus NSR royalties to Headwater, and a Stage 3 PEA (≥1,000,000 oz AuEq) to reach 70%. Project is fully permitted for drilling; Phase 1 drilling targeted for spring 2026.

Positive

- Earn-in funding up to US$25,000,000 for exploration

- Firm minimum commitment of US$2,500,000 in first three years

- Centerra may fund a PEA to increase interest to 70%

- Project is fully permitted for drilling (BLM Notice of Intent and Idaho Plan of Operation)

Negative

- Headwater ceded a 2% NSR on royalty-free claims and 1% NSR on underlying-royalty lands upon Stage 2 completion

- Stage 3 earn-in requires a PEA with a minimum 1,000,000 oz AuEq resource (material hurdle)

- If Centerra completes Stage 1 but not Stage 2, Centerra ownership can drop to 49%, creating short-term ownership uncertainty

News Market Reaction – HWAUF

On the day this news was published, HWAUF gained 3.86%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Gold peers were mixed with several notable gainers: AAUAF +14.71%, VLCJF +10.84%, RCGCF +8.01%, while RGCCF slipped -0.99%. HWAUF’s slight move -0.19% ahead of this partnership news diverged from the stronger upside in some peers, pointing to a more stock-specific setup.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 03 | Earn-in agreement | Positive | +3.9% | Centerra earn-in up to 70% at Crane Creek with up to US$25M funding. |

| Oct 30 | Conference participation | Positive | +1.9% | Participation in New Orleans Investment Conference to present exploration strategy. |

| Oct 20 | Permitting milestone | Positive | +3.6% | Spring Peak project selected for US FAST-41 expedited permitting track. |

| Oct 15 | Earn-in agreement | Positive | +1.5% | OceanaGold agreement for up to 75% in three Nevada projects via US$65M spend. |

Recent news around strategic partnerships, earn-ins, and permitting has consistently aligned with positive 24h price reactions for HWAUF.

Over the last few months, Headwater Gold has repeatedly advanced its partnership-driven exploration model. On Oct 15, 2025, it signed a definitive agreement with OceanaGold for up to US$65,000,000 in staged spending, followed by the Spring Peak FAST-41 permitting milestone on Oct 20, 2025. Participation in the New Orleans Investment Conference on Oct 30, 2025 also coincided with a gain. Today’s Centerra earn-in at Crane Creek continues this pattern of de-risking exploration via major-partner funding.

Market Pulse Summary

This announcement details a major earn-in with Centerra, under which up to US$25,000,000 in staged exploration spending could earn Centerra a 70% interest at Crane Creek while granting NSR royalties to Headwater. It continues a strategy of leveraging larger partners across multiple projects. Key factors to monitor include fulfillment of the US$2.5M minimum commitment, progress through the staged interests, completion of a qualifying PEA, and drill results from the planned Phase 1 program.

Key Terms

preliminary economic assessment technical

net smelter return financial

nsr royalty financial

epithermal technical

low-sulfidation technical

reverse-circulation technical

paleosurface technical

qualified person regulatory

AI-generated analysis. Not financial advice.

VANCOUVER, British Columbia, Dec. 03, 2025 (GLOBE NEWSWIRE) -- Headwater Gold Inc. (CSE: HWG, OTCQB: HWAUF) (the "Company" or "Headwater") is pleased to announce that it has entered into a definitive earn-in agreement (the “Agreement”) with a subsidiary of Centerra Gold Inc. (“Centerra”) (TSX: CG) for Centerra to earn up to a

Highlights:

- Headwater has entered into a definitive earn-in agreement with Centerra for a subsidiary of Centerra to earn up to a

70% interest in Headwater’s Crane Creek project in Idaho; - Up to US

$25,000,000 in staged earn-in expenditures: Centerra may elect to earn up to a60% interest in the Project by funding exploration expenditures of US$25,000,000 and granting Headwater a royalty on the Project; - US

$2,500,000 expenditure commitment: Centerra to fund a minimum commitment of US$2,500,000 in exploration expenditures during the first three years of the Agreement; - Carried interest to completion of a PEA: Centerra may earn an additional

10% interest (up to70% ) in the Project by completing a preliminary economic assessment report on the Project; and - The Project is fully permitted for drilling under a Notice of Intent with the Bureau of Land Management (“BLM”) and a Plan of Operation with the Idaho Department of Lands.

Caleb Stroup, Headwater’s President and CEO, states: “Since becoming a strategic Headwater shareholder last year, Centerra has been an engaged and supportive partner. We are very excited to expand that relationship into a fully aligned exploration partnership on the project level at Crane Creek. Centerra’s commitment to a substantial multi-stage earn-in underscores the scale of the opportunity at this project and allows us to properly test what we believe is a large, underexplored epithermal system with high-grade potential at depth as well as near surface bulk-tonnage potential. Centerra brings strong technical expertise and a collaborative approach and we look forward to working with them to unlock the full potential of the project for our shareholders.”

Table 1: Principal Structure of the Earn-In Agreement:

Stage | Expenditures (US$) | Centerra Interest (%) | Time for Each Stage | |||

| Minimum Commitment | 3 Years from Execution Date | |||||

| Stage 1 | 4 Years from Execution Date | |||||

| Stage 2 | + + | 4 Years from commencement of Stage 2 | ||||

| Stage 3 | Completion of Preliminary Economic Assessment Report 4 | 2 years from commencement of Stage 3 | ||||

- Stage 1 is inclusive of the Minimum Commitment of US

$2,500,000. - If Centerra completes Stage 1 but not Stage 2, its ownership interest in the Project is reduced to

49% , which Headwater retains the right to purchase at a mutually agreed price or, if a price cannot be mutually agreed within a specified period, for fair value that will be determined based on an agreed-upon process (“Fair Value”). - Upon completion of Stage 2, Headwater will be ceded a

2% Net Smelter Return (“NSR”) royalty on royalty-free claims which are100% -owned by Headwater and a1% NSR royalty on land subject to existing underlying royalties. - In order to acquire the additional

10% interest in the Project, Centerra shall be required to sole fund the completion of a Preliminary Economic Assessment Report reflecting a mineral resource of not less than 1,000,000 oz gold equivalent.

Commercial Terms:

The Agreement grants Centerra the exclusive right to acquire up to a

Earn-in Structure:

Stage 1: Centerra has the option to acquire a

Stage 2: Centerra may elect to earn an additional

Stage 3: Centerra may earn an additional

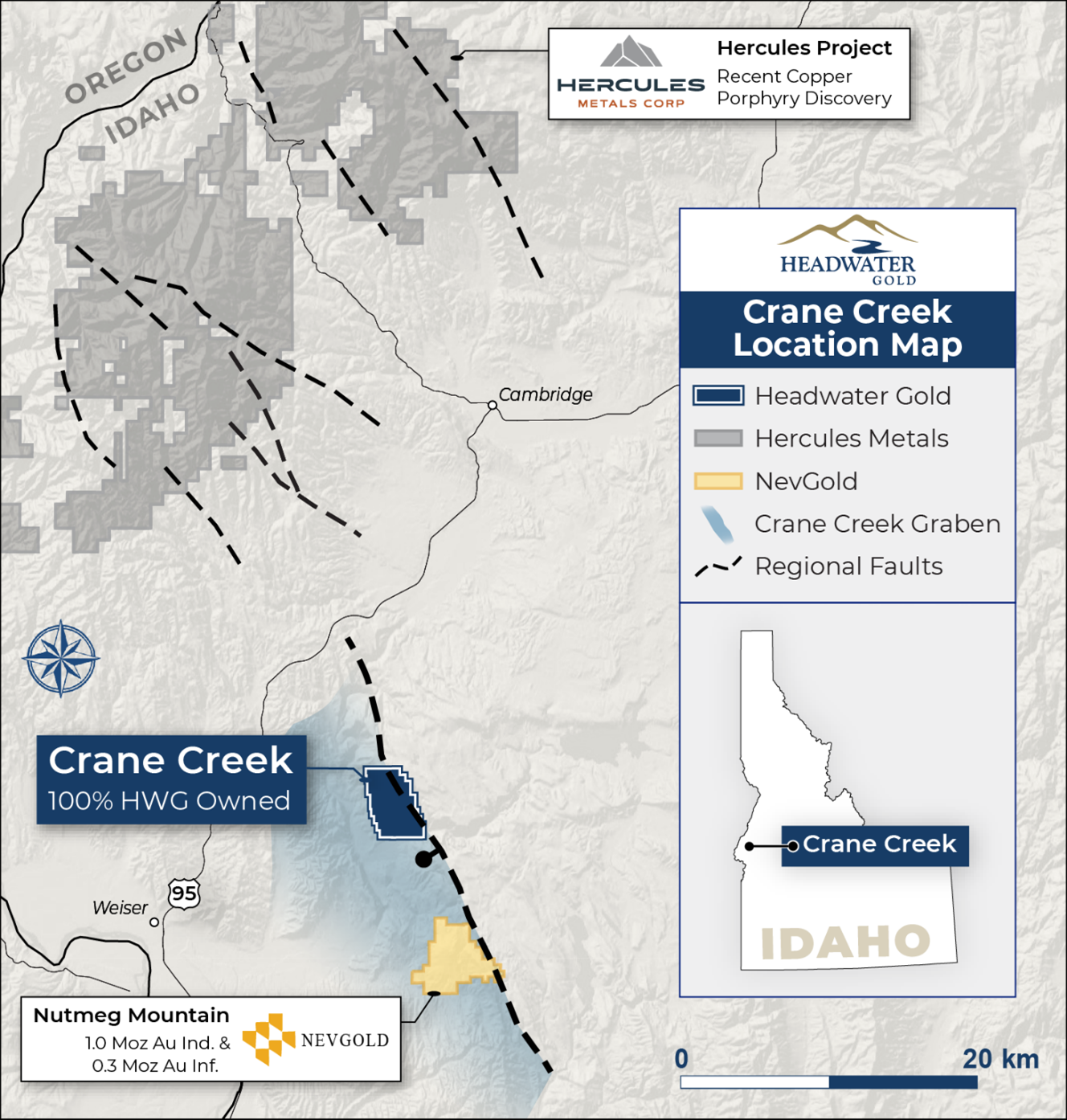

Figure 2: Location of the Crane Creek project in western Idaho with respect to the Crane Creek Graben, a major extensional fault system which hosts the Nutmeg Mountain epithermal gold deposit and lies approximately 40 km south of the recently discovered copper porphyry belt centered on the Hercules project.

About the Crane Creek Project:

The Crane Creek project is located in western Idaho, approximately 18 km northeast of the town of Weiser and 90 km northwest of the city of Boise, with a paved county road less than 1 km from the southern property boundary. The project is fully permitted for drilling under a Notice of Intent with the BLM and a Plan of Operation with the Idaho Department of Lands. The project encompasses an array of mineralized epithermal quartz veins within a broad gold and trace element geochemical anomaly and features characteristics of a well-preserved low-sulfidation system, including historical mercury workings, widespread opaline silica, and chalcedonic vein fill. This alteration cell is located 8 km along trend northwest of the Nutmeg Mountain gold project (1,006,000 oz gold Indicated, 275,000 oz gold Inferred1). The Crane Creek project comprises approximately 1,240 hectares, consisting of 123 unpatented federal mining claims on BLM land, a 640-acre State of Idaho minerals lease and a private lease.

Historic drilling took place on the property between 1984 and 1996, consisting of mainly shallow reverse-circulation holes with an average depth of 71 m. Only three holes were drilled to greater than 150 m in depth1. Historic drilling primarily targeted bulk-tonnage disseminated mineralization in a package of near-surface sedimentary rocks, with most holes terminated shortly after intercepting an underlying basalt unit. A significant number of holes encountered mineralized quartz veins ranging from 2.0 g/t Au up to 8.14 g/t Au2 that were apparently never followed up, within broader intervals of disseminated low-grade mineralization. The potential for basalt-hosted high-grade veins at depths of 100 m or more below the paleosurface, such as those occurring at the Midas mine in northern Nevada (Hecla Mining Company) and the Cerro Negro mine (Newmont Corporation) in Argentina, remains untested at the project.

Headwater recently completed a suite of airborne magnetic and radiometric surveys and a ground gravity survey across the property, which collectively delineate a large, structurally focused hydrothermal system extending well beyond the area of historical work. The radiometric data define a 4 km by 2 km potassium anomaly interpreted as illite–adularia alteration, while the magnetic and gravity datasets highlight a series of untested NNW-trending structural breaks and magnetite-destructive lows consistent with prospective fault-hosted vein zones. Integration of these datasets with surface mapping and historical results has defined multiple high-priority targets for both high-grade vein mineralization at depth and near-surface bulk-tonnage potential.

Under the earn-in agreement announced here, Headwater and Centerra will now work jointly to finalize an integrated exploration plan that incorporates the recently completed geophysical datasets, historical results and updated geological interpretation. The partners intend to prioritize and refine specific drill targets across the main vein corridor and newly generated structural and alteration targets, with the objective of initiating Phase 1 drilling as early as the spring of 2026.

About Centerra Gold:

Centerra Gold Inc. is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide. Centerra operates two mines: the Mount Milligan Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye. Centerra also owns the Kemess Project in British Columbia, Canada, the Goldfield Project in Nevada, United States, and owns and operates the Molybdenum Business Unit in the United States and Canada. Centerra’s shares trade on the Toronto Stock Exchange under the symbol CG and on the New York Stock Exchange under the symbol CGAU. Centerra is based in Toronto, Ontario, Canada. Centerra holds a

About Headwater Gold:

Headwater Gold Inc. (CSE: HWG, OTCQB: HWAUF) is a technically-driven mineral exploration company focused on exploring for and discovering high-grade precious metal deposits in the Western USA. Headwater is actively exploring one of the world’s most well-endowed, mining-friendly jurisdictions, with a goal of making world-class precious metal discoveries. The Company has a large portfolio of epithermal vein exploration projects and a technical team with diverse experience in capital markets and major mining companies. Headwater is systematically drill-testing several projects in Nevada and has strategic earn-in agreements with Newmont Corporation on its Spring Peak and Lodestar projects and OceanaGold Corporation on its TJ, Jake Creek and Hot Creek projects. In August 2022 and September 2024, Newmont and Centerra acquired strategic equity interests in the Company, further strengthening Headwater’s exploration capabilities.

Headwater is part of the NewQuest Capital Group which is a discovery-driven investment enterprise that builds value through the incubation and financing of mineral projects and companies. Further information about NewQuest can be found on its website at www.nqcapitalgroup.com.

For more information about Headwater, please visit the Company's website at www.headwatergold.com.

On Behalf of the Board of Directors

Caleb Stroup

President and CEO

+1 (775) 409-3197

cstroup@headwatergold.com

For further information, please contact:

Brennan Zerb

Investor Relations Manager

+1 (778) 867-5016

bzerb@headwatergold.com

Qualified Person

The technical information contained in this news release has been reviewed and approved by Dr. Gregory Dering, P.Geo (AIPG CPG-12298), a “Qualified Person” (“QP”) as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Dr. Dering is not independent by reason of being the Company’s Vice President of Exploration.

1Nevgold Corp. 2023 Almaden NI43-101 Technical Report ( https://www.sedarplus.ca )

2Historical drill intercepts and surface samples cannot be relied upon and are treated by the Company as historical in nature and not current or NI 43-101 compliant.

Forward-Looking Statements:

This news release includes certain forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future exploration expenditures by Centerra, anticipated content, commencement, and cost of exploration programs in respect of the Company's projects and mineral properties, and Centerra’s anticipated funding of the minimum commitment are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, risks related to the anticipated business plans and timing of future activities of the Company and Centerra, including the Company's and Centerra’s exploration plans and the proposed expenditures for exploration work on the Project, the ability of Centerra to obtain sufficient financing to fund the proposed exploration programs, delays in obtaining governmental and regulatory approvals (including of the Canadian Securities Exchange) for the Agreement, the risk that Centerra will not elect to obtain any additional interest in the Project in excess of the minimum commitment, the ability of the Company to obtain the required permits, changes in laws, regulations and policies affecting mining operations, the Company's limited operating history, currency fluctuations, title disputes or claims, environmental issues and liabilities, as well as those factors discussed in the Company's filings with the Canadian Securities Authorities, copies of which can be found under the Company's profile on the SEDAR+ website at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements, except as otherwise required by law.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/51e90036-9312-41d0-85b7-26beb6653526