Kinross reports strong 2025 second-quarter results

Rhea-AI Summary

Kinross Gold (NYSE:KGC) reported robust Q2 2025 results, with record free cash flow of $646.6 million, up 87% year-over-year. The company produced 512,574 gold equivalent ounces at a production cost of $1,080 per ounce sold.

Financial highlights include revenue of $1.73 billion, up 42% year-over-year, and net earnings of $530.7 million ($0.43 per share). Margins increased significantly to $2,204 per gold equivalent ounce, outpacing the rise in gold prices.

The company remains on track to meet its 2025 guidance of 2.0 million attributable gold equivalent ounces. Kinross has returned approximately $300 million to shareholders year-to-date through share buybacks and dividends, declaring a quarterly dividend of $0.03 per share.

Positive

- Record free cash flow of $646.6 million, up 87% year-over-year

- Revenue increased 42% to $1.73 billion in Q2 2025

- Margins increased 68% to $2,204 per gold equivalent ounce

- Strong balance sheet with $1.14 billion in cash and $2.8 billion in total liquidity

- On track to meet 2025 production guidance of 2.0 million gold equivalent ounces

- $300 million returned to shareholders year-to-date through buybacks and dividends

Negative

- Production decreased to 512,574 Au eq. oz. compared to 535,338 Au eq. oz. in Q2 2024

- Production costs increased to $1,080 per Au eq. oz. from $1,029 in Q2 2024

- All-in sustaining costs rose to $1,493 per Au eq. oz. from $1,387 year-over-year

- Lower production at key mines Tasiast and Round Mountain

News Market Reaction

On the day this news was published, KGC gained 3.76%, reflecting a moderate positive market reaction. Argus tracked a peak move of +2.3% during that session. Our momentum scanner triggered 13 alerts that day, indicating notable trading interest and price volatility. This price movement added approximately $729M to the company's valuation, bringing the market cap to $20.13B at that time.

Data tracked by StockTitan Argus on the day of publication.

Robust margins drive record free cash flow of over

On track for

Development projects advancing on plan

TORONTO, July 30, 2025 (GLOBE NEWSWIRE) -- Kinross Gold Corporation (TSX: K, NYSE: KGC) (“Kinross” or the “Company”) today announced its results for the second quarter ended June 30, 2025.

This news release contains forward-looking information about expected future events and financial and operating performance of the Company. We refer to the risks and assumptions set out in our Cautionary Statement on Forward-Looking Information located on pages 25 and 26 of this release. All dollar amounts are expressed in U.S. dollars, unless otherwise noted.

2025 second-quarter highlights:

- Production1 of 512,574 gold equivalent ounces (Au eq. oz.).

- Production cost of sales2 of

$1,080 per Au eq. oz. sold and attributable production cost of sales1 of$1,074 per Au eq. oz. sold. - Attributable all-in sustaining cost1 of

$1,493 per Au eq. oz. sold. - Operating cash flow3 of

$992.4 million . - Attributable free cash flow1 record of

$646.6 million . - Margins4 increased by

68% to$2,204 per Au eq. oz. sold compared with Q2 2024, significantly outpacing the rise in the average realized gold price. - Reported earnings5 of

$530.7 million , or$0.43 per share, with adjusted net earnings6 of$541.0 million , or$0.44 per share. - On track to meet annual guidance: On an attributable basis1, Kinross expects to produce 2.0 million Au eq. oz. (+/-

5% ) at a production cost of sales per Au eq. oz.1 of$1,120 (+/-5% ) and all-in sustaining cost1 of$1,500 (+/-5% ) per ounce sold. Total attributable capital expenditures1 are forecast to be$1,150 million (+/-5% ). - Cash and cash equivalents of

$1,136.5 million , and total liquidity7 of approximately$2.8 billion at June 30, 2025, as both increased significantly quarter-over-quarter.

Return of capital to shareholders:

- Since reactivating its share buyback program in April 2025, the Company has re-purchased approximately

$225 million in shares to date of the$500 million minimum planned for 2025. - Including its quarterly dividend, Kinross has returned approximately

$300 million in capital to shareholders year-to-date. - Kinross’ Board of Directors declared a quarterly dividend of

$0.03 per common share payable on September 4, 2025, to shareholders of record at the close of business on August 21, 2025.

Operations highlights:

- Paracatu continued its strong performance and was the highest producing mine in the portfolio.

- The Tasiast mill is performing well and on track to meet full-year guidance. Mining at the Fennec satellite deposit has commenced.

- Bald Mountain had a strong quarter, with higher production and lower cost of sales per ounce sold both quarter-over-quarter and year-over-year.

Development and exploration projects:

- Great Bear’s Advanced Exploration (AEX) program is progressing on schedule, with construction of surface facilities well underway. For the Main Project, detailed engineering for key infrastructure is advancing well and initial procurement activities have commenced.

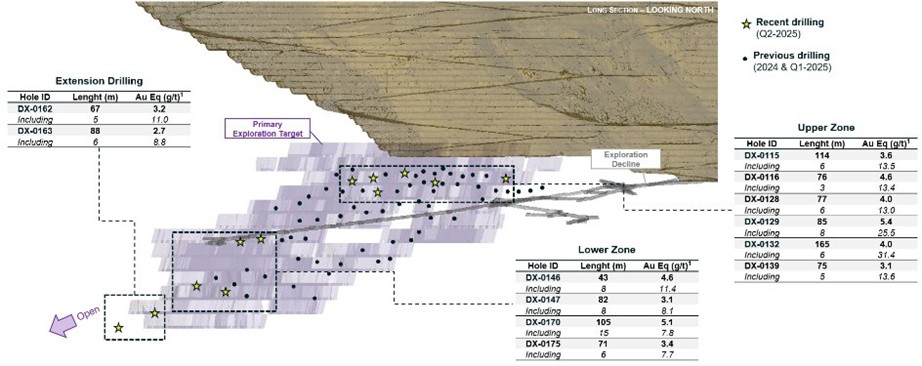

- At Round Mountain Phase X, the exploration decline has advanced, with over 4,500 metres developed to date. Underground drilling has progressed well, with results showing strong widths and grades in both the upper and lower exploration targets, and indicating continuation of mineralization down dip outside the original exploration target. Technical studies and detailed engineering are also progressing well.

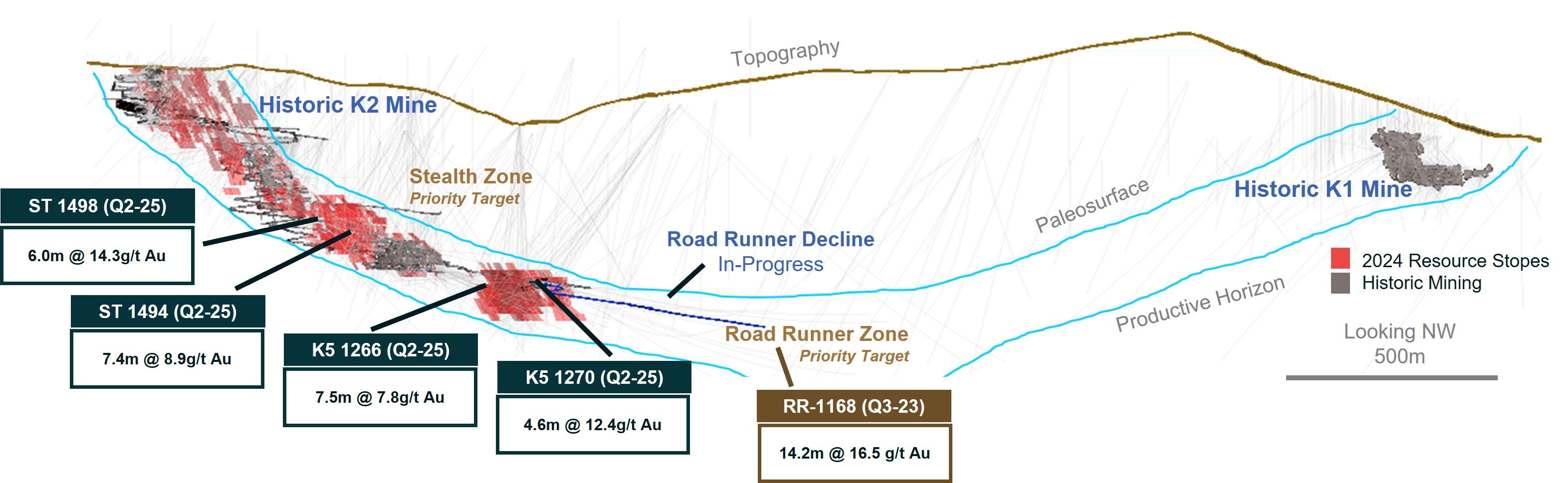

- At Curlew, drilling continues to intersect high grades and strong widths that could support high-margin production. Extension of the underground declines to target additional high-grade zones is also progressing with over 800 metres developed year-to-date.

- At Lobo-Marte, the dedicated project team continues to progress baseline studies to support permitting.

CEO commentary:

J. Paul Rollinson, CEO, made the following comments in relation to 2025 second-quarter results:

“Our portfolio of mines continued to perform well during the quarter contributing to a strong first half of the year and positioning us well to achieve our full-year guidance. The Company delivered a

“Since reactivating our share buyback program earlier this year, we have repurchased

“We are excited about our pipeline of high-quality development and exploration projects, all of which progressed well during the quarter. We have strong optionality in our substantial resource base and are focused on drilling, technical studies and permitting to advance longer-dated projects into our production profile to extend mine life, with a focus on driving margin growth.

“We are also pleased to have released our 2024 Sustainability Report during the quarter, which provides a transparent and comprehensive account of our reporting in this important area. We continue to be focused on sustainability across all aspects of our business, from operations and growth projects, to exploration and strategic priorities.”

Summary of financial and operating results

| Three months ended | Six months ended | ||||||||||||

| June 30, | June 30, | ||||||||||||

| (in millions of U.S. dollars, except ounces, per share amounts, and per ounce amounts) | 2025 | 2024 | 2025 | 2024 | |||||||||

| Operating Highlights(a) | |||||||||||||

| Total gold equivalent ounces(b) | |||||||||||||

| Produced | 530,077 | 535,338 | 1,059,938 | 1,062,737 | |||||||||

| Sold | 526,223 | 520,760 | 1,050,312 | 1,043,160 | |||||||||

| Attributable gold equivalent ounces(b) | |||||||||||||

| Produced | 512,574 | 535,338 | 1,024,662 | 1,062,737 | |||||||||

| Sold | 508,300 | 520,760 | 1,014,864 | 1,043,160 | |||||||||

| Gold ounces - sold | 519,391 | 505,122 | 1,035,659 | 1,008,726 | |||||||||

| Silver ounces - sold (000's) | 666 | 1,268 | 1,367 | 2,935 | |||||||||

| Earnings(a) | |||||||||||||

| Metal sales | $ | 1,728.5 | $ | 1,219.5 | $ | 3,226.0 | $ | 2,301.0 | |||||

| Production cost of sales | $ | 568.4 | $ | 536.1 | $ | 1,115.1 | $ | 1,049.0 | |||||

| Depreciation, depletion and amortization | $ | 262.9 | $ | 295.8 | $ | 551.3 | $ | 566.5 | |||||

| Operating earnings | $ | 774.8 | $ | 298.3 | $ | 1,345.2 | $ | 491.5 | |||||

| Net earnings attributable to common shareholders | $ | 530.7 | $ | 210.9 | $ | 898.7 | $ | 317.9 | |||||

| Net earnings per share attributable to common shareholders (basic and diluted) | $ | 0.43 | $ | 0.17 | $ | 0.73 | $ | 0.26 | |||||

| Adjusted net earnings(c) | $ | 541.0 | $ | 174.7 | $ | 905.0 | $ | 299.6 | |||||

| Adjusted net earnings per share(c) | $ | 0.44 | $ | 0.14 | $ | 0.74 | $ | 0.24 | |||||

| Cash Flow(a) | |||||||||||||

| Net cash flow provided from operating activities | $ | 992.4 | $ | 604.0 | $ | 1,589.5 | $ | 978.4 | |||||

| Attributable adjusted operating cash flow(c) | $ | 843.9 | $ | 478.3 | $ | 1,520.1 | $ | 904.0 | |||||

| Capital expenditures(d) | $ | 306.1 | $ | 274.2 | $ | 513.8 | $ | 516.1 | |||||

| Attributable capital expenditures(c) | $ | 301.8 | $ | 264.5 | $ | 505.9 | $ | 496.6 | |||||

| Attributable free cash flow(c) | $ | 646.6 | $ | 345.9 | $ | 1,017.4 | $ | 491.2 | |||||

| Per Ounce Metrics(a) | |||||||||||||

| Average realized gold price per ounce(e) | $ | 3,284 | $ | 2,342 | $ | 3,071 | $ | 2,206 | |||||

| Attributable average realized gold price per ounce(c) | $ | 3,285 | $ | 2,342 | $ | 3,071 | $ | 2,206 | |||||

| Production cost of sales per equivalent ounce sold(b)(f) | $ | 1,080 | $ | 1,029 | $ | 1,062 | $ | 1,006 | |||||

| Attributable production cost of sales per equivalent ounce sold(b)(c) | $ | 1,074 | $ | 1,029 | $ | 1,056 | $ | 1,006 | |||||

| Attributable production cost of sales per ounce sold on a by-product basis(c) | $ | 1,044 | $ | 989 | $ | 1,027 | $ | 965 | |||||

| Attributable all-in sustaining cost per equivalent ounce sold(b)(c) | $ | 1,493 | $ | 1,387 | $ | 1,424 | $ | 1,348 | |||||

| Attributable all-in sustaining cost per ounce sold on a by-product basis(c) | $ | 1,469 | $ | 1,357 | $ | 1,400 | $ | 1,319 | |||||

| Attributable all-in cost per equivalent ounce sold(b)(c) | $ | 1,936 | $ | 1,774 | $ | 1,808 | $ | 1,702 | |||||

| Attributable all-in cost per ounce sold on a by-product basis(c) | $ | 1,918 | $ | 1,756 | $ | 1,789 | $ | 1,685 | |||||

| (a) | All measures and ratios include | |

| (b) | “Gold equivalent ounces” include silver ounces produced and sold converted to a gold equivalent based on a ratio of the average spot market prices for the commodities for each period. The ratio for the second quarter and first six months of 2025 was 97.41:1 and 93.60:1, respectively (second quarter and first six months of 2024 – 81.06:1 and 84.51:1, respectively). | |

| (c) | The definition and reconciliation of these non-GAAP financial measures and ratios is included on pages 16 to 21 of this news release. Non-GAAP financial measures and ratios have no standardized meaning under International Financial Reporting Standards (“IFRS”) and therefore, may not be comparable to similar measures presented by other issuers. | |

| (d) | “Capital expenditures” is as reported as “Additions to property, plant and equipment” on the interim condensed consolidated statements of cash flows. | |

| (e) | “Average realized gold price per ounce” is defined as gold revenue divided by total gold ounces sold. | |

| (f) | “Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold. | |

The following operating and financial results are based on second-quarter gold equivalent production:

Production: Kinross produced 512,574 Au eq. oz. in Q2 2025, compared with 535,338 Au eq. oz. in Q2 2024. Higher production from Fort Knox, with the commencement of higher-grade, higher-recovery ore feed from Manh Choh in the second half of 2024, and higher production from Paracatu, was offset by lower production from Tasiast and Round Mountain, as planned.

Average realized gold price8: The average realized gold price in Q2 2025 was

Revenue: During the second quarter, revenue increased to

Production cost of sales: Production cost of sales per Au eq. oz. sold2 was

Attributable production cost of sales per Au oz. sold on a by-product basis1 was

Margins4: Kinross’ margin per Au eq. oz. sold increased by

Attributable all-in sustaining cost1: Attributable all-in sustaining cost per Au eq. oz. sold was

In Q2 2025, attributable all-in sustaining cost per Au oz. sold on a by-product basis was

Operating cash flow3: Operating cash flow increased to

Attributable adjusted operating cash flow1 for Q2 2025 increased to

Attributable free cash flow1: Attributable free cash flow increased by

Reported earnings5: Reported net earnings more than doubled to

Adjusted net earnings6 more than tripled to

Attributable capital expenditures1: Attributable capital expenditures increased to

Balance sheet

As of June 30, 2025, Kinross had cash and cash equivalents of

The Company had additional available credit10 of

Return of capital to shareholders

Reflecting the Company’s financial strength, Kinross reactivated its share buyback program in April 2025, while continuing its quarterly dividend program.

Kinross repurchased approximately

Kinross continues to target returning a minimum of

As part of its continuing quarterly dividend program, the Company declared a dividend of

Operating results

Mine-by-mine summaries for 2025 second-quarter operating results may be found on pages 10 and 14 of this news release. Highlights include the following:

At Tasiast, production decreased quarter-over-quarter and year-over-year driven by planned lower grades and lower throughput. The higher recoveries following a number of optimization initiatives to the mill were partially offset by planned lower grades year-over-year. Cost of sales per ounce sold increased compared with the previous quarter and Q2 2024 due to lower production. Tasiast remains on track to meet its annual guidance.

Production at Paracatu increased quarter-over-quarter due to higher throughput, partially offset by lower grades. Year-over-year production increased due to higher grades and recoveries partially offset by an expected decrease in throughput, as per planned mine sequencing which moved into harder, higher-grade ore this year. Cost of sales per ounce sold was in line with the previous quarter and decreased compared with Q2 2024 due to the increase in production.

At La Coipa, production increased quarter-over-quarter due to timing of ounces processed through the mill, partially offset by lower grades as a result of decreased ore tonnes mined from the pit and increased feed from low-grade stockpiles driven by higher groundwater inflows into the pits than anticipated. Relative to Q2 2024, production decreased also due to lower grades with higher feed from low-grade stockpiles. In the second half of the year, production is expected to increase as mining transitions to higher-grade ore from Phase 7, and the mine remains on track to meet its annual production guidance. Cost of sales per ounce sold was higher quarter-over-quarter as a result of the lower grades and higher royalty costs, and year-over-year as a result of the decrease in production and higher royalty, labour and contractor costs. Permitting work for mine life extensions continues, including the submission of the Environmental Impact Assessment during the quarter.

At Fort Knox, production was largely in line quarter-over-quarter, and increased year-over-year as a result of the contribution of Manh Choh’s higher-grade, higher-recovery ore starting in the second half of 2024. Cost of sales per ounce sold increased quarter-over-quarter due to higher processing costs and the timing of ounces recovered from the heap leach pads. Year-over-year costs decreased as a result of the increase in production, partially offset by higher royalty and reagent costs related largely to the start of Manh Choh production.

At Round Mountain, production was higher quarter-over-quarter driven by higher grades. Production decreased year-over-year as a result of lower mill grades and fewer ounces recovered from the heap leach pads as per planned mine sequencing as the site transitions from Phase W to Phase S.

At Bald Mountain, production was higher quarter-over-quarter and year-over-year largely as a result of strong grades and timing of ounces recovered from the heap leach pads, partially offset by fewer tonnes of ore stacked. Cost of sales per ounce sold was lower quarter-over-quarter and year-over-year as a result of the increase in production and higher proportion of capital development tonnes as mining at Redbird Phase I continues to ramp-up.

Development and exploration projects

Great Bear

At Great Bear, Kinross continues to progress its AEX program, permitting and detailed engineering for the Main Project.

AEX construction commenced in Q4 2024, earthwork activities are underway, and the AEX camp is nearing completion. Initial development of the exploration decline is on target for December 2025, subject to permitting.

For the Main Project, Kinross is progressing detailed engineering on the mill, the tailings management facility, and other site infrastructure. Initial procurement activities for major process equipment have commenced, with awards planned to start in late 2025, and manufacturing for a few long lead items is expected to commence in 2026.

In order to advance the Impact Statement (IS) on a timely basis, the Company is coordinating with the Impact Assessment Agency of Canada (IAAC) on a staged filing process. The Company intends to file the majority of the technical chapters by year end and the remaining chapters by the end of Q1 2026. This approach will underpin a robust IS filing with the necessary technical and Indigenous contributions to help facilitate an efficient review process by IAAC.

Kinross also advanced its regional exploration drilling program during the quarter, targeting favorable geophysical signatures as well as lithological contacts, looking for new, near-surface mineralization.

Round Mountain Phase X

Decline development at Round Mountain Phase X is advancing well, with over 4,500 metres developed to date. Extensive infill drilling has been completed in both the upper zone and lower zones, with results continuing to intersect strong widths and grades, and extension drilling indicating continuation of mineralization down dip outside the original exploration target. Highlights include:

- Upper Zone:

- DX-0115 – 114m @ 3.6 g/t

- Including 6m @ 13.5 g/t

- DX-0116 – 76m @ 4.6g/t

- Including 3m @ 13.4 g/t

- DX-0128 – 77m @ 4.0 g/t

- Including 6m @ 13.0 g/t

- DX-0129 – 85m @ 5.4 g/t

- Including 8m @ 25.5 g/t

- DX-0132 – 165m @ 4.0 g/t

- Including 6m @ 31.4 g/t

- DX-0139 – 75m @ 3.1 g/t

- Including 5m @ 13.6 g/t

- DX-0115 – 114m @ 3.6 g/t

- Lower Zone:

- DX-0146 – 43m @ 4.6 g/t

- Including 8m @ 11.4 g/t

- DX-0147 – 82m @ 3.1 g/t

- Including 8m @ 8.1 g/t

- DX-0170 – 105m @ 5.1 g/t

- Including 15m @ 7.8 g/t

- DX-0175 – 71m @ 3.4 g/t

- Including 6m @ 7.7 g/t

- DX-0146 – 43m @ 4.6 g/t

- Extension Drilling:

- DX-0162 – 67m @ 3.2 g/t

- Including 5m @ 11.0 g/t

- DX-0163 – 88m @ 2.7 g/t

- Including 6m @ 8.8 g/t

- Including 6m @ 8.8 g/t

- DX-0162 – 67m @ 3.2 g/t

Engineering work and technical studies are advancing well to support potential project execution at Phase X.

Kinross plans to provide a project, resource and economics update with year-end results.

See Appendix A for a Round Mountain Phase X long section.

Curlew Basin exploration

Drilling at Curlew continues to intersect high grades and strong widths at both North Stealth and K5, indicating potential to further improve the quality of the resource and the mine plan with additions of high margin mineralization. Highlights include (true width):

- ST-1498 – 6.0m @ 14.3 g/t Au

- ST-1494 – 7.4m @ 8.9 g/t Au

- K5-1266 – 7.5m @ 7.8 g/t Au

- K5-1270 – 4.6m @ 12.4 g/t Au

Extension of the underground declines is progressing well with over 800 metres developed year-to-date, focused on providing drilling access to follow up on the high grade 2023 discovery at Roadrunner and to extend mineralization in the high grade North Stealth area.

Technical studies and detailed engineering are also progressing well at Curlew.

See Appendix A for a Curlew cross section.

Bald Mountain Redbird

At Redbird, mining is advancing on schedule. Studies and detailed engineering related to the potential Phase 2 extension of Redbird are progressing well, including engineering related to the heap leach pad expansion, technical studies and mine plan optimization work. Exploration drilling and technical studies are also progressing, targeting satellite pit opportunities on the large Bald Mountain property, which could potentially augment the production profile from Redbird 2.

Lobo-Marte

Kinross is progressing baseline studies to support the Environmental Impact Assessment (EIA) for the Lobo-Marte project. Lobo-Marte continues to be a potential large, low-cost mine and Kinross is committed to progressing next steps to advance the project.

Sustainability

Following the publication of Kinross’ 2024 Sustainability Report and summary, below are several water-related highlights, a material sustainability topic for the Company and its stakeholders. Kinross’ water management standard prioritizes water supply security, water conservation and stewardship, and prevention of downstream environmental impacts. There is a strong focus on water efficiency, with a high water recycling rate of

In Chile, La Coipa contributed to this efficiency through an optimization program of the main processing circuits which resulted in lower water loss going to the dry stack tailings. Near Maricunga, wetland restoration resulted in the resurgence of ecosystem services and the return of native plant species.

At all of the Company’s development projects, science-based methods are utilized to ensure strong baseline information, including environmental DNA studies for the Great Bear project and watershed groundwater modeling for the Lobo-Marte project.

At Fort Knox in Alaska, fish populations continue to thrive at Fish Creek based on continuous monitoring by the Alaska department of Fish and Game since the late 1990s. Fish Creek was a historic placer mining area, reclaimed by Kinross in the early 1990s for the benefit of the local communities. Also in Alaska, Kinross continued its long-standing partnership with Trout Unlimited and the Alaska Abandoned Mine Restoration Initiative, with sustained progress in the recovery of fish populations in Resurrection Creek, south of Anchorage, also a placer mining area.

Conference call details

In connection with this news release, Kinross will hold a conference call and audio webcast on Thursday, July 31, 2025, at 8:00 a.m. EDT to discuss the results, followed by a question-and-answer session. To access the call, please dial:

Canada & US toll-free – 1 (888) 596-4144; Passcode: 9425112

Outside of Canada & US – 1 (646) 968-2525; Passcode: 9425112

Replay (available up to 14 days after the call):

Canada & US toll-free – 1 (800) 770-2030; Passcode: 9425112

Outside of Canada & US – 1 (609) 800-9909; Passcode: 9425112

You may also access the conference call on a listen-only basis via webcast at our website www.kinross.com. The audio webcast will be archived on www.kinross.com.

About Kinross Gold Corporation

Kinross is a Canadian-based global senior gold mining company with operations and projects in the United States, Brazil, Mauritania, Chile and Canada. Our focus is on delivering value based on the core principles of responsible mining, operational excellence, disciplined growth, and balance sheet strength. Kinross maintains listings on the Toronto Stock Exchange (symbol: K) and the New York Stock Exchange (symbol: KGC).

Media Contact

Samantha Sheffield

Director, Corporate Communications

phone: 416-365-3034

Samantha.Sheffield@Kinross.com

Investor Relations Contact

David Shaver

Senior Vice-President, Investor Relations & Communications

phone: 416-365-2854

InvestorRelations@Kinross.com

Review of operations

| Three months ended June 30, | Gold equivalent ounces | |||||||||||||||

| Produced | Sold | Production cost of sales ($millions) | Production cost of sales/equivalent ounce sold | |||||||||||||

| 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | |||||||||

| Tasiast | 119,241 | 161,629 | 121,745 | 156,038 | 102.6 | 102.3 | 843 | 656 | ||||||||

| Paracatu | 149,264 | 130,228 | 148,787 | 130,174 | 142.6 | 135.2 | 958 | 1,039 | ||||||||

| La Coipa | 54,139 | 65,851 | 50,400 | 63,506 | 70.4 | 58.8 | 1,397 | 926 | ||||||||

| Fort Knox | 115,064 | 69,914 | 113,200 | 70,477 | 141.3 | 94.8 | 1,248 | 1,345 | ||||||||

| Round Mountain | 38,665 | 61,787 | 37,864 | 60,049 | 52.1 | 93.9 | 1,376 | 1,564 | ||||||||

| Bald Mountain | 53,704 | 45,929 | 54,227 | 39,818 | 59.4 | 50.6 | 1,095 | 1,271 | ||||||||

| United States Total | 207,433 | 177,630 | 205,291 | 170,344 | 252.8 | 239.3 | 1,231 | 1,405 | ||||||||

| Less: Manh Choh non-controlling interest ( | (17,503) | - | (17,923) | - | (22.5) | - | ||||||||||

| United States Attributable Total | 189,930 | 177,630 | 187,368 | 170,344 | 230.3 | 239.3 | 1,229 | 1,405 | ||||||||

| Operations Total(a) | 530,077 | 535,338 | 526,223 | 520,760 | 568.4 | 536.1 | 1,080 | 1,029 | ||||||||

| Attributable Total(a) | 512,574 | 535,338 | 508,300 | 520,760 | 545.9 | 536.1 | 1,074 | 1,029 | ||||||||

| Six months ended June 30, | Gold equivalent ounces | |||||||||||||||

| Produced | Sold | Production cost of sales ($millions) | Production cost of sales/equivalent ounce sold | |||||||||||||

| 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | |||||||||

| Tasiast | 256,870 | 320,828 | 251,238 | 307,052 | 207.6 | 202.0 | 826 | 658 | ||||||||

| Paracatu | 295,903 | 258,501 | 295,642 | 258,284 | 282.2 | 270.9 | 955 | 1,049 | ||||||||

| La Coipa | 106,454 | 137,096 | 106,270 | 134,631 | 134.5 | 110.9 | 1,266 | 824 | ||||||||

| Fort Knox | 227,118 | 123,264 | 225,310 | 126,769 | 273.1 | 177.3 | 1,212 | 1,399 | ||||||||

| Round Mountain | 74,351 | 130,139 | 73,824 | 128,218 | 109.1 | 184.5 | 1,478 | 1,439 | ||||||||

| Bald Mountain | 99,242 | 92,909 | 98,028 | 87,059 | 108.6 | 102.7 | 1,108 | 1,180 | ||||||||

| United States Total | 400,711 | 346,312 | 397,162 | 342,046 | 490.8 | 464.5 | 1,236 | 1,358 | ||||||||

| Less: Manh Choh non-controlling interest ( | (35,276) | - | (35,448) | - | (43.2) | - | ||||||||||

| United States Attributable Total | 365,435 | 346,312 | 361,714 | 342,046 | 447.6 | 464.5 | 1,237 | 1,358 | ||||||||

| Operations Total(a) | 1,059,938 | 1,062,737 | 1,050,312 | 1,043,160 | 1,115.1 | 1,049.0 | 1,062 | 1,006 | ||||||||

| Attributable Total(a) | 1,024,662 | 1,062,737 | 1,014,864 | 1,043,160 | 1,071.9 | 1,049.0 | 1,056 | 1,006 | ||||||||

| (a) | Totals include immaterial sales and related costs from Maricunga for the three and six months ended June 30, 2024. | |

Consolidated balance sheets

| (unaudited, expressed in millions of U.S. dollars, except share amounts) | ||||||

| As at | ||||||

| June 30, | December 31, | |||||

| 2025 | 2024 | |||||

| Assets | ||||||

| Current assets | ||||||

| Cash and cash equivalents | $ | 1,136.5 | $ | 611.5 | ||

| Restricted cash | 12.7 | 10.2 | ||||

| Accounts receivable and prepaid assets | 239.9 | 257.3 | ||||

| Inventories | 1,344.7 | 1,243.2 | ||||

| Other current assets | 14.8 | 4.5 | ||||

| 2,748.6 | 2,126.7 | |||||

| Non-current assets | ||||||

| Property, plant and equipment | 7,972.7 | 7,968.6 | ||||

| Long-term investments | 89.6 | 51.9 | ||||

| Other long-term assets | 647.2 | 713.1 | ||||

| Deferred tax assets | 5.3 | 5.3 | ||||

| Total assets | $ | 11,463.4 | $ | 10,865.6 | ||

| Liabilities | ||||||

| Current liabilities | ||||||

| Accounts payable and accrued liabilities | $ | 611.3 | $ | 543.0 | ||

| Current income tax payable | 285.9 | 236.7 | ||||

| Current portion of long-term debt | - | 199.9 | ||||

| Current portion of provisions | 60.0 | 62.5 | ||||

| Other current liabilities | 9.5 | 18.0 | ||||

| 966.7 | 1,060.1 | |||||

| Non-current liabilities | ||||||

| Long-term debt | 1,236.4 | 1,235.5 | ||||

| Provisions | 964.3 | 941.5 | ||||

| Other long-term liabilities | 56.3 | 78.9 | ||||

| Deferred tax liabilities | 551.7 | 549.0 | ||||

| Total liabilities | $ | 3,775.4 | $ | 3,865.0 | ||

| Equity | ||||||

| Common shareholders' equity | ||||||

| Common share capital | $ | 4,451.0 | $ | 4,487.3 | ||

| Contributed surplus | 10,503.7 | 10,643.0 | ||||

| Accumulated deficit | (7,356.2) | (8,181.3) | ||||

| Accumulated other comprehensive loss | (44.8) | (87.4) | ||||

| Total common shareholders' equity | 7,553.7 | 6,861.6 | ||||

| Non-controlling interests | 134.3 | 139.0 | ||||

| Total equity | $ | 7,688.0 | $ | 7,000.6 | ||

| Total liabilities and equity | $ | 11,463.4 | $ | 10,865.6 | ||

| Common shares | ||||||

| Authorized | Unlimited | Unlimited | ||||

| Issued and outstanding | 1,218,782,161 | 1,229,125,606 | ||||

Consolidated statements of operations

| (unaudited, expressed in millions of U.S. dollars, except per share amounts) | ||||||||||||

| Three months ended | Six months ended | |||||||||||

| June 30, | June 30, | June 30, | June 30, | |||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||

| Revenue | ||||||||||||

| Metal sales | $ | 1,728.5 | $ | 1,219.5 | $ | 3,226.0 | $ | 2,301.0 | ||||

| Cost of sales | ||||||||||||

| Production cost of sales | 568.4 | 536.1 | 1,115.1 | 1,049.0 | ||||||||

| Depreciation, depletion and amortization | 262.9 | 295.8 | 551.3 | 566.5 | ||||||||

| Total cost of sales | 831.3 | 831.9 | 1,666.4 | 1,615.5 | ||||||||

| Gross profit | 897.2 | 387.6 | 1,559.6 | 685.5 | ||||||||

| Other operating expense | 31.1 | 1.9 | 45.1 | 29.5 | ||||||||

| Exploration and business development | 61.7 | 55.7 | 104.0 | 97.4 | ||||||||

| General and administrative | 29.6 | 31.7 | 65.3 | 67.1 | ||||||||

| Operating earnings | 774.8 | 298.3 | 1,345.2 | 491.5 | ||||||||

| Other (expense) income - net | (19.8) | 5.7 | (33.0) | 5.8 | ||||||||

| Finance income | 7.4 | 4.5 | 11.6 | 8.4 | ||||||||

| Finance expense | (32.9) | (21.8) | (68.1) | (43.3) | ||||||||

| Earnings before tax | 729.5 | 286.7 | 1,255.7 | 462.4 | ||||||||

| Income tax expense - net | (170.9) | (77.8) | (307.7) | (146.9) | ||||||||

| Net earnings | $ | 558.6 | $ | 208.90 | $ | 948.0 | $ | 315.5 | ||||

| Net earnings (loss) attributable to: | ||||||||||||

| Non-controlling interests | $ | 27.9 | $ | (2.0) | $ | 49.3 | $ | (2.4) | ||||

| Common shareholders | $ | 530.7 | $ | 210.9 | $ | 898.7 | $ | 317.9 | ||||

| Earnings per share attributable to common shareholders | ||||||||||||

| Basic | $ | 0.43 | $ | 0.17 | $ | 0.73 | $ | 0.26 | ||||

| Diluted | $ | 0.43 | $ | 0.17 | $ | 0.73 | $ | 0.26 | ||||

Consolidated statements of cash flows

| (unaudited, expressed in millions of U.S. dollars) | ||||||||||||

| Three months ended | Six months ended | |||||||||||

| June 30, | June 30, | June 30, | June 30, | |||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||

| Net inflow (outflow) of cash related to the following activities: | ||||||||||||

| Operating: | ||||||||||||

| Net earnings | $ | 558.6 | $ | 208.90 | $ | 948.0 | $ | 315.50 | ||||

| Adjustments to reconcile net earnings to net cash provided from operating activities: | ||||||||||||

| Depreciation, depletion and amortization | 262.9 | 295.8 | 551.3 | 566.5 | ||||||||

| Share-based compensation expense | 3.2 | 2.8 | 7.8 | 5.3 | ||||||||

| Finance expense | 32.9 | 21.8 | 68.1 | 43.3 | ||||||||

| Deferred tax (recovery) expense | (1.0) | (21.2) | 2.5 | (12.6) | ||||||||

| Foreign exchange losses (gains) and other | 23.3 | (7.1) | 8.3 | 7.9 | ||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Accounts receivable and other assets | 7.2 | 6.2 | 14.3 | 15.0 | ||||||||

| Inventories | 8.9 | 2.5 | (29.5) | 8.4 | ||||||||

| Accounts payable, accrued liabilities and other | 206.4 | 147.0 | 307.0 | 160.6 | ||||||||

| Cash flow provided from operating activities | 1,102.4 | 656.7 | 1,877.8 | 1,109.9 | ||||||||

| Income taxes paid | (110.0) | (52.7) | (288.3) | (131.5) | ||||||||

| Net cash flow provided from operating activities | 992.4 | 604.0 | 1,589.5 | 978.4 | ||||||||

| Investing: | ||||||||||||

| Additions to property, plant and equipment | (306.1) | (274.2) | (513.8) | (516.1) | ||||||||

| Interest paid capitalized to property, plant and equipment | - | (17.0) | (13.5) | (51.9) | ||||||||

| Net additions to long-term investments and other assets | (14.8) | (15.7) | (23.9) | (18.8) | ||||||||

| (Increase) decrease in restricted cash - net | (0.8) | 0.8 | (2.5) | 0.3 | ||||||||

| Interest received and other - net | 9.0 | 3.8 | 13.2 | 7.7 | ||||||||

| Net cash flow used in investing activities | (312.7) | (302.3) | (540.5) | (578.8) | ||||||||

| Financing: | ||||||||||||

| Repayment of debt | - | (200.0) | (200.0) | (200.0) | ||||||||

| Interest paid | - | - | (24.0) | (18.5) | ||||||||

| Payment of lease liabilities | (1.5) | (3.4) | (3.0) | (6.8) | ||||||||

| Funding from non-controlling interest | - | 11.7 | - | 27.2 | ||||||||

| Distributions paid to non-controlling interest | (30.0) | - | (54.0) | - | ||||||||

| Dividends paid to common shareholders | (36.7) | (36.8) | (73.6) | (73.7) | ||||||||

| Repurchase and cancellation of shares | (170.1) | - | (170.1) | - | ||||||||

| Other - net | - | - | - | 0.3 | ||||||||

| Net cash flow used in financing activities | (238.3) | (228.5) | (524.7) | (271.5) | ||||||||

| Effect of exchange rate changes on cash and cash equivalents | 0.5 | (0.1) | 0.7 | (0.5) | ||||||||

| Increase in cash and cash equivalents | 441.9 | 73.1 | 525.0 | 127.6 | ||||||||

| Cash and cash equivalents, beginning of period | 694.6 | 406.9 | 611.5 | 352.4 | ||||||||

| Cash and cash equivalents, end of period | 1,136.5 | 480.0 | $ | 1,136.5 | $ | 480.0 | ||||||

| Operating Summary | ||||||||||||||||||

| Mine | Period | Tonnes Ore Mined | Ore Processed (Milled) | Ore Processed (Heap Leach) | Grade (Mill) | Grade (Heap Leach) | Recovery (a)(b) | Gold Eq Production(c) | Gold Eq Sales(c) | Production cost of sales | Production cost of sales/oz(d) | Cap Ex - sustaining(e) | Total Cap Ex (e) | |||||

| ('000 tonnes) | ('000 tonnes) | ('000 tonnes) | (g/t) | (g/t) | (%) | (ounces) | (ounces) | ($ millions) | ($/ounce) | ($ millions) | ($ millions) | |||||||

| West Africa | Tasiast | Q2 2025 | 1,921 | 1,730 | - | 2.11 | - | 119,241 | 121,745 | $ | 102.6 | $ | 843 | $ | 23.1 | $ | 89.7 | |

| Q1 2025 | 1,812 | 1,932 | - | 2.15 | - | 137,629 | 129,493 | $ | 105.0 | $ | 811 | $ | 13.7 | $ | 80.1 | |||

| Q4 2024 | 1,824 | 2,205 | - | 2.13 | - | 139,411 | 144,041 | $ | 104.4 | $ | 725 | $ | 33.7 | $ | 105.4 | |||

| Q3 2024 | 1,748 | 2,203 | - | 2.46 | - | 162,155 | 158,521 | $ | 109.0 | $ | 688 | $ | 13.5 | $ | 83.8 | |||

| Q2 2024 | 1,985 | 2,161 | - | 2.70 | - | 161,629 | 156,038 | $ | 102.3 | $ | 656 | $ | 7.0 | $ | 75.2 | |||

| Americas | Paracatu | Q2 2025 | 13,497 | 14,527 | - | 0.39 | - | 149,264 | 148,787 | $ | 142.6 | $ | 958 | $ | 38.4 | $ | 38.4 | |

| Q1 2025 | 13,318 | 12,507 | - | 0.43 | - | 146,639 | 146,855 | $ | 139.6 | $ | 951 | $ | 24.4 | $ | 24.4 | |||

| Q4 2024 | 12,944 | 13,116 | - | 0.40 | - | 123,899 | 124,690 | $ | 131.6 | $ | 1,055 | $ | 35.1 | $ | 35.1 | |||

| Q3 2024 | 13,127 | 14,551 | - | 0.38 | - | 146,174 | 145,235 | $ | 146.1 | $ | 1,006 | $ | 41.2 | $ | 41.2 | |||

| Q2 2024 | 14,094 | 15,053 | - | 0.35 | - | 130,228 | 130,174 | $ | 135.2 | $ | 1,039 | $ | 44.6 | $ | 44.6 | |||

| La Coipa(f) | Q2 2025 | 580 | 911 | - | 1.77 | - | 54,139 | 50,400 | $ | 70.4 | $ | 1,397 | $ | 25.0 | $ | 25.0 | ||

| Q1 2025 | 1,265 | 971 | - | 2.19 | - | 52,315 | 55,870 | $ | 64.1 | $ | 1,147 | $ | 15.6 | $ | 15.6 | |||

| Q4 2024 | 1,385 | 1,017 | - | 1.98 | - | 58,533 | 57,852 | $ | 68.2 | $ | 1,179 | $ | 26.6 | $ | 26.6 | |||

| Q3 2024 | 786 | 809 | - | 2.17 | - | 50,502 | 48,594 | $ | 52.2 | $ | 1,074 | $ | 21.3 | $ | 24.9 | |||

| Q2 2024 | 690 | 882 | - | 1.97 | - | 65,851 | 63,506 | $ | 58.8 | $ | 926 | $ | 10.7 | $ | 10.7 | |||

| Fort Knox ( | Q2 2025 | 7,639 | 1,636 | 5,529 | 1.72 | 0.23 | 115,064 | 113,200 | $ | 141.3 | $ | 1,248 | $ | 43.0 | $ | 43.0 | ||

| Q1 2025 | 6,530 | 1,071 | 4,790 | 2.77 | 0.19 | 112,054 | 112,110 | $ | 131.8 | $ | 1,176 | $ | 28.2 | $ | 28.2 | |||

| Q4 2024 | 7,692 | 1,524 | 6,664 | 1.51 | 0.21 | 104,901 | 108,512 | $ | 141.0 | $ | 1,299 | $ | 53.3 | $ | 54.0 | |||

| Q3 2024 | 7,612 | 1,105 | 5,822 | 4.03 | 0.19 | 149,093 | 140,121 | $ | 134.2 | $ | 958 | $ | 56.6 | $ | 70.4 | |||

| Q2 2024 | 8,331 | 2,003 | 6,385 | 0.85 | 0.22 | 69,914 | 70,477 | $ | 94.8 | $ | 1,345.12 | $ | 47.6 | $ | 89.2 | |||

| Fort Knox (attributable)(g) | Q2 2025 | 7,535 | 1,567 | 5,529 | 1.47 | 0.23 | 97,561 | 95,277 | $ | 118.8 | $ | 1,246.89 | $ | 38.7 | $ | 38.7 | ||

| Q1 2025 | 6,445 | 982 | 4,790 | 2.35 | 0.19 | 94,281 | 94,585 | $ | 111.1 | $ | 1,174.60 | $ | 24.6 | $ | 24.60 | |||

| Q4 2024 | 7,619 | 1,483 | 6,664 | 1.28 | 0.21 | 91,755 | 94,763 | $ | 125.1 | $ | 1,320.14 | $ | 51.1 | $ | 52.1 | |||

| Q3 2024 | 7,509 | 991 | 5,822 | 3.44 | 0.19 | 119,500 | 112,346 | $ | 109.3 | $ | 972.89 | $ | 55.4 | $ | 67.2 | |||

| Q2 2024 | 8,249 | 2,003 | 6,385 | 0.85 | 0.22 | 69,914 | 70,477 | $ | 94.8 | $ | 1,345.12 | $ | 47.6 | $ | 79.5 | |||

| Round Mountain | Q2 2025 | 2,881 | 856 | 1,682 | 0.72 | 0.30 | 38,665 | 37,864 | $ | 52.1 | $ | 1,376 | $ | 5.70 | $ | 32.8 | ||

| Q1 2025 | 1,927 | 856 | 2,163 | 0.66 | 0.27 | 35,686 | 35,960 | $ | 57.0 | $ | 1,585 | $ | 2.8 | $ | 29.6 | |||

| Q4 2024 | 3,111 | 768 | 1,736 | 1.05 | 0.22 | 42,969 | 45,342 | $ | 80.0 | $ | 1,764 | $ | 4.4 | $ | 33.9 | |||

| Q3 2024 | 2,958 | 790 | 1,032 | 0.74 | 0.29 | 42,279 | 41,436 | $ | 63.8 | $ | 1,540 | $ | 5.2 | $ | 35.9 | |||

| Q2 2024 | 2,956 | 806 | 1,541 | 1.11 | 0.35 | 61,787 | 60,049 | $ | 93.9 | $ | 1,564 | $ | 2.1 | $ | 37.2 | |||

| Bald Mountain | Q2 2025 | 1,578 | - | 1,578 | - | 1.07 | nm | 53,704 | 54,227 | $ | 59.4 | $ | 1,095 | $ | 12.7 | $ | 40.4 | |

| Q1 2025 | 5,803 | - | 5,803 | - | 0.35 | nm | 45,538 | 43,801 | $ | 49.2 | $ | 1,123 | $ | 6.9 | $ | 17.8 | ||

| Q4 2024 | 7,622 | - | 7,622 | - | 0.46 | nm | 44,642 | 51,291 | $ | 58.7 | $ | 1,144 | $ | 4.6 | $ | 6.4 | ||

| Q3 2024 | 6,384 | - | 6,384 | - | 0.53 | nm | 43,496 | 44,410 | $ | 58.9 | $ | 1,326 | $ | 5 | $ | 6.1 | ||

| Q2 2024 | 2,906 | - | 2,906 | - | 0.47 | nm | 45,929 | 39,818 | $ | 50.6 | $ | 1,271 | $ | 4.4 | $ | 4.6 | ||

| (a) | Due to the nature of heap leach operations, recovery rates at Bald Mountain cannot be accurately measured on a quarterly basis. Recovery rates at Fort Knox and Round Mountain represent mill recovery only. | |||||||||||||||||

| (b) | "nm" means not meaningful. | |||||||||||||||||

| (c) | Gold equivalent ounces include silver ounces produced and sold converted to a gold equivalent based on the ratio of the average spot market prices for the commodities for each period. The ratios for the quarters presented are as follows: Q2 2025: 97.41:1; Q1 2025: 89.69:1; Q4 2024: 84.67:1; Q3 2024: 84.06:1; Q2 2024: 81.06:1. | |||||||||||||||||

| (d) | “Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold. | |||||||||||||||||

| (e) | "Total Cap Ex" is as reported as “Additions to property, plant and equipment” on the interim condensed consolidated statements of cash flows. "Cap Ex - sustaining" is a non-GAAP financial measure. The definition and reconciliation of this non-GAAP financial measure is included on pages 20 to 21 of this news release. | |||||||||||||||||

| (f) | La Coipa silver grade and recovery were as follows: Q2 2025: 28.89 g/t, | |||||||||||||||||

| (g) | The Fort Knox segment is composed of Fort Knox and Manh Choh, and comparative results shown are presented in accordance with the current year’s presentation. Manh Choh tonnes of ore processed and grade were as follows: Q2 2025: 231,451 tonnes, 7.39 g/t; Q1 2025: 294,238 tonnes, 7.39 g/t; Q4 2024: 138,937 tonnes, 9.58 g/t; Q3 2024: 379,786 tonnes, 9.13 g/t. Tonnes of ore processed and grade were nil for all other periods presented as production commenced in July 2024. The attributable results for Fort Knox include | |||||||||||||||||

Reconciliation of non-GAAP financial measures and ratios

The Company has included certain non-GAAP financial measures and ratios in this document. These financial measures and ratios are not defined under IFRS and should not be considered in isolation. The Company believes that these financial measures and ratios, together with financial measures and ratios determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. The inclusion of these financial measures and ratios is meant to provide additional information and should not be used as a substitute for performance measures prepared in accordance with IFRS. These financial measures and ratios are not necessarily standard and therefore may not be comparable to other issuers.

Adjusted Net Earnings and Adjusted Net Earnings per Share

Adjusted net earnings and adjusted net earnings per share are non-GAAP financial measures and ratios which determine the performance of the Company, excluding certain impacts which the Company believes are not reflective of the Company’s underlying performance for the reporting period, such as the impact of foreign exchange gains and losses, reassessment of prior year taxes and/or taxes otherwise not related to the current period, impairment charges (reversals), gains and losses and other one-time costs related to acquisitions, dispositions and other transactions, and non-hedge derivative gains and losses. Although some of the items are recurring, the Company believes that they are not reflective of the underlying operating performance of its current business and are not necessarily indicative of future operating results. Management believes that these measures and ratios, which are used internally to assess performance and in planning and forecasting future operating results, provide investors with the ability to better evaluate underlying performance, particularly since the excluded items are typically not included in public guidance. However, adjusted net earnings and adjusted net earnings per share measures and ratios are not necessarily indicative of net earnings and earnings per share measures and ratios as determined under IFRS.

The following table provides a reconciliation of net earnings to adjusted net earnings for the periods presented:

| (expressed in millions of U.S. dollars, except per share amounts) | Three months ended | Six months ended | ||||||||||

| June 30, | June 30, | |||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||

| Net earnings attributable to common shareholders - as reported | $ | 530.7 | $ | 210.9 | $ | 898.7 | $ | 317.9 | ||||

| Adjusting items: | ||||||||||||

| Foreign exchange losses (gains) | 11.1 | (6.4) | 18.8 | -9.9 | ||||||||

| Foreign exchange (gains) losses on translation of tax basis and foreign exchange on deferred income taxes within income tax expense | (15.1) | 20.3 | (21.0) | 24.3 | ||||||||

| Taxes in respect of prior periods | 3.3 | (30.7) | (4.6) | (22.7) | ||||||||

| Tasiast mill fire related costs | 13 | 0 | 13 | 0 | ||||||||

| Insurance recoveries | 0 | (22.9) | 0 | (22.9) | ||||||||

| Other(a) | 1.7 | 4.9 | 3.4 | 15.4 | ||||||||

| Tax effects of the above adjustments | (3.7) | (1.4) | (3.3) | (2.5) | ||||||||

| 10.3 | (36.2) | 6.3 | (18.3) | |||||||||

| Adjusted net earnings | $ | 541.0 | $ | 174.7 | $ | 905 | $ | 299.6 | ||||

| Weighted average number of common shares outstanding - Basic | 1225.7 | 1229 | 1228.1 | 1228.6 | ||||||||

| Adjusted net earnings per share | $ | 0.44 | $ | 0.14 | $ | 0.74 | $ | 0.24 | ||||

| Basic earnings per share attributable to common shareholders - as reported | $ | 0.43 | $ | 0.17 | $ | 0.73 | $ | 0.26 | ||||

| (a) | Other includes various impacts, such as settlement provisions, one-time costs and credits at sites, restructuring costs, adjustments related to prior years as well as gains and losses on assets and hedges, which the Company believes are not reflective of the Company’s underlying performance for the reporting period. | |

Attributable Free Cash Flow

Attributable free cash flow is a non-GAAP financial measure and is defined as net cash flow provided from operating activities less attributable capital expenditures and non-controlling interest included in net cash flows provided from operating activities. The Company believes that this measure, which is used internally to evaluate the Company’s underlying cash generation performance and the ability to repay creditors and return cash to shareholders, provides investors with the ability to better evaluate the Company’s underlying performance. However, this measure is not necessarily indicative of operating earnings or net cash flow provided from operating activities as determined under IFRS.

The following table provides a reconciliation of attributable free cash flow for the periods presented:

| (expressed in millions of U.S. dollars) | Three months ended | Six months ended | ||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net cash flow provided from operating activities - as reported | $ | 992.4 | $ | 604 | $ | 1589.5 | $ | 978.4 | ||||||||

| Adjusting items: | ||||||||||||||||

| Attributable(a) capital expenditures | (301.8 | ) | (264.5 | ) | (505.9 | ) | (496.6 | ) | ||||||||

| Non-controlling interest(b) cash flow (from) used in operating activities | (44 | ) | 6.4 | (66.2 | ) | 9.4 | ||||||||||

| Attributable(a) free cash flow | $ | 646.6 | $ | 345.9 | $ | 1017.4 | $ | 491.2 | ||||||||

See pages 21 and 22 for details of the footnotes referenced within the table above.

Attributable Adjusted Operating Cash Flow

Attributable adjusted operating cash flow is a non-GAAP financial measure and is defined as net cash flow provided from operating activities excluding changes in working capital, certain impacts which the Company believes are not reflective of the Company’s regular operating cash flow, and net cash flows provided from operating activities, net of working capital changes, relating to non-controlling interests. Working capital can be volatile due to numerous factors, including the timing of tax payments. The Company uses attributable adjusted operating cash flow internally as a measure of the underlying operating cash flow performance and future operating cash flow-generating capability of the Company. However, the attributable adjusted operating cash flow measure is not necessarily indicative of net cash flow provided from operating activities as determined under IFRS.

The following table provides a reconciliation of attributable adjusted operating cash flow for the periods presented:

| (expressed in millions of U.S. dollars) | Three months ended | Six months ended | |||||||||||||

| June 30, | June 30, | ||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||

| Net cash flow provided from operating activities - as reported | $ | 992.4 | $ | 604 | $ | 1589.5 | $ | 978.4 | |||||||

| Adjusting items: | |||||||||||||||

| Insurance proceeds received in respect of prior years | - | (22.9 | ) | - | (22.9 | ) | |||||||||

| Working capital changes: | |||||||||||||||

| Accounts receivable and other assets | (7.2 | ) | (6.2 | ) | (14.3 | ) | (15 | ) | |||||||

| Inventories | (8.9 | ) | (2.5 | ) | 29.5 | (8.4 | ) | ||||||||

| Accounts payable, accrued liabilities and other, including income taxes paid | (96.4 | ) | (94.3 | ) | (18.7 | ) | (29.1 | ) | |||||||

| 879.9 | 478.1 | 1586 | 903 | ||||||||||||

| Non-controlling interest(b) cash flow (from) used in operating activities, net of working capital changes | (36 | ) | 0.2 | (65.9 | ) | 1 | |||||||||

| Attributable(a) adjusted operating cash flow | $ | 843.9 | $ | 478.3 | $ | 1520.1 | $ | 904 | |||||||

See pages 21 and 22 for details of the footnotes referenced within the table above.

Attributable Average Realized Gold Price per Ounce

Attributable average realized gold price per ounce is a non-GAAP ratio which calculates the average price realized from gold sales attributable to the Company. The Company believes that this measure provides a more accurate measure with which to compare the Company's gold sales performance to market gold prices. The following table provides a reconciliation of attributable average realized gold price per ounce for the periods presented:

| Three months ended | Six months ended | ||||||||||||

| (expressed in millions of U.S. dollars, except ounces and average realized gold price per ounce) | June 30, | June 30, | |||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||

| Metal sales - as reported | $ | 1,728.5 | $ | 1,219.5 | $ | 3,226 | $ | 2,301 | |||||

| Less: silver revenue(c) | (22.6 | ) | (36.7 | ) | (45.1 | ) | (75.8 | ) | |||||

| Less: non-controlling interest(b) gold revenue | (58.0 | ) | - | (108.1 | ) | - | |||||||

| Attributable(a) gold revenue | $ | 1,647.9 | $ | 1,182.8 | $ | 3,072.8 | $ | 2,225.2 | |||||

| Gold ounces sold | 519,391 | 505,122 | 103,5659 | 100,8726 | |||||||||

| Less: non-controlling interest(b) gold ounces sold | (17,764 | ) | - | (35,147 | ) | - | |||||||

| Attributable(a) gold ounces sold | 501,627 | 505,122 | 100,0512 | 100,8726 | |||||||||

| Attributable(a) average realized gold price per ounce | $ | 3,285 | $ | 2,342 | $ | 3,071 | $ | 2,206 | |||||

| Average realized gold price per ounce(d) | $ | 3,284 | $ | 2,342 | $ | 3,071 | $ | 2,206 | |||||

See pages 21 and 22 for details of the footnotes referenced within the table above.

Attributable Production Cost of Sales per Equivalent Ounce Sold

Production cost of sales per equivalent ounce sold is defined as production cost of sales, as reported on the interim condensed consolidated statement of operations, divided by the total number of gold equivalent ounces sold. This measure converts the Company’s non-gold production into gold equivalent ounces and credits it to total production.

Attributable production cost of sales per equivalent ounce sold is a non-GAAP ratio and is defined as attributable production cost of sales divided by the attributable number of gold equivalent ounces sold. This measure converts the Company’s attributable non-gold production into gold equivalent ounces and credits it to total attributable production. Management uses this measure to monitor and evaluate the performance of its operating properties that are attributable to its shareholders.

The following table provides a reconciliation of production cost of sales and attributable production cost of sales per equivalent ounce sold for the periods presented:

| (expressed in millions of U.S. dollars, except ounces and production cost of sales per equivalent ounce) | Three months ended | Six months ended | ||||||||||||

| June 30, | June 30, | |||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||

| Production cost of sales - as reported | $ | 568.4 | $ | 536.1 | $ | 1,115.1 | $ | 1,049.0 | ||||||

| Less: non-controlling interest(b) production cost of sales | (22.5 | ) | - | (43.2 | ) | - | ||||||||

| Attributable(a) production cost of sales | $ | 545.9 | $ | 536.1 | $ | 1,071.9 | $ | 1,049.0 | ||||||

| Gold equivalent ounces sold | 526,223 | 520,760 | 1,050,312 | 1,043,160 | ||||||||||

| Less: non-controlling interest(b) gold equivalent ounces sold | (17,923 | ) | - | (35,448 | ) | - | ||||||||

| Attributable(a) gold equivalent ounces sold | 508,300 | 520,760 | 1,014,864 | 1,043,160 | ||||||||||

| Attributable(a) production cost of sales per equivalent ounce sold | $ | 1,074 | $ | 1,029 | $ | 1,056 | $ | 1,006 | ||||||

| Production cost of sales per equivalent ounce sold(e) | $ | 1,080 | $ | 1,029 | $ | 1,062 | $ | 1,006 | ||||||

See pages 21 and 22 for details of the footnotes referenced within the table above.

Attributable Production Cost of Sales per Ounce Sold on a By-Product Basis

Attributable production cost of sales per ounce sold on a by-product basis is a non-GAAP ratio which calculates the Company’s non-gold production as a credit against its per ounce production costs, rather than converting its non-gold production into gold equivalent ounces and crediting it to total production, as is the case in co-product accounting. Management believes that this ratio provides investors with the ability to better evaluate Kinross’ production cost of sales per ounce on a comparable basis with other major gold producers who routinely calculate their cost of sales per ounce using by-product accounting rather than co-product accounting.

The following table provides a reconciliation of attributable production cost of sales per ounce sold on a by-product basis for the periods presented:

| (expressed in millions of U.S. dollars, except ounces and production cost of sales per ounce) | Three months ended | Six months ended | ||||||||||||

| June 30, | June 30, | |||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||

| Production cost of sales - as reported | $ | 568.4 | $ | 536.1 | $ | 1,115.1 | $ | 1,049.0 | ||||||

| Less: non-controlling interest(b) production cost of sales | (22.5 | ) | - | (43.2 | ) | - | ||||||||

| Less: attributable(a) silver revenue(c) | (22.0 | ) | (36.7 | ) | (44.1 | ) | (75.8 | ) | ||||||

| Attributable(a) production cost of sales net of silver by-product revenue | $ | 523.9 | $ | 499.4 | $ | 1,027.8 | $ | 973.2 | ||||||

| Gold ounces sold | 519,391 | 505,122 | 1,035,659 | 1,008,726 | ||||||||||

| Less: non-controlling interest(b) gold ounces sold | (17,764 | ) | - | (35,147 | ) | - | ||||||||

| Attributable(a) gold ounces sold | 501,627 | 505,122 | 1,000,512 | 1,008,726 | ||||||||||

| Attributable(a) production cost of sales per ounce sold on a by-product basis | $ | 1,044 | $ | 989 | $ | 1,027 | $ | 965 | ||||||

| Production cost of sales per equivalent ounce sold(e) | $ | 1,080 | $ | 1,029 | $ | 1,062 | $ | 1,006 | ||||||

See pages 21 and 22 for details of the footnotes referenced within the table above.

Attributable All-In Sustaining Cost and All-In Cost per Ounce Sold on a By-Product Basis

Attributable all-in sustaining cost and all-in cost per ounce sold on a by-product basis are non-GAAP financial measures and ratios, as applicable, calculated based on guidance published by the World Gold Council (“WGC”). The WGC is a market development organization for the gold industry and is an association whose membership comprises leading gold mining companies including Kinross. Although the WGC is not a mining industry regulatory organization, it worked closely with its member companies to develop these metrics. Adoption of the all-in sustaining cost and all-in cost metrics is voluntary and not necessarily standard, and therefore, these measures and ratios presented by the Company may not be comparable to similar measures and ratios presented by other issuers. The Company believes that the all-in sustaining cost and all-in cost measures complement existing measures and ratios reported by Kinross.

All-in sustaining cost includes both operating and capital costs required to sustain gold production on an ongoing basis. The value of silver sold is deducted from the total production cost of sales as it is considered residual production, i.e. a by-product. Sustaining operating costs represent expenditures incurred at current operations that are considered necessary to maintain current production. Sustaining capital represents capital expenditures at existing operations comprising mine development costs, including capitalized development, and ongoing replacement of mine equipment and other capital facilities, and does not include capital expenditures for major growth projects or enhancement capital for significant infrastructure improvements at existing operations.

All-in cost is comprised of all-in sustaining cost as well as operating expenditures incurred at locations with no current operation, or costs related to other non-sustaining activities, and capital expenditures for major growth projects or enhancement capital for significant infrastructure improvements at existing operations.

Attributable all-in sustaining cost and all-in cost per ounce sold on a by-product basis are calculated by adjusting production cost of sales, as reported on the interim condensed consolidated statements of operations, as follows:

| (expressed in millions of U.S. dollars, except ounces and costs per ounce) | Three months ended | Six months ended | ||||||||||||

| June 30, | June 30, | |||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||

| Production cost of sales - as reported | $ | 568.4 | $ | 536.1 | $ | 1,115.1 | $ | 1,049.0 | ||||||

| Less: non-controlling interest(b) production cost of sales | (22.5 | ) | - | (43.2 | ) | - | ||||||||

| Less: attributable(a) silver revenue(c) | (22.0 | ) | (36.7 | ) | (44.1 | ) | (75.8 | ) | ||||||

| Attributable(a) production cost of sales net of silver by-product revenue | $ | 523.9 | $ | 499.4 | $ | 1,027.8 | $ | 973.2 | ||||||

| Adjusting items on an attributable(a) basis: | ||||||||||||||

| General and administrative(f) | 29.6 | 32.4 | 65.3 | 63.1 | ||||||||||

| Other operating expense - sustaining(g) | 0.9 | 1.6 | 1.1 | 2.4 | ||||||||||

| Reclamation and remediation - sustaining(h) | 22.4 | 19.4 | 44.7 | 37.7 | ||||||||||

| Exploration and business development - sustaining(i) | 15.3 | 13.1 | 27.8 | 21.8 | ||||||||||

| Additions to property, plant and equipment - sustaining(j) | 143.7 | 116.5 | 231.9 | 225.8 | ||||||||||

| Lease payments - sustaining(k) | 1.3 | 3.3 | 2.6 | 6.7 | ||||||||||

| All-in Sustaining Cost on a by-product basis - attributable(a) | $ | 737.1 | $ | 685.7 | $ | 1,401.2 | $ | 1,330.7 | ||||||

| Adjusting items on an attributable(a) basis: | ||||||||||||||

| Other operating expense - non-sustaining(g) | 19.1 | 9.8 | 35.3 | 19.9 | ||||||||||

| Reclamation and remediation - non-sustaining(h) | 2.3 | 1.7 | 4.6 | 3.4 | ||||||||||

| Exploration and business development - non-sustaining(i) | 45.5 | 41.8 | 74.9 | 74.7 | ||||||||||

| Additions to property, plant and equipment - non-sustaining(j) | 158.1 | 148.0 | 274.0 | 270.8 | ||||||||||

| Lease payments - non-sustaining(k) | 0.2 | 0.1 | 0.4 | 0.1 | ||||||||||

| All-in Cost on a by-product basis - attributable(a) | $ | 962.3 | $ | 887.1 | $ | 1,790.4 | $ | 1,699.6 | ||||||

| Gold ounces sold | 519,391 | 505,122 | 1,035,659 | 1,008,726 | ||||||||||

| Less: non-controlling interest(b) gold ounces sold | (17,764 | ) | - | (35,147 | ) | - | ||||||||

| Attributable(a) gold ounces sold | 501,627 | 505,122 | 1,000,512 | 1,008,726 | ||||||||||

| Attributable(a) all-in sustaining cost per ounce sold on a by-product basis | $ | 1,469 | $ | 1,357 | $ | 1,400 | $ | 1,319 | ||||||

| Attributable(a) all-in cost per ounce sold on a by-product basis | $ | 1,918 | $ | 1,756 | $ | 1,789 | $ | 1,685 | ||||||

| Production cost of sales per equivalent ounce sold(e) | $ | 1,080 | $ | 1,029 | $ | 1,062 | $ | 1,006 | ||||||

See pages 21 and 22 for details of the footnotes referenced within the table above.

Attributable All-In Sustaining Cost and All-In Cost per Equivalent Ounce Sold

The Company also assesses its attributable all-in sustaining cost and all-in cost on a gold equivalent ounce basis. Under these non-GAAP financial measures and ratios, the Company’s production of silver is converted into gold equivalent ounces and credited to total production.

Attributable all-in sustaining cost and all-in cost per equivalent ounce sold are calculated by adjusting production cost of sales, as reported on the interim condensed consolidated statements of operations, as follows:

| (expressed in millions of U.S. dollars, except ounces and costs per ounce) | Three months ended | Six months ended | ||||||||||||

| June 30, | June 30, | |||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||

| Production cost of sales - as reported | $ | 568.4 | $ | 536.1 | $ | 1,115.1 | $ | 1,049.0 | ||||||

| Less: non-controlling interest(b) production cost of sales | (22.5 | ) | - | (43.2 | ) | - | ||||||||

| Attributable(a) production cost of sales | $ | 545.9 | $ | 536.1 | $ | 1,071.9 | $ | 1,049.0 | ||||||

| Adjusting items on an attributable(a) basis: | ||||||||||||||

| General and administrative(f) | 29.6 | 32.4 | 65.3 | 63.1 | ||||||||||

| Other operating expense - sustaining(g) | 0.9 | 1.6 | 1.1 | 2.4 | ||||||||||

| Reclamation and remediation - sustaining(h) | 22.4 | 19.4 | 44.7 | 37.7 | ||||||||||

| Exploration and business development - sustaining(i) | 15.3 | 13.1 | 27.8 | 21.8 | ||||||||||

| Additions to property, plant and equipment - sustaining(j) | 143.7 | 116.5 | 231.9 | 225.8 | ||||||||||

| Lease payments - sustaining(k) | 1.3 | 3.3 | 2.6 | 6.7 | ||||||||||

| All-in Sustaining Cost - attributable(a) | $ | 759.1 | $ | 722.4 | $ | 1,445.3 | $ | 1,406.5 | ||||||

| Adjusting items on an attributable(a) basis: | ||||||||||||||

| Other operating expense - non-sustaining(g) | 19.1 | 9.8 | 35.3 | 19.9 | ||||||||||

| Reclamation and remediation - non-sustaining(h) | 2.3 | 1.7 | 4.6 | 3.4 | ||||||||||

| Exploration and business development - non-sustaining(i) | 45.5 | 41.8 | 74.9 | 74.7 | ||||||||||

| Additions to property, plant and equipment - non-sustaining(j) | 158.1 | 148.0 | 274.0 | 270.8 | ||||||||||

| Lease payments - non-sustaining(k) | 0.2 | 0.1 | 0.4 | 0.1 | ||||||||||

| All-in Cost - attributable(a) | $ | 984.3 | $ | 923.8 | $ | 1,834.5 | $ | 1,775.4 | ||||||

| Gold equivalent ounces sold | 526,223 | 520,760 | 1,050,312 | 1,043,160 | ||||||||||

| Less: non-controlling interest(b) gold equivalent ounces sold | (17,923 | ) | - | (35,448 | ) | - | ||||||||

| Attributable(a) gold equivalent ounces sold | 508,300 | 520,760 | 1,014,864 | 1,043,160 | ||||||||||

| Attributable(a) all-in sustaining cost per equivalent ounce sold | $ | 1,493 | $ | 1,387 | $ | 1,424 | $ | 1,348 | ||||||

| Attributable(a) all-in cost per equivalent ounce sold | $ | 1,936 | $ | 1,774 | $ | 1,808 | $ | 1,702 | ||||||

| Production cost of sales per equivalent ounce sold(e) | $ | 1,080 | $ | 1,029 | $ | 1,062 | $ | 1,006 | ||||||

See pages 21 and 22 for details of the footnotes referenced within the table above.

Capital Expenditures and Attributable Capital Expenditures

Capital expenditures are classified as either sustaining capital expenditures or non-sustaining capital expenditures, depending on the nature of the expenditure. Sustaining capital expenditures typically represent capital expenditures at existing operations including capitalized exploration costs and capitalized development unless related to major projects, ongoing replacement of mine equipment and other capital facilities and other capital expenditures and is calculated as total additions to property, plant and equipment (as reported on the interim condensed consolidated statements of cash flows), less non-sustaining capital expenditures. Non-sustaining capital expenditures represent capital expenditures for major projects, including major capital development projects at existing operations that are expected to materially benefit the operation, as well as enhancement capital for significant infrastructure improvements at existing operations. Management believes the distinction between sustaining capital expenditures and non-sustaining expenditures is a useful indicator of the purpose of capital expenditures and this distinction is an input into the calculation of attributable all-in sustaining costs per ounce and attributable all-in costs per ounce. The categorization of sustaining capital expenditures and non-sustaining capital expenditures is consistent with the definitions under the WGC all-in cost standard. Sustaining capital expenditures and non-sustaining capital expenditures are not defined under IFRS, however, the sum of these two measures total to additions to property, plant and equipment as disclosed under IFRS on the interim condensed consolidated statements of cash flows.

Additions to property, plant and equipment per the interim condensed consolidated statements of cash flows includes

The following table provides a reconciliation of the classification of capital expenditures for the periods presented:

| (expressed in millions of U.S. dollars) | ||||||||||||||||||||||

| Three months ended June 30, 2025 | Tasiast (Mauritania) | Paracatu (Brazil) | La Coipa (Chile) | Fort Knox(l) (USA) | Round Mountain (USA) | Bald Mountain (USA) | Total USA | Other | Total | |||||||||||||

| Sustaining capital expenditures | $ | 23.1 | $ | 38.4 | $ | 25.0 | $ | 43.0 | $ | 5.7 | $ | 12.7 | $ | 61.4 | $ | 0.1 | $ | 148.0 | ||||

| Non-sustaining capital expenditures | 66.6 | - | - | - | 27.1 | $ | 27.7 | $ | 54.8 | 36.7 | 158.1 | |||||||||||

| Additions to property, plant and equipment - per cash flow | $ | 89.7 | $ | 38.4 | $ | 25.0 | $ | 43.0 | $ | 32.8 | $ | 40.4 | $ | 116.2 | $ | 36.8 | $ | 306.1 | ||||

| Less: Non-controlling interest(b) | $ | - | $ | - | $ | - | $ | (4.3 | ) | $ | - | $ | - | $ | (4.3 | ) | $ | - | $ | (4.3 | ) | |

| Attributable(a) capital expenditures | $ | 89.7 | $ | 38.4 | $ | 25.0 | $ | 38.7 | $ | 32.8 | $ | 40.4 | $ | 111.9 | $ | 36.8 | $ | 301.8 | ||||

| Three months ended June 30, 2024 | ||||||||||||||||||||||

| Sustaining capital expenditures | $ | 7.0 | $ | 44.6 | $ | 10.7 | $ | 47.6 | $ | 2.1 | $ | 4.4 | $ | $ 54.1 | $ | 0.1 | $ | 116.5 | ||||

| Non-sustaining capital expenditures | 68.2 | - | - | 41.6 | 35.1 | 0.2 | 76.9 | 12.6 | 157.7 | |||||||||||||

| Additions to property, plant and equipment - per cash flow | $ | 75.2 | $ | 44.6 | $ | 10.7 | $ | 89.2 | $ | 37.2 | $ | 4.6 | $ | 131.0 | $ | 12.7 | $ | 274.2 | ||||

| Less: Non-controlling interest(b) | $ | - | $ | - | $ | - | $ | (9.7 | ) | $ | - | $ | - | $ | (9.7 | ) | $ | - | $ | (9.7 | ) | |

| Attributable(a) capital expenditures | $ | 75.2 | $ | 44.6 | $ | 10.7 | $ | 79.5 | $ | 37.2 | $ | 4.6 | $ | 121.3 | $ | 12.7 | $ | 264.5 | ||||

| (expressed in millions of U.S. dollars) | ||||||||||||||||||||||

| Six months ended June 30, 2025 | Tasiast (Mauritania) | Paracatu (Brazil) | La Coipa (Chile) | Fort Knox(l)(USA) | Round Mountain (USA) | Bald Mountain (USA) | Total USA | Other | Total | |||||||||||||

| Sustaining capital expenditures | $ | 36.8 | $ | 62.8 | $ | 40.6 | $ | 71.2 | $ | 8.5 | $ | 19.6 | $ | 99.3 | $ | 0.3 | $ | 239.8 | ||||

| Non-sustaining capital expenditures | 133.0 | - | - | - | 53.9 | 38.6 | 92.5 | 48.5 | 274.0 | |||||||||||||

| Additions to property, plant and equipment - per cash flow | $ | 169.8 | $ | 62.8 | $ | 40.6 | $ | 71.2 | $ | 62.4 | $ | 58.2 | $ | 191.8 | $ | 48.8 | $ | 513.8 | ||||

| Less: Non-controlling interest(b) | $ | - | $ | - | $ | - | $ | (7.9 | ) | $ | - | $ | - | $ | (7.9 | ) | $ | - | $ | (7.9 | ) | |

| Attributable(a) capital expenditures | $ | 169.8 | $ | 62.8 | $ | 40.6 | $ | 63.3 | $ | 62.4 | $ | 58.2 | $ | 183.9 | $ | 48.8 | $ | 505.9 | ||||

| Six months ended June 30, 2024 | ||||||||||||||||||||||

| Sustaining capital expenditures | $ | 17.1 | $ | 64.2 | $ | 17.9 | $ | 85.3 | $ | 5.8 | $ | 36.8 | $ | 127.9 | $ | (1.3 | ) | $ | 225.8 | |||

| Non-sustaining capital expenditures | 137.6 | - | - | 82.5 | 50.7 | 0.2 | 133.4 | 19.3 | 290.3 | |||||||||||||

| Additions to property, plant and equipment - per cash flow | $ | 154.7 | $ | 64.2 | $ | 17.9 | $ | 167.8 | $ | 56.5 | $ | 37.0 | $ | 261.3 | $ | 18.0 | $ | 516.1 | ||||

| Less: Non-controlling interest(b) | $ | - | $ | - | $ | - | $ | (19.5 | ) | $ | - | $ | - | $ | (19.5 | ) | $ | - | $ | (19.5 | ) | |

| Attributable(a) capital expenditures | $ | 154.7 | $ | 64.2 | $ | 17.9 | $ | 148.3 | $ | 56.5 | $ | 37.0 | $ | 241.8 | $ | 18.0 | $ | 496.6 | ||||

See pages 21 and 22 for details of the footnotes referenced within the tables above.

| (a) | “Attributable” measures and ratios include Kinross’ share of Manh Choh ( | |

| (b) | “Non-controlling interest” represents the non-controlling interest portion in Manh Choh ( | |

| (c) | “Silver revenue” represents the portion of metal sales realized from the production of secondary or by-product metal (i.e. silver), which is produced as a by-product of the process used to produce gold and effectively reduces the cost of gold production. | |

| (d) | “Average realized gold price per ounce” is defined as gold revenue divided by total gold ounces sold. | |

| (e) | “Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold. | |

| (f) | “General and administrative” expenses are as reported on the interim condensed consolidated statements of operations, excluding certain impacts which the Company believes are not reflective of the Company’s underlying performance for the reporting period. General and administrative expenses are considered sustaining costs as they are required to be absorbed on a continuing basis for the effective operation and governance of the Company. | |

| (g) | “Other operating expense – sustaining” is calculated as “Other operating expense” as reported on the interim condensed consolidated statements of operations, less the non-controlling interest portion in Manh Choh ( | |

| (h) | “Reclamation and remediation – sustaining” is calculated as current period accretion related to reclamation and remediation obligations plus current period amortization of the corresponding reclamation and remediation assets, less the non-controlling interest portion in Manh Choh ( | |

| (i) | “Exploration and business development – sustaining” is calculated as “Exploration and business development” expenses as reported on the interim condensed consolidated statements of operations, less the non-controlling interest portion in Manh Choh ( | |

| (j) | “Additions to property, plant and equipment – sustaining” and “non-sustaining” are as presented on pages 20 and 21 of this news release and include Kinross’ share of Manh Choh’s ( | |

| (k) | “Lease payments – sustaining” represents the majority of lease payments as reported on the interim condensed consolidated statements of cash flows and is made up of the principal and financing components of such cash payments, less the non-controlling interest portion in Manh Choh ( | |

| (l) | The Fort Knox segment is composed of Fort Knox and Manh Choh for all periods presented. | |

Appendix A

Figure 1: At Round Mountain Phase X, drilling continues to confirm good grades and widths in the primary target zones. Further, extension drilling is showing continuation of down dip mineralization outside of the original target zone.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/35c67e19-628d-46b4-9d40-f684abc11797

Figure 2: At Curlew, drill results continued to demonstrate wide, high-grade intercepts.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/41ac9a18-22e2-4b77-ae81-8a398e7b06b9

Cautionary statement on forward-looking information

All statements, other than statements of historical fact, contained or incorporated by reference in this news release including, but not limited to, any information as to the future financial or operating performance of Kinross, constitute “forward-looking information” or “forward-looking statements” within the meaning of certain securities laws, including the provisions of the Securities Act (Ontario) and the provisions for “safe harbor” under the United States Private Securities Litigation Reform Act of 1995 and are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements contained in this news release, include, but are not limited to, those under the headings (or headings that include) “2025 second-quarter highlights”, “Return of Capital to shareholders”, “Operations highlights”, “Development and exploration projects” and “CEO commentary”, as well as statements with respect to our guidance for production, cost guidance, including production costs of sales, all-in sustaining cost of sales, and capital expenditures; anticipated returns of capital to shareholders, including the declaration, payment and sustainability of the Company’s dividends; the size, scope and execution of the proposed share buybacks and the anticipated timing thereof, including the Company’s statement targeting share buybacks for 2025 of at least

Key Sensitivities

Approximately

A

Specific to the Brazilian real, a

Specific to the Chilean peso, a

A

A

Other information

Where we say "we", "us", "our", the "Company", or "Kinross" in this news release, we mean Kinross Gold Corporation and/or one or more or all of its subsidiaries, as may be applicable.

The technical information about the Company’s mineral properties contained in this news release has been prepared under the supervision of Mr. Nicos Pfeiffer, an officer of the Company who is a “qualified person” within the meaning of National Instrument 43-101.

Source: Kinross Gold Corporation

__________________________________

1 Unless otherwise stated, production figures in this news release are on an attributable basis. “Attributable” includes Kinross’

2 “Production cost of sales per equivalent ounce sold” is defined as production cost of sales, as reported on the interim condensed consolidated statements of operations, divided by total gold equivalent ounces sold.

3 Operating cash flow figures in this release represent “Net cash flow provided from operating activities,” as reported on the interim condensed consolidated statements of cash flows.

4 “Margins” per equivalent ounce sold is defined as average realized gold price per ounce less production cost of sales per equivalent ounce sold.

5 Earnings, net earnings, and reported net earnings figures in this news release represent “Net earnings attributable to common shareholders,” as reported on the interim condensed consolidated statements of operations.

6 These figures are non-GAAP financial measures and ratios, as applicable, and are defined and reconciled on pages 16 to 21 of this news release. Non-GAAP financial measures and ratios have no standardized meaning under International Financial Reporting Standards (“IFRS”) and therefore, may not be comparable to similar measures presented by other issuers.

7 “Total liquidity” is defined as the sum of cash and cash equivalents, as reported on the interim condensed consolidated balance sheets, and available credit under the Company’s credit facilities (as calculated in Section 6 Liquidity and Capital Resources of Kinross’ MD&A for the three and six months ended June 30, 2025).

8 “Average realized gold price per ounce” is defined as gold revenue divided by total gold ounces sold.

9 Net debt is calculated as long-term debt of

10 “Available credit” is defined as available credit under the Company’s credit facilities and is calculated in Section 6 Liquidity and Capital Resources of Kinross’ MD&A for the three and six months ended June 30, 2025.

11 Refers to all of the currencies in the countries where the Company has mining operations, fluctuating simultaneously by