Klondike Gold's Montana Creek Placer Property Exceeds Expectations in First Season Yields $542,282 in Royalty Payments

Rhea-AI Summary

Klondike Gold (OTCQB:KDKGF) reported an additional $42,282 production royalty from the Montana Creek placer property, bringing 2025 total production royalty receipts to $542,282. Under the lease with Armstrong Mining, a 10% production royalty applies until a $9.5M purchase price is paid; $8.9M remains payable to complete the option by March 2031.

Armstrong Mining began production ahead of schedule, upgraded camp and processing equipment, completed 140 short-hole sonic drill holes across ~1.5 sq km, installed a light-airstrip, and stockpiled material to accelerate 2026 restart. All required permitting and remediation procedures were maintained.

Positive

- $542,282 total production royalty receipts in 2025

- $8.9M remaining purchase price toward a $9.5M option

- Production began ahead of schedule in 2025

- 140 short-hole sonic drill holes over ~1.5 sq km

- Installed upgraded camp, new processing equipment, and light airstrip

Negative

- Majority of purchase price unpaid: $8.9M remaining to March 2031, creating timing and realization risk

News Market Reaction

On the day this news was published, KDKGF gained 6.00%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESS Newswire / November 13, 2025 / Klondike Gold Corp. (TSXV:KG)(FRA:LBDP)(OTCQB:KDKGF) ("Klondike Gold" or the "Company") is pleased to provide a summary of significant work progress and to report receipt of an additional

Peter Tallman, President and CEO of Klondike Gold Corp comments "The Montana Creek placer deposit was an idle, under-appreciated asset that is now returning dilution-free funding for Klondike Gold. We are pleased with Armstrong Mining's professional and competent management of the operation, which has exceeded our expectations from the start, and now is positioned to contribute increasing royalty revenues beyond our original projections for the next several years."

The Company's Montana Creek Placer Property agreement grants Armstrong Mining a 6-year lease with option to purchase

Armstrong Mining's 2025 Season Highlights

Began production and gold recovery ahead of schedule and exceeded projected returns

Early season successful mobilization of all heavy equipment

Installed a new camp and upgraded existing camp infrastructure

Installed and calibrated new processing equipment (wash plant and gold cleaning machine), with second larger capacity plant scheduled before start of next season for increased capacity

Stripped and stockpiled material will facilitate a rapid start to 2026 season production

Installed a light aircraft emergency airstrip

Completed 140 short-hole sonic drilling exploration program covering ~1.5 sq kms to further delineate and expand previously documented White Channel Gravel 'pay streaks'

Maintained and filed all required permitting and remediation procedures

Peter Tallman, President and CEO of Klondike further states "I congratulate the Armstrong Mining team for their professional effort that exceeded our productivity and financial objectives for 2025. Their crew completed significant mobilization early, reorganized the mine site plan to increase environmental remediation, including improvement of 5km of access roads, completed a significant sonic drilling exploration program, and then exceeded our aggressive economic target for 2025 by delivering

Background

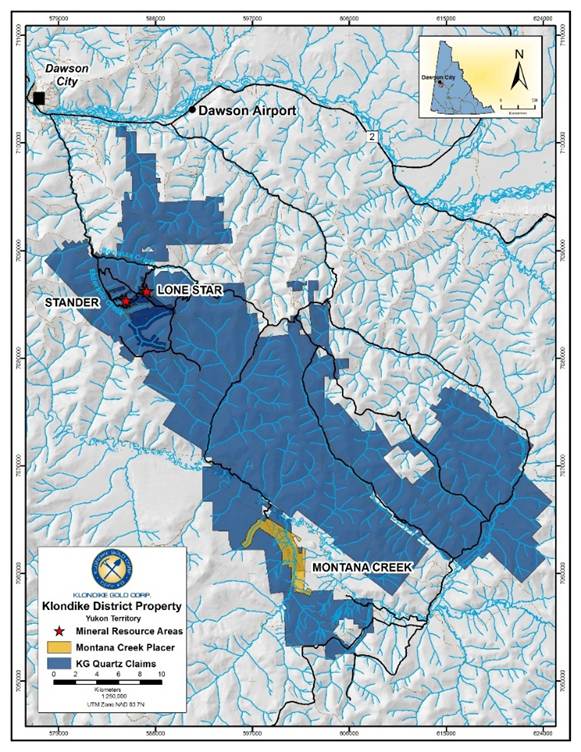

The Montana Creek Placer Property was staked in 2005 by Klondike Gold and is comprised of 239 placer claims covering 13.4 square kilometers located near Dawson City, Yukon within the area of quartz bedrock claims comprising the Company's "Klondike District Property". Between 2005 and 2014 Klondike Gold completed 550 auger drill holes to delineate White Channel Gravel gold 'pay streaks' covering approximately

ABOUT KLONDIKE GOLD CORP.

Klondike Gold is a Vancouver based gold exploration company advancing its

ON BEHALF OF KLONDIKE GOLD CORP.

"Peter Tallman"

Peter Tallman,

President and CEO

FOR FURTHER INFORMATION:

Telephone: (604) 609-6138

E-mail: info@klondikegoldcorp.com

Website: www.klondikegoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain statements contained in this news release constitute "forward-looking statements". When used in this document, the words "anticipated", "expect", "estimated", "forecast", "planned", and similar expressions are intended to identify forward-looking statements or information. These statements are based on current expectations of management, however, they are subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking statements in this news release. Readers are cautioned not to place undue reliance on these statements. Klondike Gold does not undertake any obligation to revise or update any forward-looking statements as a result of new information, future events or otherwise after the date hereof, except as required by securities laws.

Forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company's securities; fluctuations in commodity prices and changes in the Company's business plans. In making the forward looking statements in this news release, the Company has applied several material assumptions that the Company believes are reasonable, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. The Company seeks safe harbor.

For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedarplus.ca.

[1]The Mineral Resource Estimate for the Klondike District Property was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., an independent Qualified Person in accordance with the requirements of NI 43-101. The technical report supporting the Mineral Resource Estimate entitled "NI 43-101 Technical Report on the Klondike District Gold Project, Yukon Territory, Canada" has been filed on SEDAR at www.sedarplus.ca effective November 10, 2022. Refer to news release of December 16, 2022.

SOURCE: Klondike Gold Corp.

View the original press release on ACCESS Newswire