Plains to Acquire 55% Interest in EPIC Crude Holdings, LP

Rhea-AI Summary

Plains All American Pipeline (Nasdaq: PAA) has announced a strategic acquisition of a 55% non-operated interest in EPIC Crude Holdings for approximately $1.57 billion, which includes about $600 million of debt. The transaction includes a potential $193 million earnout payment if pipeline capacity expansion reaches 900,000 barrels per day by 2027.

EPIC Crude Holdings owns and operates the EPIC Pipeline, which spans 800 miles connecting Permian and Eagle Ford basins to Corpus Christi, with a current capacity of 600,000 barrels per day. The system includes 7 million barrels of operational storage and over 200,000 barrels per day of export capacity.

The acquisition, expected to close by early 2026, will be immediately accretive to distributable cash flow and is projected to generate mid-teens unlevered returns. The remaining 45% stake is owned by an Ares Management Corporation portfolio company.

Positive

- Immediately accretive to distributable cash flow with mid-teens unlevered returns expected

- System underpinned by long-term minimum volume commitments from high-quality customers

- Significant operational capacity with 600,000 barrels per day and expansion potential

- Strategic enhancement of Plains' Permian wellhead to water strategy

- Leverage ratio expected to remain within target range despite transaction size

- Potential for additional synergies through expanded scale and integration

Negative

- Large debt component of $600 million included in acquisition price

- Non-operated interest position limits operational control

- Transaction completion subject to regulatory approval and closing conditions

- Significant capital outlay of $1.57 billion with additional potential earnout of $193 million

News Market Reaction

On the day this news was published, PAA declined 1.72%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Enhancing Wellhead to Water Strategy

HOUSTON, Sept. 02, 2025 (GLOBE NEWSWIRE) -- Plains All American Pipeline, L.P. (Nasdaq: PAA) and Plains GP Holdings (Nasdaq: PAGP) (collectively, “Plains”) announced today that a wholly owned subsidiary has entered into a definitive agreement to acquire from subsidiaries of Diamondback Energy, Inc. and Kinetik Holdings Inc., a

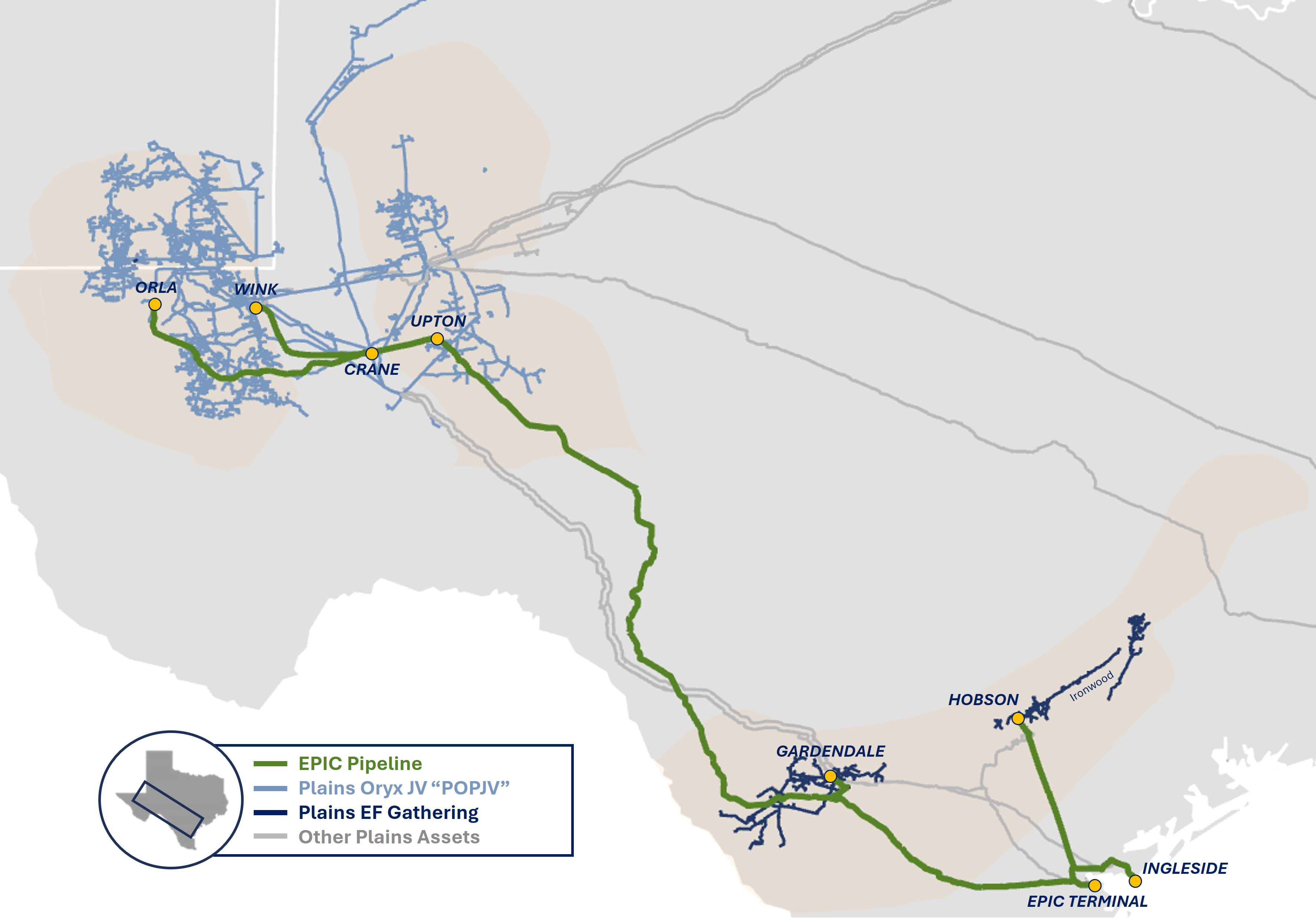

The EPIC Pipeline provides long-haul crude oil takeaway from the Permian and Eagle Ford basins to the Gulf Coast market at Corpus Christi. EPIC Crude Holdings’ assets include:

- Approximately 800 miles of long-haul pipelines, including the EPIC Pipeline

- Operating capacity of over 600,000 barrels per day with low-cost expansion capabilities

- Approximately 7 million barrels of operational storage

- Over 200,000 barrels per day of export capacity

Transaction Highlights:

- Ability to provide customers with additional upstream connectivity and enhanced downstream market connectivity and optionality

- Enhances and expands Plains’ existing Permian wellhead to water strategy

- Synergy potential and Permian growth improves acquisition multiple over the next few years

- System underpinned by long-term minimum volume commitments from high-quality customers

- Expect pro forma leverage ratio to remain within target range (excluding NGL divestiture proceeds); strong balance sheet utilized to finance transaction with cash and debt

- Expected to be immediately accretive to distributable cash flow, supporting additional return of capital opportunities

“We are excited to work with the EPIC Management team. This transaction strengthens our position as the premier crude oil midstream provider, complements our asset footprint and enhances our customer offering. The combination of our stake in EPIC Crude Holdings coupled with our existing integrated Permian and Eagle Ford assets enhances our commitment to offering a high level of connectivity and flexibility for our customers. By further linking our Permian and Eagle Ford gathering systems to Corpus Christi, we are enhancing market access and ensuring our customers have reliable, cost-effective routes to multiple demand centers,” said Willie Chiang, Chairman, CEO and President.

“The combined assets will allow us to capture synergies through additional service offerings, and drive value via expanded scale and integration. Our financial flexibility enables us to finance the acquisition utilizing our balance sheet, while maintaining a pro-forma leverage ratio within our established leverage target range. Ultimately, our interest in EPIC Crude Holdings will not only benefit Plains and our partners but also our unit holders by creating further return of capital opportunities.”

The transaction is expected to be completed by early 2026, subject to customary closing conditions, including clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

Forward-Looking Statements

Except for the historical information contained herein, the matters discussed in this release consist of forward-looking statements including, but not limited to, statements regarding the proposed acquisition of an interest in EPIC Crude Holdings and the terms, timing and anticipated operational, financial and strategic benefits thereof. There are a number of risks and uncertainties that could cause actual results or outcomes to differ materially from results or outcomes anticipated in the forward-looking statements. These risks and uncertainties include, among other things: changes in or disruptions to economic, market or business conditions; substantial declines in commodity prices or demand for crude oil; third-party constraints; legal constraints (including the impact of governmental regulations, orders or policies); unforeseen delays with respect to the receipt of regulatory approvals and completion of other closing conditions; and other factors and uncertainties inherent in transactions of the type discussed herein or in our business as discussed in PAA’s and PAGP’s filings with the Securities and Exchange Commission.

About Plains

PAA is a publicly traded master limited partnership that owns and operates midstream energy infrastructure and provides logistics services for crude oil and natural gas liquids (NGL). PAA owns an extensive network of pipeline gathering and transportation systems, in addition to terminalling, storage, processing, fractionation and other infrastructure assets serving key producing basins, transportation corridors and major market hubs and export outlets in the United States and Canada. On average, PAA handles approximately eight million barrels per day of crude oil and NGL.

PAGP is a publicly traded entity that owns an indirect, non-economic controlling general partner interest in PAA and an indirect limited partner interest in PAA, one of the largest energy infrastructure and logistics companies in North America.

PAA and PAGP are headquartered in Houston, Texas. More information is available at www.plains.com.

Investor Relations Contacts:

Blake Fernandez

Michael Gladstein

PlainsIR@plains.com

(866) 809-1291

A photo accompanying this announcement is available at: https://www.globenewswire.com/NewsRoom/AttachmentNg/f1d33717-c88e-4467-8f8c-779a1107a238