Aura Announces Preliminary Q4 2025 and 2025 Production Results; Record High Production and 2025 Guidance Achieved

Rhea-AI Summary

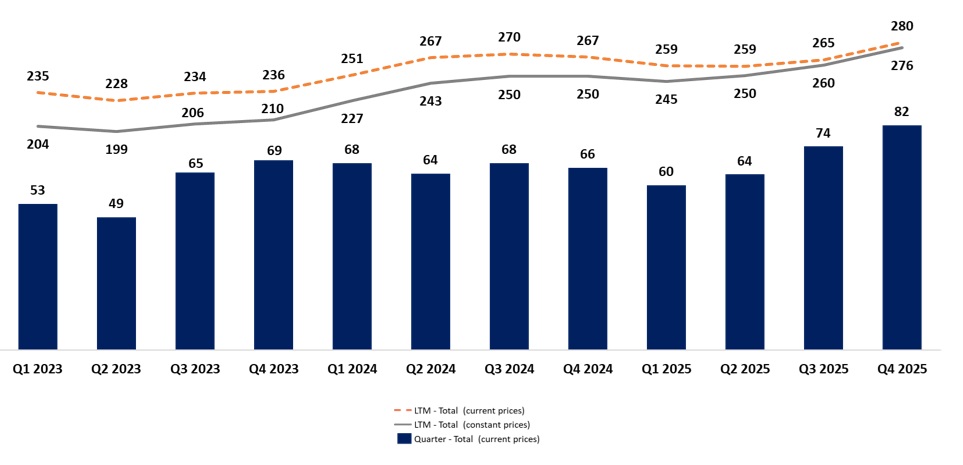

Aura Minerals (NASDAQ: AUGO) reported preliminary Q4 2025 production of 82,067 GEO (record high), up 11% vs Q3 2025 and 23% vs Q4 2024 at current prices. Full-year 2025 production reached 280,414 GEO (5% above 2024 at current prices) and 285,380 GEO at 2025 guidance prices (MSG excluded), landing in the upper half of the 266k–300k GEO guidance range. Highlights include Borborema ramp-up (recovery to 91.7%, grade ~1.42 g/t), Aranzazu metal-price impacts on GEO conversion, and consolidation of MSG results for December 2025 (4,761 GEO).

Positive

- Q4 2025 record production of 82,067 GEO (+11% QoQ)

- Full-year 2025 production 280,414 GEO (+5% vs 2024)

- Production at guidance prices 285,380 GEO (upper half of guidance)

- Borborema recovery improved to 91.7% with grade ~1.42 g/t

- Almas 2025 production +5% vs 2024 after plant expansion

- MSG consolidation added 4,761 GEO in December 2025

Negative

- Aranzazu 2025 production down 15% vs 2024 at current prices

- Aranzazu GEO reduced by metal price conversion effects

- Borborema delivered below guidance earlier during ramp-up

Key Figures

Market Reality Check

Peers on Argus

Gold peers showed mixed moves: FSM +1.89%, NG +0.20%, NGD +3.63%, while SAND fell 5.16% and SSRM slipped 0.50%. With Aura up 3.03% and no peers in the momentum scanner, the reaction appears stock-specific to its record production and guidance.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Jan 06 | Project license update | Positive | +1.5% | Construction license and early works start at Era Dorada project. |

| Dec 08 | Growth outlook update | Positive | -2.0% | Multi-year outlook lifted to scenarios above <b>600,000 GEO</b> annually. |

| Dec 08 | Feasibility study release | Positive | -2.0% | Era Dorada feasibility with high NPV and strong IRR economics disclosed. |

| Dec 01 | Mine acquisition close | Positive | +0.3% | Closing of MSG acquisition on agreed enterprise value of <b>US$76M</b>. |

| Nov 06 | Equity investment move | Positive | +3.4% | Exercise of <b>24M</b> Altamira warrants, increasing strategic ownership stake. |

Recent news tied to project advancement, feasibility work and acquisitions has generally seen modest positive reactions, though two December growth-focused updates drew negative moves, indicating occasional divergence between upbeat strategic news and short-term price action.

Over the past few months, Aura has advanced several growth drivers. It closed the MSG acquisition with 2024 production of 80 koz and later exercised 24,000,000 Altamira warrants, lifting its stake. The Era Dorada Feasibility Study outlined 1.75 million GEO over 16.8 years with after-tax NPV of US$1,344.5M and base IRR of 35.6%. A Jan 2026 construction-license update and today’s record production both reinforce this expansion narrative.

Market Pulse Summary

This announcement highlights record Q4 production of 82,067 GEO and full-year 2025 output of 280,414 GEO, placing results in the upper half of the 266k–300k GEO guidance range. It also underscores improving recoveries at Borborema and initial consolidation of MSG. In the months prior, Aura advanced Era Dorada and closed MSG, so investors may track follow-through on these growth projects, ramp-up stability, and future production guidance updates.

Key Terms

gold equivalent ounces technical

GEO technical

molybdenum medical

NI 43-101 regulatory

AI-generated analysis. Not financial advice.

ROAD TOWN, British Virgin Islands, Jan. 12, 2026 (GLOBE NEWSWIRE) -- Aura Minerals Inc. (NASDAQ: AUGO and B3: AURA33) (“Aura” or the “Company”) is pleased to announce Q4 2025 preliminary production results from the Company’s six operating mines: Aranzazu, Apoena, Minosa, Almas, Borborema and MSG (“Mineração Serra Grande”). Total production in Q4 2025, at current prices, reached 82,067 gold equivalent ounces (“GEO”)1, a record high in the history of the Company,

Rodrigo Barbosa, CEO and President, commented: “We are delighted to close 2025 on a high note, delivering 82.1k GEO in Q4 at current prices — a

Q4 2025 | 2025 Highlights:

- At Aranzazu, production reached 18,878 GEO, representing a

12% decrease compared to the previous quarter, resulting mainly from metal prices since higher gold prices negatively impact the conversion to GEO. When compared to Q4 2024, production decreased by19% due to the sharp increase in gold and silver prices between the periods which also impacted GEO conversion. At constant prices4, Aranzazu production was7% lower when compared to Q3 2025 as well as compared to Q4 2024, due to slightly lower grades of copper, silver and gold, due to mine sequencing and according to the Company’s plan. In 2025, total production decreased by15% compared to the previous year at current prices, reaching 83,149, in line with the negative impact of the metals price conversion. At constant prices, Aranzazu produced 78,771 GEO, in line with the same period of the previous year, mainly due to higher grades and commercial molybdenum production. At 2025 Guidance Prices3, Aranzazu ended 2025 with a production of 92,876 GEO, in line with the Guidance range.

- At Minosa, production totaled 17,818 GEO in Q4 2025,

2% lower than Q3 2025 and8% Q4 2024, mainly due to the impact of the rainy season and an expansion works to increase the stacking area. In 2025, production achieved 71,649 GEO, a decrease of9% mainly due to lower ore feed to the plant, reflecting mine sequencing and weather-related constraints, but consistent with Aura’s expectations. This performance allowed Minosa to close 2025 at the upper end of the Guidance range.

- At Almas, production reached 15,872 GEO,

5% higher than Q3 2025 (15,088 GEO), driven by higher ore processed volumes and improved mine performance, reflecting the results of the plant expansion. Production was5% lower when compared to Q4 2024, due to the grades decrease from 1.2g/ton to 1.02g/ton in line with the mine sequencing. Also, as a result of the expansion project, Almas closed 2025 with production of 56,979,5% higher than the prior year, despite lower grades due to mine sequencing. With this performance, Almas ended the year near the upper end of its Guidance.

- At Apoena, production was 8,961 GEO,

3% lower than Q3 2025, driven by due to lower ore feed to the plant and lower recovery, but in line with the Company’s plan. Compared with Q4 2024, production increased26% , primarily because of higher recovery rates, with4% increase, and higher grades, from 0.70 g/ton to 0.79 g/ton. In 2025, production was of 35,304 GEO, a decrease of5% when compared to 2024, attributable mainly to lower grades and lower ore mined as expected. Considering the full year of 2025, Apoena exceeded the Company’s expectations by delivering higher grades and improved productivity, allowing the mine to finish 2025 above the upper end of the Guidance range, which was 32k GEO.

- At Borborema, production totaled 15,777 GEO,

54% above the previous quarter, reflecting progress along the ramp-up curve, achieving higher milling throughput, prioritizing higher-grade material, and increasing overall recovery. During the year, Borborema delivered results below the guidance range, mainly due to lower recoveries achieved during the pre-commercial production phase. This led to the decision to feed the plant with lower-grade material until full stabilization of performance. Performance improved significantly over the course of the year, and at the end of Q4 2025, recovery reached91.7% , a significant improvement compared to the start of the ramp-up (76.5% ), along with a35% increase in grade compared to 2Q25, closing the year with an average grade of 1.42 g/t, due to mine sequencing.

- Considering the conclusion of the acquisition of MSG on December 2, 2025, Aura is consolidating MSG’s results only for the month of December, which a production of 4,761 GEO in the month.

Production Results

Preliminary GEO1,2 production volume for the three months ended December 31, 2025, when compared to the previous quarter and the same period of the previous year is presented below by operating mine:

| Q4 2025 | Q4 2024 | Q3 2025 | % change vs. Q4 2024 | % change vs. Q3 2025 | 2025 | 2024 | % change vs. 2024 | ||||

| Ounces produced (GEO) | |||||||||||

| Aranzazu | 18,878 | 23,379 | 21,534 | -19% | -12% | 83,149 | 97,558 | -15% | |||

| Minosa | 17,818 | 19,294 | 18,138 | -8% | -2% | 71,649 | 78,372 | -9% | |||

| Almas | 15,872 | 16,679 | 15,088 | -5% | 5% | 56,979 | 54,129 | 5% | |||

| Apoena | 8,961 | 7,121 | 9,248 | 26% | -3% | 35,304 | 37,173 | -5% | |||

| Borborema | 15,777 | - | 10,219 | n.a. | 54% | 28,573 | - | n.a. | |||

| MSG (December 2025 only)1 | 4,761 | n.a. | n.a. | n.a. | n.a. | 4,761 | - | n.a. | |||

| Total GEO produced - Current Prices | 82,067 | 66,473 | 74,227 | 23% | 11% | 280,414 | 267,232 | 5% | |||

| Total GEO produced - Constant Prices | 82,067 | 63,353 | 72,981 | 30% | 12% | 276,036 | 247,938 | 9% | |||

| Total GEO produced - Guidance Prices (excluding MSG) | 79,929 | 67,188 | 76,957 | 19% | 4% | 285,380 | 263,059 | 8% | |||

| Note: (1) Consider only the December 2025 production. | |||||||||||

| 1 The total may not add due to rounding. | |||||||||||

| 2 Applies the metal sale prices in Aranzazu realized at each relevant quarter. | |||||||||||

The table below shows production by each type of metal at Aranzazu:

| Q4 2025 | Q4 2024 | Q3 2025 | % change vs. Q4 2024 | % change vs. Q3 2025 | 2025 | 2024 | % change vs. 2024 | ||||

| Gold Production (oz) | 6,158 | 6,987 | 6,707 | -12% | -8% | 26,700 | 26,578 | 0% | |||

| Silver Production (oz) | 126,712 | 146,187 | 141,117 | -13% | -10% | 542,046 | 539,532 | 0% | |||

| Copper Production (klbs) | 8,474 | 9,413 | 9,726 | -10% | -13% | 36,583 | 36,988 | -1% | |||

| Molybdenum Production (Klbs) | 86 | - | 105 | n.a. | -18% | 249 | - | n.a. | |||

| Total GEO produced - Current Prices | 18,878 | 23,379 | 21,534 | -19% | -12% | 83,149 | 97,558 | -15% | |||

| Total GEO produced - Constant Prices | 18,878 | 20,260 | 20,288 | -7% | -7% | 78,771 | 78,264 | 1% | |||

The chart below displays the consolidated quarterly GEO production measured at current and constant prices since Q1 2023, as well as the last twelve months at the end of each reporting period:

Qualified Person

The scientific and technical information contained in this press release has been reviewed and approved by Farshid Ghazanfari, P.Geo., Geology and Mineral Resources Manager, an employee of Aura and a “qualified person” within the meaning of NI 43-101 and SK-1300.

About Aura 360° Mining

Aura is focused on mining in complete terms — thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a company focused on the development and operation of gold and base metal projects in the Americas. The Company's six operating assets include the Minosa gold mine in Honduras; the Almas, Apoena, Borborema and MSG gold mines in Brazil; and the Aranzazu copper, gold, and silver mine in Mexico. Additionally, the Company owns Era Dorada, a gold project in Guatemala; Tolda Fria, a gold project in Colombia; and three projects in Brazil: Matupá, which is under development; São Francisco, which is in care and maintenance; and the Carajás copper project in the Carajás region, in the exploration phase.

For more information, please contact:

Investor Relations

ri@auraminerals.com

www.auraminerals.com

The information contained in this press release is preliminary in nature and is provided for informational purposes only. It is based on current estimates, assumptions, and expectations, which remain subject to ongoing review, verification, and possible revision. Final Q4 2025 Production Results may differ from those set forth herein, and no assurance is given as to the accuracy or completeness of the information at this stage. Readers are cautioned not to place undue reliance on this preliminary results.

Forward-Looking Information

This press release contains “forward-looking information” and “forward-looking statements”, as defined in applicable securities laws (collectively, “forward-looking statements”) which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Often, but not always, forward-looking statements can be identified by the use of words and phrases such as “plans,” “expects,” “is expected,” “budget,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates,” or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved.

Known and unknown risks, uncertainties and other factors, many of which are beyond the Company’s ability to predict or control, could cause actual results to differ materially from those contained in the forward-looking statements. Specific reference is made to the most recent Annual Information Form on file with certain Canadian provincial securities regulatory authorities and to the Company’s Form F-1 filed with the U.S. Securities and Exchange Commission (“SEC”) for a discussion of some of the factors underlying forward-looking statements, which include, without limitation, volatility in the prices of gold, copper and certain other commodities, changes in debt and equity markets, the uncertainties involved in interpreting geological data, increases in costs, environmental compliance and changes in environmental legislation and regulation, interest rate and exchange rate fluctuations, general economic conditions and other risks involved in the mineral exploration and development industry as described in filings with Canadian securities regulators and the SEC. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements.

All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

1 Gold equivalent ounces, or GEO, is calculated by converting the production of silver, copper and molybdenum into gold using a ratio of the prices of these metals to that of gold. The prices used to determine the GEO are based on the weighted average price of silver and copper realized from sales at the Aranzazu Mine during the relevant period.

2 Applies the metal sale prices in Aranzazu realized during Q4 2025: Copper price = US

3 Applies the metal sale prices of the 2025 Guidance in Aranzazu: Copper price = US

4 “Constant Price” is a method of converting our copper, silver and molybdenum production or sales volume into GEO based on fixed metal prices. This approach eliminates the impact of metal price fluctuations, when comparing production or sales figures across different periods. Using constant prices allows for a consistent and meaningful comparison of gold equivalent production or sales over time. It ensures that differences in GEO production or sales between two periods reflect changes in actual physical metal production or metal sales and not changes due to fluctuations in commodity prices among the periods. GEO at constant price for previous period, to be compared to GEO for current period, is copper production or sales volume previous period multiplied by copper prices current period plus silver production or sales volume for previous period multiplied by silver prices from current period plus molybdenum production or sales volume for previous period multiplied by molybdenum prices from current period divided by gold price for current period.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/399bfb65-1b3a-4a9b-bc8d-21f73a615942