Meridian Drills Multiple Intersections of Shallow High-Grade Au-Cu-Ag & Zn Mineralization at Santa Helena

Rhea-AI Summary

Positive

- Multiple high-grade intersections discovered, including highest-grade bedrock gold intersection to date of 25.4g/t Au and 449.0g/t Ag

- Shallow mineralization found across multiple drill holes, suggesting potential for open pit mining

- Successful infill drilling program strengthening confidence for upcoming resource estimate

- Expansion of exploration programs at Santa Fé showing promising geochemical and IP anomalies

Negative

- Some drill holes terminated early due to mining voids, potentially limiting full mineralization assessment

- Certain historical datasets were not fully sampled, requiring additional verification

- Some areas have colluvial cover, making exploration more challenging

News Market Reaction

On the day this news was published, MRRDF gained 0.95%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Highlights:

Meridian drills multiple intersections of shallow high-grade Au-Cu-Ag & Zn mineralization at Santa Helena:

CD-660: 11.6m @ 5.9g/t AuEq (

4.0% CuEq) from 42.0m*;Including 7.5m @ 8.0g/t AuEq (

5.4% CuEq) from 44.5m;

CD-700: 17.6m @ 3.6g/t AuEq (

2.4% CuEq) from 4.6m;Including 7.8m @ 5.6g/t AuEq (

3.8% CuEq) from 13.5m;

CD-691: 8.3m @ 3.8g/t AuEq (

2.6% CuEq) from 39.5m;Including 4.5m @ 6.3g/t AuEq (

4.2% CuEq) from 39.5m;

CD-686: 8.3m @ 3.7g/t AuEq (

2.5% CuEq) from 53.0m;Including 4.2m @ 6.8g/t AuEq (

4.6% CuEq) from 57.1m;

CD-701: 7.0m @ 5.2g/t AuEq (

3.5% CuEq) from 42.0m;Including 2.5m @ 7.3g/t AuEq (

4.9% CuEq) from 46.0m;

Meridian drills its highest-grade bedrock gold intersection to date at Santa Helena of 25.4g/t Au and 449.0g/t Ag (CD-701: CBDS103356; 48.1 - 48.45m); and

Meridian expands multiple surface exploration programs at Santa Fé.

*See Technical note for AuEq and CuEq equations and inputs.

LONDON, UK / ACCESS Newswire / June 10, 2025 / Meridian Mining UK S (TSX:MNO),(Frankfurt/Tradegate:2MM)(OTCQX:MRRDF) ("Meridian" or the "Company") is pleased to provide an update on its Santa Helena Au-Cu-Ag & Zn project ("Santa Helena"). Multiple intersections of shallow high-grade Au-Cu-Ag & Zn mineralization have been drilled as part of Santa Helena's expanded resource delineation drill program1.

The Company is also reporting, that due to strong extensions of geochemical and coincident geophysical anomalies at Santa Fé, it is expanding the active exploration programs there. Drill programs at Cabaçal, Santa Helena and Santa Fé continue with results pending.

Mr. Gilbert Clark, CEO, comments: "We continue to confirm more shallow and high-grade zones of Au-Cu-Ag & Zn mineralization at Santa Helena, including one of our highest grading gold assays to date. This continual stream of strong results from the on-going infill drill program are strengthening our confidence for the Santa Helena resource estimate that is planned for later this year. Having this potential for a second open pit with Santa Helena can only strengthen the optionality of it also becoming the 2nd processing hub of the Cabaçal belt.

At only 5km to the south of Santa Helena, the scale of the exploration activity at Santa Fé is developing quickly. We are seeing an expansion of open robust geochemical and IP anomalies and have a rig active there. With multiple deposits being developed, one of the best PFS economic results2 in recent time and an expanding exploration program. I am confident when I express that the Cabaçal Au-Cu belt is the preeminent VMS Au-Cu development project of South America."

1 See Meridian news release of April 15, 2025.

2 See Meridian news release of March 10, 2025.

Santa Helena Drilling

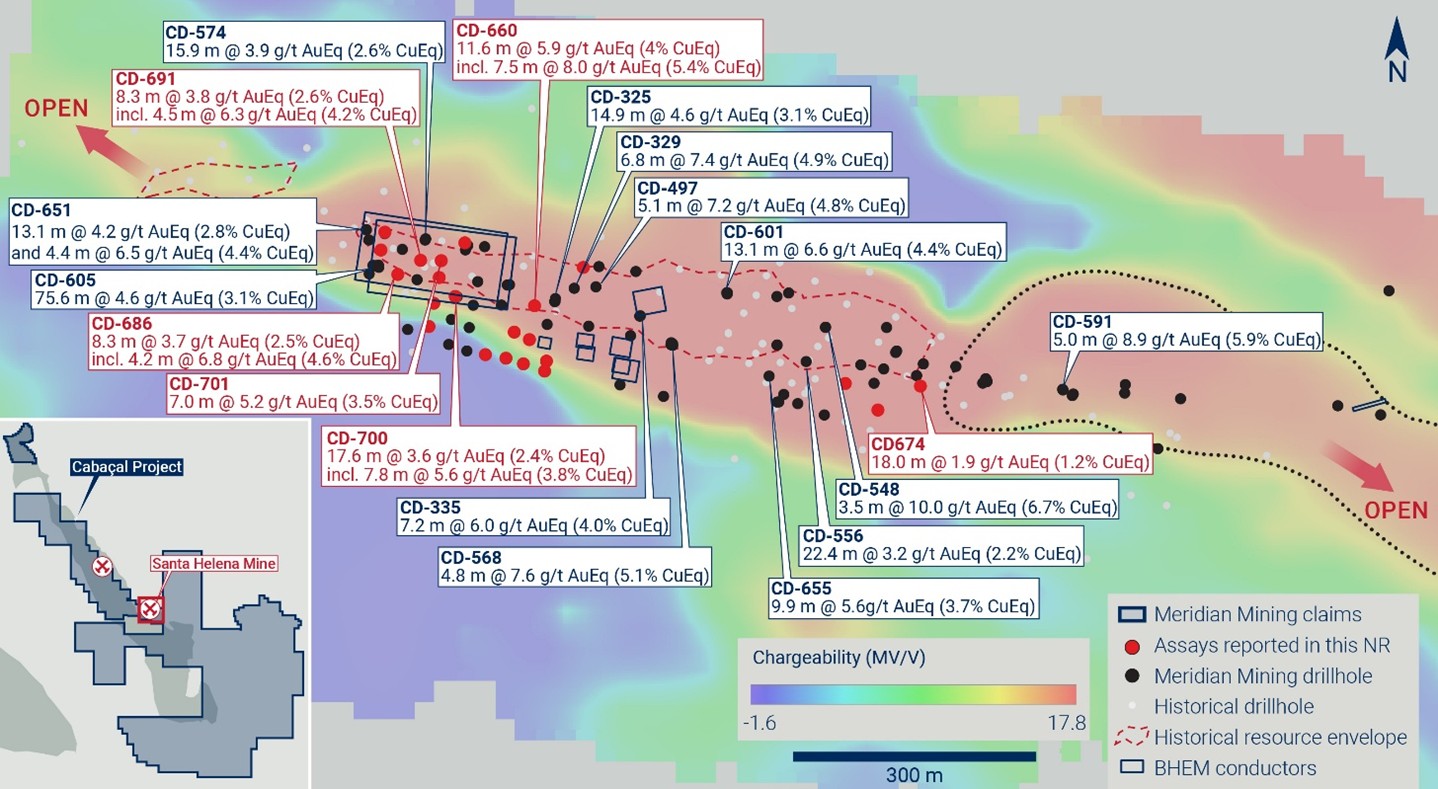

The Santa Helena infill drill program continues, delivering strong results in the eastern and western sectors of the deposit ("Figure 1" "Table 1"). Drilling is being conducted to increase confidence in the Au-Cu-Ag & Zn mineralization's geometry and grade continuity characteristics, particularly related to historical datasets where holes were not fully sampled.

CD-686, on the western sector of the deposit, returned 8.3m @ 3.7g/t AuEq (

Along strike, CD-701 returned 7.0m @ 5.2g/t AuEq (

Along strike to the east, CD-660 returned a 11.6m @ 5.9g/t AuEq (

Up-dip infill drilling on the western flank of the deposit included:

Hole-id | Zone | Int (m) | AuEq (g/t) | CuEq (%) | From (m) |

CD-700 | SHM | ||||

17.6 | 3.6 | 2.4 | 4.6 | ||

Including | 7.8 | 5.6 | 3.8 | 13.5 | |

Including | 2.7 | 10.5 | 7.1 | 18.1 | |

CD-699 | SHM | ||||

8.7 | 3.9 | 2.6 | 24.2 | ||

And | 2.2 | 3.4 | 2.6 | 41.0 | |

CD-698 | SHM | ||||

9.6 | 1.9 | 1.3 | 23.1 | ||

Including | 1.5 | 3.5 | 2.3 | 24.3 | |

CD-697 | SHM | ||||

19.5 | 1.3 | 0.9 | 2.4 | ||

Including | 5.8 | 2.8 | 1.9 | 3.1 | |

CD-691 | SHM | ||||

8.3 | 3.8 | 2.6 | 39.5 | ||

Including | 4.5 | 6.3 | 4.2 | 39.5 | |

CD-685 | SHM | ||||

9.0 | 0.9 | 0.6 | 38.6 | ||

Including | 2.1 | 2.1 | 1.4 | 45.4 |

Results from the shallow eastern sector of the deposit included CD-674 which cut the upper projection of the sheet and its immediate footwall, returning 18.0m @ 1.9g/t AuEq (

Resource definition will be ongoing through the second half of the year. The infill will be important to the definition of the VMS sheet geometry, which can show both thickening and thinning relating to folding and strain.

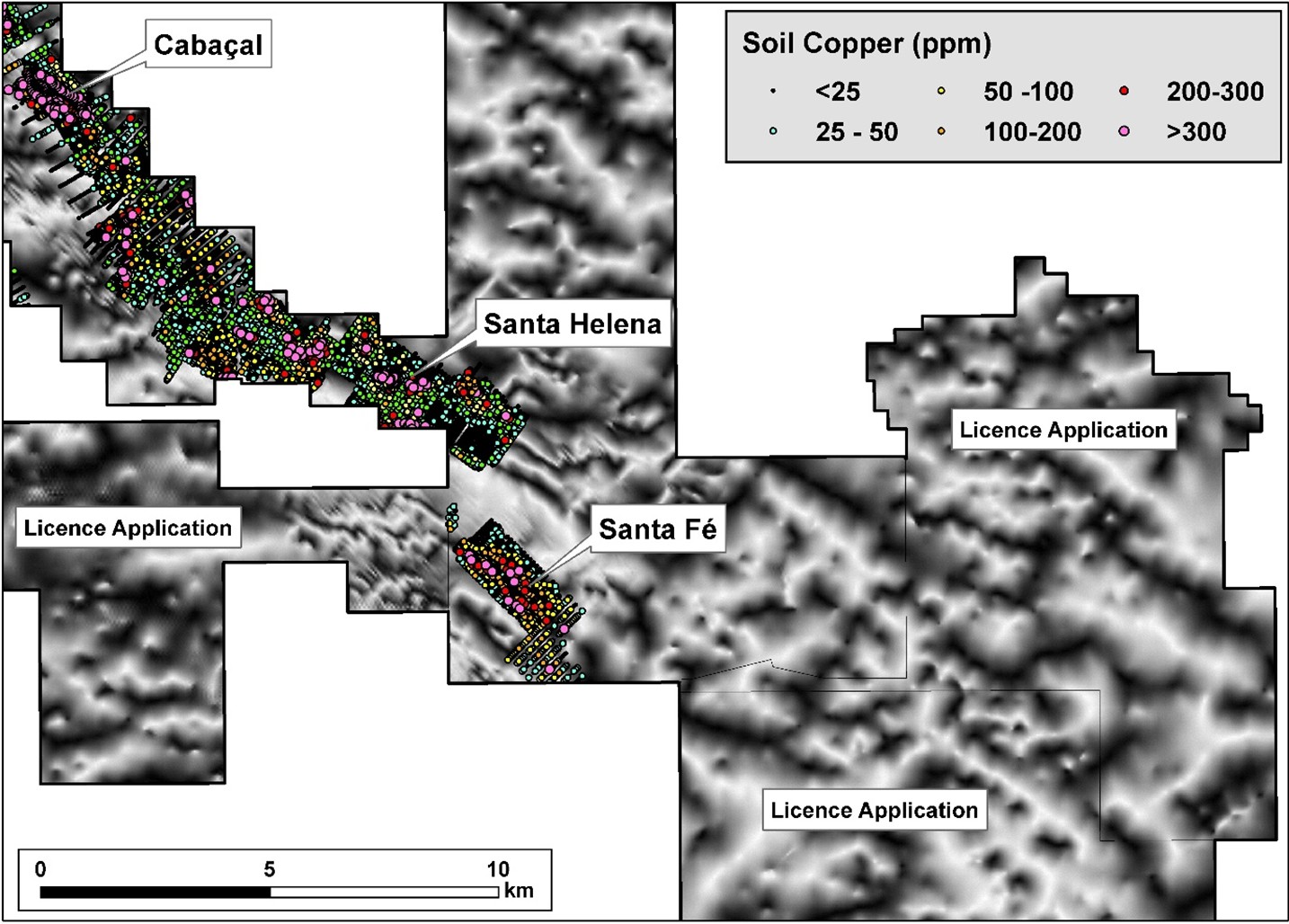

Santa Fé Target

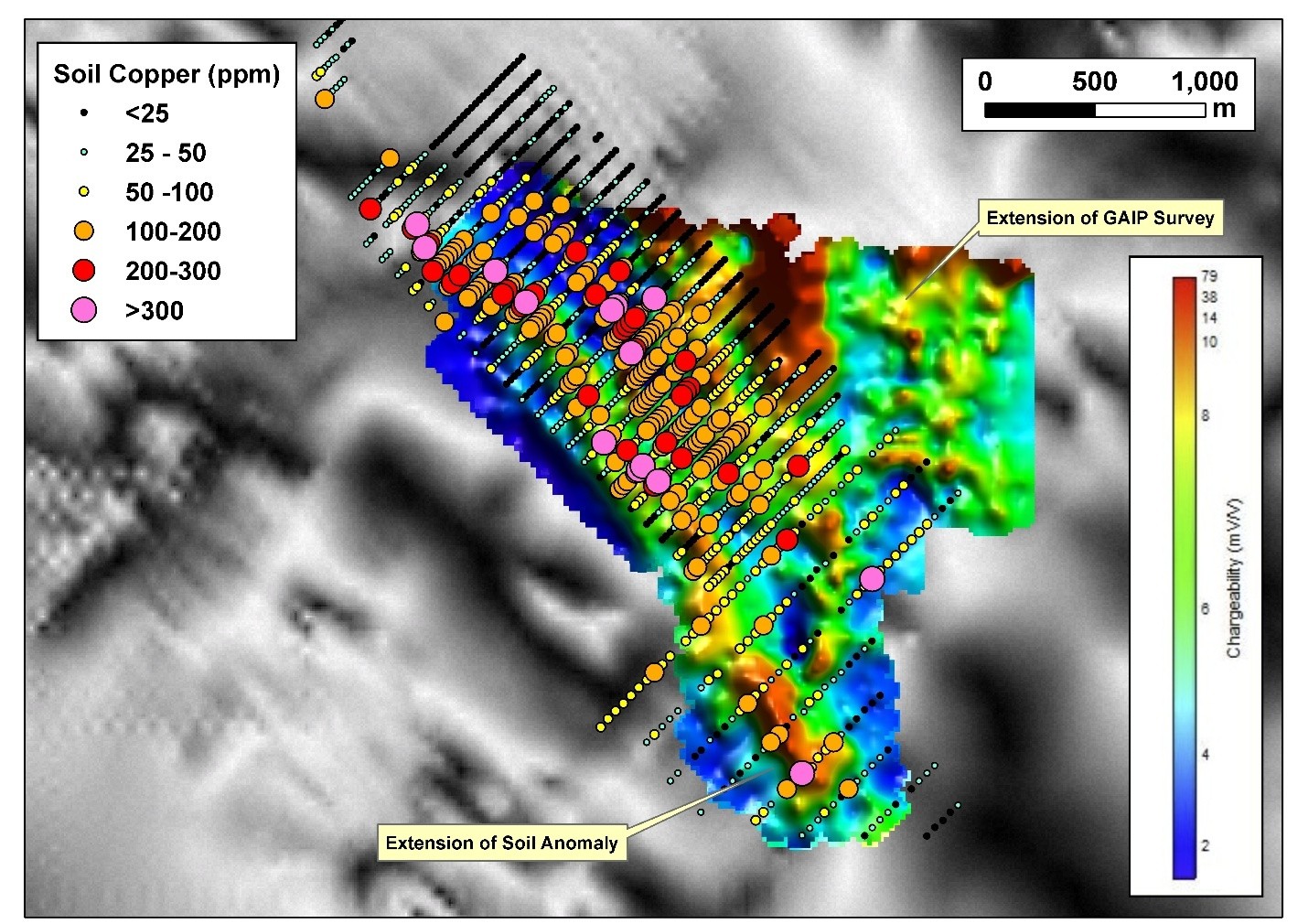

Following the reporting of a new target area, Santa Fe, in the southeast of the Cabaçal Belt, in April 2025, the Company has expanded its reconnaissance programs with an extension of the induced polarization survey to the west and an active geochemical stream and soil sampling program. Geochemical results have expanded the footprint of the soil anomaly previously reported at Santa Fé. The Company believes the Santa Fé, and Santa Helena trends have the potential to extend into Meridian's new exploration licence applications which are awaiting approval.

Geophysical and geochemical programs have also been extended eastwards through an area largely obscured by colluvial cover but with local pockets of greenstone belt exposed. Stream geochemistry is being undertaken as a first indicator of metal anomalism in areas down-cut through the colluvial sheet. The extension of the geophysical grid is showing a number of anomalies emerging in this newly expanded eastern area ("Figure 2"; "Figure 3").

The Company has mobilized a rig to start shallow reconnaissance drilling in order to characterize bedrock associated with chargeability anomalies, with results pending.

Technical Notes

Samples have been analysed at ALS laboratory in Lima, Peru. Samples are dried, crushed with

Gold equivalents for Santa Helena are based on metallurgical recoveries from the historical resource calculation, updated with pricing forecasts aligned with the Cabaçal PEA. AuEq (g/t) = (Au(g/t) *

Induced polarization surveys have been conducted by the Company's in-house team utilizing its GDD GRx8-16c receiver and 5000W-2400-15A transmitter. Results are sent daily for processing and quality control to the Company's consultancy, Core Geophysics. Modelling of conductivity response is undertaken using industry-standard Maxwell software. Geophysical and geochemical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit.

Qualified Person Statement

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, verified and approved the technical information in this news release.

About Meridian

Meridian Mining is focused on:

The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

The initial resource definition at the second higher-grade VMS asset at Santa Helena as the first stage of the Cabaçal Hub development strategy;

Regional scale exploration of the Cabaçal VMS belt to expand the Cabaçal Hub strategy; and

Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Pre-feasibility Study technical report (the "PFS Technical Report") dated March 31, 2025, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Pre-feasibility Study" outlines a base case after-tax NPV5 of USD 984 million and

The Cabaçal Mineral Reserve estimate consists of Proven and Probable reserves of 41.7 million tonnes at 0.63g/t gold,

Readers are encouraged to read the PFS Technical Report in its entirety. The PFS Technical Report may be found under the Company's profile on SEDAR+ at www.sedarplus.ca and on the Company's website at www.meridianmining.co

The PFS Technical Report was prepared for the Company by Tommaso Roberto Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering Canada ULC; Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering Canada ULC; John Anthony McCartney, C.Geol., Ausenco Chile Ltda.; Porfirio Cabaleiro Rodriguez (Engineer Geologist FAIG), of GE21 Consultoria Mineral; Leonardo Soares (PGeo, MAIG), Senior Geological Consultant of GE21 Consultoria Mineral; Norman Lotter (Mineral Processing Engineer; P.Eng.), of Flowsheets Metallurgical Consulting Inc.; and, Juliano Felix de Lima (Engineer Geologist MAIG), of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

8th Floor, 4 More London Riverside

London SE1 2AU

United Kingdom

Email: info@meridianmining.co

Ph: +1 778 715-6410 (BST))

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Cautionary Statement on Forward-Looking Information

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Table 1: Assay Results from Santa Helena Drilling

Hole-id | Dip | Azi | EOH | Zone | Int | AuEq | CuEq | Au | Cu | Ag | Zn | Pb | From |

(m) | (m) | (g/t) | (%) | (g/t) | (%) | (g/t) | (%) | (%) | (m) | ||||

CD-707 | -78 | 190 | 59.9 | SHM | |||||||||

18.6 | 0.9 | 0.6 | 0.2 | 0.3 | 12.5 | 0.8 | 0.2 | 40.0 | |||||

Including | 3.5 | 2.1 | 1.4 | 0.3 | 1.1 | 30.5 | 0.5 | 0.2 | 40.9 | ||||

Including | 3.2 | 1.5 | 1.0 | 0.2 | 0.1 | 18.7 | 2.3 | 0.6 | 52.8 | ||||

CD-701 | -75 | 191 | 70.0 | SHM | |||||||||

0.9 | 1.5 | 1.0 | 2.2 | 0.0 | 0.4 | 0.0 | 0.0 | 38.5 | |||||

7.0 | 5.2 | 3.5 | 3.3 | 0.3 | 71.4 | 5.0 | 1.4 | 42.0 | |||||

Including | 2.5 | 7.3 | 4.9 | 5.5 | 0.3 | 96.9 | 6.0 | 1.6 | 46.0 | ||||

1.1 | 0.8 | 0.6 | 0.7 | 0.1 | 6.4 | 0.5 | 0.1 | 59.4 | |||||

CD-700 | -86 | 198 | 45.0 | SHM | |||||||||

17.6 | 3.6 | 2.4 | 1.3 | 1.1 | 34.2 | 2.3 | 1.5 | 4.6 | |||||

Including | 7.8 | 5.6 | 3.8 | 1.2 | 1.9 | 46.9 | 4.5 | 1.9 | 13.5 | ||||

Including | 2.7 | 10.5 | 7.1 | 2.1 | 3.4 | 55.8 | 10.1 | 0.6 | 18.1 | ||||

CD-699 | -67 | 197 | 50.0 | SHM | |||||||||

8.7 | 3.9 | 2.6 | 0.5 | 0.5 | 26.1 | 6.3 | 1.1 | 24.2 | |||||

Including | 1.9 | 8.4 | 5.7 | 1.3 | 1.6 | 55.4 | 12.1 | 1.8 | 25.1 | ||||

Including | 1.7 | 6.8 | 4.6 | 0.6 | 0.5 | 43.7 | 12.8 | 2.0 | 29.0 | ||||

2.2 | 3.4 | 2.3 | 0.3 | 0.2 | 17.7 | 6.7 | 0.6 | 41.0 | |||||

CD-698 | -65 | 191 | 35.3 | SHM | |||||||||

9.6 | 1.9 | 1.3 | 0.7 | 0.5 | 9.7 | 1.7 | 0.9 | 23.1 | |||||

Including | 1.5 | 3.5 | 2.3 | 2.8 | 0.9 | 19.7 | 0.6 | 2.4 | 24.3 | ||||

CD-697 | -78 | 186 | 35.1 | SHM | |||||||||

19.5 | 1.3 | 0.9 | 0.7 | 0.4 | 11.4 | 0.6 | 0.6 | 2.4 | |||||

Including | 5.8 | 2.8 | 1.9 | 2.3 | 0.6 | 27.5 | 0.5 | 1.5 | 3.1 | ||||

CD-696 | -64 | 191 | 40.0 | SHM | |||||||||

18.6 | 1.0 | 0.7 | 0.5 | 0.2 | 4.5 | 0.8 | 0.2 | 18.4 | |||||

Including | 2.9 | 2.3 | 1.5 | 2.7 | 0.2 | 5.2 | 0.5 | 0.4 | 18.4 | ||||

CD-691 | -50 | 189 | 60.2 | SHM | |||||||||

8.3 | 3.8 | 2.6 | 2.3 | 1.1 | 31.3 | 1.5 | 2.1 | 39.5 | |||||

Including | 4.5 | 6.3 | 4.2 | 4.2 | 1.9 | 49.5 | 1.4 | 3.6 | 39.5 | ||||

1.9 | 1.5 | 1.0 | 0.1 | 0.1 | 9.0 | 3.0 | 0.8 | 50.5 | |||||

CD-690 | -89 | 000 | 45.0 | SHM | |||||||||

28.8 | 1.0 | 0.7 | 0.2 | 0.4 | 6.5 | 0.8 | 0.2 | 3.2 | |||||

Including | 13.3 | 1.5 | 1.0 | 0.3 | 0.5 | 9.0 | 1.2 | 0.3 | 17.6 | ||||

Including | 6.5 | 2.0 | 1.3 | 0.4 | 0.8 | 9.1 | 1.2 | 0.5 | 17.6 | ||||

CD-688 | -58 | 173 | 35.2 | SHM | |||||||||

17.2 | 0.9 | 0.6 | 0.1 | 0.3 | 4.8 | 0.9 | 0.1 | 4.4 | |||||

Including | 1.5 | 3.0 | 2.0 | 0.6 | 1.2 | 9.5 | 2.2 | 0.7 | 9.7 | ||||

CD-686 | -72 | 187 | 81.3 | SHM | |||||||||

8.3 | 3.7 | 2.5 | 0.5 | 0.9 | 46.5 | 4.3 | 0.9 | 53.0 | |||||

Including | 4.2 | 6.8 | 4.6 | 0.7 | 1.6 | 87.7 | 8.4 | 1.8 | 57.1 | ||||

Including | 1.4 | 9.1 | 6.1 | 1.6 | 3.2 | 126.7 | 6.6 | 1.2 | 57.6 | ||||

3.0 | 0.3 | 0.2 | 0.3 | 0.0 | 15.2 | 0.0 | 0.3 | 74.0 | |||||

CD-685 | -51 | 189 | 61.1 | SHM | |||||||||

3.0 | 0.6 | 0.4 | 0.0 | 0.2 | 1.3 | 0.7 | 0.3 | 30.1 | |||||

9.0 | 0.9 | 0.6 | 0.1 | 0.3 | 3.8 | 1.1 | 0.4 | 38.6 | |||||

Including | 2.1 | 2.1 | 1.4 | 0.2 | 0.8 | 3.3 | 2.0 | 1.3 | 45.4 | ||||

CD-682 | -70 | 193 | 25.0 | SHM | |||||||||

17.6 | 1.3 | 0.9 | 0.2 | 0.5 | 3.6 | 1.4 | 0.2 | 2.5 | |||||

Including | 3.0 | 3.1 | 2.1 | 0.3 | 1.2 | 1.1 | 2.9 | 0.7 | 2.5 | ||||

CD-681 | -78 | 187 | 15.0 | SHM | |||||||||

2.6 | 0.6 | 0.4 | 0.6 | 0.1 | 3.8 | 0.1 | 0.2 | 0.0 | |||||

CD-677 | -88 | 000 | 105.1 | SHM | |||||||||

12.3 | 0.5 | 0.3 | 0.2 | 0.1 | 5.1 | 0.6 | 0.1 | 67.2 | |||||

Including | 3.1 | 1.1 | 0.7 | 0.5 | 0.2 | 10.8 | 0.8 | 0.2 | 68.5 | ||||

CD-676 | -52 | 189 | 30.1 | SHM | |||||||||

16.3 | 0.9 | 0.6 | 0.3 | 0.2 | 9.2 | 0.8 | 0.1 | 2.1 | |||||

CD-674 | -71 | 215 | 45.5 | SHM | |||||||||

18.0 | 1.9 | 1.2 | 1.6 | 0.3 | 5.8 | 0.7 | 0.4 | 2.8 | |||||

Including | 7.9 | 3.3 | 2.2 | 3.4 | 0.6 | 3.7 | 0.6 | 0.5 | 2.8 | ||||

Including | 3.0 | 6.0 | 4.0 | 7.0 | 0.8 | 4.8 | 0.8 | 0.9 | 3.8 | ||||

0.4 | 2.5 | 1.7 | 3.8 | 0.0 | 0.7 | 0.0 | 0.0 | 25.6 | |||||

CD-672 | -65 | 207 | 42.0 | SHM | |||||||||

3.8 | 1.4 | 1.0 | 0.7 | 0.6 | 9.2 | 0.4 | 0.8 | 0.0 | |||||

24.0 | 0.5 | 0.3 | 0.1 | 0.1 | 3.2 | 0.6 | 0.1 | 5.7 | |||||

CD-670 | -61 | 206 | 36.1 | SHM | |||||||||

13.5 | 0.6 | 0.4 | 0.3 | 0.2 | 4.9 | 0.2 | 0.3 | 0.0 | |||||

11.3 | 0.3 | 0.2 | 0.1 | 0.0 | 7.5 | 0.3 | 0.1 | 17.2 | |||||

2.4 | 0.6 | 0.4 | 0.0 | 0.1 | 3.8 | 1.0 | 0.3 | 31.6 | |||||

CD-668 | -65 | 036 | 40.7 | SHM | |||||||||

3.5 | 0.3 | 0.2 | 0.2 | 0.0 | 6.2 | 0.3 | 0.2 | 7.6 | |||||

1.6 | 0.3 | 0.2 | 0.1 | 0.1 | 3.0 | 0.2 | 0.2 | 17.1 | |||||

1.0 | 0.9 | 0.6 | 1.0 | 0.0 | 10.7 | 0.5 | 0.3 | 26.0 | |||||

CD-662 | -64 | 193 | 47.8 | SHM | |||||||||

22.6 | 0.8 | 0.5 | 0.2 | 0.2 | 7.7 | 0.7 | 0.3 | 6.6 | |||||

Including | 11.6 | 1.0 | 0.7 | 0.2 | 0.3 | 6.9 | 0.8 | 0.2 | 6.6 | ||||

2.8 | 1.0 | 0.6 | 0.1 | 0.2 | 5.7 | 1.6 | 0.2 | 33.9 | |||||

CD-660 | -44 | 054 | 55.6 | SHM | |||||||||

11.6 | 5.9 | 4.0 | 1.6 | 1.2 | 61.2 | 6.7 | 1.3 | 42.0 | |||||

Including | 7.5 | 8.0 | 5.4 | 1.8 | 1.7 | 79.4 | 9.6 | 1.7 | 44.5 | ||||

Including | 1.3 | 12.8 | 8.6 | 2.3 | 2.8 | 121.8 | 15.9 | 2.5 | 48.7 | ||||

SOURCE: Meridian Mining UK S

View the original press release on ACCESS Newswire