Magma Silver Plans Drill Program at Niñobamba

Rhea-AI Summary

Magma Silver (OTCQB: MAGMF) plans a two‑phase, 4,000‑metre drill program at the Niñobamba Joramina zone targeting gold‑silver mineralization, with Phase 1 starting Q1 2026 from Pad A (2,000 m) and Phase 2 contingent on Phase 1 results.

The company allocated US$1,000,000 (CAD$1,400,000) to Joramina exploration and drilling, citing access to Newmont's historical dataset (US$7m spent, 65 diamond holes) to improve drill targeting. Notable historical and recent assays cited include hole JOR‑001: 72.3 m of 1.19 g/t Au from 53 m, drift sampling: 10 m of 2.32 g/t Au and a 5‑m composite silver result equivalent to 115.8 g/t Ag.

Positive

- Planned drilling of 4,000 metres (two phases)

- Phase 1 initial program of 2,000 metres from Pad A

- Exploration budget of US$1,000,000 (CAD$1.4M) allocated

- Access to Newmont data (US$7M historical work, 65 drill holes) to guide targeting

Negative

- Phase 2 is conditional on Phase 1 results, creating execution uncertainty

- True widths from reported hole JOR‑001 cannot be determined from a single hole

News Market Reaction

On the day this news was published, MAGMF declined 3.56%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers show mixed moves: ACRL up 1.9%, ILHMF up 79.69%, while OMGPF, TTEXF and SLMLF are flat. This contrasts with MAGMF’s -1.72% move, suggesting stock-specific trading.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 01 | Drill program plan | Positive | -3.6% | Announced two‑phase 4,000 m drill program and $1M Joramina budget. |

| Nov 06 | Drill permit | Positive | -1.3% | Peru drill permit for Joramina and allocation to expand program. |

| Nov 04 | Access payments | Positive | +0.7% | Completion of community access payments preserving exploration access. |

| Oct 30 | Phase 2 results | Positive | +5.4% | Reported high‑grade Phase 2 Au‑Ag sampling at Niñobamba zones. |

| Oct 10 | Stock options grant | Neutral | +15.0% | Granted 1,850,000 incentive options at CAD $0.20 for five years. |

News flow has been consistently project-positive, but price reactions have been mixed, with drill/permit updates sometimes sold while strong technical results and corporate actions have attracted buying.

Over the last few months, Magma Silver has advanced the Niñobamba project through permitting, sampling and now a planned 4,000 m drill program. A drill permit covering 20 pads and a US$5,000,000 financing preceded Phase 2 sampling that delivered multiple high‑grade Au‑Ag assays. An options grant at CAD $0.20 also coincided with a strong price reaction. Today’s announcement builds directly on Newmont’s historical work and the recent Phase 2 results at Joramina.

Market Pulse Summary

This announcement details a two‑phase, 4,000 m drill program at Niñobamba’s Joramina zone, backed by a US$1,000,000 budget and extensive Newmont datasets. Historical work includes intervals such as 72.3 m @ 1.19 g/t Au and high‑grade drift sampling, which the new drilling aims to confirm and extend. Investors may watch for updated NI 43‑101 work, drill orientations versus prior holes, and how results compare with the highlighted gold and silver assays.

Key Terms

diamond drill holes technical

fatal flaw analysis technical

drill collar locations technical

drift sampling technical

adit technical

grams per tonne technical

National Instrument 43-101 regulatory

investor relations services financial

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - December 1, 2025) - Magma Silver Corp. (TSXV: MGMA) (OTCQB: MAGMF) (FSE: BC21) (WKN: A411DV) (the "Company" or "Magma") is pleased to provide an update on the planned drill program for Q1 2026. The drill program will consist of two phases with a total of 4,000 metres.

Stephen Barley, Chairman and CEO, stated: "The commencing of a drill program at Ninobamba is exciting and a major accomplishment. Newmont Mining Corp. ("Newmont") spent US

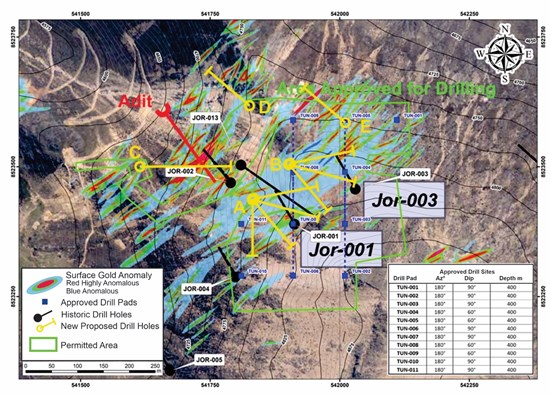

The Company's geologists have reviewed historical drilling conducted by Newmont and determined that the drilling was not oriented in the most optimal direction. The Company plans to modify the current permit to reflect the new drill sites. Adding or modifying new drill pads is permitted by the mining ministry in Peru as the new pads will be located in the area covered by the existing permit. Phase 1 will consist of 2,000 meters of drilling from Pad A. The purpose of the initial drilling is to determine the orientation and size of the gold zone intersected by Newmont. For reference, hole JOR-001 drilled in 2010 returned 72.3 metres of 1.19 g/t Au starting at a depth of 53 metres. The true widths of mineralization from this drill hole cannot be determined from a single hole. Further drilling is required to determine both the lateral and vertical extent of the mineralization intersected.

Phase 2 will be contingent on results from Phase 1. Phase 2 is planned to extend the Au-Ag mineralization. This phase will also test previously undrilled Au-Ag surface anomalies outlined by Newmont and confirmed by the Company's geologist. The drilling will also test the Au-Ag mineralization exposed in a 160 m adit recently sampled by the Company. Drift sampling on the Joramina zone returned 10 metres of 2.32 grams per tonne gold and a five-metre composite returning 4.085 ounces (115.8 g) per ton of silver.

Proposed Expanded Exploration Program

Magma has allocated US

The following diagram shows the proposed drill program. Pad A is where the initial drilling will commence.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3145/276361_5268b5ec34a0b94f_001full.jpg

Qualified Person

Jeffrey Reeder, P.Geo, a qualified person as defined in National Instrument 43-101 and a Senior Technical Advisor of the Company, has prepared, supervised the preparation of, and approved the scientific and technical disclosure contained in this news release.

AGORACOM

The Company also announces that it has issued 128,409 common shares to AGORA Internet Relations Corp. in accordance with the investor relations services agreement previously disclosed on August 28, 2025.

About Magma Silver Corp.

Magma Silver Corp. is a natural resources exploration company focused on acquiring, exploring, developing, and operating precious metal mining projects. Listed on the TSV Venture Exchange ("MGMA"), OTCQB ("MAGMF"), and Frankfurt Exchange ("BC21"), the Company's primary focus is on exploring and developing the advanced Niñobamba silver-gold project in the mining-friendly country of Peru. Niñobamba spans an 8 km mineralized corridor in a prolific geological belt of a high-sulphidation epithermal system. Extensive exploration by Newmont Corporation, AngloGold Ashanti Limited, Bear Creek Mining Corporation and Rio Silver, has demonstrated significant resource potential with over C

For more information, please visit our website at www.magmasilver.com.

Contact Information

Stephen Barley, Chairman & CEO

Phone: +1 (604) 988-5870

Email: ir@magmasilver.com

Website: www.magmasilver.com

X: @MagmaSilverCorp

Jason Baker, CFO & Director

Phone: +1 (604) 988-5870

Email: ir@magmasilver.com

Website: www.magmasilver.com

X: @MagmaSilverCorp

Reader Advisory

This news release may contain forward-looking information within the meaning of applicable securities laws. All information and statements other than statements of current or historical facts contained in this news release are forward-looking information. Forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed here and elsewhere in Magma Silver Corp.'s periodic filings with Canadian securities regulators. When used in this news release, words such as "will", "could", "plan", "estimate", "expect", "intend", "may", "potential", "should", and similar expressions are forward-looking statements. The information provided in this document is necessarily summarized and may not contain all available material information. Forward-looking statements include those in relation to (i) the planned drill program for Q1 2026, including its phases, scope, and objectives; (ii) the Company's intention to modify the current permit to reflect new drill sites; (iii) the Company's plans to further test and evaluate mineralisation identified in previous drilling by Newmont; and (iv) the timing of future news releases regarding the Joramina program, drill locations, and program commencement. Although the Company believes the expectations reflected in such forward-looking statements are based on reasonable assumptions, it can't make any assurances that its expectations will be achieved. Such assumptions may prove incorrect. Although the Company has attempted to identify important factors that could cause actual results, performance, or achievements to differ materially from those contained in the forward-looking statements, there can be other factors that cause results, performance, or achievements not to be as anticipated, estimated, or intended. There can be no assurance that such information will prove to be accurate or that management's expectations or estimates of future developments, circumstances, or results will materialize. As a result of these risks and uncertainties, no assurance can be given that any events anticipated by the forward-looking information in this news release will transpire or occur, or, if any of them do so, what benefits that the Company will derive therefrom. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this news release are made as of the date of this news release, and the Company disclaims any intention or obligation to update or revise such information, except as required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276361