National Survey: Two-Thirds of Middle-Income Families Believe They are Falling Behind the Cost of Living

Cooking at home overwhelmingly preferred (

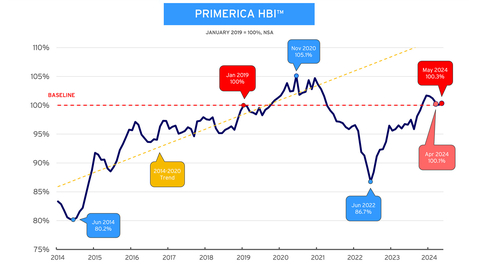

Primerica Household Budget Index™ (HBI™) - Middle-income households experienced a slight increase in purchasing power as the HBI™ rose for the first time in 5 months —

This perception may be influencing individual financial habits with

“Middle-income families are continuing to make adjustments in their budgets in an attempt to manage the ongoing high cost of living,” said Glenn Williams, CEO of Primerica. “Unfortunately, their difficult decisions include the increasing use of credit cards and scaling back saving for the future, which both could negatively impact their long-term financial condition.”

This latest FSM™ survey coincides with the release of Primerica’s Household Budget Index™ (HBI™), which indicates middle-income households experienced a slight increase in purchasing power as the HBI™ rose for the first time in 5 months —

“It’s mildly encouraging that, after taking overall inflation into account, middle-income households saw an average real income gain of

Key Findings from Primerica’s

-

Reports of cutting costs or pausing savings altogether by middle-income families remained steady. During the first quarter,

46% of families reported they were scaling back with48% reporting the same during the second quarter. - The percentage of people cooking at home has increased. There is a major shift in spending and saving habits among middle-income families, including a staggering 4:1 ratio of families who report cooking meals at home compared to eating at restaurants or ordering takeout.

-

Majority grasp financial basics but not complexities. Overall, two-thirds (

65% ) of households feel confident in making sound financial decisions without outside help, particularly when it comes to financial fundamentals like building good credit (87% confident), paying down credit card debt (83% ) and creating and following a financial budget (74% ). However, households continue to express less confidence when it comes to more complex financial matters, including setting up a retirement account such as a 401(k) or Individual Retirement Account (IRA) (66% confident), buying life insurance (63% ), and investing in stocks (50% ). -

Anxiety and limited time are the main drivers in lack of financial planning. More than a quarter (

31% ) say they don’t contribute to a savings account, follow a budget, contribute to an investment account or set a financial budget each month. Anxiety (29% ) and not having time (19% ) continue to be cited as the biggest challenges people have tracking their financial information.

Primerica Financial Security Monitor™ (FSM™) Topline Trends Data

|

Jun 2024 |

Mar 2024 |

Dec 2023 |

Sept 2023 |

Jun 2023 |

Mar 2023 |

Dec 2022 |

Sep 2022 |

Jun 2022 |

How would you rate the condition of your personal finances? Share reporting “Excellent” or “good.” |

|

|

|

|

|

|

|

|

|

Analysis: Respondents remain split on their assessment of their personal finances. |

|||||||||

Overall, would you say your income is…? Share reporting “Falling behind the cost of living” |

|

|

|

|

|

|

|

|

|

Share reporting “Stayed about even with the cost of living” |

|

|

|

|

|

|

|

|

|

Analysis: Concern about meeting the increased cost of living remained steady with two-thirds reporting they are falling behind the cost of living. |

|||||||||

And in the next year, do you think the American economy will be…? Share reporting “Worse off than it is now” |

|

|

|

|

|

|

|

|

|

Share reporting “Uncertain” |

|

|

|

|

|

|

|

|

|

Analysis: Fewer respondents think the economy will get worse over the next year, while more are uncertain about the direction of the economy. |

|||||||||

Do you have an emergency fund that would cover an expense of |

|

|

|

|

|

|

|

|

|

Analysis: The percentage of Americans who have an emergency fund that would cover an expense of |

|||||||||

How would you rate the economic health of your community? (Reporting “Not so good” and “Poor” responses.) |

|

|

|

|

|

|

|

|

|

Analysis: Respondents’ rating of the economic health of their communities has gotten slightly worse over the past year. |

|||||||||

How would you rate your ability to save for the future? (Reporting “Not so good” and “Poor” responses.) |

|

|

|

|

|

|

|

|

|

Analysis: Though slightly improving, a significant majority continue to feel it is difficult to save for the future. |

|||||||||

In the past three months, has your credit card debt…? (Reporting “Increased” responses.) |

|

|

|

|

|

|

|

|

|

Analysis: Credit card debt has fallen slightly over the past year. |

|||||||||

About Primerica’s Middle-Income Financial Security Monitor™ (FSM™)

Since September 2020, the Primerica Financial Security Monitor™ has surveyed middle-income households quarterly to gain a clear picture of their financial situation, and it coincides with the release of the monthly HBI™ four times annually. Polling was conducted online from June 8-11, 2024. Using Dynamic Online Sampling, Change Research polled 1,017 adults nationwide with incomes between

About the Primerica Household Budget Index™ (HBI™)

The Primerica Household Budget Index™ (HBI™) is constructed monthly on behalf of Primerica by its chief economic consultant Amy Crews Cutts, PhD, CBE®. The index measures the purchasing power of middle-income families with household incomes from

The HBI™ is presented as a percentage. If the index is above

Periodically, prior HBI™ values may be revised due to revisions in the CPI series and Consumer Expenditure Survey releases by the

About Primerica, Inc.

Primerica, Inc., headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20240626551113/en/

Public Relations

Gana Ahn, 678-431-9266

gana.ahn@primerica.com

Investor Relations

Nicole Russell, 470-564-6663

nicole.russell@primerica.com

Source: Primerica, Inc.