Grid Metals Reports Best Intercept to Date at Falcon West Cesium Project of 16.5% Cs2O over 3.45m

Rhea-AI Summary

Grid Metals (OTCQB:MSMGF) reported additional high‑grade cesium assays from the Lucy South zone at its 100%‑owned Falcon West cesium property dated December 4, 2025. Highlights include 4.04 m @ 10.4% Cs2O (incl. 1.24 m @ 27.1% Cs2O) in LU25‑08 and 3.45 m @ 16.8% Cs2O in LU25‑09. The initial phase completed 67 holes (3,035 m); assays for the remaining 56 holes are pending.

The pollucite‑hosted cesium zone is near surface, defined over ~100 m strike and remains open; phase 2 drilling is expected to start in mid‑January 2026. Report notes cesium carbonate pricing at US$218,000/t.

Positive

- 1.24 m sub‑interval grading 27.1% Cs2O

- 3.45 m at 16.8% Cs2O (LU25‑09)

- 4.04 m at 10.4% Cs2O (LU25‑08)

- Initial phase: 67 drill holes totaling 3,035 m

- Cesium carbonate price cited at US$218,000/t

Negative

- High‑grade zone currently defined over only ~100 m strike

- 56 drill hole assays from phase 1 remain pending

- Phase 2 drilling not started and expected mid‑January 2026

News Market Reaction

On the day this news was published, MSMGF gained 1.53%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

MSMGF gained 9.56% while peers were mixed: GARWF up 4.53%, KBXFF up 1.57%, GBMCF down 1.03%, others flat. No broad sector move indicated.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 04 | Drill results update | Positive | +1.5% | Reported best-to-date high-grade cesium intercepts at Falcon West Lucy South. |

| Nov 20 | Initial drill assays | Positive | +20.1% | First 2025 drill results with high-grade pollucite-hosted cesium at Lucy South. |

| Nov 11 | Exploration & financing | Positive | -1.4% | Announced C$4.0M financing, cesium-focused drilling and Makwa Ni-Cu-PGE exploration. |

| Oct 30 | Private placement close | Neutral | -2.8% | Closed second tranche of strategic private placement for exploration funding. |

| Oct 17 | Private placement close | Neutral | -7.5% | Closed first tranche of private placement to a strategic investor for projects. |

Recent high-grade cesium drill results at Falcon West have coincided with positive price moves, while financing-related announcements saw mild negative reactions.

Over the last few months, Grid Metals reported multiple funding and exploration milestones. Two private placement tranches in October 2025 raised an aggregate C$4,027,158 for Falcon West and other targets, but shares slipped modestly after those announcements. In November 2025, the company began reporting high-grade cesium intercepts at Falcon West, including up to 14.0% Cs2O over 3.01 m, which drew stronger positive reactions. Today’s update extends that narrative with higher-grade intercepts and a larger drilled footprint.

Market Pulse Summary

This announcement extends Grid Metals’ Falcon West story with new high-grade cesium intercepts, including up to 27.09% Cs2O within broader mineralized zones and a near-surface LCT pegmatite roughly 10 m thick over ~100 m of strike. Earlier 2025 financing rounds totaling C$4,027,158 funded this program, with 56 drill assays still pending. Key factors to monitor include continuity of high grades, the scale of the cesium zone, and timing and results of the planned phase 2 drilling.

Key Terms

pollucite medical

spodumene medical

lepidolite medical

tantalite medical

qaqc technical

icp-oes technical

icp-ms technical

AI-generated analysis. Not financial advice.

TORONTO, ON / ACCESS Newswire / December 4, 2025 / Grid Metals Corp. (TSXV:GRDM)(OTCQB:MSMGF) ("Grid" or the "Company") is pleased to announce additional high-grade cesium assays from the Lucy South target zone at its

Program Highlights

High-grade cesium intercepts, including 4.0m at 10.4% Cs2O with 1.2m at

27.1% Cs2O (LU25-08) and 3.45m at16.8% Cs2O (LU25-09), are amongst the highest Cs2O drill intercepts reported globally, in recent years.Reported drill holes confirm near surface high-grade pollucite-hosted cesium mineralization as well as high-grade lithium and rubidium. Pollucite is a highly sought-after cesium mineral that is the principal feedstock for cesium chemical production.

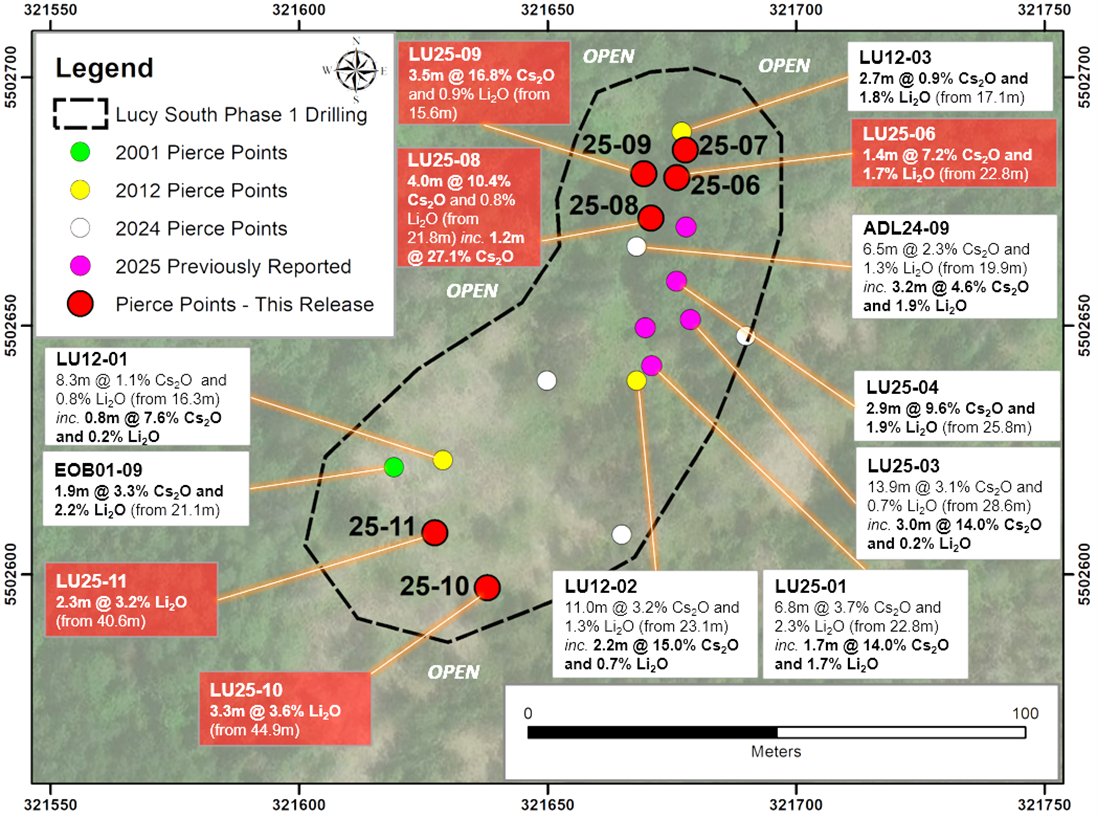

Drilling is targeting the southeastern part of the Lucy pegmatite where it forms a flat-lying, near surface and highly fractionated LCT-type (lithium-cesium- and tantalum-enriched) pegmatite that is approximately ten (10) metres thick. A total of 67 drill holes (3,035 metres) were completed in the first phase of the program. Assay results from the remaining 56 drill holes are pending.

High-grade cesium intercepts are now defined over a strike length of approximately 100 metres, and the cesium enrichment trend remains open in multiple directions, with phase 2 of the drilling campaign expected to commence in mid-January, 2026.

Table 1: Analytical Results for Drill Holes LU25-06 to LU25-11, Lucy South cesium target. See Appendix for hole locations. Note the true thickness for each interval reported is estimated to represent between

Hole ID | From | To | Length | Cs2O | Li2O | Rb2O | Ta2O5 | Comments |

LU25-06 | 19.30 | 25.75 | 6.45 | 1.91 | 0.63 | 0.99 | 180 | Li-Cs-Rb-Ta Enriched Section |

inc. | 22.77 | 25.75 | 2.98 | 3.73 | 0.98 | 0.48 | 370 | Pollucite-rich Section |

with | 22.77 | 24.15 | 1.38 | 7.16 | 1.70 | 0.48 | 210 | Pollucite-rich Section |

LU25-07 | 19.90 | 22.76 | 2.86 | 0.48 | 0.83 | 0.66 | 201 | Li-Cs-Rb-Ta Enriched Section |

inc. | 20.66 | 20.85 | 0.19 | 4.76 | 1.82 | 0.23 | 186 | Pollucite-rich Section |

LU25-08 | 21.76 | 30.90 | 9.14 | 4.69 | 0.59 | 0.30 | 136 | Li-Cs-Rb-Ta Enriched Section |

inc. | 21.76 | 25.80 | 4.04 | 10.42 | 0.76 | 0.30 | 5 | Pollucite-rich Section |

with | 21.76 | 23.00 | 1.24 | 27.09 | 0.27 | 0.77 | 2 | Pollucite-rich Section |

and | 25.30 | 25.80 | 0.50 | 16.52 | 1.74 | 0.49 | 20 | Pollucite-rich Section |

LU25-09 | 14.60 | 29.55 | 14.95 | 3.96 | 0.55 | 0.29 | 65 | Li-Cs-Rb Enriched Section |

inc. | 15.55 | 19.00 | 3.45 | 16.79 | 0.86 | 0.69 | 17 | Pollucite-rich Section |

LU25-10 | 43.78 | 50.24 | 6.46 | 0.11 | 2.42 | 0.33 | 243 | Li-Rb-Ta Enriched Section |

inc. | 44.90 | 48.17 | 3.27 | 0.04 | 3.64 | 0.06 | 280 | Li-rich Section |

LU25-11 | 31.50 | 44.32 | 12.82 | 0.04 | 0.89 | 0.18 | 48 | Li-Rb-Ta Enriched Section |

inc. | 40.56 | 42.82 | 2.26 | 0.04 | 3.17 | 0.15 | 52 | Li-rich Section |

Figure 1: Map of Lucy South target area with interpreted pierce points into the top of the flat-lying Lucy LCT pegmatite projected to surface for holes LU25-01 to LU25-11 and previous holes completed in this area The initial target area is outlined in black.

Drill Results Discussion

Highlights from the second batch of assays (holes 6-11) include 4.04 metres with

The initial phase of the current drill program focused on defining the distribution of pollucite within a 150m x 40m near surface target area (Figure 1) using closely-spaced drill hole pierce points into the southeastern part of the Lucy pegmatite.All holes reported to date have intersected a highly fractionated section of the Lucy pegmatite including variably developed subzones enriched in cesium (pollucite +/- mica, feldspar), lithium (spodumene +/- lepidolite), rubidium (feldspar and mica) and tantalum (tantalite). Pollucite, where present, is typically concentrated in the middle of the pegmatite.

The pollucite-enriched part of the southeastern target area is fully open to the north for a distance of over 100 metres and is partly open to the northwest and southeast. Phase 2 of the current drilling program is expected to commence in January and will focus on these adjoining, high potential areas.

Project and Cesium Overview

The Falcon West Cesium Project is one of only three known high-grade cesium exploration projects under development globally. Cesium-rich pollucite ore can be crushed and ore sorted to a high-value pollucite concentrate which is the principal feedstock for cesium chemical production. As such, the capital intensity of producing a high-grade cesium concentrate from near surface material could be extremely low as a conventional mill and tailings facility would not be required.

Cesium is an extremely high-value material with the current price of cesium carbonate trading for US

Quality Assurance and Quality Control

The Company's ongoing exploration program at the Falcon West lithium property is being supervised by Dave Peck, P.Geo. Grid Metals applies best practice quality assurance and quality control ("QAQC") protocols on all of its exploration programs. For the current program, all core was logged and sampled at the Company's core facility located on its Makwa nickel property. Generally, 1.0 metre sample lengths were used. Samples were bagged and tagged and then transported by secure carrier to the Activation Laboratories facility in Ancaster, Ontario for sample preparation and analysis for lithium, cesium, rubidium, tantalum and selected major and trace element abundances using a sodium peroxide fusion total digestion method followed by ICP-OES and ICP-MS analysis. The Company is using two rare metal certified reference materials ("CRMs") and an analytical blank for the program to monitor analytical accuracy and check for cross contamination between samples. The blank and CRM results for the reported intervals were determined to fall within the accepted range of deviation from the certified values.

Dr. Dave Peck, P.Geo., the Company's Vice President, Exploration, has reviewed and approved the technical information contained in this release.

1 SMM pricing, China VAT excluded as of November 2025

About Grid Metals Corp.

Grid Metals is focused on exploration and development in southeastern Manitoba with four key projects in the Bird River area.

The Makwa Property (Ni-Cu-PGM-Co), which is subject to an Option and Joint Venture Agreement with Teck Resources Limited ("Teck"). Teck can earn up to a

70% interest in Makwa by incurring a total of CAD$17.3 million , comprising project expenditures (CAD$15.7 million ) and cash payments or equity participation (CAD$1.6 million ) with Grid. Makwa is located on the south arm of the Bird River Greenstone Belt.The Mayville Property (Cu-Ni) is located on the north arm of the Bird River Greenstone Belt. The property is owned subject to a minority interest. The project contains a NI 43-101 compliant open pit resource of 32 million tonnes grading

0.61% CuEq.The Falcon West Property (Li-Cs) is located 110 km east of Winnipeg along the Trans-Canada highway and contains highly anomalous cesium values including 3.0 m at

14.0% Cs2O and 3.5 m at16.8% Cs2O.The Donner Property (Li-Cs) is adjacent to the Mayville Property, and Grid owns

75% of the project. The project contains a NI 43-101 compliant resource of 6.8 million tonnes grading1.39% Li2O.

All of the Company's southeastern Manitoba projects are located on the ancestral lands of the Sagkeeng First Nation with whom the Company maintains an Exploration Agreement.

On Behalf of the Board of Grid Metals Corp.

For more information about the Company, please visit our website at www.gridmetalscorp.com or contact:

Robin Dunbar - President, CEO & Director - rd@gridmetalscorp.com

Brandon Smith - Chief Development Officer - bsmith@gridmetalscorp.com

David Black - Investor Relations - info@gridmetalscorp.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

We seek safe harbour. This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario) (together, "forward-looking statements"). Such forward-looking statements include the Company's intended use of proceeds and receipt of regulatory approvals, the overall economic potential of its properties, the availability of adequate financing and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements expressed or implied by such forward-looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to potential political risk, uncertainty of production and capital costs estimates and the potential for unexpected costs and expenses, physical risks inherent in mining operations, metallurgical risk, currency fluctuations, fluctuations in the price of nickel, cobalt, copper and other metals, completion of economic evaluations, changes in project parameters as plans continue to be refined, the inability or failure to obtain adequate financing on a timely basis, and other risks and uncertainties, including those described in the Company's Management Discussion and Analysis for the most recent financial period and Material Change Reports filed with the Canadian Securities Administrators and available at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Appendix: Drill hole specifications. Collar coordinates are based on the NAD 83 datum and the UTM Zone 15N projection.

Drill Hole | Easting | Northing | Elevation (m) | Length (m) | Azimuth (°) | Dip | |

LU25-06 | 321676 | 5502680 | 327.4 | 42 | 0 | -90 | |

LU25-07 | 321676 | 5502680 | 327.4 | 30 | 15 | -72 | |

LU25-08 | 321676 | 5502680 | 327.4 | 36 | 215 | -65 | |

LU25-09 | 321676 | 5502680 | 327.4 | 39 | 280 | -65 | |

LU25-10 | 321650 | 5502586 | 333.1 | 60 | 315 | -45 | |

LU25-11 | 321650 | 5502586 | 333.1 | 72 | 315 | -60 |

SOURCE: Grid Metals Corp.

View the original press release on ACCESS Newswire