Max Resource Secures Ex-Collective Mining's Technical and Logistical Team Leaders, Reuniting Key Management for Its Mora Gold-Silver Project in Colombia

Rhea-AI Summary

Max Resource Corp (OTC:MXROF) has strengthened its technical team by appointing Sergio Cocunubo as Head Geologist, reuniting with Technical Advisor Dr. Chris Grainger and Community Relations specialist John Henao. All three were key members of the Collective Mining and Continental Gold team that developed the Buritica Au-Ag deposit, which was sold to Zijin Mining for US $1.4 billion.

The team will lead exploration of the newly acquired Mora Gold-Silver Project in Colombia's Marmato Gold District. The property features over 40 historic workings, 5 active mines, and polymetallic structures spanning 2,500m by 1,000m. Notable channel sample results include 45.0 g/t gold & 7,110 g/t silver over 1.0m. The project is strategically located adjacent to Aris Mining's 9.2Moz Marmato Gold Operation and Collective Mining's Guayabales Project.

Max has initiated a two-phase exploration program, including geological and geophysical data collection, channel sampling, and ground gravity surveys to delineate drilling targets.

Positive

- Appointment of three highly experienced mining executives with proven track record of billion-dollar project development

- Strategic location adjacent to major gold operations including Aris Mining's 9.2Moz Marmato Gold Operation

- High-grade sampling results including 45.0 g/t gold & 7,110 g/t silver over 1.0m

- Property features over 40 historic workings and 5 active mines indicating significant mineralization potential

Negative

- Significant payments required to complete acquisition: total of $8.4 million in staged payments

- Property is largely unexplored with limited historical data

- 3% net smelter royalty commitment on future production

News Market Reaction – MXROF

On the day this news was published, MXROF gained 19.38%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - September 17, 2025) - MAX RESOURCE CORP. (TSXV: MAX) (OTC Pink: MXROF) (FSE: M1D2) ("Max" or the "Company") is pleased to report the new appointment of Mr. Sergio Cocunubo as Head Geologist, reuniting with key Technical Advisor Dr. Chris Grainger and Community Relations specialist Mr. John Henao, all key members of the Collective Mining and the Continental Gold team that developed the Buritica Au-Ag deposit, sold to Zijin Mining for US

Highlights:

- Mr. Cocunubo, the newly appointed Head Geologist has extensive experience along Colombia's productive Cauca Belt including the role of Senior Exploration Geologist for Collective Mining's (TSX: CNL) (NYSE: CNL) neighbouring Guayabales Project.

- Mr. Cocunubo reunites with Co-Founder of Collective Mining, Dr. Grainger who acts as Technical Advisor.

- In addition, he reunites with Collective Mining's Community Relations and Logistics specialist, Mr. John Henao acts in this same role for Max.

"We are please to have these 3 strategic individuals who have played such vital roles in developing the most active and valued precious metals belt in Colombia. Their addition as key members of the Max team is a testament to the potential that Max sees as we advance the newly acquired Mora Project," says Max CEO Brett Matich.

"The Mora Property lies in the heart of the Marmato District, directly south of Collective Mining's Guayabales Project abutting the western and southern boundaries and Aris Mining's Marmato Operations abuts along the 2.8 km eastern boundary. Mr. Cocunubo's unique tie to the Marmato District, subsequent experience and expertise at Guayabales will no doubt add immense value to the Company and its Shareholders," he concluded.

"I am excited to be heading the exploration and development of the Mora Property, where there has been primitive to limited exploration to date. The Marmato-gold-silver-type potential is confirmed by the extensive series of exposed mineralized "polymetallic" veins together with numerous historic and active artisanal underground mines," says Max Head Geologist Sergio Cocunubo.

"In addition, Aris Mining's Marmato Operations have recently confirmed the discovery of high-grade porphyry environment at depth, which together with porphyry-type environment characteristics of Collective Mining's Guayabales Project, increases the probability of the existence of the same type of mineralizing environment within the Mora Property, since these systems are typically generated in clusters," he concluded.

Cannot view this video? Visit:

https://www.youtube.com/watch?v=Ob-AFDysVwo

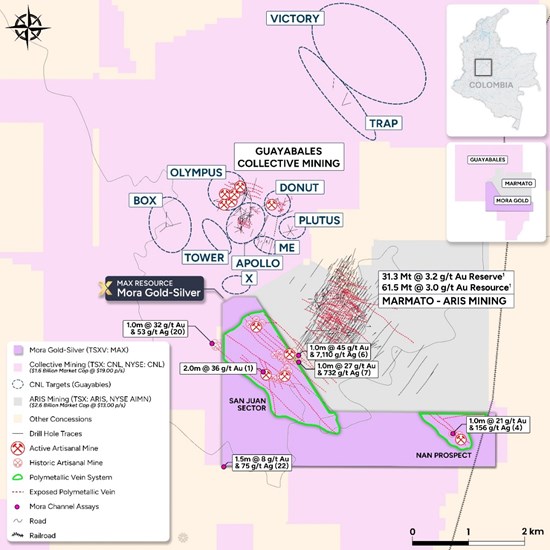

Figure 1: Polymetallic Structures, Mines, Assays, Marmato (2012¹), Apollo Discovery.

https://www.maxresource.com/images/gallery/MAX_Mora-Gold-Silver_Maps-&-Figures_167.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/266785_6b959be72420f8a4_002full.jpg

Mr. Cocunubo holds a Masters' Degree in Economic Geology with a specialization on Mining Exploration from the Universidad Católica del Norte de Chile and Degree in Engineering Geology, with technical training and analytical capacity to solve complex problems in geosciences from the Pedagogical and Technological University of Colombia (2013).

In Colombia, he previously acted as exploration geologist for AngloGold Ashanti on Nuevo Chaquiro (6.1Mozs Au, 85Mozs Ag, 3.9Mt Cu, Resources: 604Mt @

Dr. Grainger holds a BSc and PhD in Economic Geology from the University of Western Australia, where he was sponsored by Vale Brazil. His doctoral research focused on the Serra Pelada epigenetic Au-Pd-Pt deposit in Brazil. He is fluent in English and Portuguese and has an advanced level of proficiency in Spanish.

Notable career achievements in Colombia include: initial due diligence of the Continental Gold asset portfolio as VP of Exploration which included the world-class Buritica Au-Ag deposit acquired by Zijin Mining for US

Mr. Henao is a Technologist in Military Sciences with training in security, risk and strategic management. He specializes in negotiation, intelligence and community management in exploration projects. He was responsible for Community Relations and Logistics for Continental Gold, Collective Mining and acts in the same role for the Max.

Discussion of the Mora Gold-Silver Project

Highlights

- The undrilled Mora Property encompasses over 40 historic workings, 5 active mines, a series of exposed polymetallic structures over 2,500m by 1,000m, adjacent to Aris Mining's (TSX: ARIS) (NYSE: AIMN) 9.2Moz Marmato Gold Operation (P&P Reserves: 31.3Mt @ 3.2 g/t Au for 3.2Mozs, M&I Resources: 61.5Mt @ 3.0 g/t Au for 6.0Moz, Inferred Resources: 35Mt at 2.4 g/t Au for 2.8Mozs ¹).

- Aris Mining's Marmato Property abuts the 2.8 km eastern boundary, and Collective Mining's (TSX: CNL) (NYSE: CNL) Guayabales Project abuts along 3.7 km north (Apollo Porphyry System), west, south, and vertical east boundaries of the Mora Property.

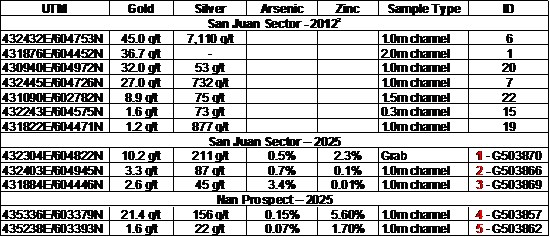

- Highlight, Mora Gold-Silver Property channel sample results include (refer to Table 1)

- 45.0 g/t gold & 7,110 g/t silver over 1.0m; 32.0 g/t gold & 53 g/t silver over 1.0m.

- 27.0 g/t gold & 732 g/t silver over 1.0m; 8.9 g/t gold & 75 g/t silver over 1.5m.

Max advises investors that the gold mineralization at the Marmato gold deposit and the Apollo porphyry zone may not necessarily by indicative of similar mineralization at the Mora Property. Max further advises the QP has been unable to verify the information on Marmato and Guayabales and that the information is not necessarily indicative to the mineralization on the Mora Property.

The geology exposed at Marmato appears very similar in character to Mora, and can be considered analogous, due to its close proximately and geological similarities, including the same type: a) host rocks, b) structural trends, c) styles of mineralization, and d) types of alteration. These are all key characteristics of the world class bulk tonnage porphyry-related gold deposits of the Cauca Gold Belt.

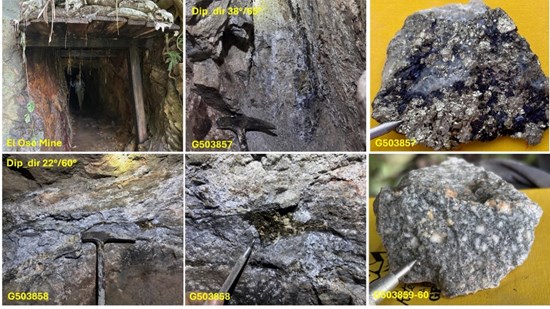

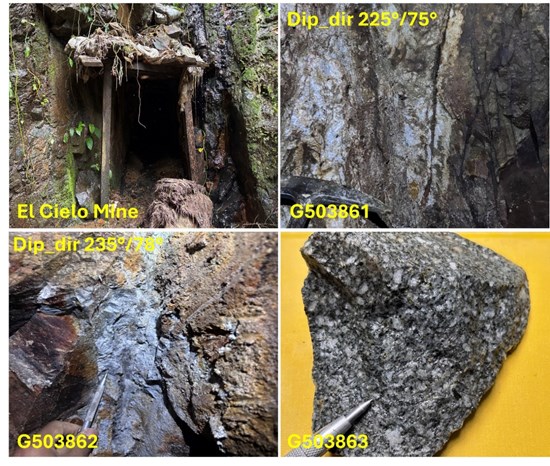

In April 2025, a 2-day reconnaissance visit was conducted by a geological consultant, on behalf of the Company. Investigation of the San Juan Sector in the northern portion of the Mora Property, confirmed a series of NW to SE striking polymetallic sub-parallel mineralized structures along over 2,500m of strike, dipping to the SW, across a width of 1,500m SW to NE. Over 40 historic workings and 5 active artisanal gold mines were noted. The polymetallic mineralized structures clearly cross the eastern boundary towards the Marmato Gold Operations.

The Nan Prospect in the lower SE corner of the Mora Property, identified one east to west polymetallic mineralized structure dipping to the south and two other polymetallic structure's running NW to SE dipping NE crossing across the boundary trending to Marmato (refer to Table 1).

Historical Work

The mining and exploration on the Mora Property has been primitive and limited to date. The only recorded exploration and mining consists over 40 historic workings and active artisanal mines, with the exception of a report documenting a field visit in 2012 for Crown Gold Corp².

The author identified numerous high-grade gold and silver sulphide veins exploited by artisanal miners on both Marmato and the Mora Title (Property). His comments include:

"There is no question that the geology of Marmato continues across the Mora title (KK6-08031) boundary in the region of San Juan. Gran Colombia states that their deposit (Marmato) is open and continues at depth and to the west and south, both areas are within in the Mora title (Property)."

In addition, the Crown Gold Corp. news release, dated December 20, 2012² stated:

"During a visit in November, Crown gained access to, and channel sampled, 7 of the 40 adits which it has located to date, on the Mora Property. A total of 7 channels were cut in these 7 adits and all samples returned gold and silver values. The weighted average value of gold was 13.2 g/t over 5.9m sampled, while the weighted average value of silver was 1,647 g/t.

"Sampling to date has been concentrated within 1-km² block (San Juan Sector) of the 7-km² Mora Property. There appears to be a series of mineralized "polymetallic" veins running through the Mora Property, similar mineralization to Gran Colombia's Marmato gold deposit, which lies adjacent east side of the Mora Property.

"The Marmato property has a 43:101 measured and indicated resource of over 11.7Mozs of gold and 80Mozs of silver to vertical depth of 400m. In addition, recent drilling at Marmato has revealed high grade mineralization extending a further 700m below the present resource."

The Company's 2025 exploration program is now underway:

- Phase 1: collect geological and geophysical data, channel sample all active and historical underground shafts (represent as drill holes), outcrops, airborne LiDAR and magnetic, 3D geological/DTM/topographic modelling.

- Phase 2: ground gravity surveys and delineate drilling targets.

Table 1: Highlight Assay Results for 2012² and 2025 Field Investigations.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/266785_6b959be72420f8a4_003full.jpg

Figure 2. El Oso Gold-Silver Mine located within the Mora Title.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/266785_6b959be72420f8a4_004full.jpg

Figure 3. El Cielo Gold-Silver Mine located within the Mora Title.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/266785_6b959be72420f8a4_005full.jpg

| Name | Highlights | Reference |

| News Release Dec 20, 2012 | Crown Gold Corp. (TSXV: CWN) Mora Property | Scott Franko, senior consultant to Crown Gold and a registered Professional Geologist was designated as the Qualified Person under NI 43:101 for the Colombian Mining Project |

| Marmato Gold Deposit¹ | Aris Mining (TSX: ARIS) (NYSE: AIMN) | https://aris-mining.com/operation/reserves-and-resources/ |

| P&P Reserve: 31.28Mt at 3.16 g/t Au for 3.178Mozs | ||

| M&I Resources: 61.50Mt at 3.03 g/t Au for 5.997Mozs | ||

| Inferred Resource: 35.60Mt at 2.43 g/t Au for 2.787Mozs | ||

| Guayabales Project² | Collective Mining (TSX: CNL) (NYSE: CNL) | https://collectivemining.com/ |

| Apollo: 497m at 3.0 g/t AuEq. | ||

| Trap: 632m at 1.1 g/t AuEq. | ||

| Plutus: 301m at 3.0 g/t AuEq. | ||

| Ramp: 75m at 8.0 g/t Au | ||

| ME: 111m at 1.0 g/t AuEq. | ||

| Buriticá Gold Deposit³ | Zijin Mining - Continental Gold | https://www.zijinmining.com/global/program-detail-71741.htm |

| P&P Reserve: 3.8Mozs at 6.9 g/t Au&13Mozs at 24 g/t Ag in 15.61Mt | ||

| M&I Resource: 4.4Mozs at 8.9 g/t Au&14.6Mozs at 29 g/t in 14.02Mt | ||

| Inf. Resource: 5.1Mozs at 8.9 g/t Au&18Mozs at 29 g/t Ag in 16.2Mt | ||

| Nuevo Chaquiro Deposit• | AngloGold Ashanti (NYSE: AU) Resource: 604Mt @ | https://portergeo.com.au/database/mineinfo.php?mineid=mn1501 |

| Alacran Depositº | Cordoba Minerals Resource: 99.456Mt at | https://wp-cordobaminerals2024.s3.ca-central-1.amazonaws.com/media/2024/08/Cordoba_-_tech_report_-_feasibility_study_-_Alacran.pdf |

Table 2. References.

Terms of the Purchase Agreement

Under the terms of the Purchase Agreement (the "Agreement"), the Company's wholly owned Colombian subsidiary Maximum Company Colombia S.A.S. ("Maximum") has the exclusive rights to earn up to

The Purchase Period;

Under certain conditions prior to Maximum initiating the Purchase Period, Maximum shall be entitled to acquire the Mora Title, rather than Villamora, under the same terms and conditions. The Company committed to

Qualified Person

The Company's disclosure of a technical or scientific nature in this news release was reviewed and approved by Tim Henneberry, P.Geo (British Columbia), a member of the Max Resource advisory board, who serves as a qualified person under the definition of National Instrument 43-101.

About Max Resource Corp.

Max's wholly owned Sierra Azul Copper-Silver Project sits along the Colombian portion of the world's largest producing copper belt (Andean belt), with world-class infrastructure and the presence of global majors (Glencore and Chevron). Max has an Earn-In Agreement ("EIA") with Freeport-McMoRan Exploration Corporation ("Freeport"), a wholly owned affiliate of Freeport-McMoRan Inc. relating to the Sierra Azul Project. Under the terms of the EIA, Freeport has been granted a two-stage option to acquire up to an

Max Iron Brazil's wholly owned Florália Hematite DSO Project is located 67-km east of Belo Horizonte, Minas Gerais, Brazil's largest iron ore and steel producing State. Max's technical team has significantly expanded the Florália Hematite DSO Geological Target from 8-12mt at

Max cautions investors the potential quantity and grade of the iron ore is conceptual in nature, and further cautions there has been insufficient exploration to define a mineral resource and Max is uncertain if further exploration will result in the geological target being delineated as a mineral resource. Hematite mineralization tonnage potential estimation is based on in situ high-grade outcrops and interpreted and modelled magnetic anomalies. Density value used for the estimate is 2.8t/m³. Hematite sample grades range between 55

For more information, visit on Max Resource: https://www.maxresource.com/

For additional information, contact:

Tim McNulty E: info@maxresource.com T: (604) 290-8100

Rahim Lakha E: rahim@bluesailcapital.com

Brett Matich T: (604) 484 1230

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law.

Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. There are no assurances that the commercialization plans for Max Resources Corp. described in this news release will come into effect on the terms or time frame described herein.

The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedarplus.ca.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/266785