RF Industries Reports Third Quarter Fiscal Year 2025 Financial Results

Rhea-AI Summary

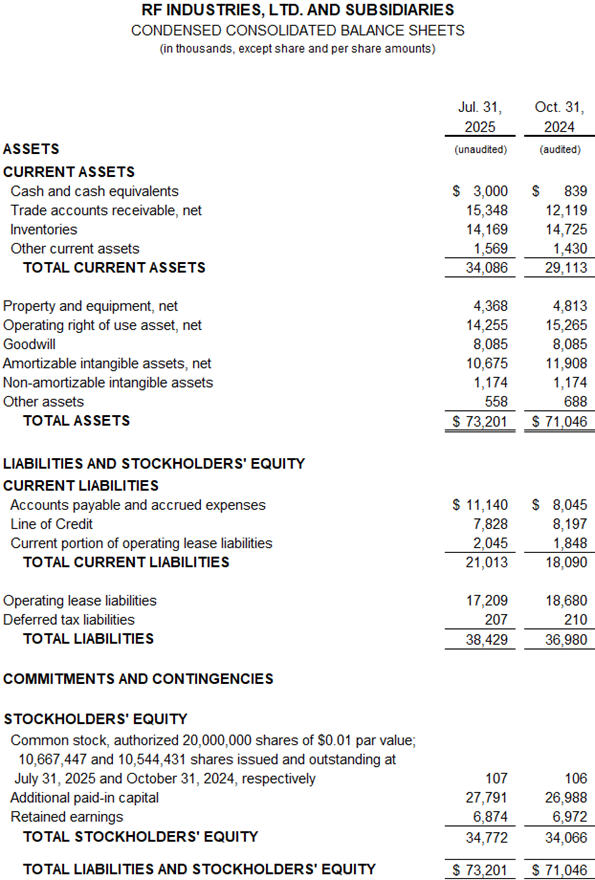

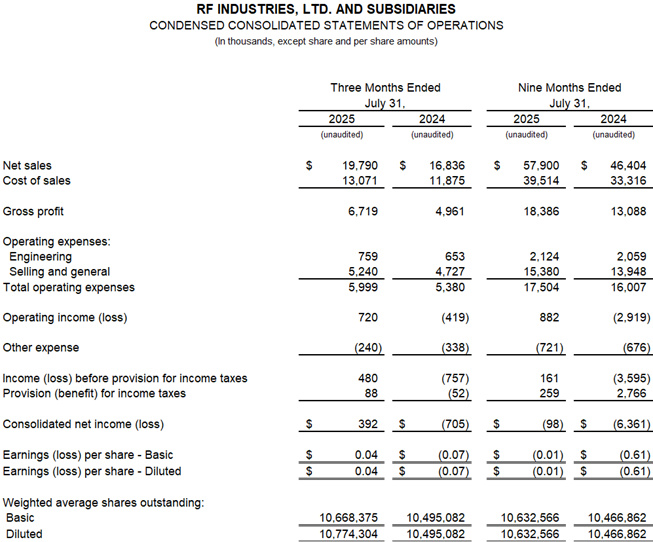

RF Industries (NASDAQ:RFIL) reported strong Q3 fiscal 2025 results with net sales of $19.8 million, up 17.5% year-over-year. The company achieved a gross profit margin of 34%, exceeding their 30% target, and reported operating income of $720,000, compared to a loss in the previous year.

Key financial metrics include consolidated net income of $392,000 ($0.04 per diluted share), non-GAAP net income of $1.1 million ($0.10 per diluted share), and Adjusted EBITDA of $1.6 million. The company ended the quarter with a backlog of $19.7 million on quarterly bookings of $24.5 million.

Management highlighted success in diversifying their customer base and gaining traction with higher-value solutions in aerospace, transportation, and data center markets, while positioning for upcoming stadium and venue buildouts for events like the Olympics and World Cup.

Positive

- Net sales increased 17.5% year-over-year to $19.8 million

- Gross profit margin improved to 34% from 29.5% year-over-year

- Achieved operating income of $720,000 vs loss of $419,000 year-over-year

- Strong backlog of $19.7 million with Q3 bookings of $24.5 million

- Successfully diversified customer base into new markets including aerospace and data centers

Negative

- Facing uncertainties from tariffs and general economic conditions

- Adjusted EBITDA at 8% still below 10% target goal

- Current backlog of $16.1 million shows decline from quarter-end

News Market Reaction

On the day this news was published, RFIL declined 13.13%, reflecting a significant negative market reaction. Argus tracked a peak move of +10.7% during that session. Argus tracked a trough of -22.1% from its starting point during tracking. Our momentum scanner triggered 11 alerts that day, indicating notable trading interest and price volatility. This price movement removed approximately $14M from the company's valuation, bringing the market cap to $92M at that time. Trading volume was exceptionally heavy at 6.1x the daily average, suggesting significant selling pressure.

Data tracked by StockTitan Argus on the day of publication.

SAN DIEGO, CA / ACCESS Newswire / September 11, 2025 / RF Industries, Ltd, (NASDAQ:RFIL), a national manufacturer and marketer of interconnect products and systems, today announced third quarter fiscal year 2025 financial results for the fiscal quarter ended July 31, 2025.

Third Quarter Fiscal 2025 Highlights and Operating Results:

Net sales were

$19.8 million , an increase of17.5% from$16.8 million year-over-year and an increase of4.7% from$18.9 million in the second quarter of fiscal 2025.Backlog of

$19.7 million at quarter-end on third quarter bookings of$24.5 million . As of today, the backlog stands at$16.1 million .Gross profit margin was

34% , up from29.5% in the prior year quarter.Operating income was

$720,000 , an improvement from an operating loss of$419,000 year-over-year.Consolidated net income was

$392,000 , or$0.04 per diluted share, an improvement from a consolidated net loss of$705,000 , or$0.07 per diluted share, year-over-year.Non-GAAP net income was

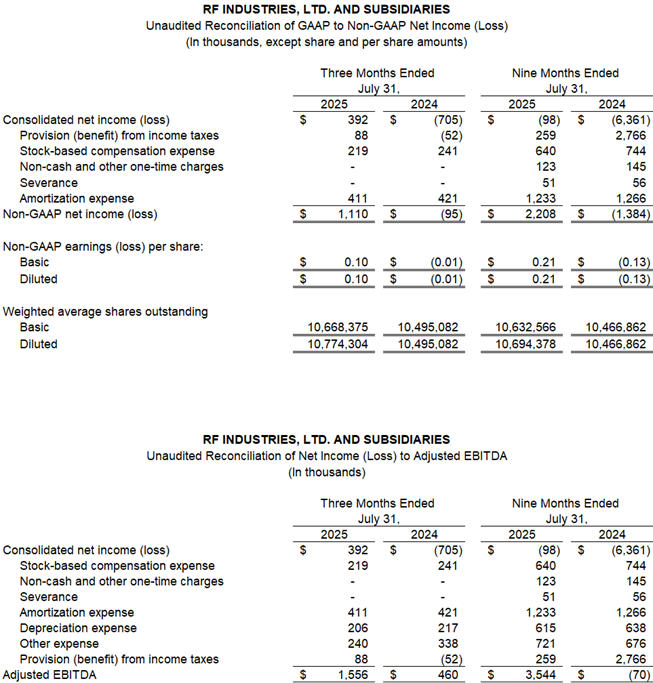

$1.1 million , or$0.10 per diluted share, compared to non-GAAP net loss of$95,000 , or$0.01 per diluted share, in the third quarter of fiscal 2024.Adjusted EBITDA was

$1.6 million , up from$460,000 year-over-year.

See "Note Regarding Use of Non-GAAP Financial Measures," "Unaudited Reconciliation of GAAP to non-GAAP Net Income (Loss)" "Unaudited Reconciliation of Net Income (Loss) to Adjusted EBITDA" and the description of bookings and backlog below for additional information.

Management Commentary

"Our team continued to execute very well in our fiscal third quarter. Net sales increased

"There are several reasons to feel confident that our long-term strategy to become a technology-solutions provider is working. While we are performing well across several product lines, we are pleased that our higher value solutions like DAC thermal cooling and small cell products continue to gain traction with both our traditional Tier 1 customers and in new and exciting end markets. I am tremendously proud of how our team has successfully further diversified our customer base while providing world-class service to current markets and customers. It's exciting to say that the aerospace, transportation, and data center markets are now contributors in our sales pipeline, and we are well positioned for the next wave of new stadium and venue buildouts for world-class events like the Olympics and the World Cup."

"The RFI team has also worked hard over the past few years to lower our cost structure to the point of achieving operating leverage while maintaining the quality that is the hallmark of RFI's reputation. Like many companies, we are carefully navigating an uncertain environment including tariffs and general economic conditions, yet we feel that we have solid momentum as we wrap up a long-awaited breakout year in fiscal 2025," concluded Dawson.

Conference Call and Webcast

RF Industries will host a conference call and live webcast today, September 11, 2025, at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time) to discuss its fiscal third quarter 2025 financial results. To access the live call, dial 888-506-0062 (US and Canada) or 973-528-0011 (International) and give the participant access code 939489. A live audio webcast of the call will also be available on the Investor Relations section of RFI's website at www.rfindustries.com and will be archived for replay.

About RF Industries

RF Industries designs and manufactures a broad range of interconnect products across diversified, growing markets, including wireless/wireline telecom, data communications and industrial. The Company's products include high-performance components used in commercial applications such as RF connectors and adapters, RF passives including dividers, directional couplers and filters, coaxial cables, data cables, wire harnesses, fiber optic cables, custom cabling, energy-efficient cooling systems and integrated small cell enclosures. The Company is headquartered in San Diego, California with additional operations in New York, Connecticut, Rhode Island and New Jersey. Please visit the RF Industries website at www.rfindustries.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to future events. Forward-looking statements include, among others, statements concerning our expectations about profitability, revenues, industry trends, markets and demand for our products, backlog, financial goals, growth opportunities and the expected benefits and desirability of our products, in each case which are subject to a number of factors that could cause actual results to differ materially. Factors that could cause or contribute to such differences include, but are not limited to: the Company's cash and liquidity needs; ability to continue as a going concern; non-compliance with terms and covenants in our credit facility; changes in the telecommunications industry and materialization and timing of expected network buildouts; timing and breadth of new products; our ability to realize increased sales; successfully integrating new products and teams; our ability to execute on our go-to-market strategies and channel models; our reliance on certain distributors and customers for a significant portion of anticipated revenues; the impact of existing and additional future tariffs imposed by U.S. and foreign nations; our ability to expand our OEM relationships; our ability to continue to deliver newly designed and custom fiber optic and cabling products to principal customers; our ability to maintain strong margins and diversify our customer base; our ability to initiate operating efficiencies, cost savings and expense reductions; our ability to address the changing needs of the market and capitalize on new market opportunities; our ability to add value to our customer's needs; the success of any product launches; and our ability to increase revenue, gross margins or obtain profitability in a timely manner. Further discussion of these and other potential risks and uncertainties may be found in the Company's public filings with the Securities and Exchange Commission (www.sec.gov) including our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. All forward-looking statements are based upon information available to the Company on the date they are published, and we undertake no obligation to publicly update or revise any forward-looking statements to reflect events or new information after the date of this release.

Note Regarding Use of Non-GAAP Financial Measures

To supplement our unaudited condensed financial statements presented in accordance with U.S. generally accepted accounting principles (GAAP), this earnings release and the accompanying tables and the related earnings conference call contain certain non-GAAP financial measures, including adjusted earnings before interest, taxes, depreciation, amortization (Adjusted EBITDA), non-GAAP net income (loss) and non-GAAP earnings per share, basic and diluted (non-GAAP EPS).

We believe these financial measures provide useful information to investors with which to analyze our operating trends and performance by excluding certain non-cash and other one-time expenses that we believe are not indicative of our operating results.

In computing Adjusted EBITDA, non-GAAP net income (loss) and non-GAAP EPS, we exclude stock-based compensation expense, which represents non-cash charges for the fair value of stock options and other non-cash awards granted to employees, non-cash and other one-time charges, severance, amortization expense and provision from income taxes. For Adjusted EBITDA, we also exclude depreciation and interest expense. Because of varying available valuation methodologies, subjective assumptions, and the variety of equity instruments that can impact a company's non-cash operating expenses, we believe that providing non-GAAP financial measures that exclude non-cash expense and non-recurring costs and expenses allows for meaningful comparisons between our core business operating results and those of other companies, as well as providing us with an important tool for financial and operational decision-making and for evaluating our own core business operating results over different periods of time.

Our Adjusted EBITDA, non-GAAP net income (loss) and non-GAAP EPS measures may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial results differently, particularly related to non-recurring, unusual items. Our Adjusted EBITDA, non-GAAP net income (loss) and non-GAAP EPS are not measurements of financial performance under GAAP and should not be considered as an alternative to operating or net income or as an indication of operating performance or any other measure of performance derived in accordance with GAAP. We do not consider these non-GAAP measures to be a substitute for, or superior to, the information provided by GAAP financial results. Non-GAAP financial measures are subject to limitations and should be read only in conjunction with the Company's consolidated financial statements prepared in accordance with GAAP. We believe that these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our GAAP results of operations. We compensate for the limitations of non-GAAP financial measures by relying upon GAAP results to gain a complete picture of our performance. A reconciliation of specific adjustments to GAAP results is provided in the last two tables at the end of this press release.

In addition, we have included order bookings and backlogs in this earnings release. Bookings represent new orders that have been received inclusive of any modification or cancellation of previous orders. Backlog represents orders that have been received where revenue has not been recognized as of the specified date. We believe both Bookings and Backlog are indicators of future revenues that the Company expects to generate based on orders that management believes to be firm.

RF Industries Contact:

Peter Yin

SVP and CFO

(858) 549-6340

rfi@rfindustries.com

IR Contact:

Donni Case

Financial Profiles, Inc.

(310) 622-8224

RFIL@finprofiles.com

# # #

SOURCE: RF Industries, Ltd.

View the original press release on ACCESS Newswire