Aura Announces Preliminary Q3 2025 and 9M 2025 Production Results, Reaching Record Highs

Rhea-AI Summary

Aura (NASDAQ:ORAAF) reported preliminary Q3 2025 production of 74,227 GEO, up 16% QoQ and 9% YoY at current prices, and a record quarter at constant prices (+17% QoQ). 9M 2025 production reached 198,347 GEO (203,592 GEO at 2025 guidance prices), leaving the company on track for its 2025 guidance of 266,000–300,000 GEO. Key drivers: Borborema reached commercial production in September contributing 10,219 GEO with recovery >92%; Almas and Apoena showed QoQ gains; Aranzazu and Minosa were affected by price conversion, sequencing and weather. Qualified person: Farshid Ghazanfari, P.Geo.

Positive

- Q3 2025 production of 74,227 GEO (+16% QoQ, +9% YoY)

- 9M 2025 production of 203,592 GEO at guidance prices, on track to guidance

- Borborema reached commercial production in Sept and delivered 10,219 GEO with >92% recovery

- Almas production +17% QoQ to 15,088 GEO; 9M +10% driven by higher ore processed

Negative

- Aranzazu Q3 production down 12% YoY to 21,534 GEO due to metal price conversion impacts

- Minosa Q3 production down 13% YoY to 18,138 GEO; 9M down 9% from lower ore feed and weather

- Apoena 9M production down 12% YoY due to higher 2024 grades

Insights

Record quarterly GEO and 9M output, driven by Borborema ramp‑up and Almas expansion; production on track to 2025 guidance.

Aura reported a Q3 2025 total of 74,227 GEO, a

Risks and dependencies center on metal price conversion effects and weather/mine sequencing: Aranzazu and Minosa show declines when measured at current prices, while constant‑price metrics and metal mix improvements offset that. Key near‑term items to watch are sustained ramp at Borborema, recovery rates (notably Apoena at

Operational execution delivered on‑time, on‑budget ramp and capacity gains; production mix and prices drove GEO conversion swings.

Concrete drivers include Borborema achieving >10,000 ounces with >

Monitor quarterly plant feed and recovery, weather impacts on stacking/sequencing at Minosa, and the conversion sensitivity to gold price movements that reduced Aranzazu's GEO at current prices; expected milestones include continued ramp metrics for Borborema and full‑year production reconciliation in

ROAD TOWN, British Virgin Islands, Oct. 10, 2025 (GLOBE NEWSWIRE) -- Aura Minerals Inc. (NASDAQ: AUGO and B3: AURA33) (“Aura” or the “Company”) is pleased to announce Q3 2025 preliminary production results from the Company’s operating mines: Aranzazu, Apoena, Minosa, Almas and Borborema. Total production in Q3 2025, at current prices reached 74,227 gold equivalent ounces (“GEO”)1,2,

Rodrigo Barbosa, CEO and President commented: “We are pleased to announce a record high quarter of strong performance across our operations, achieving 74,227 gold equivalent ounces (GEO) in Q3, contributing to 265,000 GEO over the last twelve months. For the first nine months of 2025, our production of 203,592 GEO at guidance prices positions us firmly within our 2025 guidance of 266,000–300,000 GEO. A key milestone was the start of commercial production at Borborema, which delivered over 10,000 ounces with a recovery rate above

Q3 2025 | 9M 2025 Highlights:

- At Aranzazu, production reached 21,534 GEO, representing a

3% decrease compared to the previous quarter, resulting mainly from metal prices since higher gold prices negatively impact the conversion to GEO. When compared to Q3 2024, production decreased by12% due to the sharp increase in gold prices between the periods which also impacted GEO conversion. At constant prices4, Aranzazu production was in line when compared to Q2 2025 and4% higher when compared to the Q3 2024, also due to higher grades of copper and silver. In the 9M 2025, total production decreased by16% compared to the previous quarter, reaching 64,271, in line with the negative impact of the metals price conversion. At constant prices, Aranzazu produced 62,046 GEO,4% higher than the same period of the previous year, mainly due to higher grades and commercial molybdenum production. - At Minosa, production totaled 18,138 GEO, another stable quarter and in line when compared to the previous quarter, resulting from higher grades processed during the quarter and higher recovery rate, which achieved

68% . When compared to the same quarter last year, production decreased by13% , due to lower stacking in Q3 2025 compared to Q3 2024 due to higher rainfall in Q3 2025. In the 9M 2025, production decreased9% mainly due to lower ore feed to the plant, reflecting mine sequencing and weather-related constraints, and was consistent with Aura’s expectations. - At Almas, production reached 15,088 GEO,

17% higher than Q2 2025 (12,917 GEO), driven by higher ore processed volumes and improved mine performance, reflecting the results of the plant expansion. Production was in line when compared to Q3 2024, although the higher ore processed, due to the grades decrease due to mine sequencing. In the 9M 2025, production increased10% , driven by a higher volume of ore processed, supported by the implementation of larger equipment, which expanded the mine’s operational capacity and enhanced process efficiency. - At Apoena, production was 9,248 GEO,

13% higher than Q2 2025, driven by higher recovery rates of95% . Compared with Q3 2024, production increased15% , primarily because of higher recovery rates and higher processed tonnage feed. In the 9M 2025, production decreased12% when compared to the same period of the last year, attributable to higher grades in 9M 2024, especially Q1 2024, due to the higher grade of Ernesto pit. So far, 2025’s performance has been above Company expectations. - At Borborema, production totaled 10,219 GEO, reflecting progress along the ramp-up curve, reaching commercial production in September as planned by the Company.

Production Results

Preliminary GEO56 production volume for the three months ended September 30, 2025, when compared to the previous quarter and the same period of the previous year is presented below by operating mine:

| Q3 2025 | Q3 2024 | Q2 2025 | % change vs. Q3 2024 | % change vs. Q2 2025 | 9M 2025 | 9M 2024 | % change vs.9M 2024 | ||||||

| Ounces produced (GEO) | |||||||||||||

| Aranzazu | 21,534 | 24,486 | 22,281 | -12 | % | -3 | % | 64,271 | 74,179 | -13 | % | ||

| Minosa | 18,138 | 20,750 | 18,039 | -13 | % | 1 | % | 53,831 | 59,078 | -9 | % | ||

| Almas | 15,088 | 14,975 | 12,917 | 1 | % | 17 | % | 41,107 | 37,450 | 10 | % | ||

| Apoena | 9,248 | 8,035 | 8,219 | 15 | % | 13 | % | 26,343 | 30,052 | -12 | % | ||

| Borborema | 10,219 | - | 2,577 | n.a. | 297 | % | 12,796 | 0 | n.a. | ||||

| Total GEO produced - Current Prices | 74,227 | 68,246 | 64,033 | 9 | % | 16 | % | 198,347 | 200,758 | -1 | % | ||

| Total GEO produced - Constant Prices | 74,227 | 64,408 | 63,557 | 15 | % | 17 | % | 196,122 | 185,979 | 5 | % | ||

| Total GEO produced - Guidance Prices | 74,227 | 68,256 | 67,572 | 9 | % | 10 | % | 203,592 | 197,119 | 3 | % | ||

The table below shows production by each type of metal at Aranzazu.

| Q3 2025 | Q3 2024 | Q2 2025 | % change vs. Q3 2024 | % change vs. Q2 2025 | 9M 2025 | 9M 2024 | % change vs.9M 2024 | ||||||

| Gold Production (oz) | 6,707 | 6,898 | 7,461 | -3 | % | -10 | % | 20,543 | 19,592 | 5 | % | ||

| Silver Production (oz) | 141,117 | 137,414 | 143,318 | 3 | % | -2 | % | 415,335 | 393,346 | 6 | % | ||

| Copper Production (klbs) | 9,726 | 9,511 | 9,922 | 2 | % | -2 | % | 28,109 | 27,575 | 2 | % | ||

| Molybdenum Production (Klbs) | 105 | 0 | 58 | n.a. | 81 | % | 163 | 0 | n.a. | ||||

| Total GEO produced - Current Prices | 21,534 | 24,486 | 22,281 | -12 | % | -3 | % | 64,271 | 74,179 | -13 | % | ||

| Total GEO produced - Constant Prices | 21,534 | 20,648 | 21,805 | 4 | % | -1 | % | 62,046 | 59,399 | 4 | % | ||

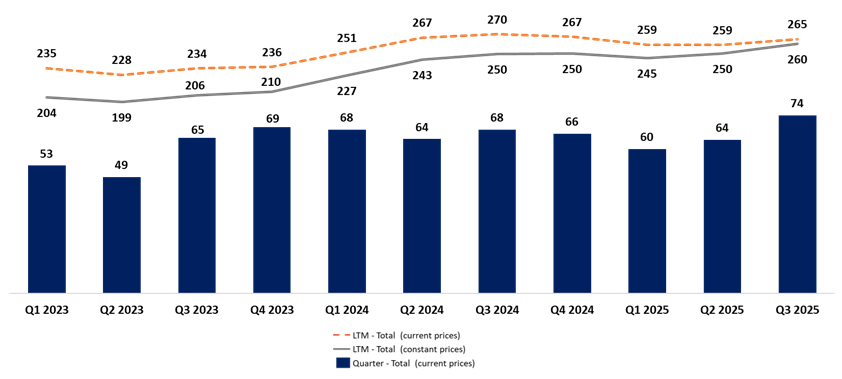

The chart below displays the consolidated quarterly GEO production measured at current and constant prices since Q1 2023, as well as the last twelve months at the end of each reporting period:

Qualified Person

The scientific and technical information contained in this press release has been reviewed and approved by Farshid Ghazanfari, P.Geo., Geology and Mineral Resources Manager, an employee of Aura and a “qualified person” within the meaning of NI 43-101 and SK-1300.

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a company focused on the development and operation of gold and base metal projects in the Americas. The Company's five operating assets include the Minosa gold mine in Honduras; the Almas, Apoena, and Borborema gold mines in Brazil; and the Aranzazu copper, gold, and silver mine in Mexico. Additionally, the Company owns Era Dorada, a gold project in Guatemala; Tolda Fria, a gold project in Colombia; and three projects in Brazil: Matupá, which is under development; São Francisco, which is in care and maintenance; and the Carajás copper project in the Carajás region, in the exploration phase.

The information contained in this press release is preliminary in nature and is provided for informational purposes only. It is based on current estimates, assumptions, and expectations, which remain subject to ongoing review, verification, and possible revision. Final Q3 2025 Production Results may differ from those set forth herein, and no assurance is given as to the accuracy or completeness of the information at this stage. Readers are cautioned not to place undue reliance on this preliminary results.

Forward-Looking Information

This press release contains “forward-looking information” and “forward-looking statements”, as defined in applicable securities laws (collectively, “forward-looking statements”) which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Often, but not always, forward-looking statements can be identified by the use of words and phrases such as “plans,” “expects,” “is expected,” “budget,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates,” or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved.

Known and unknown risks, uncertainties and other factors, many of which are beyond the Company’s ability to predict or control, could cause actual results to differ materially from those contained in the forward-looking statements. Specific reference is made to the most recent Annual Information Form on file with certain Canadian provincial securities regulatory authorities for a discussion of some of the factors underlying forward-looking statements, which include, without limitation, volatility in the prices of gold, copper and certain other commodities, changes in debt and equity markets, the uncertainties involved in interpreting geological data, increases in costs, environmental compliance and changes in environmental legislation and regulation, interest rate and exchange rate fluctuations, general economic conditions and other risks involved in the mineral exploration and development industry. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements.

All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

1 Gold equivalent ounces, or GEO, is calculated by converting the production of silver, copper and molybdenum into gold using a ratio of the prices of these metals to that of gold. The prices used to determine the GEO are based on the weighted average price of silver and copper realized from sales at the Aranzazu Mine during the relevant period.

2 Applies the metal sale prices in Aranzazu realized during Q3 2025: Copper price = US

3 Applies the metal sale prices of the 2025 Guidance in Aranzazu: Copper price = US

4 Constant Price" is a method of converting our copper, silver and molybdenum production or sales volume into GEO based on fixed metal prices. This approach eliminates the impact of metal price fluctuations, when comparing production or sales figures across different periods. Using constant prices allows for a consistent and meaningful comparison of gold equivalent production or sales over time. It ensures that differences in GEO production or sales between two periods reflect changes in actual physical metal production or metal sales and not changes due to fluctuations in commodity prices among the periods. GEO at constant price for previous period, to be compared to GEO for current period, is copper production or sales volume previous period multiplied by copper prices current period plus silver production or sales volume for previous period multiplied by silver prices from current period plus molybdenum production or sales volume for previous period multiplied by molybdenum prices from current period divided by gold price for current period.

5 The total may not add due to rounding.

6 Applies the metal sale prices in Aranzazu realized at each relevant quarter.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/48d857f3-6e9b-4667-b2db-6dd622fd79f8

For more information, please contact: Investor Relations ri@auraminerals.com www.auraminerals.com