Lake Victoria Gold Reports Continued Barrick Exploration Success at Tembo-Area Licences

Rhea-AI Summary

Lake Victoria Gold (OTCQB: LVGLF) provided a Q2 2025 update on exploration conducted by Bulyanhulu Gold Mine (owned by Twiga/Barrick) on six licences sold to Buly in 2022. Q2 work included 12 reverse-circulation holes totaling 1,380 metres testing the granite–greenstone contact and planning aircore and RC programs to follow up geochemical anomalies.

Drilling intersected mafic metavolcanics, quartz porphyry dykes, silica‑sericite alteration, localized pyrite and quartz veining; rock chips from artisanal workings show potentially mineralized structures. Under the 2022 asset sale, LVG may receive up to US $45 million in contingent payments tied to future discoveries or resource thresholds. Barrick will prioritize Q3 2025 follow-up targets.

Positive

- Contingent payments up to US $45 million

- 12 RC holes drilled totaling 1,380 metres in Q2 2025

- Drilling confirmed mafic metavolcanics and silica‑sericite alteration

Negative

- US $45 million contingent on future discoveries/resource thresholds

- SIDIS investor relations contract: $100,000 fee over six months

- Market IQ investor relations contract: $100,000 fee payable on approval

News Market Reaction

On the day this news was published, LVGLF gained 2.81%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - October 24, 2025) - Lake Victoria Gold Ltd. (TSXV: LVG) (OTCQB: LVGLF) (FSE: E1K) ("LVG" or the "Company") is pleased to provide an update on the Q2 2025 exploration activities conducted on the licenses LVG sold to Bulyanhulu Gold Mine Limited ("Buly") ("the Project"). Buly acquired six licences from LVG under an Asset Purchase Agreement in 2022. Buly is owned by Twiga Minerals Corporation, a joint venture between Barrick Mining Corporation ("Barrick") and the Government of Tanzania.

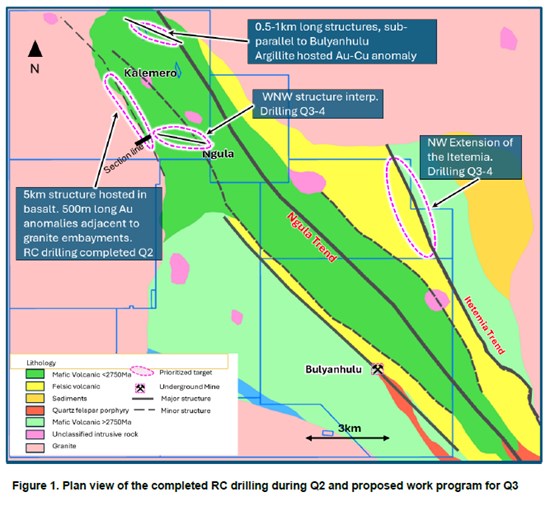

Exploration during Q2 2025 was focussed on testing with reverse circulation (RC) drilling the granite-greenstone contact in the northwest, interpreted to be prospective, and developing and planning an aircore (AC) drilling plan aimed at testing prospective areas considered to have a similar stratigraphic sequence to Bulyanhulu Mine, and a RC drilling program to test geochemical anomalies identified in previous AC drilling programs.

Q2 2025 Highlights

12 reverse-circulation (RC) holes drilled totaling 1,380 metres. Drilling tested the granite greenstone contact which had been identified in the previous AC drilling and was considered to be structurally favorable with possible dilation zones, and which returned anomalous Au in associated favorable geology.

Favourable geology confirmed - The drilling along the northwest trending contact intersected mafic metavolcanics (greenstone) and quartz porphyry dykes, which display weak to moderate deformation and have associated silica-sericite alteration, and localized disseminated pyrite and quartz veining, promising for gold mineralization.

Rock-chip samples from artisanal workings near zones of strong chlorite-sericite alteration, indicate the presence of potentially mineralized structures.

The results to date reinforce the geological continuity between the Bulyanhulu Mine and the Tembo Project area, validating LVG's long-standing interpretation of the belt's broader potential.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2214/271659_fe3008ca34500899_002full.jpg

Strategic Context

Under the Asset Purchase Agreement executed in 2022, LVG may receive up to US

Management Comments

Simon Benstead, Executive Chairman & CFO, stated: "We are encouraged to see Barrick's sustained exploration momentum and technical validation across the Tembo-area licences. Their work continues to confirm the fertility of this part of the Lake Victoria Goldfields, where LVG remains a significant stakeholder through both our adjacent

Marc Cernovitch, President & CEO, added: "Barrick's methodical exploration is confirming the geological architecture we've interpreted on our licence area. As they advance, LVG benefits from both the direct geological insights and the potential for substantial contingent payments-creating a rare opportunity of value addition through a combination of near-term potential production development at Imwelo and the Tembo project, and discovery leverage through the Buly exploration."

Next Steps

Barrick's Q3 2025 program is focusing on ranking and prioritizing follow-up drill targets along the most prospective structural corridors defined by the Q2 results and earlier geochemical anomalies.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by David Scott, Pr. Sci. Nat., who is a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Mr. Scott is a Director and Officer of the Company.

Investor Relations Agreements

As previously announced on October 9, 2025, the Company has engaged SIDIS & Market IQ for investor relations and capital market advisory services, and has made filings with the Exchange regarding its investor relations contracts with SIDIS and Market IQ. The SIDIS contract is for a term of six months with a fee of

About Lake Victoria Gold (LVG):

Lake Victoria Gold is a rapidly growing gold exploration and development company listed on the TSX Venture Exchange under the symbol LVG. Leveraging our unique position and experience, the Company is principally focused on growth and consolidation in the highly prolific and prospective Lake Victoria Goldfield in Tanzania.

The Company has a

LVG has assembled a highly experienced team with a track record of developing, financing, and operating mining projects in Africa with management, directors and partners owning more than

On Behalf of the Board of Directors of the Company,

Simon Benstead

Executive Chairman & CFO

Phone: +1 604-685-9316

Email: sbenstead@lakevictoriagold.com

For more information please contact:

Simon Benstead

Executive Chairman & CFO

Phone:+ 1 604-685-9316

Email: sbenstead@lakevictoriagold.com

Marc Cernovitch

CEO & Director

Phone: +1 604-685-9316

Email: mcernovitch@lakevictoriagold.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "forward-looking information" within the meaning of applicable Canadian securities legislation, including: future exploration and development plans with respect to the Imwelo Project, contract work on the Imwelo Project by Taifa Mining, securing additional financing for the development costs of the Imwelo project, the closing of the acquisition of the Imwelo Project and the concurrent financing, including the satisfaction of the closing conditions thereunder, and receipt of all regulatory approvals, including the approval of the TSX Venture Exchange for the acquisition and financing. All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will", "would", "may", "could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made.

Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of which are beyond LVG's control, including risks associated with or related to: the completion of the acquisition of the Imwelo project, the concurrent financing and related transactions, including receipt of all regulatory approvals and third-party consents, the volatility of metal prices and LVG's common shares; changes in tax laws; the dangers inherent in exploration, development and mining activities; the uncertainty of reserve and resource estimates; not achieving development or production, cost or other estimates; actual exploration or development plans and costs differing materially from the Company's estimates; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change and climate change regulations; fluctuations in exchange rates; the availability of financing; financing and debt activities; operations in foreign and developing countries and the compliance with foreign laws, including those associated with operations in Tanzania and including risks related to changes in foreign laws and changing policies related to mining and local ownership requirements or resource nationalization generally, including in response to the COVID-19 outbreak; remote operations and the availability of adequate infrastructure; fluctuations in price and availability of energy and other inputs necessary for mining operations; shortages or cost increases in necessary equipment, supplies and labour; regulatory, political and country risks, including local instability or acts of terrorism and the effects thereof; the reliance upon contractors, third parties and joint venture partners; challenges to title or surface rights; the dependence on key personnel and the ability to attract and retain skilled personnel; the risk of an uninsurable or uninsured loss; adverse climate and weather conditions; litigation risk; competition with other mining companies; community support for LVG's operations, including risks related to strikes and the halting of such operations from time to time; conflicts with small scale miners; failures of information systems or information security threats; the ability to maintain adequate internal controls over financial reporting as required by law; compliance with anti-corruption laws, and sanctions or other similar measures; social media and LVG's reputation; and other risks disclosed in the Company's public filings.

LVG's forward-looking statements are based on the opinions and estimates of management and reflect their current expectations regarding future events and operating performance and speak only as of the date hereof. LVG does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change other than as required by applicable law. There can be no assurance that forward-looking statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what benefits or liabilities LVG will derive therefrom. For the reasons set forth above, undue reliance should not be placed on forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/271659