Max Resource: Corporate Rationale for the 4:1 Share Consolidation

Rhea-AI Summary

Max Resource (OTC: MXROF) approved a 4-for-1 share consolidation expected to reduce issued common shares from 222,029,325 to ~55,507,331, aiming to attract institutional and high-net-worth investors.

The company closed an oversubscribed private placement of $3.4M and highlighted project funding: a C$50M earn-in by Freeport-McMoRan for Sierra Azul and a proposed Bolt Metals transaction for Florália (Bolt to issue 32,294,679 shares to Max). Mora project assays include surface results up to 45.0 g/t Au and 7,110 g/t Ag. The Consolidation is subject to TSXV approval.

Positive

- Share count to reduce from 222.03M to ~55.51M

- Raised an oversubscribed $3.4M private placement

- Sierra Azul C$50M earn-in funded by Freeport-McMoRan

- Florália option structured with Bolt issuing 32,294,679 shares to Max

Negative

- Consolidation remains subject to TSXV approval

- Fractional post-consolidation interests under 0.5 will be cancelled

- Mora assay samples are selective and may not reflect true mineralization

- Florália transaction contingent on due diligence and regulatory approvals

News Market Reaction

On the day this news was published, MXROF gained 7.67%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - December 24, 2025) - MAX RESOURCE CORP. (TSXV: MAX) (OTC Pink: MXROF) (FSE: M1D2) ("Max" or the "Company") announces in anticipation of a marketing initiative the Company has approved a consolidation of the Company's issued and outstanding common shares (the "Common Shares") on the basis of four (4) pre-consolidated Common Shares for one (1) new post consolidated Common Share (the "Consolidation").

The Share Consolidation initiative is driven by strategic foresight, aimed at attracting broader institutional and high net worth investors, and support of its capital markets strategy.

Rationale and potential benefits include:

(a) attracting greater investor interest - the Consolidation will have the immediate effect of effecting the share price by the consolidation ratio. It is the Company's belief that the Consolidation could have the effect of appealing to a broader range of investors following the Consolidation.

(b) increasing institutional investor participation - it is the Company's belief that the smaller float following the Consolidation may have the effect of stabilizing the Company's share price and thereby appealing to a broader spectrum of investor.

(c) providing greater flexibility in business opportunities - the Consolidation will tighten the float and as such, the Company believes will make the Company's shares more attractive to potential counterparties and other business opportunities where share consideration would be offered by the Company.

"The Company has recently closed an oversubscribed private placement of

The Company currently has 222,029,325 issued and outstanding Common Shares and accordingly, on completion of the proposed Consolidation the Company anticipates there to be approximately 55,507,331 issued and outstanding Common Shares. The Company's name and stock symbol will remain the same after the Consolidation. No fractional Shares will be issued as a result of the Consolidation. Instead, any fractional share interest of 0.5 or higher arising from the Consolidation will be rounded up to one whole Share, and any fractional share interest of less than 0.5 will be cancelled.

The Company will issue a further news release notifying shareholders as to when the effective date of the Consolidation will occur and the date on which the Company's Common Shares will commence trading on the TSXV.

The Consolidation remains subject to the approval of the TSX Venture Exchange.

Mora Gold Silver Property in Colombia

The Company has exclusive rights to purchase

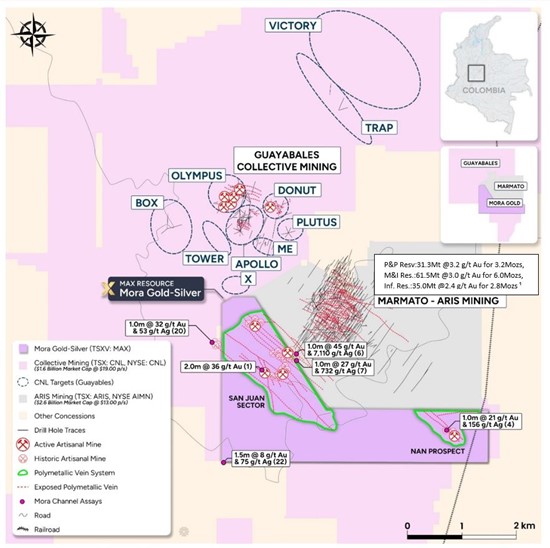

Figure 1. Mora Gold Silver Property encompasses over 40 historic workings, 5 active mines, a series of exposed polymetallic structures over 2,500m by 1,000m.

Surface samples collected from San Juan and NAN by their nature are selective samples and may not be indicative of underlying mine

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/279049_max1.jpg

Highlights

- The undrilled Mora Property encompasses over 40 historic workings, 5 active mines, a series of exposed polymetallic structures over 2,500m by 1,000m, adjacent to Aris Mining's 9.2Moz Marmato Gold Operation (P&P Reserves: 31.3Mt @ 3.2 g/t Au for 3.2Mozs, M&I Resources: 61.5Mt @ 3.0 g/t Au for 6.0Moz, Inferred Resources: 35Mt @ 2.4 g/t Au for 2.8Mozs ¹), currently under construction aiming to increase annual production to 200,000oz by H2 2026¹.

Aris Mining's Marmato Project abuts the Mora Property along the entire 3.4 km eastern boundary, and Collective Mining's Guayabales Project, host to the newly discovered Apollo System, abuts a common boundary of 4.8 km in length. The recent Apollo discovery is reported to host large-scale, outcropping, bulk-tonnage and high-grade gold-silver mineralization. Collective Mining's latest drill results at the Ramp Zone (Apollo Deeps) included 63.90m @ 13.46 g/t Au from 388.25m (refer to CNL news release, Dec. 16, 2025).

Mora surface channel sample results include (refer to Table 1)

- 45.0 g/t gold & 7,110 g/t silver over 1.0m;

- 32.0 g/t gold & 53 g/t silver over 1.0m;

- 27.0 g/t gold & 732 g/t silver over 1.0m;

- 8.9 g/t gold & 75 g/t silver over 1.5m.

- In September 2025, Max reported the appointment of Mr. Sergio Cocunubo as Head Geologist, reuniting with Technical Advisor Dr. Christian Grainger both key members of the Collective Mining and Continental Gold exploration team that developed the Buriticá Gold Deposit, prior to the

$1.4 billion takeover by Zijin in 2019 (CNL, news release dated December 2, 2019).

- To date at the Mora Property, 33 artisanal underground mines have been documented in historic technical reports of which Max has successfully mapped 9 inactive mines. The depth or advance of the artisanal mines varies between 5.0m and 90.5m.

- Channel sampling artisanal underground mines is very important; it's almost like having a drillhole, identifying geological characteristics of fresh rock such as lithology, hydrothermal alterations, types of sulfides or mineralization, structures-uplifts-faults-veins and veinlets.

- Exploration: The Company's 2025 exploration program is well underway and includes collection of historic data, channel sampling of all active and non-active artisanal mines/workings, outcrops, 3D geological/DTM/topographic modelling and delineation of drill targets. The Company plans on conducting an airborne LiDAR survey to assist in building an accurate 3D model to advance the success of Max's planned drill program.

Max advises investors that the gold mineralization at the Marmato gold deposit and the Apollo porphyry zone may not necessarily by indicative of similar mineralization at the Mora Property. Max further advises the QP has been unable to verify the information on Marmato and Guayabales and that the information is not necessarily indicative to the mineralization on the Mora Property.

Figure 2. Drone Video of Mora Gold Silver Property.

Cannot view this video? Visit:

https://www.youtube.com/watch?v=Ob-AFDysVwo

Table 1. Highlight Assay Results for 2012² and 2025 Field Investigations. Surface samples collected from San Juan and NAN by their nature are selective samples and may not be indicative of underlying mineralization.

| UTM | Gold | Silver | Sample Type | ID |

| San Juan Sector - 2012² | ||||

| 432432E/604753N | 45.0 g/t | 7110 g/t | 1.0m channel | 6 |

| 431876E/604452N | 36.7 g/t | - | 2.0m channel | 1 |

| 430940E/604972N | 32.0 g/t | 52.8 g/t | 1.0m channel | 20 |

| 432445E/604726N | 27.0 g/t | 732 g/t | 1.0m channel | 7 |

| 431090E/602782N | 8.9 g/t | 75.3 g/t | 1.5m channel | 22 |

| 432243E/604575N | 1.6 g/t | 72.6 g/t | 0.3m channel | 15 |

| 431822E/604471N | 1.2 g/t | 877 g/t | 1.0m channel | 19 |

| San Juan Sector - 2025 | ||||

| 432304E/604822N | 10.2 g/t | 211 g/t | Grab | G503870 (1) |

| 432473E/604945N | 3.3 g/t | 87 g/t | 1.0m channel | G503866 (2) |

| 431884E/604446N | 2.6 g/t | 45 g/t | 1.0m channel | G503869 (3) |

| Nan Prospect - 2025 | ||||

| 435336E/603379N | 21.4 g/t | 156 g/t | 1.0m channel | G503857 (4) |

| 435238E/603393N | 1.6 g/t | 22 g/t | 1.0m channel | G503862 (5) |

Sierra Azul Copper-Silver Project in Colombia

Max's wholly owned Sierra Azul Copper-Silver Project sits along the Colombian portion of the world's largest producing copper belt (Andean belt), covering three significant Districts (AM, Conejo, URU) spanning over 120 km of strike. The Project is adjacent to major infrastructure resulting from mining operations, including Cerrejón, the largest coal mine in South America, held by global miner Glencore.

In addition, Sierra Azul is fully funded via global miner Freeport-McMoRan Inc. (NYSE: FCX) funding cumulative expenditures of C

Significant events include the AM-13 and AM-15 discoveries which host Manto-style mineralization and alteration, similar to deposits in the Tocopilla - Taltal region of northern Chile, where a mineralized corridor extends over 100-km and hosts several economic deposits, including Mantos Blancos (*500mt at

1.8% copper and 7.2 g/t silver over 48m1.0% copper and 5.7 g/t silver over 26.0m1.1% copper and 4.3 g/t silver over 9.0m

Max cautions investors copper-silver mineralization at Mantos Blancos is not necessarily indicative of similar mineralization at Sierra Azul. *Reference: https://www.researchgate.net/publication/40884036_The_Mantos_Blancos_copper_deposit_An_upper_Jurassic_breccia-style_hydrothermal_system_in_the_Coastal_Range_of_Northern_Chile

Figure 3. Drone Video of the AM-13 and AM-15 Discoveries.

Cannot view this video? Visit:

https://www.youtube.com/watch?v=Kf_I9GAFLZE

Florália High-Grade Iron Property in Brazil

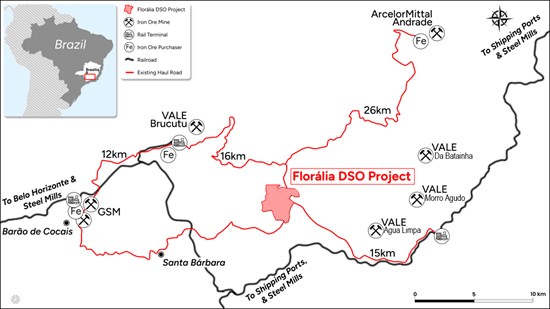

The Florália Iron Property (mineral right 832.022/2018) is located in Minas Gerais, Brazil's largest iron ore and steel producing State. Most importantly, the Property has established road access to rail terminal (15 km) linking to steel mills and shipping ports; roads connect to buyers Vale (16 km) and ArcelorMittal (26 km) ensuring efficient logistics and market access (refer to Figure 4). Max's technical team has significantly expanded the Florália Iron Geological Target from 8-12Mt at

Max cautions investors the potential quantity and grade of the iron ore is conceptual in nature, and further cautions there has been insufficient exploration to define a mineral resource and Max is uncertain if further exploration will result in the geological target being delineated as a mineral resource. Hematite mineralization tonnage potential estimation is based on in situ high-grade outcrops and interpreted and modelled magnetic anomalies. Density value used for the estimate is 2.8t/m³. Hematite sample grades range between 55

Florália is to be fully funded through a proposed option to purchase by Bolt Metals Corp (CSE: BOLT) who will issue an aggregate of 32,294,679 common shares to MAX. Completion of the transaction remains subject to satisfactory due diligence, definitive documentation, and applicable regulatory approvals. To date, Bolt have expended in excess of USD

Figure 4. Florália Property located nearby infrastructure and markets.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/279049_a0c7b9cd34470ac6_005full.jpg

Mora Quality Assurance

Max adheres to a strict QA/QC program for sample handling, sampling, sample transportation and analyses. All 21 rock samples were taken by the Max consulting geologist, labelled, placed in sealed, securitized bags and shipped to ALS Lab's sample preparation facility in Medellin, Columbia. ALS Medellin is an ISO 9001: 2008 certified facility and is independent of Max. All samples were analyzed using ALS procedure ME-ICP61, a four-acid digestion with inductively coupled plasma finished. Over-limit gold is determined by ALS procedure Au-GRA21 a 30-gram fire assay with a gravimetric finish. Over-limit silver, lead, arsenic and zinc were determined by ALS procedure OG-62, a four-acid digestion with an atomic absorption spectroscopy finish.

At this early stage of exploration, Max has relied on the QA/QC protocol's employed by ALS.

Qualified Person

The Company's disclosure of a technical or scientific nature in this news release was reviewed and approved by Tim Henneberry, P.Geo (British Columbia), a member of the Max Resource advisory board, who serves as a qualified person under the definition of National Instrument 43-101.

Table 2. References.

| Name | Highlights | Reference |

| News Release² Dec 20, 2012 | Crown Gold Corp. Mora Property | Scott Franko, senior consultant to Crown Gold and a registered Professional Geologist was designated as the Qualified Person under NI 43:101 for the Colombian Mining Project |

| Marmato Gold Deposit¹ | Aris Mining | https://aris-mining.com/operation/reserves-and-resources/ |

| P&P Reserve: 31.28Mt at 3.16 g/t Au for 3.178Mozs | ||

| M&I Resources: 61.50Mt at 3.03 g/t Au for 5.997Mozs | ||

| Inferred Resource: 35.60Mt at 2.43 g/t Au for 2.787Mozs |

For more information, visit on Max Resource: https://www.maxresource.com/

For additional information, contact:

| Tim McNulty | E: info@maxresource.com T: (604) 290-8100 |

| Brett Matich | T: (604) 484 1230 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law.

Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. There are no assurances that the commercialization plans for Max Resources Corp. described in this news release will come into effect on the terms or time frame described herein.

The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedarplus.ca.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/279049