Magma Silver CEO Letter to Shareholders

Rhea-AI Summary

Magma Silver (OTC:MAGMF) acquired 100% of the Niñobamba silver‑gold project in Peru in January 2025 and closed 2025 with a drill‑ready, permitted asset and operations established in country.

The company completed financings totaling $6.5M, ended the year with over $5M in treasury, and saw its share price rise 209% in 2025; investor Eric Sprott holds a 13.4% fully diluted interest. Q1 2026 drilling is planned, with 2026 focused on confirming resources, expansion drilling, surface sampling and adding compliant ounces.

Positive

- $6.5M financings completed to fund 2026 programs

- Treasury of over $5M at year‑end 2025

- Share price ↑ 209% during 2025

- Eric Sprott holds 13.4% fully diluted stake

- Q1 2026 drilling restart on Niñobamba (first since 2010)

- High‑grade grab samples: 136 g/mt Ag and 5.32 g/mt Au average

Negative

- Exploration and operational risks in Peru noted as material

- Results depend on volatile commodity prices (silver +173% in 2025)

- Reliance on historical data and interpretation for resource targeting

- Permits, drilling success and future financing remain uncertain

News Market Reaction

On the day this news was published, MAGMF gained 3.20%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - January 13, 2026) -

Dear Shareholders,

Welcome to 2026. Magma Silver started 2025 without a project and in January acquired

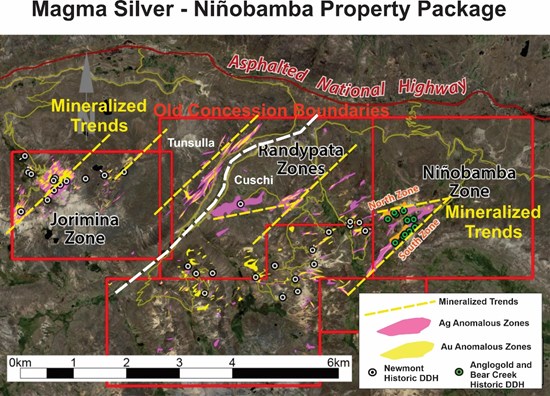

In 2025, Magma completed the acquisition of the controlling interest in Niñobamba on favorable business terms, established operations in Peru, and retained consultants to maintain a sound relationship with the affected communities. Our technical team, with a combined 60 years of experience in the Peruvian mining sector, reviewed vast amounts of historical data and conducted two field programs to verify the accuracy of known geological data and to collect additional samples to expand our knowledge base as a precursor to the upcoming 2026 drill program.

Magma had meaningful advancements on the corporate side during the year. We completed financings totaling

2026 will be an expansion and new discovery year for Magma. Niñobamba has been quietly waiting to show its potential. Drills will turn in Q1 on one segment of the project for the first time since 2010, and drilling and assay results are expected to continue throughout the year. Concurrently with drilling, our team will conduct surface sampling, trenching, and geological mapping on the balance of the project, in preparation for an expanded drill program on high-potential but not drill-tested silver and gold targets. Niñobamba is a shallow-to-near-surface project, so assayed samples from surface work will provide a meaningful indication of mineralization lying slightly deeper. We will begin adding compliant ounces to further support the project's potential.

We will continue our efforts commenced in late 2025 to bring the Niñobamba project to the attention of the strategic long-term investment community through conferences, direct contact, and other media. We will maintain our relationship-building process with the affected local communities, as that is paramount to a successful long-term operation and of the utmost importance within our corporate philosophy.

Historical work by Newmont, AngloGold, Bear Creek, and Rio Silver indicated Niñobamba would be a viable mining operation at lower silver and gold prices. The two field programs conducted by Magma in August and September of 2025 confirmed and, in certain cases, exceeded the historical results. Highlights from the Joramina and Randypata programs included (news release dated October 30, 2025):

Grab sampling on the Joramina zone returned 17g/mt to 300 g/mt silver and 0.50 g/mt to 14.56 g/mt gold, averaging 136 g/mt silver and 5.32 g/mt gold.

Drift sampling on the Joramina zone returned a 5-metre composite returning 115.09 g/mt silver and 10m of 2.32 g/mt gold.

Sampling close to the drift returned 0.70m of 395.19g/mt silver and 17.41 g/mt of gold.

A random composite grab sample returned 242 g/mt silver and 0.20 g/mt gold from the undrilled Randypata zone 2 km silver anomaly.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3145/280142_725eb7f534cef82e_002full.jpg

Silver prices rose by approximately

2025 was an organizational year, and 2026 will be a year to start delivering on the promise of this project. We are taking the correct steps to position our company and shareholders to realize the potential of Niñobamba. Our efforts are designed to expand on historical results and create long-term incremental value for all stakeholders. We appreciate your continued support.

Sincerely,

Stephen Barley, Chairman & CEO

stephen.barley@magmasilver.com

www.magmasilver.com

Jeffrey Reeder, P.Geo, a Qualified Person as defined in National Instrument 43-101 and a Senior Technical Advisor of the Company, has prepared, or supervised the preparation of the assays and approved the scientific and technical disclosure contained in this communication.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This communication contains forward-looking statements and information under applicable Canadian securities laws. These statements relate to future events or future performance and include, but are not limited to, statements regarding the Company's exploration plans for 2026 at the Niñobamba project, the timing and success of drilling programs, the potential for resource expansion and new discoveries, the project's anticipated economics, future silver prices, and the Company's community and investor relations initiatives. Such statements reflect management's current beliefs and are based on assumptions made by and information currently available to the Company. Forward-looking statements are subject to known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking statements. These risks include risks inherent in mineral exploration, the interpretation of drill results, the volatility of commodity prices, operational risks in Peru, the ability to secure necessary permits and financing, and reliance on historical data. The Company assumes no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280142