Ivanhoe Mines Announces Kamoa-Kakula Copper Production Guidance for 2026 and 2027 as Recovery Plan Advances

Rhea-AI Summary

Ivanhoe Mines (OTCQX: IVPAF) issued 2026–2027 guidance for the Kamoa‑Kakula copper complex and updated Kakula dewatering progress. Management guides 2026 production 380,000–420,000 tonnes and 2027 production 500,000–540,000 tonnes, while maintaining a medium‑term target of ~550,000 tonnes. Copper sales in 2026 are expected to exceed production as the new on‑site smelter destocks ~20,000 tonnes of concentrate. Dewatering at Kakula is advancing (west ~70%, east ~60%), 13.4 km of workings rehabilitated, and Phase 1–3 processing capacity is planned to reach 17 Mtpa in 2027.

Positive

- 2026 production guidance: 380,000–420,000 t

- 2027 production guidance: 500,000–540,000 t

- Medium‑term target: ~550,000 t

- On‑site destocking: ~20,000 t concentrate cleared for 2026 sales

- Kakula dewatering progress: west 70%, east 60%

- Processing capacity target: 17 Mtpa from 2027

Negative

- 2025 seismic interruptions required revised guidance and recovery work

- Dewatering incomplete; critical underground infrastructure integrity remains a risk

- Stage 3 pump re‑commissioning required; full steady‑state capacity not yet restored

- Kakula eastern flooded volume: ~2,200 megalitres below Stage 2 pumps

News Market Reaction

On the day this news was published, IVPAF gained 8.65%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

IVPAF gained 5.21% while key peers showed mixed, mostly modest moves (e.g., SOUHY +5.55%, BDNNY +0.77%, GLNCY 0%), pointing to a stock-specific reaction.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 03 | Production guidance | Positive | +8.7% | Issued 2026–2027 Kamoa-Kakula copper production guidance and dewatering update. |

| Dec 01 | Smelter commissioning | Positive | -0.3% | Commencement of heat-up for 500,000 tpa copper smelter and inventory rundown. |

| Nov 26 | Leadership changes | Positive | +6.7% | New COO and board changes to support Kamoa-Kakula recovery and growth plans. |

| Nov 25 | Power capacity | Positive | +1.6% | Hydropower Turbine #5 completion boosting grid supply to Kamoa-Kakula. |

| Nov 21 | Strategic MoU | Positive | +4.9% | MoU with QIA to advance critical minerals exploration and development. |

Recent operational, strategic and power-supply updates have typically seen positive price reactions, with only one mild divergence.

Over the last few weeks, Ivanhoe reported smelter heat-up, hydropower ramp-up, a strategic MoU with QIA, and leadership changes tied to Kamoa-Kakula’s recovery. These events often coincided with positive moves, such as +6.71% on leadership appointments and +4.87% on the QIA MoU. Today’s production and dewatering guidance continues that operational recovery narrative, building on smelter commissioning and power availability to support medium-term output targets near 550,000 tonnes.

Market Pulse Summary

The stock moved +8.7% in the session following this news. A strong positive reaction aligns with Ivanhoe’s recent pattern, where operational milestones such as leadership changes and infrastructure upgrades saw gains up to 8.65%. The detailed 2026–2027 guidance and dewatering progress support the recovery narrative at Kamoa-Kakula. Investors would have weighed improving production visibility and processing capacity against execution risks around dewatering, ramp-up and access to new mining areas, which could cap how long an initial surge is sustained.

Key Terms

ni 43-101 regulatory

qualified person regulatory

cash cost (C1) financial

AI-generated analysis. Not financial advice.

2026 copper production range 380,000 to 420,000 tonnes and 2027 copper production range 500,000 to 540,000 tonnes

2026 copper sales expected to exceed production as surplus concentrate inventory at smelter is cleared; first feed is expected at the end of December

Medium-term annualized copper production target maintained at 550,000 tonnes

Kakula Mine Stage 2 dewatering progressing well at over

Johannesburg, South Africa--(Newsfile Corp. - December 3, 2025) - Ivanhoe Mines (TSX: IVN) (OTCQX: IVPAF) Executive Co-Chairman Robert Friedland and President and Chief Executive Officer Marna Cloete announce today Kamoa-Kakula's copper production guidance for 2026 and 2027, as well as an update on the Kakula Mine's dewatering activities.

Dewatering of the Kakula Mine is progressing well, with dewatering approximately

Positive progress to date on underground rehabilitation, along with ongoing mine planning, provides Kamoa-Kakula's management team with sufficient confidence to issue copper production guidance of 380,000 to 420,000 tonnes for 2026 and 500,000 to 540,000 tonnes for 2027. Kamoa-Kakula is still targeting medium-term production of approximately 550,000 tonnes. An updated life-of-mine plan for Kamoa-Kakula is on target for completion in late Q1 2026.

Following the commencement of the Kamoa-Kakula Copper Smelter as announced on December 1, 2025, copper sales in 2026 are expected to be higher than copper production as the on-site inventory of unsold copper concentrate is destocked by approximately 20,000 tonnes of copper.

Ivanhoe Mines Founder and Executive Co-Chairman Robert Friedland commented:

"The turnaround at Kamoa-Kakula is advancing with confidence. Even during the recovery years of 2025 and 2026, this remarkable copper complex is set to produce approximately 400,000 tonnes of copper … an extraordinary testament to the quality of Kamoa-Kakula's world-leading natural endowment. As we move through this transition and into the next phase of growth in the coming years, Kamoa-Kakula and the Western Forelands will become one of the largest, if not the largest, copper complexes in the world. Our stakeholders are blessed with a Tier-One mining complex that will operate for generations to come.

"We are also on the cusp of a transformational change for Kamoa-Kakula and the Democratic Republic of the Congo as we transition from producing copper in concentrate in huge volumes, to producing copper anodes for sale to consumers all over the world, at our own smelter complex, the largest in Africa."

Ivanhoe Mines President and Chief Executive Officer Marna Cloete commented:

"We extend our deepest gratitude to the entire team at Kamoa-Kakula for their unwavering dedication throughout the dewatering and rehabilitation of the Kakula Mine. They have worked under pressure, and done so with discipline, resilience, and an unshakable commitment to doing things the right way. Most importantly, they have carried out this demanding work with an outstanding focus on safety. Their dedication and professionalism are the foundation of our progress, and we are extremely proud of their achievements."

Kakula copper grades improving as dewatering activities re-open higher-grade mining areas

The revised Kakula mine design has been developed based on geotechnical expert guidance, including new pillar designs and extraction sequencing.

Mining rates on the western side of Kakula have increased to an average rate of 350,000 tonnes per month, equivalent to 4.2 million tonnes (Mt) annualized.

Mining activities have been focused on higher-elevation areas in the north and southwest, where copper grades are lower than those of the higher-grade centre section. As water levels on the western side recede, mining crews are advancing towards the high-grade centre section, where grades increase to between

Mining rates at Kakula are expected to improve gradually through 2026. Selective mining within the existing workings on the eastern side of the Kakula Mine is expected to start in Q1 2026, augmenting rising production rates from higher-grade areas on Kakula's western side. This is expected to increase production rates to 450,000 tonnes per month, or 5.5 Mtpa annualized, by the end of the quarter. In addition, underground development towards a new mining area further to the east is expected to begin mining ore from mid-year 2026.

Approximately 6 Mt of ore is expected to be mined at Kakula during 2026, which is expected to increase to between 7 and 8 Mt during 2027. Grades are expected to range from

Mining rate of the Kamoa mines targeted to increase to 10 million tonnes per annum in 2027, filling the Phase 3 concentrator and supporting the Phase 1 and 2 concentrators

The combined annualized mining rate of Kamoa 1, Kamoa 2 and Kansoko underground mines (the Kamoa mines) is targeted to increase from approximately 6.5 Mt currently, to approximately 8.5 Mt in 2026 and to over 10 Mt in 2027. Grades from the Kamoa mines are expected to average approximately

Increased mining rates will be supported by a newly commissioned belt at Kamoa 1, new mine accesses at Kansoko Sud to improve efficiency and new mine accesses at Kamoa 2 to increase the number of underground crews. Mining efficiency is also expected to improve through increased end availability and redundancy, as well as other productivity enhancements.

The Kamoa mines are operating in accordance with similar geotechnical expert guidance, incorporating learnings from Kakula.

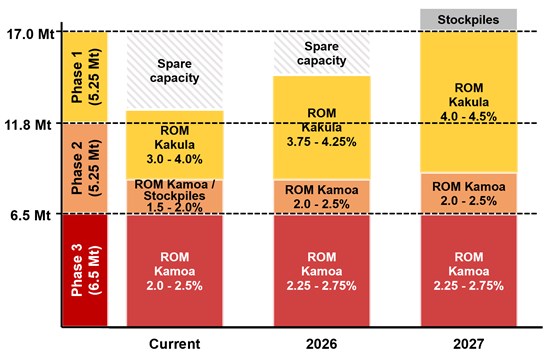

The increased mining rate will enable the Kamoa mine to feed the Phase 3 concentrator and provide supplementary feed to the Phase 1 and 2 concentrators, as shown in Figure 1.

Total processing capacity of Phase 1, 2 and 3 concentrators to reach 17 million tonnes per annum from 2027

The Phase 1 and 2 concentrators will continue to process ore from the western side of the Kakula Mine and surface stockpiles until Q1 2026 when the stockpiles are depleted. In addition, from Q1 2026, Phase 1 and 2 will be supplemented with an increasing quantity of ore from the eastern side of Kakula, as well as ore trammed from Kamoa.

In 2026, approximately 2 Mt of ore from Kamoa is expected to be processed by the Phase 1 and 2 concentrators. In 2027, this is expected to increase to 2.5 Mt.

The Phase 1 and 2 concentrators have demonstrated combined operating capacity of 10.5 Mtpa, or 5.25 Mtpa per line, since various de-bottlenecking activities were completed.

The Phase 3 concentrator will continue to process at a rate of 6.5 Mt per annum, which has also been demonstrated over many months of operations, fed by the Kamoa mines.

The recoveries of the Phase 1 and 2 concentrators are expected to improve following the completion of Project 95 in Q2 2026, after which recoveries are expected to increase to approximately

Figure 1. Kamoa-Kakula Copper Complex processing strategy by mining area in 2026 and 2027 (Mt)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3396/276774_4447ebfe14273a8b_002full.jpg

Updated life-of-mine integrated development plan on track for Q1 2026; targeting return of annualized copper production to approximately 550,000 tonnes

Work is advancing on track for the updated life-of-mine integrated development plan to be completed by end of Q1 2026. The plan includes a full review of both the Kakula and Kamoa life-of-mine plans, based on Phase 1, 2 and 3 at a processing rate of 17 million tonnes per annum, prior to the Phase 4 expansion. The study will also include an expansion scenario for Phase 4, intended to increasing processing capacity by 6.5 Mt per annum by constructing a duplicate of the Phase 3 concentrator.

Production rates are expected to steadily improve as the Kakula Mine recovery plan is completed, and annualized copper production expected to return to approximately 550,000 tonnes over the medium and long term.

Kakula Mine Stage 2 dewatering progressing well at over

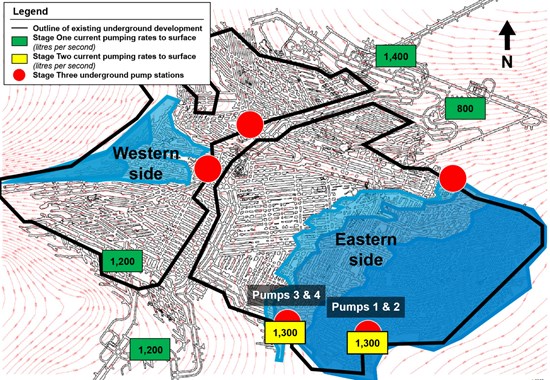

As announced on September 18, 2025, Stage 2 dewatering activities have been underway since early September, when two pairs of high-capacity submersible pumps, with a combined capacity of 2,600 litres per second were installed and commissioned in under six weeks.

Dewatering activities successfully split the flooded areas into discrete western and eastern zones during the month of November. Dewatering from the western side of the mine is

Stage 3 dewatering consists of re-commissioning the existing, water-damaged underground horizontal pump stations which are used during steady-state operations. The rehabilitation work consists of fitting new pump motors, substations and electrical cabling. All the required equipment is on site, and the installation work will take place once access to the horizontal pump stations becomes available. To date, approximately 800 litres per second of Stage 3 pumping capacity has been re-established. Access to an additional 800 litres per second of pumping capacity is expected by year end, with access to a further 600 litres per second of pumping capacity expected in January 2026.

On the eastern side of the mine, Stage 2 dewatering is

The second pair of pumps (Pumps 1 and 2), which were installed in a deeper section of the mine, as shown in Figure 2, have reduced the water level by 45 metres, or approximately

Over 2,200 megalitres of water lie below the level of the Stage 2 dewatering pumps, which will be pumped out gradually using the Stage 3 dewatering infrastructure. This existing flooded mine area is not on the critical path for ramping up mining rates on the eastern side of the Kakula Mine, which will be focused on a new mining area on the east beyond a barrier pillar. Future mining will be de-risked by dewatering in advance of the working face, using similar technology to the Stage 2 dewatering system.

Figure 2. A schematic of the underground water levels at the Kakula Mine as at December 1, 2025, overlaid with the underground pumping infrastructure.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3396/276774_4447ebfe14273a8b_003full.jpg

Looking south over the two surface-mounted pump stations that provide the Stage 2 dewatering. Combined, both pumps operate at 2,600 litres per second.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3396/276774_4447ebfe14273a8b_004full.jpg

2026 & 2027 COPPER PRODUCTION GUIDANCE

| Kamoa-Kakula Production Guidance | |

| 2026 contained copper (tonnes) | 380,000 - 420,000 |

| 2027 contained copper (tonnes) | 500,000 - 540,000 |

Guidance figures are on a

Kamoa-Kakula's 2026 and 2027 production guidance is based on several assumptions and estimates. It involves estimates of known and unknown risks, uncertainties, and other factors that may cause the actual results to differ materially.

The 2025 production guidance was revised on June 11, 2025 following the seismic activity as reported on May 20, 2025, and associated interruptions in mining operations at the Kakula Mine. The Kamoa-Kakula Copper Complex produced 316,395 tonnes of copper in concentrate for the nine months ended September 30, 2025 and is on track to meet revised full-year guidance of 370,000 to 420,000 tonnes of copper.

Although mining on the western side of the Kakula Mine has restarted, risk factors remain, including the integrity of underground infrastructure once dewatering is complete, the ability to ramp up underground operations, the ability to complete dewatering activities, and the time required to access the new mining areas. The updated 2026 and 2027 production guidance ranges for Kamoa-Kakula are based on an assessment of these factors that management believes are reasonable at this time, given all available information.

Kamoa-Kakula's adjusted 2025 and 2026 capital expenditure guidance, as announced on October 29, 2025 remains unchanged. Cash cost (C1) guidance for 2026 will be provided with the 2025 full-year financial results in February 2026.

Qualified Persons

Disclosures of a scientific or technical nature at the Kamoa-Kakula Copper Complex in this news release have been reviewed and approved by Steve Amos, who is considered, by virtue of his education, experience, and professional association, a Qualified Person under the terms of NI 43-101. Mr. Amos is not considered independent under NI 43-101 as he is Ivanhoe Mines' Executive Vice President, Projects. Mr. Amos has verified the technical data disclosed in this news release.

Ivanhoe has prepared an independent, NI 43-101-compliant technical report for the Kamoa-Kakula Copper Complex, which is available on the company's website and under the company's SEDAR+ profile at www.sedarplus.ca:

- Kamoa-Kakula Integrated Development Plan 2023 Technical Report dated March 6, 2023, prepared by OreWin Pty Ltd.; China Nerin Engineering Co. Ltd.; DRA Global; Epoch Resources; Golder Associates Africa; Metso Outotec Oyj; Paterson and Cooke; SRK Consulting Ltd.; and The MSA Group.

The technical report includes relevant information regarding the assumptions, parameters, and methods of the mineral resource estimates on the Kamoa-Kakula Copper Complex cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release.

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on advancing its three principal operations in Southern Africa; the Kamoa-Kakula Copper Complex in the DRC, the ultra-high-grade Kipushi zinc-copper-germanium-silver mine, also in the DRC; and the tier-one Platreef platinum-palladium-nickel-rhodium-gold-copper mine in South Africa.

Ivanhoe Mines is exploring for copper in its highly prospective, 54

Information contact

Follow Robert Friedland (@robert_ivanhoe) and Ivanhoe Mines (@IvanhoeMines_) on X.

Investors

Vancouver: Matthew Keevil +1.604.558.1034

London: Tommy Horton +44 7866 913 207

Media

Tanya Todd +1.604.331.9834

Website: www.ivanhoemines.com

Forward-looking statements

Certain statements in this release constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties, and other factors that may cause the actual results, performance, or achievements of the company, its projects, or industry results, to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified using words such as "may", "would", "could", "will", "intend", "expect", "believe", "plan", "anticipate", "estimate", "scheduled", "forecast", "predict" and other similar terminology, or state that certain actions, events, or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. These statements reflect the company's current expectations regarding future events, performance, and results and speak only as of the date of this release.

Such statements include, without limitation: (i) statements regarding production guidance of 380,000 to 420,000 tonnes for 2026 and 500,000 to 540,000 tonnes for 2027; (ii) statements that Kamoa-Kakula is continuing to target medium-term production of approximately 550,000, as the Kakula Mine recovery plan is completed; (iii) statements that updated life-of-mine plan for Kamoa-Kakula is on target for completion in late Q1 2026; (iv) statements that copper sales in 2026 are expected to be higher than copper production as the on-site inventory of unsold copper concentrate is destocked by approximately 20,000 tonnes of copper; (v) statements that mining rates at the Kakula Mine are expected to improve gradually through 2026; (vi) statements that selective mining within the existing workings on the eastern side of the Kakula Mine is expected to start in Q1 2026, augmenting rising production rates from higher-grade areas on Kakula's western side, which is expected to increase production rates to 450,000 tonnes per month, or 5.5 Mtpa annualized, by the end of the quarter; (vii) statements that underground development towards a new mining area further to the east is expected to begin mining ore from mid-year 2026; (viii) statements that approximately 6 Mt of ore will be mined at Kakula during 2026, which is expected to increase to between 7 and 8 Mt during 2027, and that grades are expected to range from

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indicators of whether such results will be achieved. Many factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to: (i) uncertainty around the rate of water ingress into underground workings; (ii) the ability, and speed with which, additional equipment can be secured, if an as required; (iii) the continuation of seismic activity; (iv) the full state of underground infrastructure; (v) uncertainty around when future underground access can be fully secured; (vi) the fact that future mine stability cannot be guaranteed; (vii) the fact that future mining methods may differ and impact on Kakula operations; and (viii) the ultimate conclusion of the assessment of the cause of the seismic activity at Kakula and the impact of same on the final mining plan at the Kamoa Kakula Copper Complex. Additional factors also include those discussed above and under the "Risk Factors" section in the company's MD&A for the three and nine months ended September 30, 2025, and its current annual information form, and elsewhere in this news release, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; changes in the rate of water ingress into underground workings; recurrence of seismic activity; the state of underground infrastructure; delays in securing full underground access; changes to the mining methods required in the future; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

The company's actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors outlined in the "Risk Factors" section in the company's MD&A for the three and nine months ended September 30, 2025, and its current annual information form.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276774