Surge Announces Entering into Joint Venture with Evolution Mining Limited

Rhea-AI Summary

Surge Battery Metals (OTCQX: NILIF) and a subsidiary of Evolution Mining formed a joint venture dated December 2, 2025 to advance the Nevada North Lithium Project (NNLP) via Nevada North Lithium, LLC.

Surge US contributed its NNLP mining claims; Evolution contributed a 75% interest in an 880-acre private land parcel and 75% rights in over 21,000 acres. Surge US initially holds 77% of the JV, Evolution 23%. Evolution will fund up to CAD$10,000,000 for a PFS (CAD$3,000,000 expected by Dec 5, 2025), which can increase Evolution to 32.5% ownership if fully funded.

Positive

- Evolution committed up to CAD$10,000,000 to fund a PFS

- Initial CAD$3,000,000 expected to be funded by Dec 5, 2025

- Evolution contributed 75% interests in 880 acres private land

- Evolution contributed 75% rights in 21,000+ acres surrounding NNLP

- Surge US retains managerial control while ownership remains >50%

Negative

- Surge ownership falls from 77% to 74.15% on initial funding

- If Evolution fully funds, Surge dilution to 67.5% ownership

- Funding is staged and subject to conditions, not guaranteed

- Key JV actions require an 80% super-majority, limiting unilateral control

News Market Reaction

On the day this news was published, NILIF declined 0.42%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers in Other Industrial Metals & Mining showed mixed moves (e.g., WHYRF +6.09%, PGZFF -2.29%, REMRF -3.02%), while NILIF was down 1.53%, pointing to a stock-specific reaction path historically.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 10 | JV funding update | Positive | -1.5% | Evolution’s initial CA$3,000,000 JV funding increased its NNLP ownership stake. |

| Dec 02 | JV formation | Positive | -0.4% | Definitive JV agreement with Evolution to advance Nevada North Lithium Project. |

| Nov 21 | JV progress update | Positive | -0.3% | Update on proposed JV with Evolution and TSXV conditional approval details. |

| Oct 30 | Drill program results | Positive | -0.9% | Completion of 2025 infill drilling intersecting thick lithium claystone at NNLP. |

| Oct 20 | Drill and PEA update | Positive | +13.5% | Drilling progress and PEA with large after-tax NPV and project metrics. |

Recent positive operational and partnership updates often coincided with negative or modest price moves, with only one strong upside reaction to project economics.

Over the last few months, Surge has repeatedly advanced the Nevada North Lithium Project. On Oct 20, a drilling update and strong PEA metrics saw a 13.46% gain. Subsequent infill drilling on Oct 30 and JV progress updates on Nov 21 and Dec 2 all described constructive developments but were followed by modest declines. The Dec 10 confirmation of Evolution’s initial CA$3,000,000 JV funding also saw a small drop, suggesting good news has not consistently driven immediate upside.

Market Pulse Summary

This announcement finalizes a joint venture with Evolution Mining to advance NNLP, including up to CAD$10,000,000 in staged funding for a Preliminary Feasibility Study. Surge US retains majority ownership but Evolution’s stake can rise to 32.5%, altering long-term economics. The grant of 3.2 million options at $0.60 adds potential dilution to monitor. Investors may watch future PFS milestones, JV funding stages, and governance decisions under the Operating Committee.

Key Terms

preliminary feasibility study technical

preliminary economic assessment technical

rights of first refusal financial

tag along rights financial

drag along rights financial

stock options financial

AI-generated analysis. Not financial advice.

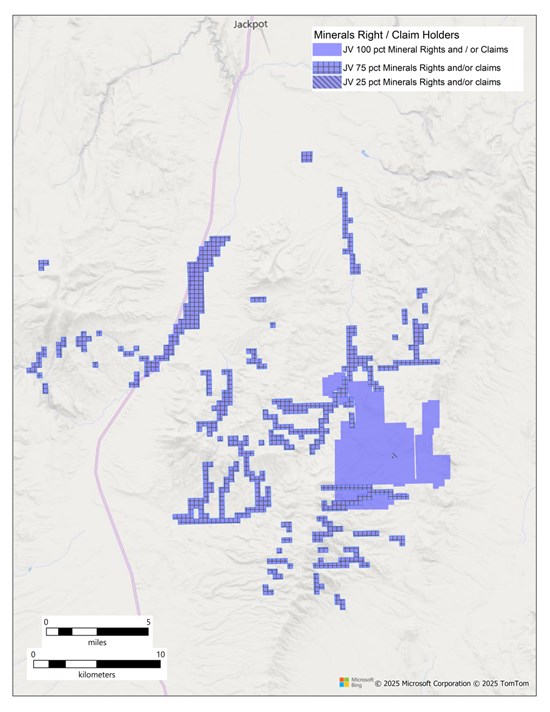

West Vancouver, British Columbia--(Newsfile Corp. - December 2, 2025) - Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) (FSE: DJ5) (the "Company" or "Surge"), through its wholly-owned U.S. subsidiary, Surge Battery Metals USA Inc. ("Surge US"), is pleased to announce (pursuant to its November 27, 2025 news release) that it has entered into an amended and restated operating agreement dated December 2, 2025 (the "JV Agreement") with a subsidiary of Evolution Mining Limited (collectively, "Evolution"), pursuant to which Surge US and Evolution formed a joint venture (the "JV"), to be implemented via Nevada North Lithium, LLC, a Nevada limited liability company for the purpose of continuing the development of the Nevada North Lithium Project (the "NNLP").

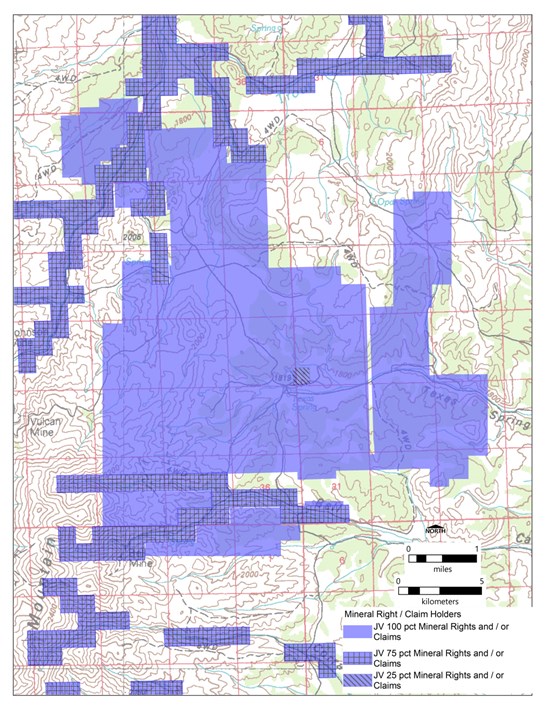

In addition to the JV Agreement, Surge US and Evolution entered into a contribution agreement (the "Contribution Agreement"), pursuant to which each party transferred into the JV certain assets they each held in connection with the NNLP. The initial focus of the JV will be facilitating the completion of a Preliminary Feasibility Study ("PFS") for the purpose of evaluating the potential for the proposed development of the NNLP.

Material Terms of the JV Agreement and the Contribution Agreement

Pursuant to the Contribution Agreement, Surge US has contributed to the JV all of its mining claims and mineral rights that comprise the NNLP. Evolution has contributed its

The JV Agreement sets out the terms governing the JV, including, among other things, the ownership interests as between Surge US and Evolution, the JV's governance framework, defaults and each party's financial obligations.

Surge US's ownership interest in the JV shall initially be

The JV will principally be governed by its operating committee (the "Operating Committee") which will, among other matter, determine the overall policies, objectives and actions of the JV and its management team. The Operating Committee will be comprised of five appointees: three initially appointed by Surge US and two initially appointed by Evolution. As set out in the JV Agreement, certain decisions of the Operating Committee require the approval of appointees representing members holding at least

Under the JV Agreement, Surge US is the general manager of the NNLP (the "Manager") for so long as Surge US holds more than a

The JV Agreement also contains certain rights in favour of both Surge US and Evolution with respect to rights of first refusal, tag along rights and drag along rights in connection with the direct or indirect transfer of either party's ownership interests in the JV.

The JV Agreement and the Contribution Agreement will be available on Surge's SEDAR+ profile at sedarplus.ca.

Mr. Greg Reimer, Chief Executive Officer and Director, commented, "Surge is very pleased to have concluded the definitive agreements to formally establish the joint venture with Evolution Mining on the NNLP. This marks a major milestone in advancing one of the most promising lithium assets in the United States. With the partnership now official, we are poised to accelerate the projects development and meet the growing demand for critical battery metals."

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9838/276653_1e742a8cf42b9a7d_001full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9838/276653_1e742a8cf42b9a7d_002full.jpg

The Company also announces that it has granted a total of 3.2 million stock options, exercisable for a period of five years, at an exercise price of 60 cents a share to certain directors, officers and consultants.

About Surge Battery Metals Inc.

Surge Battery Metals, a Canadian-based mineral exploration company, is at the forefront of securing the supply of domestic lithium through its active engagement in the Nevada North Lithium Project. The project focuses on exploring for clean, high-grade lithium energy metals in Nevada, USA, a crucial element for powering electric vehicles. With a primary listing on the TSX Venture Exchange in Canada and the OTCQX Market in the US, Surge Battery Metals Inc. is strategically positioned as a key player in advancing lithium exploration.

About Evolution Mining Limited

Evolution is a leading, globally relevant gold miner. Evolution operates six mines, comprising five wholly-owned mines - Cowal in New South Wales, Ernest Henry and Mt Rawdon in Queensland, Mungari in Western Australia, and Red Lake in Ontario, Canada, and an

On behalf of the Board of Directors

"Greg Reimer"

Greg Reimer,

Director, President & CEO

Contact Information

Email : info@surgebatterymetals.com

Phone : 604-662-8184

Website: surgebatterymetals.com

Keep up-to-date with Surge Battery Metals:

Twitter

Facebook

LinkedIn

Instagram

YouTube

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This document may contain certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target, "plan" or "planned", "possible", "potential", "forecast", "intend", "may", "schedule" and similar words or expressions identify forward-looking statements or information. Forwards-looking statements herein, include statements related to the timing of the Initial Obligation and future ownership interests. Such statements represent the Company's current views with respect to future events and are necessarily based upon several assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political, environmental (including endangered species, habitat preservation and water related risks) and social risks, contingencies, and uncertainties, including risks related to the ability of Surge US to fulfill its obligations under the JV Agreement. Many factors, both known and unknown, could cause results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules, and regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276653