Novagold Reports High-Grade Drill Results and Receives Positive Decision From Alaska Supreme Court

Rhea-AI Summary

Novagold (NYSE American: NG) reported final assay results from the 2025 Donlin Gold drill program and received a favorable Alaska Supreme Court decision on key state permits on November 14, 2025. The 2025 program returned high‑grade intercepts including 26.22 g/t Au over 4.38 m and other intervals up to 41.09 m at 3.06 g/t, supporting inputs for a Bankable Feasibility Study (BFS) planned to commence by Q1 2026. Donlin Gold was accepted into the federal FAST‑41 permitting program on October 27, 2025, and the Alaska Supreme Court affirmed the project’s water rights and State right‑of‑way lease for the proposed 316‑mile natural gas pipeline. The company issued the BFS RFP, received proposals, and continues QA/QC and technical reporting work ahead of BFS selection.

Positive

- Intercept of 26.22 g/t Au over 4.38 m

- Interval of 41.09 m at 3.06 g/t Au

- Accepted into FAST‑41 on October 27, 2025

- Alaska Supreme Court affirmed water rights and State ROW

- Drill program supported by ~80 locally hired staff

- BFS procurement underway; proposals received for selection

Negative

- Supplemental EIS ordered by court may extend federal timeline

- ADEC 401 Certification appeal remains pending in Alaska Supreme Court

- BFS not yet awarded; engineering firm selection still outstanding

News Market Reaction – NG

On the day this news was published, NG gained 6.21%, reflecting a notable positive market reaction. Our momentum scanner triggered 5 alerts that day, indicating moderate trading interest and price volatility. This price movement added approximately $207M to the company's valuation, bringing the market cap to $3.54B at that time.

Data tracked by StockTitan Argus on the day of publication.

- Final Assay Results Yield Additional High-Grade Gold Intercepts: The 2025 Donlin Gold drill program delivered high-grade intercepts, across multiple zones, including standout intervals up to 26.22 g/t gold, further supporting its position as one of the largest and highest-quality gold projects globally.

- Alaska Supreme Court Upholds Key State Permits: The Court affirmed Donlin Gold’s water rights for the mine and State Right-Of-Way (“State ROW”) lease for its proposed natural gas pipeline, validating the State of Alaska’s rigorous review and enabling the project to move forward responsibly.

- Federal Permits in Hand with Acceptance into the Fixing America’s Surface Transportation Act (FAST-41): The FAST-41 enhances transparency, accountability, and predictability in Donlin Gold’s supplemental federal permitting process.

VANCOUVER, British Columbia, Nov. 25, 2025 (GLOBE NEWSWIRE) -- NOVAGOLD RESOURCES INC. (“NOVAGOLD” or the “Company”) (NYSE American, TSX: NG) is pleased to announce the final assay results from the 2025 Donlin Gold drill program, marking a significant milestone in the advancement of what is anticipated to be America’s largest gold mine. Additionally, NOVAGOLD achieved two significant permitting milestones with the acceptance of Donlin Gold into the Federal Permitting Improvement Steering Council’s FAST-41 program — an important step to ensure a transparent, accountable, and predictable process for conducting the supplemental environmental analysis requested by the U.S. District Court for the District of Alaska — and a favorable ruling from the Alaska Supreme Court affirming both the project’s water rights and the Department of Natural Resources’ approval of the State ROW lease for the proposed 316-mile natural gas pipeline.

“To date, the drilling at Donlin has yielded terrific results,” said Greg Lang, NOVAGOLD’s President and CEO. “The 2025 drill program continues to exceed expectations and provide key data points for the Bankable Feasibility Study (BFS), which is expected to commence by the first quarter of 2026. With consistent high-grade intercepts, acceptance into the FAST-41 program, and a decisive legal win in Alaska, Donlin Gold is advancing with remarkable determination. These milestones not only validate the extraordinary quality of the asset and demonstrate the strength of our team, but also provide the momentum needed to support the next phase of development. The progress we have made — both technically and on the permitting front — positions Donlin Gold as a standout project in the global gold sector.”

Most Recent Drill Program Solidifies Donlin Gold’s Path to BFS

The 2025 Donlin Gold drill program was expanded to support the updated resource model and advance the BFS, reinforcing the project’s long-term development strategy. Work centered on three key areas: grid drilling to refine mine-planning inputs; in-pit exploration drilling to strengthen geological modelling and resource conversion; and geotechnical drilling, including pit wall and material site assessments for the planned access road — all essential to the BFS.

Supported by a team of about 80 locally hired staff and external contractors, the 2025 drill program intersected multiple zones of high-grade gold mineralization. The findings contribute vital inputs for engineering work, mine planning, and resource modelling — marking an important milestone on the Company’s path to a BFS.

The top five intervals from the final set of 2025 assays include:

- DC25-2262 intersected 41.09 m grading 3.06 g/t gold starting at 387.96 m drilled depth. The true width of mineralization across this interval is estimated to be 35.87 m. 1

- DC25-2262 intersected 21.03 m grading 4.51 g/t gold starting at 354.09 m drilled depth. The true width of mineralization across this interval is estimated to be 18.16 m.

- DC25-2275 intersected 4.38 m grading 26.22 g/t gold starting at 165.95 m drilled depth. The true width of mineralization across this interval is estimated to be 3.15 m.

- DC25-2263 intersected 27.43 m grading 4.14 gold starting at 381.17 m drilled depth. The true width of mineralization across this interval is estimated to be 17.72 m.

- DC25-2267 intersected 13.89 m grading 7.08 g/t gold starting at 442.67 m drilled depth. The true width of mineralization across this interval is estimated to be 12.87 m.

________________________

1 True width of intercepts has been estimated based on the latest geological model and it is subject to refinement as additional data becomes available. Except where specifically disclosed, the true width of intercepts is unknown at this stage.

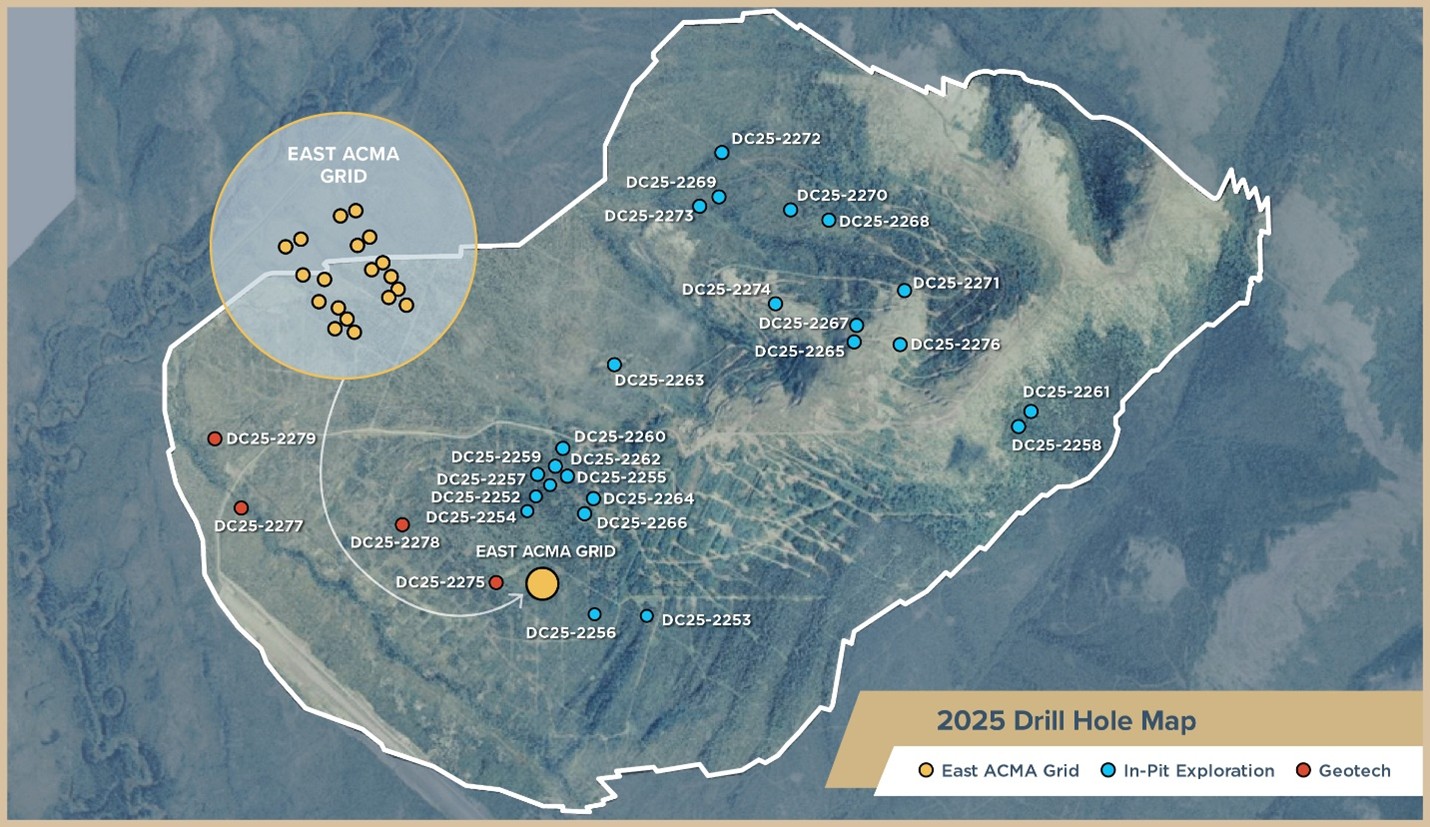

Figure 1 — Donlin Gold Drill Hole Collar Locations

The figure shows the drill hole collar locations of the 2025 program. The drill hole orientations, depths and significant intervals are shown at the end of this release in Tables 1 and 2 of the Appendix.

The program included 19 infill holes in the previously drilled East ACMA grid (2021) totaling 5,079 meters, aimed at verifying short scale continuity of mineralization and improving resource confidence and key inputs for mine planning.

In-pit exploration comprised 24 holes totaling 10,370 meters, targeting areas of the pit containing Inferred Resources with the potential to be converted to Indicated Resources.

Geotechnical drilling comprised four holes totaling 2,607 meters for pit wall stability analysis and mine design, and an additional 26 holes totaling 399 meters of drilling on the material sites for construction of the access road from the Jungjuk port on the Kuskokwim River to Donlin Gold. All drilling was conducted using core methods to ensure precision and high-quality geological data.

Federal FAST-41 Designation

On October 27, 2025, Donlin Gold was formally accepted into the FAST-41 program, a federal initiative that enhances transparency, accountability, and predictability in the federal permitting process. Established in 2015, FAST-41 ensures that permitting timelines are clearly defined, publicly available and coordinated among federal agencies, while maintaining every existing environmental safeguard and regulatory requirement. This designation is expected to result in a more efficient permitting timeline and reflects the strategic importance of Donlin Gold as a responsible and key economic development project in Alaska.

“We’re grateful to the Permitting Council for including Donlin Gold in the FAST-41 program,” said Todd Dahlman, Donlin Gold’s General Manager. “This milestone brings us one step closer to responsibly advancing the project through this improved federal coordination program, with its predictable permitting timelines and improved public transparency.”

As part of the acceptance, Donlin Gold is now listed on the Federal Permitting Dashboard in connection with the project’s Supplemental Environmental Impact Statement (SEIS). In 2025, the U.S. Alaska District Court directed the U.S. Army Corps of Engineers (USACE) and the Bureau of Land Management (BLM) to supplement the current Environmental Impact Statement with an analysis of a larger theoretical tailings dam release, while leaving Donlin Gold’s federal permits in place. As part of the ongoing federal review, the USACE, in consultation with BLM, will lead the SEIS process to conduct this analysis. This transparent, science-based review is designed to provide both the public and decision-makers with complete and accurate information. While most projects that are accepted into FAST-41 program are at the initial stages of permitting, Donlin Gold has been deeply engaged in permitting for over a decade and has received most of its state and federal permits. Donlin’s inclusion in the FAST-41 program is focused on ensuring a transparent, accountable, and predictable process for the federal agencies’ supplemental environmental analysis requested by the Court.

Alaska Supreme Court Decision

On November 14, 2025, Donlin Gold welcomed the Alaska Supreme Court’s decision affirming both the project’s water rights permits for the mine and the Department of Natural Resources’ approval of the State’s ROW for the state-owned lands portion of the proposed 316-mile natural gas pipeline. The ruling validates the State of Alaska’s thorough review process and reinforces that the project can move forward in a manner that safeguards the lands, waters, and communities of the Yukon-Kuskokwim and southcentral regions.

We continue to support the State of Alaska in defending the Department of Environmental Conservation’s (ADEC) Clean Water Act Section 401 Water Quality Certification (“401 Certification”), which is the only remaining challenge to Donlin Gold’s permits in state court. On May 6, 2025, the Alaska Superior Court upheld ADEC’s issuance of the 401 Certification. Earthjustice filed an appeal in the Alaska Supreme Court and filed their opening brief on September 16, 2025. Donlin Gold’s and the State of Alaska’s briefs are due before year-end.

Bankable Feasibility Study Update

The Request for Proposals for the BFS work was issued in the third quarter to engineering firms with the expertise to deliver a project of this scale. Proposals were received last month, and Donlin Gold remains on track to select a top-tier engineering firm to lead the BFS in the coming months. The comprehensive data generated from this year’s drill program will further strengthen the foundation to be used for mine planning, engineering, and resource modelling.

Alaska’s Regional Energy Synergies

As evidenced by the recent announcement in Washington, D.C. of a strategic alliance between Glenfarne Alaska LNG, LLC (“Glenfarne”) and Baker Hughes to advance the Alaska LNG Project, momentum is steadily growing for the development of Alaska’s energy infrastructure.2 These advancements will strengthen Alaska’s energy independence and offer potential long-term benefits that would improve access to locally sourced, affordable fuel for energy for Donlin Gold.

QA/QC Procedures

The QA/QC procedures for the 2025 Donlin Gold project drill program and sampling protocol were developed and managed by Donlin Gold and overseen by NOVAGOLD. The chain of custody from the drill site to the sample preparation facility was continuously monitored. All samples are HQ-diameter core. Approximately

Downhole directional surveys were completed on all reported holes by Boart Longyear drill operators, and collar surveys were completed by Donlin Gold staff under the supervision of Professional Licensed Surveyors from Brice Engineering LLC.

Each of Bureau Veritas, ALS Limited, Boart Longyear, and Brice Engineering LLC are independent of Donlin Gold and NOVAGOLD.

________________________

2 See media release dated November 10, 2025, titled “Glenfarne, Baker Hughes Announce Definitive Agreements to Advance Alaska LNG”.

Scientific and Technical Information

Certain scientific and technical information contained herein with respect to the Donlin Gold project is derived from the report titled “NI 43-101 Technical Report on the Donlin Gold Project, Alaska, USA” with an effective date of June 1, 2021 (the “2021 Technical Report”) and the report titled “S-K 1300 Technical Report Summary on the Donlin Gold Project, Alaska, USA” (the “S-K 1300 Technical Report Summary”). The Company has retained Wood to prepare interim updates to these technical reports by the first quarter of 2026, which will satisfy regulatory requirements while the BFS is in progress.

Henry Kim, P.Geo., Senior Resource Geologist, Wood Canada Limited; Mike Woloschuk, P.Eng., VP Global Business Development & Consulting, Wood Group USA, Inc.; and Kirk Hanson, MBA, P.E., Technical Director, Open Pit Mining, Wood Group USA, Inc. are the Qualified Persons responsible for the preparation of the 2021 Technical Report, and each is an independent Qualified Person as defined by NI 43-101 and S-K 1300.

Paul Chilson, P.E., Manager of Mine Engineering for NOVAGOLD and a Qualified Person under NI 43-101 and S-K 1300, has approved the scientific and technical information related to the 2025 Donlin Gold project drill programs, the 2021 Technical Report and the S-K 1300 Technical Report Summary contained in this media release and has verified the data disclosed regarding the 2025 Donlin Gold project drill programs. To verify the information related to the drilling programs, he has visited the property in the past year; discussed logging, sampling, and sample shipping processes with responsible site staff; discussed and reviewed assay and QA/QC results with responsible personnel; and reviewed supporting documentation, including drill hole location and orientation and significant assay interval calculations.

About NOVAGOLD

NOVAGOLD is a well-financed precious metals company focused on the development of the Donlin Gold project in Alaska, one of the safest mining jurisdictions in the world. With approximately 39 million ounces of gold in the Measured and Indicated Mineral Resource categories (541 million tonnes at an average grade of approximately 2.24 grams per tonne, in the Measured and Indicated Mineral Resource categories on a

NOVAGOLD Contacts:

Mélanie Hennessey

Vice President, Corporate Communications

Frank Gagnon

Manager, Investor Relations

604-669-6227 or 1-866-669-6227

info@novagold.com

www.novagold.com

________________________

3 Donlin Gold data as per the 2021 Technical Report and the S-K 1300 Technical Report Summary dated November 30, 2021. Donlin Gold possesses Measured Resources of approximately 8 Mt grading 2.52 g/t and Indicated Resources of approximately 534 Mt grading 2.24 g/t, each on a

Cautionary Note Regarding Forward-Looking Statements

This media release includes certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation, including the United States Private Securities Litigation Reform Act of 1995. Forward- looking statements are frequently, but not always, identified by words such as “expects”, “continue”, “ongoing”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, “would” or “should” occur or be achieved. Forward-looking statements contained in this media release are based on a number of material assumptions, including but not limited to the following, which could prove to be significantly incorrect: our ability to achieve production at Donlin Gold; the cost estimates and assumptions contained in the 2021 Technical Report and the S-K 1300 Technical Report Summary; estimated metal pricing, metallurgy, mineability, marketability and operating and capital costs, together with other assumptions underlying our resource and reserve estimates; our expected ability to develop adequate infrastructure and that the cost of doing so will be reasonable; assumptions that all necessary permits and governmental approvals will be obtained and the timing of such approvals; assumptions made in the interpretation of drill results, the geology, grade and continuity of our mineral deposits; our expectations regarding demand for equipment, skilled labor and services needed for exploration and development of mineral properties; our ability to improve our ESG initiatives and goals; and that our activities will not be adversely disrupted or impeded by development, operating or regulatory risks. Forward-looking statements are necessarily based on several opinions, estimates and assumptions that management of NOVAGOLD considered appropriate and reasonable as of the date such statements are made, are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results, activity, performance, or achievements to be materially different from those expressed or implied by such forward-looking statements. All statements, other than statements of historical fact, included herein are forward-looking statements. These forward-looking statements include statements regarding the anticipated use and benefits of the results of the 2025 Donlin Gold drill program; plans for and the estimated timing of the Donlin Gold BFS; our goals and planned activities for 2025; the potential development and construction of the Donlin Gold project; the timing and ability for the Donlin Gold project to hit critical milestones; Donlin Gold’s continued support for the state and federal permitting process and the expected benefits of the FAST-41 program; expected alignment with the Alaska LNG Project; the ability for the Donlin Gold development project to hit the anticipated projections; perceived merit of properties; mineral reserve and mineral resource estimates; plans to continue to advance the Donlin Gold project safely, responsibly and to sustainably generate value for our stakeholders; continued cooperation between the owners of Donlin Gold LLC to advance the project; the Company’s ability to deliver on its strategy with the Donlin Gold project, increasing the value of the project; the success of the strategic mine plan for the Donlin Gold project; the success of the Donlin Gold community relations plan; the anticipated outcome of exploration drilling at the Donlin Gold project and the timing thereof; and the completion of test work and modeling and the timing thereof, including expected production and mine life. In addition, any statement that refers to expectations, intentions, projections or other characterizations of future events or circumstances are forward-looking statements. Forward-looking statements are not historical facts but instead represent the expectations of NOVAGOLD management’s estimates and projections regarding future events or circumstances on the date the statements are made. Important factors that could cause actual results to differ materially from expectations include the need to obtain additional permits and governmental approvals; the timing and likelihood of obtaining and maintaining permits necessary to construct and operate; the need for additional financing to complete an updated feasibility study and to explore and develop properties; availability of financing in the debt and capital markets; disease pandemics; uncertainties involved in the interpretation of drill results and geological tests and the estimation of reserves and resources; changes in mineral production performance, exploitation and exploration successes; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices, expropriation or nationalization of property and political or economic developments in the United States or Canada; the need for continued cooperation between the owners of Donlin Gold LLC to advance the project; the need for cooperation of government agencies and Native groups in the development and operation of properties; risks of construction and mining projects such as accidents, equipment breakdowns, bad weather, disease pandemics, non-compliance with environmental and permit requirements, unanticipated variation in geological structures, ore grades or recovery rates; unexpected cost increases, which could include significant increases in estimated capital and operating costs; fluctuations in metal prices and currency exchange rates; whether or when a positive construction decision will be made regarding the Donlin Gold project; and other risks and uncertainties disclosed in NOVAGOLD’s most recent reports on Forms 10-K and 10-Q, particularly the “Risk Factors” sections of those reports and other documents filed by NOVAGOLD with applicable securities regulatory authorities from time to time. Copies of these filings may be obtained by visiting NOVAGOLD’s website at www.novagold.com, or the SEC’s website at www.sec.gov, or on SEDAR+ at www.sedarplus.ca. The forward-looking statements contained herein reflect the beliefs, opinions and projections of NOVAGOLD on the date the statements are made. NOVAGOLD assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

APPENDIX

TABLE 1

Drill Hole Orientations* and Depths

| Hole ID | Azimuth (°) | Inclination (°) | Depth (m) | |

| DC25-2231 | 333 | 62 | 252.14 | |

| DC25-2232 | 335 | 60 | 263.22 | |

| DC25-2234 | 332 | 62 | 247.16 | |

| DC25-2235 | 333 | 62 | 248.68 | |

| DC25-2236 | 332 | 61 | 239.32 | |

| DC25-2237 | 332 | 61 | 250.40 | |

| DC25-2238 | 332 | 59 | 230.05 | |

| DC25-2239 | 334 | 56 | 239.09 | |

| DC25-2241 | 333 | 59 | 88.25 | |

| DC25-2242 | 332 | 61 | 246.88 | |

| DC25-2243 | 333 | 60 | 254.57 | |

| DC25-2244 | 334 | 60 | 260.13 | |

| DC25-2245 | 333 | 61 | 248.30 | |

| DC25-2246 | 333 | 62 | 251.14 | |

| DC25-2247 | 334 | 59 | 236.65 | |

| DC25-2248 | 332 | 61 | 239.13 | |

| DC25-2249 | 333 | 61 | 236.88 | |

| DC25-2250 | 335 | 56 | 550.39 | |

| DC25-2251 | 330 | 62 | 244.48 | |

| DC25-2252 | 318 | 62 | 427.32 | |

| DC25-2253 | 333 | 71 | 521.51 | |

| DC25-2254 | 312 | 60 | 424.80 | |

| DC25-2255 | 313 | 70 | 423.98 | |

| DC25-2256 | 332 | 76 | 548.84 | |

| DC25-2257 | 315 | 75 | 437.13 | |

| DC25-2258 | 308 | 60 | 538.04 | |

| DC25-2259 | 318 | 74 | 462.47 | |

| DC25-2260 | 313 | 71 | 427.84 | |

| DC25-2261 | 307 | 61 | 594.56 | |

| DC25-2262 | 316 | 69 | 440.75 | |

| DC25-2263 | 304 | 71 | 416.34 | |

| DC25-2264 | 317 | 73 | 457.77 | |

| DC25-2265 | 310 | 65 | 548.35 | |

| DC25-2266 | 314 | 68 | 496.09 | |

| DC25-2267 | 312 | 64 | 498.46 | |

| DC25-2268 | 300 | 66 | 226.99 | |

| DC25-2269 | 318 | 64 | 368.20 | |

| DC25-2270 | 304 | 61 | 168.76 | |

| DC25-2271 | 305 | 60 | 546.62 | |

| DC25-2272 | 314 | 70 | 137.38 | |

| DC25-2273 | 316 | 64 | 325.20 | |

| DC25-2274 | 303 | 57 | 257.70 | |

| DC25-2275 | 214 | 59 | 656.68 | |

| DC25-2276 | 314 | 74 | 479.13 | |

| DC25-2277 | 224 | 53 | 643.01 | |

| DC25-2278 | 214 | 55 | 649.58 | |

| DC25-2279 | 236 | 67 | 646.20 |

* Note that azimuth and inclination values vary as each hole progresses. The stated values are hole averages, rounded to the nearest degree.

TABLE 2

2025 Donlin Gold Significant Assay Intervals

| Hole ID | Area | From (Meters) | To (Meters) | Length (Meters) | Au Grade (g/t) | |||||

| DC25-2231 | ACMA | 26.06 | 35.30 | 9.24 | 2.12 | Reported 9/8 | ||||

| DC25-2231 | 97.88 | 103.99 | 6.11 | 5.12 | Reported 9/8 | |||||

| DC25-2231 | 118.60 | 145.69 | 27.09 | 3.21 | Reported 9/8 | |||||

| DC25-2231 | 155.87 | 181.71 | 25.84 | 3.88 | Reported 9/8 | |||||

| DC25-2231 | 197.01 | 213.07 | 16.06 | 3.87 | Reported 9/8 | |||||

| DC25-2231 | TOTAL | 84.34 | 3.56 | |||||||

| DC25-2232 | ACMA | 73.52 | 78.73 | 5.21 | 5.63 | Reported 9/8 | ||||

| DC25-2232 | 138.99 | 149.70 | 10.71 | 4.61 | Reported 9/8 | |||||

| DC25-2232 | 154.22 | 164.50 | 10.28 | 2.01 | Reported 9/8 | |||||

| DC25-2232 | 179.90 | 199.36 | 19.46 | 6.80 | Reported 9/8 | |||||

| Including | 189.62 | 197.44 | 7.82 | 11.62 | Reported 9/8 | |||||

| DC25-2232 | 203.83 | 207.46 | 3.63 | 1.43 | Reported 9/8 | |||||

| DC25-2232 | 239.67 | 243.43 | 3.76 | 1.71 | Reported 9/8 | |||||

| DC25-2232 | 247.70 | 252.93 | 5.23 | 5.91 | Reported 9/8 | |||||

| DC25-2232 | TOTAL | 58.28 | 4.70 | |||||||

| DC25-2234 | ACMA | 70.46 | 77.90 | 7.44 | 4.75 | Reported 9/8 | ||||

| DC25-2234 | 117.13 | 120.45 | 3.32 | 6.05 | Reported 9/8 | |||||

| DC25-2234 | 132.09 | 166.60 | 34.51 | 5.14 | Reported 9/8 | |||||

| Including | 144.85 | 148.93 | 4.08 | 10.18 | Reported 9/8 | |||||

| DC25-2234 | 180.92 | 184.33 | 3.41 | 2.36 | Reported 9/8 | |||||

| DC25-2234 | 232.05 | 241.86 | 9.81 | 4.15 | Reported 9/8 | |||||

| DC25-2234 | TOTAL | 58.49 | 4.82 | |||||||

| DC25-2235 | ACMA | 17.05 | 21.13 | 4.08 | 2.20 | Reported 9/8 | ||||

| DC25-2235 | 97.47 | 105.96 | 8.49 | 1.60 | Reported 9/8 | |||||

| DC25-2235 | 116.13 | 143.05 | 26.92 | 3.22 | Reported 9/8 | |||||

| DC25-2235 | 148.65 | 162.44 | 13.79 | 2.21 | Reported 9/8 | |||||

| DC25-2235 | 167.23 | 173.43 | 6.20 | 4.78 | Reported 9/8 | |||||

| DC25-2235 | 192.27 | 220.88 | 28.61 | 2.72 | Reported 9/8 | |||||

| DC25-2235 | TOTAL | 88.09 | 2.81 | |||||||

| DC25-2236 | ACMA | 93.34 | 96.55 | 3.21 | 9.19 | Reported 9/8 | ||||

| DC25-2236 | 108.62 | 134.57 | 25.95 | 2.57 | Reported 9/8 | |||||

| DC25-2236 | 149.38 | 153.87 | 4.49 | 10.44 | Reported 9/8 | |||||

| DC25-2236 | 200.95 | 208.70 | 7.75 | 2.62 | Reported 9/8 | |||||

| DC25-2236 | TOTAL | 41.40 | 3.95 | |||||||

| DC25-2237 | ACMA | 30.19 | 55.51 | 25.32 | 4.18 | Reported 9/8 | ||||

| DC25-2237 | 67.95 | 74.55 | 6.60 | 3.31 | Reported 9/8 | |||||

| DC25-2237 | 105.44 | 114.30 | 8.86 | 3.63 | Reported 9/8 | |||||

| DC25-2237 | 125.50 | 153.60 | 28.10 | 4.56 | Reported 9/8 | |||||

| DC25-2237 | 194.66 | 198.60 | 3.94 | 3.74 | Reported 9/8 | |||||

| DC25-2237 | 218.69 | 228.12 | 9.43 | 1.64 | Reported 9/8 | |||||

| DC25-2237 | TOTAL | 82.25 | 3.87 | |||||||

| DC25-2238 | ACMA | 110.07 | 114.00 | 3.93 | 2.85 | Reported 9/8 | ||||

| DC25-2238 | 123.18 | 126.98 | 3.80 | 2.50 | Reported 9/8 | |||||

| DC25-2238 | 132.45 | 139.14 | 6.69 | 2.12 | Reported 9/8 | |||||

| DC25-2238 | 177.32 | 187.60 | 10.28 | 2.77 | Reported 9/8 | |||||

| DC25-2238 | TOTAL | 24.70 | 2.56 | |||||||

| DC25-2239 | ACMA | 33.72 | 44.72 | 11.00 | 5.33 | Reported 9/8 | ||||

| DC25-2239 | 116.38 | 147.47 | 31.09 | 5.05 | Reported 9/8 | |||||

| DC25-2239 | 158.63 | 161.83 | 3.20 | 1.19 | Reported 9/8 | |||||

| DC25-2239 | 172.49 | 179.74 | 7.25 | 3.56 | Reported 9/8 | |||||

| DC25-2239 | 200.04 | 209.18 | 9.14 | 3.84 | Reported 9/8 | |||||

| DC25-2239 | 215.20 | 243.54 | 28.34 | 1.29 | Reported 9/8 | |||||

| DC25-2239 | TOTAL | 90.02 | 3.52 | |||||||

| DC25-2241 | ACMA | 29.67 | 33.96 | 4.29 | 5.22 | Reported 9/8 | ||||

| DC25-2241 | 114.64 | 143.70 | 29.06 | 6.13 | Reported 9/8 | |||||

| Including | 136.40 | 142.39 | 5.99 | 21.33 | Reported 9/8 | |||||

| DC25-2241 | 150.60 | 154.24 | 3.64 | 10.79 | Reported 9/8 | |||||

| DC25-2241 | 160.28 | 175.59 | 15.31 | 3.81 | Reported 9/8 | |||||

| DC25-2241 | 193.41 | 220.46 | 27.05 | 2.30 | Reported 9/8 | |||||

| DC25-2241 | TOTAL | 79.35 | 4.54 | |||||||

| DC25-2242 | ACMA | 23.50 | 41.29 | 17.79 | 3.80 | Reported 9/8 | ||||

| DC25-2242 | 46.29 | 61.36 | 15.07 | 4.84 | Reported 9/8 | |||||

| DC25-2242 | 97.60 | 108.51 | 10.91 | 6.38 | Reported 9/8 | |||||

| DC25-2242 | 128.23 | 136.46 | 8.23 | 2.61 | Reported 9/8 | |||||

| DC25-2242 | 229.96 | 239.71 | 9.75 | 1.76 | Reported 9/8 | |||||

| DC25-2242 | TOTAL | 61.75 | 4.03 | |||||||

| DC25-2243 | ACMA | 93.60 | 108.26 | 14.66 | 3.80 | Reported 9/8 | ||||

| DC25-2243 | 125.70 | 136.95 | 11.25 | 2.10 | Reported 9/8 | |||||

| DC25-2243 | 147.79 | 158.90 | 11.11 | 1.66 | Reported 9/8 | |||||

| DC25-2243 | 167.25 | 172.54 | 5.29 | 2.29 | Reported 9/8 | |||||

| DC25-2243 | 187.05 | 198.17 | 11.12 | 1.79 | Reported 9/8 | |||||

| DC25-2243 | 202.45 | 212.53 | 10.08 | 2.93 | Reported 9/8 | |||||

| DC25-2243 | 219.15 | 228.99 | 9.84 | 1.11 | Reported 9/8 | |||||

| DC25-2243 | TOTAL | 73.35 | 2.32 | |||||||

| DC25-2244 | ACMA | 75.56 | 80.31 | 4.75 | 12.97 | Reported 9/8 | ||||

| DC25-2244 | 111.82 | 120.96 | 9.14 | 2.35 | Reported 9/8 | |||||

| DC25-2244 | 135.83 | 144.67 | 8.84 | 7.99 | Reported 9/8 | |||||

| DC25-2244 | 157.34 | 161.17 | 3.83 | 1.91 | Reported 9/8 | |||||

| DC25-2244 | 191.35 | 195.09 | 3.74 | 7.65 | Reported 9/8 | |||||

| DC25-2244 | 216.09 | 226.03 | 9.94 | 3.25 | Reported 9/8 | |||||

| DC25-2244 | 251.20 | 262.06 | 10.86 | 5.02 | Reported 9/8 | |||||

| DC25-2244 | TOTAL | 51.10 | 5.41 | |||||||

| DC25-2245 | ACMA | 12.20 | 27.39 | 15.19 | 4.99 | Reported 9/8 | ||||

| DC25-2245 | 99.54 | 102.56 | 3.02 | 4.16 | Reported 9/8 | |||||

| DC25-2245 | 107.23 | 129.66 | 22.43 | 5.35 | Reported 9/8 | |||||

| DC25-2245 | 137.20 | 144.00 | 6.80 | 1.14 | Reported 9/8 | |||||

| DC25-2245 | 152.77 | 162.52 | 9.75 | 2.92 | Reported 9/8 | |||||

| DC25-2245 | 186.03 | 197.93 | 11.90 | 2.65 | Reported 9/8 | |||||

| DC25-2245 | 204.35 | 211.50 | 7.15 | 2.82 | Reported 9/8 | |||||

| DC25-2245 | TOTAL | 76.24 | 3.89 | |||||||

| DC25-2246 | ACMA | 70.92 | 81.33 | 10.41 | 2.77 | Reported 9/8 | ||||

| DC25-2246 | 131.18 | 151.15 | 19.97 | 4.66 | Reported 9/8 | |||||

| DC25-2246 | 187.45 | 199.20 | 11.75 | 3.78 | Reported 9/8 | |||||

| DC25-2246 | 206.96 | 211.70 | 4.74 | 1.14 | Reported 9/8 | |||||

| DC25-2246 | TOTAL | 46.87 | 3.67 | |||||||

| DC25-2247 | ACMA | 6.31 | 12.81 | 6.50 | 1.13 | Reported 9/8 | ||||

| DC25-2247 | 87.90 | 124.85 | 36.95 | 5.33 | Reported 9/8 | |||||

| Including | 89.64 | 98.91 | 9.27 | 11.00 | Reported 9/8 | |||||

| DC25-2247 | 133.21 | 140.60 | 7.39 | 4.41 | Reported 9/8 | |||||

| DC25-2247 | 156.72 | 161.78 | 5.06 | 1.75 | Reported 9/8 | |||||

| DC25-2247 | 177.69 | 182.00 | 4.31 | 1.34 | Reported 9/8 | |||||

| DC25-2247 | 187.32 | 208.70 | 21.38 | 3.21 | Reported 9/8 | |||||

| DC25-2247 | TOTAL | 81.59 | 3.92 | |||||||

| DC25-2248 | ACMA | 71.75 | 75.23 | 3.48 | 4.47 | Reported 9/8 | ||||

| DC25-2248 | 104.37 | 117.35 | 12.98 | 2.75 | Reported 9/8 | |||||

| DC25-2248 | 126.87 | 154.86 | 27.99 | 3.70 | Reported 9/8 | |||||

| DC25-2248 | 167.50 | 193.61 | 26.11 | 3.39 | Reported 9/8 | |||||

| DC25-2248 | 231.65 | 241.02 | 9.37 | 6.23 | Reported 9/8 | |||||

| DC25-2248 | TOTAL | 79.93 | 3.77 | |||||||

| DC25-2249 | ACMA | 25.09 | 31.50 | 6.41 | 3.96 | Reported 9/8 | ||||

| DC25-2249 | 95.28 | 104.67 | 9.39 | 2.87 | Reported 9/8 | |||||

| DC25-2249 | 125.57 | 138.48 | 12.91 | 8.08 | Reported 9/8 | |||||

| DC25-2249 | 152.15 | 171.45 | 19.30 | 5.35 | Reported 9/8 | |||||

| Including | 152.15 | 159.56 | 7.41 | 11.10 | Reported 9/8 | |||||

| DC25-2249 | 187.72 | 195.46 | 7.74 | 3.09 | Reported 9/8 | |||||

| DC25-2249 | 199.97 | 223.29 | 23.32 | 1.06 | Reported 9/8 | |||||

| DC25-2249 | TOTAL | 79.07 | 3.90 | |||||||

| DC25-2250 | ACMA | 82.70 | 90.58 | 7.88 | 4.12 | Reported 9/8 | ||||

| DC25-2250 | 134.13 | 159.18 | 25.05 | 5.44 | Reported 9/8 | |||||

| Including | 152.58 | 156.17 | 3.59 | 12.57 | Reported 9/8 | |||||

| DC25-2250 | 168.40 | 184.94 | 16.54 | 1.54 | Reported 9/8 | |||||

| DC25-2250 | 194.30 | 204.31 | 10.01 | 3.82 | Reported 9/8 | |||||

| DC25-2250 | 346.93 | 355.54 | 8.61 | 5.91 | Reported 9/8 | |||||

| DC25-2250 | 379.78 | 386.36 | 6.58 | 2.29 | Reported 9/8 | |||||

| DC25-2250 | 391.73 | 403.72 | 11.99 | 1.81 | Reported 9/8 | |||||

| DC25-2250 | 434.65 | 439.22 | 4.57 | 3.48 | Reported 9/8 | |||||

| DC25-2250 | 501.05 | 506.75 | 5.70 | 3.11 | Reported 9/8 | |||||

| DC25-2250 | TOTAL | 96.93 | 3.65 | |||||||

| DC25-2251 | ACMA | 21.29 | 38.40 | 17.11 | 4.66 | Reported 9/8 | ||||

| DC25-2251 | 67.18 | 73.15 | 5.97 | 1.31 | Reported 9/8 | |||||

| DC25-2251 | 90.07 | 102.30 | 12.23 | 5.16 | Reported 9/8 | |||||

| DC25-2251 | 116.10 | 127.05 | 10.95 | 3.97 | Reported 9/8 | |||||

| DC25-2251 | 143.29 | 150.13 | 6.84 | 2.60 | Reported 9/8 | |||||

| DC25-2251 | 211.50 | 218.02 | 6.52 | 6.60 | Reported 9/8 | |||||

| DC25-2251 | TOTAL | 59.62 | 4.28 | |||||||

| DC25-2252 | Divide | 41.25 | 49.26 | 8.01 | 2.39 | Reported 9/8 | ||||

| DC25-2252 | 290.24 | 296.61 | 6.37 | 2.80 | Reported 9/8 | |||||

| DC25-2252 | 305.60 | 357.50 | 51.90 | 3.77 | Reported 9/8 | |||||

| DC25-2252 | 433.05 | 436.26 | 3.21 | 1.11 | Reported 9/8 | |||||

| DC25-2252 | TOTAL | 69.49 | 3.40 | |||||||

| DC25-2253 | ACMA | 64.42 | 73.16 | 8.74 | 2.58 | Reported 9/8 | ||||

| DC25-2253 | 93.53 | 96.68 | 3.15 | 1.70 | Reported 9/8 | |||||

| DC25-2253 | 177.55 | 195.05 | 17.50 | 2.47 | Reported 9/8 | |||||

| DC25-2253 | 211.23 | 224.73 | 13.50 | 4.25 | Reported 9/8 | |||||

| DC25-2253 | 230.91 | 244.73 | 13.82 | 1.11 | Reported 9/8 | |||||

| DC25-2253 | 293.43 | 298.67 | 5.24 | 3.71 | Reported 9/8 | |||||

| DC25-2253 | 304.91 | 308.13 | 3.22 | 1.73 | Reported 9/8 | |||||

| DC25-2253 | 315.01 | 321.38 | 6.37 | 10.29 | Reported 9/8 | |||||

| DC25-2253 | 330.91 | 347.24 | 16.33 | 6.57 | Reported 9/8 | |||||

| Including | 340.19 | 344.71 | 4.52 | 14.02 | Reported 9/8 | |||||

| DC25-2253 | 430.70 | 437.65 | 6.95 | 2.24 | Reported 9/8 | |||||

| DC25-2253 | 493.86 | 499.15 | 5.29 | 3.01 | Reported 9/8 | |||||

| DC25-2253 | TOTAL | 100.11 | 3.73 | |||||||

| DC25-2254 | Divide | 328.64 | 333.62 | 4.98 | 1.60 | Reported 9/8 | ||||

| DC25-2254 | 360.44 | 368.50 | 8.06 | 1.60 | Reported 9/8 | |||||

| DC25-2254 | TOTAL | 13.04 | 1.60 | |||||||

| DC25-2255 | Divide | 132.28 | 137.96 | 5.68 | 1.96 | |||||

| DC25-2255 | 233.70 | 239.30 | 5.60 | 7.94 | ||||||

| DC25-2255 | 427.48 | 432.21 | 4.73 | 3.72 | Reported 9/8 | |||||

| DC25-2255 | TOTAL | 16.01 | 4.57 | |||||||

| DC25-2256 | ACMA | 146.95 | 155.32 | 8.37 | 1.60 | Reported 9/8 | ||||

| DC25-2256 | 193.35 | 198.77 | 5.42 | 1.76 | Reported 9/8 | |||||

| DC25-2256 | 473.30 | 487.10 | 13.80 | 2.28 | Reported 9/8 | |||||

| DC25-2256 | 502.37 | 516.26 | 13.89 | 4.21 | Reported 9/8 | |||||

| Including | 504.62 | 507.75 | 3.13 | 12.57 | Reported 9/8 | |||||

| DC25-2256 | 541.29 | 546.04 | 4.75 | 7.28 | Reported 9/8 | |||||

| DC25-2256 | TOTAL | 46.23 | 3.19 | |||||||

| DC25-2257 | Divide | 329.23 | 338.56 | 9.33 | 1.49 | Reported 9/8 | ||||

| DC25-2257 | 393.34 | 402.46 | 9.12 | 8.32 | Reported 9/8 | |||||

| DC25-2257 | TOTAL | 18.45 | 4.87 | |||||||

| DC25-2258 | Lewis | 106.98 | 111.89 | 4.91 | 2.26 | Reported 9/8 | ||||

| DC25-2258 | 327.14 | 336.60 | 9.46 | 2.04 | Reported 9/8 | |||||

| DC25-2258 | 396.10 | 399.17 | 3.07 | 5.55 | Reported 9/8 | |||||

| DC25-2258 | 525.34 | 532.69 | 7.35 | 23.49 | Reported 9/8 | |||||

| DC25-2258 | TOTAL | 24.79 | 8.88 | |||||||

| DC25-2259 | Divide | 85.50 | 94.83 | 9.33 | 2.23 | Reported 9/8 | ||||

| DC25-2259 | 321.33 | 326.89 | 5.56 | 4.76 | ||||||

| DC25-2259 | 346.89 | 355.80 | 8.91 | 3.67 | ||||||

| DC25-2259 | 421.97 | 432.51 | 10.54 | 3.01 | ||||||

| DC25-2259 | TOTAL | 34.34 | 3.25 | |||||||

| DC25-2260 | Divide | 46.94 | 66.13 | 19.19 | 2.50 | Reported 9/8 | ||||

| DC25-2260 | 71.41 | 88.08 | 16.67 | 3.32 | Reported 9/8 | |||||

| DC25-2260 | 109.64 | 112.93 | 3.29 | 2.20 | Reported 9/8 | |||||

| DC25-2260 | 129.00 | 138.69 | 9.69 | 2.45 | Reported 9/8 | |||||

| DC25-2260 | 401.12 | 405.10 | 3.98 | 4.27 | ||||||

| DC25-2260 | TOTAL | 52.82 | 2.86 | |||||||

| DC25-2261 | Lewis | 279.42 | 285.13 | 5.71 | 3.49 | |||||

| DC25-2261 | 341.68 | 349.74 | 8.06 | 1.03 | ||||||

| DC25-2261 | 406.91 | 419.96 | 13.05 | 1.41 | ||||||

| DC25-2261 | 472.31 | 477.19 | 4.88 | 3.07 | ||||||

| DC25-2261 | TOTAL | 31.70 | 1.94 | |||||||

| DC25-2262 | Divide | 354.09 | 375.12 | 21.03 | 4.51 | |||||

| DC25-2262 | 387.96 | 429.05 | 41.09 | 3.06 | ||||||

| DC25-2262 | TOTAL | 62.12 | 3.55 | |||||||

| DC25-2263 | Lewis | 277.17 | 300.00 | 22.83 | 2.39 | |||||

| DC25-2263 | 348.75 | 363.80 | 15.05 | 2.04 | ||||||

| DC25-2263 | 381.17 | 408.60 | 27.43 | 4.14 | ||||||

| DC25-2263 | TOTAL | 65.31 | 3.04 | |||||||

| DC25-2265 | Lewis | 260.27 | 265.10 | 4.83 | 5.67 | |||||

| DC25-2265 | 292.48 | 319.90 | 27.42 | 2.33 | ||||||

| DC25-2265 | 381.96 | 403.97 | 22.01 | 1.16 | ||||||

| DC25-2265 | 455.31 | 458.78 | 3.47 | 2.47 | ||||||

| DC25-2265 | 472.85 | 479.73 | 6.88 | 1.31 | ||||||

| DC25-2265 | 524.00 | 541.34 | 17.34 | 2.15 | ||||||

| DC25-2265 | TOTAL | 81.95 | 2.09 | |||||||

| DC25-2266 | Divide | 469.74 | 473.52 | 3.78 | 9.14 | |||||

| DC25-2266 | TOTAL | 3.78 | 9.14 | |||||||

| DC25-2267 | Lewis | 248.14 | 267.60 | 19.46 | 2.63 | |||||

| DC25-2267 | 285.03 | 301.75 | 16.72 | 4.14 | ||||||

| DC25-2267 | 346.86 | 365.90 | 19.04 | 3.63 | ||||||

| DC25-2267 | 388.33 | 393.29 | 4.96 | 1.49 | ||||||

| DC25-2267 | 401.34 | 408.49 | 7.15 | 3.81 | ||||||

| DC25-2267 | 423.68 | 436.80 | 13.12 | 3.61 | ||||||

| DC25-2267 | 442.67 | 456.56 | 13.89 | 7.08 | ||||||

| DC25-2267 | TOTAL | 94.34 | 3.92 | |||||||

| DC25-2268 | Lewis | 145.52 | 151.53 | 6.01 | 4.53 | |||||

| DC25-2268 | 156.40 | 160.26 | 3.86 | 6.97 | ||||||

| DC25-2268 | 217.66 | 227.89 | 10.23 | 2.76 | ||||||

| DC25-2268 | TOTAL | 20.10 | 4.09 | |||||||

| DC25-2269 | Lewis | 45.73 | 71.93 | 26.20 | 2.60 | |||||

| DC25-2269 | 250.50 | 258.72 | 8.22 | 4.51 | ||||||

| DC25-2269 | 275.92 | 283.60 | 7.68 | 1.35 | ||||||

| DC25-2269 | 353.94 | 358.14 | 4.20 | 18.30 | ||||||

| Including | 354.94 | 358.14 | 3.20 | 21.43 | ||||||

| DC25-2269 | 364.84 | 370.48 | 5.64 | 1.87 | ||||||

| DC25-2269 | TOTAL | 51.94 | 3.91 | |||||||

| DC25-2270 | Lewis | 12.97 | 17.68 | 4.71 | 1.05 | |||||

| DC25-2270 | 21.90 | 26.61 | 4.71 | 2.70 | ||||||

| DC25-2270 | 142.48 | 162.30 | 19.82 | 2.99 | ||||||

| DC25-2270 | TOTAL | 29.24 | 2.63 | |||||||

| DC25-2271 | Lewis | 49.83 | 54.48 | 4.65 | 1.02 | |||||

| DC25-2271 | 328.06 | 331.17 | 3.11 | 2.03 | ||||||

| DC25-2271 | 380.91 | 401.39 | 20.48 | 2.91 | ||||||

| DC25-2271 | 429.23 | 433.22 | 3.99 | 4.74 | ||||||

| DC25-2271 | 438.27 | 444.50 | 6.23 | 3.97 | ||||||

| DC25-2271 | 480.97 | 502.82 | 21.85 | 1.51 | ||||||

| DC25-2271 | TOTAL | 60.31 | 2.44 | |||||||

| DC25-2272 | Lewis | 45.96 | 49.53 | 3.57 | 6.00 | |||||

| DC25-2272 | 97.26 | 101.22 | 3.96 | 1.11 | ||||||

| DC25-2272 | 114.80 | 129.02 | 14.22 | 5.18 | ||||||

| Including | 121.62 | 125.66 | 4.04 | 14.09 | ||||||

| DC25-2272 | 134.63 | 139.48 | 4.85 | 2.14 | ||||||

| DC25-2272 | 148.69 | 158.77 | 10.08 | 4.19 | ||||||

| DC25-2272 | 166.91 | 170.84 | 3.93 | 4.04 | ||||||

| DC25-2272 | 178.97 | 188.69 | 9.72 | 2.60 | ||||||

| DC25-2272 | 198.81 | 201.89 | 3.08 | 3.52 | ||||||

| DC25-2272 | TOTAL | 53.41 | 3.82 | |||||||

| DC25-2273 | Lewis | 42.73 | 48.39 | 5.66 | 5.18 | |||||

| DC25-2273 | 258.25 | 264.83 | 6.58 | 1.01 | ||||||

| DC25-2273 | 279.57 | 283.51 | 3.94 | 2.81 | ||||||

| DC25-2273 | TOTAL | 16.18 | 2.91 | |||||||

| DC25-2274 | Lewis | 76.45 | 95.11 | 18.66 | 3.02 | |||||

| DC25-2274 | 134.57 | 141.40 | 6.83 | 4.70 | ||||||

| DC25-2274 | TOTAL | 25.49 | 3.47 | |||||||

| DC25-2275 | ACMA | 5.49 | 8.94 | 3.45 | 3.03 | |||||

| DC25-2275 | 21.07 | 32.60 | 11.53 | 3.31 | ||||||

| DC25-2275 | 56.30 | 65.00 | 8.70 | 4.44 | ||||||

| DC25-2275 | 165.95 | 170.33 | 4.38 | 26.22 | ||||||

| Including | 166.64 | 170.33 | 3.69 | 30.69 | ||||||

| DC25-2275 | 195.59 | 200.75 | 5.16 | 4.53 | ||||||

| DC25-2275 | 250.02 | 253.86 | 3.84 | 1.75 | ||||||

| DC25-2275 | 352.04 | 364.62 | 12.58 | 1.46 | ||||||

| DC25-2275 | 418.49 | 435.83 | 17.34 | 4.68 | ||||||

| DC25-2275 | TOTAL | 66.98 | 4.95 | |||||||

| DC25-2276 | Lewis | 275.50 | 279.71 | 4.21 | 6.19 | |||||

| DC25-2276 | TOTAL | 4.21 | 6.19 | |||||||

| DC25-2278 | ACMA | 136.28 | 146.82 | 10.54 | 3.76 | |||||

| DC25-2278 | 153.02 | 185.57 | 32.55 | 1.68 | ||||||

| DC25-2278 | 191.50 | 194.79 | 3.29 | 8.04 | ||||||

| DC25-2278 | 199.73 | 206.73 | 7.00 | 5.15 | ||||||

| DC25-2278 | TOTAL | 53.38 | 2.94 |

Significant intervals represent drilled intervals and not necessarily true thickness of mineralization due to drilling at a low angle relative to the interpreted mineralization controls. True width of intercepts has been estimated based on the latest geological model and it is subject to refinement as additional data becomes available. Except where specifically disclosed, the true width of intercepts is unknown at this stage. Mineralized intervals meet or exceed 3 meters in length above 1 g/t. A maximum of 4 meters of continuous dilution (< 1 g/t) is permitted. Assays from DC25-2231, DC25-2232, DC25-2234 through DC25-2239, and DC25-2041 through DC25-2251 represent holes from the East ACMA grid infill drilling. Assays from DC25-2252 through DC25-2274 and DC25-2276 represent holes from the in-pit exploration drilling. Assays from DC25-2275 and DC25-2277 through DC25-2279 represent holes from the in-pit geotechnical drilling. DC25-2233 was redrilled as DC25-2235 and DC25-2240 was redrilled as DC25-2241, both due to deviation outside of acceptable limits.

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c46868f8-fa4b-4bd6-b773-b95911a3c56b