Max Resource Reports Update on the Floralia Iron Ore Property

Rhea-AI Summary

Max Resource (OTC: MXROF) announced that majority‑owned Max Iron Brazil entered a non‑binding LOI with Bolt Metals for an option to earn 100% of the Florália iron ore property (mineral right 832.022/2018).

Under proposed terms Bolt would pay USD $200,000 to Jaguar Mining on behalf of Max Brazil, maintain property standing, and issue 26,200,000 shares to Max Brazil and 6,094,679 shares to Max Resource over 30 months, subject to due diligence, definitive agreements and approvals.

Max reports its technical team expanded the Florália DSO geological target from 8–12 Mt at 58% Fe to 50–70 Mt at 55–61% Fe and cautions the estimate is conceptual and not yet a defined mineral resource.

Positive

- Florália target expanded to 50–70 Mt at 55%–61% Fe

- Bolt to issue 26.2M shares to Max Brazil and 6.09M shares to Max Resource

- Bolt to pay USD $200,000 and keep property in good standing

- Freeport fully funded USD $4.8M 2025 exploration program at Sierra Azul

Negative

- Florália quantity and grade are conceptual; insufficient exploration to define resource

- Completion subject to due diligence, definitive documentation and regulatory approvals

- Qualified Person unable to verify Marmato/Guayabales comparatives for Mora property

News Market Reaction

On the day this news was published, MXROF declined 8.24%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - October 23, 2025) - MAX RESOURCE CORP. (TSXV: MAX) (OTC Pink: MXROF) (FSE: M1D2) ("Max" or the "Company") is pleased to report that the Company's majority owned Max Iron Brazil Ltd. has entered into a non-binding letter of intent with Bolt Metals Corp. ("Bolt") whereby Bolt may acquire an option to earn a

Under the proposed terms, Bolt will pay USD

Summary of Max Resource Mineral Properties

Mora Gold Property in Colombia

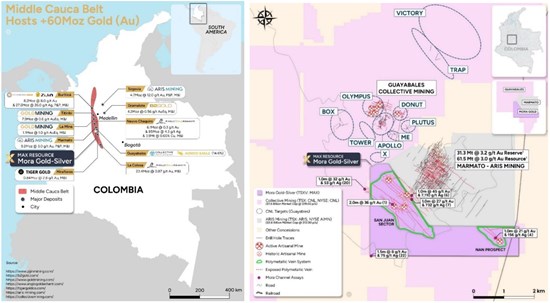

The undrilled Mora Property encompasses over 40 historic workings, 5 active mines, a series of exposed polymetallic structures over 2,500m by 1,000m, adjacent to Aris Mining's (TSX: ARIS) (NYSE: AIMN) 9.2Moz Marmato Gold Operation (P&P Reserves: 31.3Mt @ 3.2 g/t Au for 3.2Mozs, M&I Resources: 61.5Mt @ 3.0 g/t Au for 6.0Moz ¹) and Collective Mining's (TSX: CNL) (NYSE: CNL) Guayabales Project abuts along 3.7 km north (Apollo Porphyry System), west, south, and vertical east boundaries of the Mora Property (refer to Figure 1 and Table 1).

Appointment of Mr. Cocunubo as Head Geologist and Mr. Henao Head of Community Relations both acted the same roles for Collective Mining (TSX: CNL) joining Co-Founder of Collective Mining, Dr. Grainger who acts as Technical Advisor.

The geological team has commenced channel sampling of active underground artisanal mines, depth and advance ranges from 5m to 90m. This important step allows visual identification of the geological characteristics of fresh rock such as lithology, hydrothermal alterations, types of sulfides or mineralization, structures-faults-veins and veinlets. The Company will release exploration results shortly.

Max advises investors that the gold mineralization at the Marmato gold deposit and the Apollo porphyry zone may not necessarily by indicative of similar mineralization at the Mora Property. Max further advises the QP has been unable to verify the information on Marmato and Guayabales and that the information is not necessarily indicative to the mineralization on the Mora Property.

Sierra Azul Copper-Silver Project in Colombia

- Max's wholly owned Sierra Azul Copper-Silver Project sits along the Colombian portion of the world's largest producing copper belt (Andean belt). Max has an Earn-In Agreement ("EIA") with Freeport-McMoRan Exploration Corporation ("Freeport"), a wholly owned affiliate of Freeport-McMoRan Inc. whereby the fully funded USD

$4.8m 2025 exploration program is well underway. Updated exploration results are due shortly.

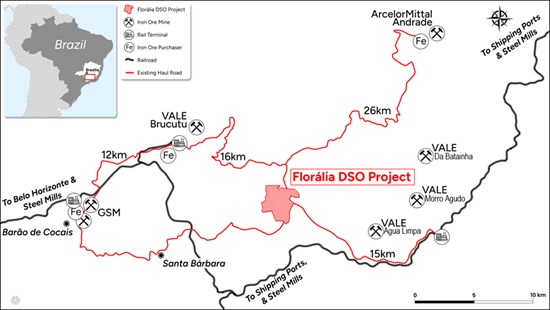

Florália Property in Brazil

The Florália Iron Ore Property lies within Minas Gerais, Brazil's largest iron ore and steel producing State. The Property has established road access to rail terminal (15 km) linking to steel mills and shipping ports; roads connect to DSO buyers Vale (16 km) and ArcelorMittal (26 km) ensuring efficient logistics and market access. Max's technical team has significantly expanded the Florália Hematite DSO Geological Target from 8-12Mt at

Max cautions investors the potential quantity and grade of the iron ore is conceptual in nature, and further cautions there has been insufficient exploration to define a mineral resource and Max is uncertain if further exploration will result in the geological target being delineated as a mineral resource. Hematite mineralization tonnage potential estimation is based on in situ high-grade outcrops and interpreted and modelled magnetic anomalies. Density value used for the estimate is 2.8t/m³. Hematite sample grades range between 55

Figure 1: Mora Gold-Silver Property regional and local location maps

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/271581_0ffe278544773bd5_001full.jpg

Cannot view this video? Visit:

https://www.youtube.com/watch?v=Ob-AFDysVwo

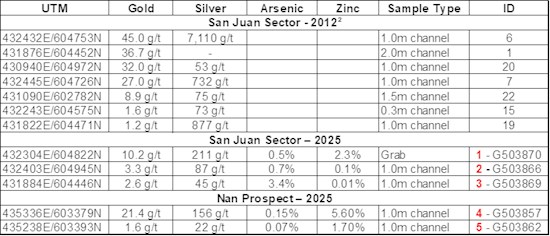

Table 1: Highlight Assay Results for 2012² and 2025 Field Investigations.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/271581_0ffe278544773bd5_003full.jpg

Figure 2: Florália Property located nearby infrastructure and markets

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/271581_0ffe278544773bd5_004full.jpg

Qualified Person

The Company's disclosure of a technical or scientific nature in this news release was reviewed and approved by Tim Henneberry, P.Geo (British Columbia), a member of the Max Resource advisory board, who serves as a qualified person under the definition of National Instrument 43-101.

| Name | Highlights | Reference |

| Marmato Gold Deposit¹ | Aris Mining (TSX: ARIS) (NYSE: AIMN) | https://aris-mining.com/operation/reserves-and-resources/ |

| P&P Reserve: 31.28Mt at 3.16 g/t Au for 3.178Mozs | ||

| M&I Resources: 61.50Mt at 3.03 g/t Au for 5.997Mozs | ||

| Inferred Resource: 35.60Mt at 2.43 g/t Au for 2.787Mozs | ||

| Guayabales Project² | Collective Mining (TSX: CNL) (NYSE: CNL) | https://collectivemining.com/ |

| Apollo: 497m at 3.0 g/t AuEq. | ||

| Trap: 632m at 1.1 g/t AuEq. | ||

| Plutus: 301m at 3.0 g/t AuEq. | ||

| Ramp: 75m at 8.0 g/t Au | ||

| ME: 111m at 1.0 g/t AuEq. |

Table 2. References.

For more information visit on Max Resource: https://www.maxresource.com/

For additional information contact:

Tim McNulty E: info@maxresource.com T: (604) 290-8100

Brett Matich T: (604) 484 1230

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law.

Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. There are no assurances that the commercialization plans for Max Resources Corp. described in this news release will come into effect on the terms or time frame described herein.

The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedarplus.ca.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/271581