Kodiak Reaches Key Milestone with Initial Mineral Resource Estimate at the MPD Copper-Gold Project

Rhea-AI Summary

Kodiak Copper (OTCQX: KDKCF) reported an initial Mineral Resource Estimate for the 100%‑owned MPD copper‑gold project effective December 9, 2025. The MRE covers seven deposits with a Total Indicated of 82.9 Mt @ 0.39% CuEq (≈519 Mlb Cu, 0.39 Moz Au) and Total Inferred of 356.3 Mt @ 0.32% CuEq (≈1,889 Mlb Cu, 1.28 Moz Au) using a 0.2% CuEq cut‑off. West and Adit host high‑grade mineralization from surface; South is a large, shallow bulk tonnage zone still underexplored. Sensitivity at lower cut‑offs shows materially higher tonnages and in‑situ metal. Next steps include a NI 43‑101 Q1 2026 filing, metallurgical results Q1, and resource expansion drilling starting Q2 2026.

Positive

- Initial MRE totals 2,408 Mlbs CuEq in situ across categories

- Indicated Resource of 82.9 Mt @ 0.39% CuEq

- Multiple deposits open for expansion in multiple directions

- Sensitivity: Indicated tonnage rises to 120.6 Mt at 0.12% CuEq

Negative

- Majority of inventory is Inferred: 356.3 Mt (lower confidence)

- Mineral Resources are not mineral reserves and lack demonstrated economic viability

News Market Reaction

On the day this news was published, KDKCF declined 1.19%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers showed mixed moves, with METALLIC MINERALS up 7.57%, DRYDEN GOLD up 2.51%, while CANTERRA MINERALS fell 4.93% and DENARIUS METALS fell 1.81%. This dispersion suggests KDKCF’s reaction was more stock-specific than sector-driven.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 09 | Maiden resource update | Positive | -1.2% | First MPD Mineral Resource across seven deposits with detailed CuEq metrics. |

| Dec 04 | Listing upgrade | Positive | -6.5% | Upgrade to OTCQX Best Market aimed at better visibility and access for U.S. investors. |

| Nov 18 | Marketing engagement | Positive | -2.4% | Hired Capital Analytica for six months of marketing ahead of the maiden MPD resource. |

| Oct 28 | Metallurgical program | Positive | +2.4% | Initiated expanded metallurgical testwork on six MPD zones with results targeted for Q1 2026. |

| Oct 20 | Project expansion | Positive | +9.3% | Acquired adjacent claims, expanding MPD to 357 km2 and launching 2,000-sample soil program. |

Recent positive corporate and project milestones often saw mixed reactions, with both aligned gains and notable selloffs on otherwise constructive news.

This announcement adds a maiden Mineral Resource Estimate for MPD, totaling 82.9 Mt Indicated @ 0.39% CuEq and 356.3 Mt Inferred @ 0.32% CuEq effective Dec 9, 2025. It follows the OTCQX upgrade on Dec 4, marketing engagement in mid‑November, expanded metallurgical testwork initiated in late October, and strategic claim acquisitions that grew MPD to 357 km2. Together, these events outline steady project derisking, corporate visibility improvements, and land/package growth ahead of detailed 2026 work programs.

Market Pulse Summary

This announcement provides a foundational Mineral Resource for MPD, with 82.9 Mt Indicated @ 0.39% CuEq and 356.3 Mt Inferred @ 0.32% CuEq at a 0.2% CuEq cut‑off. It follows prior steps including metallurgical testwork and strategic claim expansion, indicating steady technical and land‑position progress. Investors may watch for the planned NI 43‑101 report, Q1 metallurgical results, and 2026 resource‑expansion drilling as key checkpoints for advancing and potentially updating this initial estimate.

Key Terms

mineral resource technical

cut-off grade technical

ni 43-101 regulatory

cim technical

copper equivalent technical

lerchs-grossmann technical

qualified person regulatory

nsr financial

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - December 9, 2025) - Kodiak Copper Corp. (TSXV: KDK) (OTCQX: KDKCF) (FSE: 5DD1) (the "Company" or "Kodiak") reports the initial Mineral Resource estimate at the Company's

Highlights

Large, open-pit copper-gold initial Mineral Resource estimate ("MRE") which shows the scale and potential of MPD and lays the foundation for future resource growth and development.

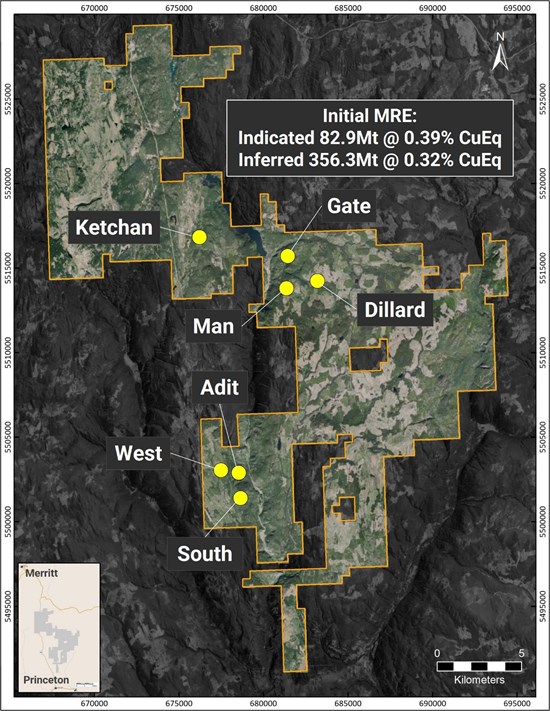

The Initial MRE comprises seven deposits. Resource estimates for the West, Adit and South deposits are reported today, complementing the Resource estimates for the Gate, Ketchan, Man, and Dillard deposits announced in June. Figure 1

The West, Adit and South deposits all feature shallow mineralization and favourable geometry, characteristics that are expected to support low strip ratios in future economic evaluations. West and Adit host high grade mineralization from surface, while South is a large bulk tonnage deposit over 1km in length that is still underexplored. Figure 2 & 3

Total Indicated Mineral Resource: 82.9 million tonnes (Mt) grading

0.39% copper equivalent (CuEq) for 519 million pounds (Mlb) of copper (Cu) and 0.39 million ounces (Moz) of gold (Au). Table 1Total Inferred Mineral Resource: 356.3 million tonnes (Mt) grading

0.32% copper equivalent (CuEq) for 1,889 million pounds (Mlb) of copper (Cu) and 1.28 million ounces (Moz) of gold (Au). Table 1The MRE is defined using a cut-off grade of

0.2% CuEq. Sensitivity cases using lower cut-of grades typical of producing mines in the area have significantly higher tonnages and metal contents. Table 2All deposits remain open for expansion within and beyond the MRE pit shells, most in multiple directions and at depth. Kodiak's work in 2026 will be focussed on Resource growth. In addition, Kodiak intends to test some of the numerous underexplored targets on the MPD property which present opportunities to discover new mineralized zones.

Webinar: Tuesday, December 9th @ 9am PT (register here)

Join President & CEO Claudia Tornquist and Chairman Chris Taylor as they discuss the

Mineral Resource Estimate and future plans for Kodiak Copper's MPD Project

Claudia Tornquist, President and CEO of Kodiak said, "I am very pleased to share the resource estimate for the West, Adit and South zones today. These deposits will clearly play a key role in advancing MPD's overall economic potential. West and Adit in particular host high-grade mineralization right from surface, an important characteristic that positions these zones well as starter pits in a possible future mining scenario. Overall, MPD's maiden Resource shows considerable scale, strong growth potential and grades consistent with leading copper porphyry projects in North America. With multiple deposits, MPD offers unique optionality and flexibility for future development pathways. Add to this its strategic location in a well-established, low-cost mining district in southern British Columbia and MPD stands out as a highly promising project with clear economic potential."

Chris Taylor, Chairman of Kodiak said, "This maiden resource marks a key milestone in MPD's advancement toward becoming a major mine. With all deposits remaining open for expansion, I have no doubt that continued drilling will drive significant resource growth. It is also noteworthy how clearly the sensitivity cases at lower cut-off grades demonstrate the large in-situ metal endowment at MPD. Next year's exploration program will prioritize resource expansion and test multiple target areas with the potential to add meaningful tonnage to our existing deposits. We also plan to drill several promising copper and gold targets on the property, some supported by encouraging historic drill results, others defined using VRIFY AI-supported targeting. The large number of targets on the property, approximately 20 at current count, underscores MPD's remarkable prospectivity and the exciting opportunity for yet another major discovery."

Figure 1: MPD Project - Location map of Mineral Resources

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3803/277328_2d86ef4554a0b85f_002full.jpg

Initial Mineral Resource Estimate

The drill hole density in the South Zone, West Zone and central part of the Gate Zone was sufficient to develop a 82.9 Mt Indicated Resource grading

Table 1: MPD Initial Mineral Resource Estimate

| MPD Initial Mineral Resource Estimate | |||||||||||

| Zone | Resource Category | Tonnes | Average Grade | Metal Content | Date Reported | ||||||

| (Mt) | Cu (%) | Au (g/t) | Ag (g/t) | CuEq (%) | Cu (Mlbs) | Au (Moz) | Ag (Moz) | CuEq (Mlbs) | |||

| Gate | Indicated | 56.4 | 0.31 | 0.14 | 1.18 | 0.42 | 385 | 0.25 | 2.14 | 522 | 2025-06-25 |

| West | Indicated | 14.2 | 0.21 | 0.24 | 0.80 | 0.37 | 66 | 0.11 | 0.37 | 116 | 2025-12-09 |

| South | Indicated | 12.3 | 0.25 | 0.07 | 1.17 | 0.30 | 68 | 0.03 | 0.46 | 82 | 2025-12-09 |

| Gate | Inferred | 114.5 | 0.27 | 0.13 | 1.07 | 0.36 | 681 | 0.48 | 3.94 | 909 | 2025-06-25 |

| Ketchan | Inferred | 66.0 | 0.24 | 0.12 | 1.09 | 0.33 | 349 | 0.25 | 2.31 | 480 | 2025-06-25 |

| Dillard | Inferred | 51.9 | 0.20 | 0.09 | 0.39 | 0.26 | 229 | 0.15 | 0.65 | 298 | 2025-06-25 |

| Man | Inferred | 8.3 | 0.17 | 0.30 | 0.56 | 0.37 | 31 | 0.08 | 0.15 | 68 | 2025-06-25 |

| West | Inferred | 24.7 | 0.22 | 0.20 | 0.77 | 0.36 | 120 | 0.16 | 0.61 | 196 | 2025-12-09 |

| Adit | Inferred | 20.1 | 0.34 | 0.03 | 2.79 | 0.38 | 151 | 0.02 | 1.80 | 168 | 2025-12-09 |

| South | Inferred | 70.9 | 0.21 | 0.06 | 1.25 | 0.26 | 328 | 0.14 | 2.85 | 406 | 2025-12-09 |

| Total Indicated | 82.9 | 0.28 | 0.15 | 1.11 | 0.39 | 519 | 0.39 | 2.97 | 719 | 2025-12-09 | |

| Total Inferred | 356.3 | 0.24 | 0.11 | 1.07 | 0.32 | 1,889 | 1.28 | 12.31 | 2,524 | 2025-12-09 | |

Notes:

1. The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), Definition Standards for Mineral Resources and Reserves, as prepared by the CIM Standing Committee and adopted by CIM Council.

2. A cut-off grade of

3. Pit shell optimization used average recoveries derived from metallurgical test work of Cu

4. Copper equivalence (CuEq) and constraining pit shells assume metal prices (US$) of:

5. The copper equivalency equation used is: CuEq(%) = Cu(%) + Au(g/t) x 0.6606 + Ag(g/t) x 0.0069

6. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves in the future. The MRE may be materially affected by considerations including, but not limited to, permitting, legal, sociopolitical, environmental issues, market conditions or other factors.

7. All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines.

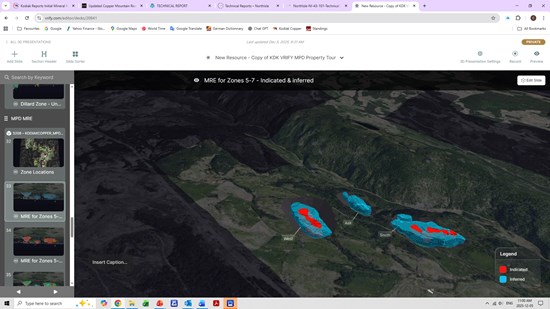

Figure 2: MPD Project -Aerial View of Mineral Resource Block Models and associated RPEEE 3D pit shells

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3803/277328_2d86ef4554a0b85f_003full.jpg

Figure 3: MPD Project - Underground view of Mineral Resource Block Models and associated RPEEE 3D pit shells

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3803/277328_2d86ef4554a0b85f_004full.jpg

Sensitivity Cut-off Grades

In addition to the base case cut-off grade ("COG") of

Table 2: Cut-Off Grade Sensitivity Summary

| MPD Initial Mineral Resource Estimate & Cut-Off Grade Sensitivity Scenarios | ||||||

| Cut-Off Grade | Indicated | Inferred | ||||

| (CuEq %) | Tonnes (Mt) | CuEq (%) | CuEq (Mlbs) | Tonnes (Mt) | CuEq (%) | CuEq (Mlbs) |

| 0.22 | 73.4 | 0.42 | 674 | 297.5 | 0.34 | 2,237 |

| 0.20 | 82.9 | 0.39 | 719 | 356.3 | 0.32 | 2,524 |

| 0.18 | 92.4 | 0.37 | 747 | 424.0 | 0.30 | 2,830 |

| 0.15 | 107.1 | 0.34 | 806 | 537.7 | 0.27 | 3,216 |

| 0.12 | 120.6 | 0.31 | 838 | 657.1 | 0.24 | 3,551 |

Notes: 1. Copper equivalence (CuEq) assumes metal prices (US$) of:

2. CuEq is based on average recoveries derived from metallurgical test work as applied in the pit optimization process. Average recoveries are: Cu

3. The copper equivalency equation used is: CuEq(%) = Cu(%) + Au(g/t) x 0.6606 + Ag(g/t) x 0.0069

Next Steps

Kodiak is actively advancing the MPD Project through the following key work streams and upcoming catalysts in 2026:

- File NI 43-101 Technical Report on SEDAR+ - Q1

- Metallurgical test results - Q1

- Soil results and drill targets - Q1

- Resource expansion drilling - Q2 onwards

- Exploration drilling, testing new targets - Q2 onwards

- Geophysical programs - Q2 onwards

- Resource update - Q1 2027

- Ongoing structural studies

- Continued environmental baseline studies

- Ongoing engagement with indigenous rightsholders and local stakeholders

Estimation Methods for the South, West and Adit Deposits

The Resource estimate was completed by James N. Gray, P.Geo. of Advantage Geoservices Ltd., an Independent Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Standards on Mineral Resources and Mineral Reserves, adopted by CIM Council, as amended. Estimation methods for the South, West and Adit deposits are summarized below. The estimation methods for the Gate, Man, Dillard and Ketchan deposits are presented in the June news release (see news release June 25, 2025).

The West, Adit and South Resource estimates are controlled by lithology and alteration models based on a three-dimensional interpretation of drill results. Where appropriate, structural features were also included in the geological models. A total of 135 holes, completed by Kodiak and previous operators through 2025, have been used for grade estimation; 50 holes at West, 31 at Adit, and 54 at South. Sixty-seven of the 135 core holes drilled were completed under the supervision of Kodiak. To appropriately control the impact of outliers on copper, gold, and silver distributions, minor high-grade capping was applied to assay values prior to compositing at a length of three metres. Grades at all three project areas were estimated by inverse distance weighting. Block size was 10 x 10 x 10 metres for each deposit. Average rock densities were applied based on models of lithology. A total of 2,074 density measurements from core samples was used to assign average block densities. Bulk density values average 2.69 tonnes/m3 at West, 2.60 tonnes/m3 at Adit and 2.73 tonnes/m3 at South.

Block models were classified based on calculated drill spacing. Blocks were assigned as an Inferred Mineral Resource where drill spacing was less than 150 metres. At West and South, where more drill information has allowed a higher degree of confidence in the geologic model, blocks at a drill spacing of up to 70 m have been classified as Indicated.

Reasonable prospects of eventual economic extraction (RPEEE) were established by JDS Energy & Mining Inc ("JDS") to constrain the MRE. To consider the RPEEE, JDS produced Lerchs-Grossmann optimized pit shells at each project area using the following parameters: Cu US

Quality Assurance and Quality Control procedures employed by Kodiak for the laboratory analysis of drill core included the inclusion of certified standards, blanks and duplicates. All Kodiak samples were sent for analysis to either ALS Canada Ltd or Activation Laboratories Ltd, both of which meet all requirements of International Standards ISO/IEC 17025:2005 and ISO 9001:2015. The historic results included in the Mineral Resources were reviewed and are believed to be from reliable sources using industry standards at the time, however the company has not independently verified, or cannot guarantee, the accuracy of historical information. The historical results will be summarized in the accompanying NI 43-101 technical report.

Qualified Person

The MRE was prepared by James Gray, P.Geo., of Advantage Geoservices Ltd., with contributions from Tysen Hantelmann, P.Eng., of JDS Energy & Mining Inc. for cut-off grade and Pit Shell optimization and Shane Tad Crowie, P.Eng., of JDS Energy & Mining Inc., for metallurgical parameters, in accordance with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards and Canadian National Instrument 43-101 ("NI 43-101"). James Gray, Tysen Hantelmann and Shane Tad Crowie, are independent Qualified Persons as defined by NI 43-101 and have reviewed and approved the contents of this news release. Dave Skelton, P.Geo. (AB), Vice President Exploration and a Qualified Person as defined by National Instrument 43-101, has approved and verified the technical information used in this news release. The historic work referenced herein is believed to be from reliable sources using industry standards at the time, based on Kodiak's review of available documentation. However, the Company has not independently validated all historic work, and the reader is cautioned about its accuracy.

On behalf of the Board of Directors

Kodiak Copper Corp.

Claudia Tornquist

President & CEO

For further information contact:

Nancy Curry, VP Corporate Development

ncurry@kodiakcoppercorp.com

+1 (604) 646-8362

About Kodiak Copper Corp.

Kodiak is focused on advancing its copper porphyry projects in Canada and the USA, which host known mineral discoveries with the potential to hold large-scale deposits. Kodiak Copper's most advanced asset is the

Kodiak's founder and Chairman is Chris Taylor who is well-known for his gold discovery success with Great Bear Resources. Kodiak is also part of Discovery Group led by John Robins, one of the most successful mining entrepreneurs in Canada.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement (Safe Harbor Statement): This press release contains forward-looking statements within the meaning of applicable securities laws. The use of any of the words "anticipate", "plan", "continue", "expect", "estimate", "objective", "may", "will", "project", "should", "predict", "potential" and similar expressions are intended to identify forward-looking statements. In particular, this press release contains forward-looking statements concerning the Company's exploration plans. Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company cannot give any assurance that they will prove correct. Since forward-looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with conditions in the equity financing markets, and assumptions and risks regarding receipt of regulatory and shareholder approvals.

Management has provided the above summary of risks and assumptions related to forward-looking statements in this press release in order to provide readers with a more comprehensive perspective on the Company's future operations. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward-looking statements are made as of the date of this press release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or results or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277328