Lion One Reports Preliminary Gold Results, Announces C$16.3M in Quarterly Revenue

Rhea-AI Summary

Lion One Metals (OTCQX:LOMLF) reported strong preliminary Q2 2025 results from its Tuvatu Gold Mine in Fiji. The company achieved quarterly revenue of C$16.3 million, representing a 24% increase from the previous quarter and 77% year-over-year growth. The quarter saw record operational metrics, including 96% mill utilization and 33,726 tonnes of throughput.

The company sold 3,577 oz of gold at an average price of C$4,541 per ounce, with gold recovery improving to 84.1% in June. Mine development reached record levels with 1,503m of underground development completed. The completion of the first shrinkage stope, which showed high-grade intervals up to 489.52 g/t Au, positions the company for stronger performance in the upcoming quarter.

Positive

- Revenue increased 24% QoQ to C$16.3M and 77% YoY

- Record 96% mill utilization with 33,726 tonnes throughput

- Gold recovery improved to 84.1% in June 2025

- Record underground development of 1,503m completed

- High-grade intervals discovered in shrinkage stope (up to 489.52 g/t Au)

- New mining equipment arrival improving operational capacity

Negative

- Low average head grade due to ventilation project delays

- Limited mining flexibility due to development delays

- Still in pilot plant stage of development

- Gold recoveries still below target of 90%

News Market Reaction

On the day this news was published, LOMLF gained 2.83%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

North Vancouver, British Columbia--(Newsfile Corp. - July 21, 2025) - Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF) ("Lion One" or the "Company") is pleased to provide an operations update and to report preliminary quarterly gold production from the Tuvatu Gold Mine in Fiji for the quarter ending June 30th, 2025.

Highlights of Operations:

Record mill utilization of

96% Record mill throughput of 33,726 tonnes

Record capital development of 489 m

Record operating development of 1,014 m

Shrink stope development complete, production beginning

Sustained increase in gold recoveries

Preliminary Quarterly Production Results:

3,577 oz of gold sold

3,214 oz of gold recovered

81.6% recovery3.6 g/t gold average head grade

Total revenue of C

$16,300,821

Lion One Metals sold approximately 3,577 oz of gold and 1,233 oz of silver during the three-month period ending June 30th, 2025. The average sale price for the quarter was C

Mill performance for the quarter was very strong, achieving record quarterly mill utilization of

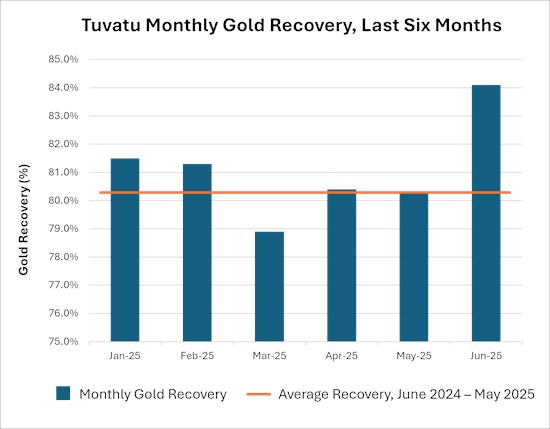

Figure 1. Tuvatu Monthly Recovery, Last Six Months. Gold recoveries increased from a 12-month average of

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/259381_5ef20fb714edb865_001full.jpg

Mine development achieved record levels during the quarter with a total of 1,503 m of underground development completed. The arrival of new mining equipment during the quarter, as well as the completion of the mine ventilation project in early April enabled the mining team to increase the rate of underground development and to open more levels of the mine. The top three months of development at Tuvatu were all achieved during this past quarter, with a new record monthly development of 545 m achieved in May 2025. The average monthly mine development at Tuvatu for the 12 months preceding this quarter was 340.5 m (Figure 2). More new mining equipment is scheduled to arrive on site and undergo commissioning in July and August, which is expected to further increase the rate of development at Tuvatu. Notably, the development of the Company's first shrinkage stope is now complete, with production scheduled for July, August, and September. Drilling in the shrinkage stope has returned high grade intervals, such as 142.66 g/t Au over 2.2 m, 489.52 g/t Au over 0.4 m, 168.95 g/t Au over 0.5 m, and 156.55 g/t Au over 0.6 m (see news releases dated March 25, 2025 and May 12, 2025).

Lion One CEO Ian Berzins stated: "With the Tuvatu gold mine still in the pilot plant stage of development, we have made great progress this quarter in laying the foundations for future success at Tuvatu. We have increased gold recoveries on the mill side and we have increased the rate of underground development on the mine side, both of which we expect to continue to improve moving forward. With production from the shrink stope coming online in July we anticipate this upcoming quarter to achieve even stronger results."

Figure 2. Tuvatu Monthly Mine Development, Last Six Months. Record Capital and Operating Development was achieved during the quarter ending June 30th 2025. This was a result of the arrival of new mining equipment during the quarter as well as the completion of the mine ventilation project in early April 2025. Record mine development of 545 m was achieved in May 2025. This compares to average monthly mine development of 340.5 m during the preceding 12 months from April 2024 to March 2025.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/259381_5ef20fb714edb865_002full.jpg

Qualified Persons Statement

In accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43- 101"), William J. Witte, P.Eng., Principal Advisor to the Company, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Lion One Laboratories / QAQC

Lion One adheres to rigorous QAQC procedures above and beyond basic regulatory guidelines in conducting its drilling, sampling, testing, and analyses. The Company operates its own geochemical assay laboratory and its own fleet of diamond drill rigs using PQ, HQ and NQ sized drill rods.

Diamond drill core samples are logged by Lion One personnel on site. Exploration diamond drill core is split by Lion One personnel on site, with half core samples sent for analysis and the other half core remaining on site. Grade control diamond drill core is whole core assayed. Core samples are delivered to the Lion One Laboratory for preparation and analysis. All samples are pulverized at the Lion One lab to

Duplicates of

About Lion One Metals Limited

Lion One Metals is an emerging Canadian gold producer headquartered in North Vancouver BC, with new operations established in late 2023 at its

On behalf of the Board of Directors,

Walter Berukoff, Chairman of the Board

Contact Information

Email: info@liononemetals.com

Phone: 1-855-805-1250 (toll free North America)

Website: www.liononemetals.com

Neither the TSX-V nor its Regulation Service Provider accepts responsibility or the adequacy or accuracy of this release

This press release may contain statements that may be deemed to be "forward-looking statements" within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "proposed", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited's current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance, or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labor or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259381