Roundtable CEO James Heckman and RYVYL Announce NASDAQ Listing Secured, with Direct Equity Investment and Reverse Split Ahead of Merger

Rhea-AI Summary

Roundtable and RYVYL (NASDAQ: RVYL) announced that NASDAQ has confirmed RYVYL met the required shareholder equity threshold on Oct 15, 2025, ending prior delisting risk ahead of the planned merger. Roundtable made a direct capital investment to strengthen RYVYL’s balance sheet. RYVYL seeks shareholder approval for a 15:1 reverse stock split at its Annual Meeting on Oct 30, 2025, intended to meet NASDAQ's minimum share price before the compliance deadline of Dec 9, 2025. A definitive merger agreement is signed; closing remains subject to shareholder and regulatory approvals.

Positive

- NASDAQ compliance confirmed on Oct 15, 2025

- Direct capital investment from Roundtable strengthened balance sheet

- Planned 15:1 reverse split proposed for Oct 30, 2025

- Definitive merger agreement signed between Roundtable and RYVYL

Negative

- Merger closing remains subject to shareholder and regulatory approval

- Continued NASDAQ compliance required through the Dec 9, 2025 deadline

Insights

NASDAQ listing risk has been removed via a Roundtable capital infusion; a 15:1 reverse split and a pending merger remain key next steps.

Roundtable’s direct equity investment into RYVYL restored the required shareholder equity threshold and lifted the immediate delisting risk, which stabilizes the company’s public listing ahead of the planned merger. The announced 15:1 reverse stock split, if approved at the

Material dependencies remain: shareholder approval for the reverse split and completion of standard regulatory review for the merger. The lifting of legacy listing issues is explicit, but ongoing compliance is required; the company must maintain post-split share-price and equity metrics to avoid future notices. The definitive agreement is signed, yet closing still depends on routine approvals and votes, which are explicitly unresolved.

Watch the

SAN DIEGO, CA, Oct. 15, 2025 (GLOBE NEWSWIRE) -- Roundtable CEO James Heckman and RYVYL Inc. (NASDAQ: RVYL) today announced that RYVYL was notified by NASDAQ that it has achieved the required shareholder equity threshold, thereby lifting the previous delisting risk, well ahead of anticipated merger between Roundtable and RYVYL.

Compliance confirmation followed a direct capital investment by Roundtable into RYVYL, providing sufficient funding to strengthen its balance sheet and maintain its NASDAQ listing ahead of the previously announced merger between the two companies.

RYVYL Management further confirmed that it is seeking shareholder approval of a planned 15:1 reverse stock split at the Company’s 2025 Annual Meeting of Stockholders scheduled for October 30, 2025, which, upon shareholder approval, is expected to ensure compliance with the NASDAQ’s minimum share price requirement, well in advance of the NASDAQ compliance deadline of December 9, 2025. There are no other legacy NASDAQ listing issues remaining; but requires RYVYL’s continued compliance.

Liquidity-Pool-Powered Media SaaS Platform, Not a Crypto Treasury

Heckman clarified and emphasized for RYVYL investors that, unlike many recently announced “crypto-treasury” mergers and SPAC transactions, Roundtable operates a fully funded enterprise-SaaS platform business, with no investor capital held in escrow. The company is already powering its Web3 media platform for major media brands and premium clients, generating Web3 revenue and reaching millions of monthly media consumers through partnerships with Yahoo, TheStreet and nearly two hundred sports reporters, including the majority of Sports Illustrated’s top revenue producing and highest-audience team channels, as well as the world’s #1 hockey network - also departing SI - all of which recently migrated to Roundtable’s platform.

“It’s important shareholders understand that our Bitcoin-powered liquidity pool Is a competitive advantage for our Web3 SaaS platform business,” said Heckman. “Our revolutionary DeFi media-liquidity pool powers a decentralized payment system that ensures total financial control and sovereignty for our partners and journalists. Roundtable leverages the most advanced and efficient elements of blockchain technology, including decentralized reporting, security, encrypted IP and audience data storage, Web3-based content management and storage, and automated syndication.

Roundtable’s “DeWeb” platform is the most efficient, secure, and profit-creating platform in the industry, architected by the top product pioneers in media and blockchain.”

Restoring IP and Financial Control for Media Companies

“We are excited to bring our large-scale vision to the public marketplace,” said Roundtable co-founder Eyal Hertzog, designer of ‘DeWeb’, Roundtable’s proprietary media platform.

“Media companies everywhere have lost control of their IP and have forfeited economics and distribution - now more than ever as a result of AI co-opting their content – and face opaque revenue and traffic reporting. ‘Followers’ are a myth, payments are delayed for months, and audience data is taken and auctioned off to competitors. We created our platform to help major media brands and professional content creators reclaim ownership, control, and value over their content investments.”

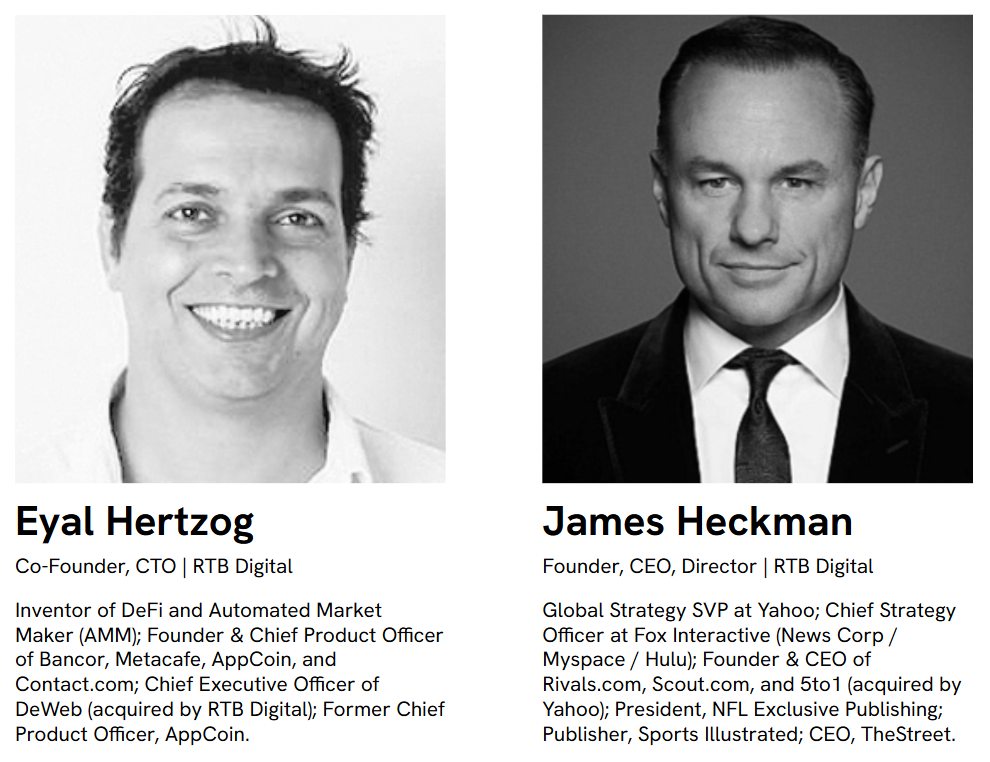

Founders: Digital Media SaaS, Blockchain Pioneers

“DeWeb” Platform architect, Eyal Hertzog and Digital Media SaaS Entrepreneur James Heckman

Heckman leads a team of world-class technology and blockchain innovators, including Eyal Hertzog, co-founder and architect of Roundtable’s “DeWeb” platform, the inventor and patent holder of the primary DeFi protocols, including automated market-making and liquidity pool mechanisms that underpin decentralized finance today as well as Roundtable’s payment system. Hertzog also invented the first social recommendation algorithm at MetaCafe, a precursor to YouTube.

Heckman and Hertzog have joined forces to build the first major media scale, blockchain-based, professional SaaS media platform, including a decentralized payment system that offers publishers transparent, real-time reporting and ability to self-pay without collection delay, while restoring control of their data, audiences, and IP.

They are joined by long-time technology collaborator and co-founder, Bill Sornsin, former Senior Product Leader at Microsoft and co-architect of several global-scale platforms, partnered with Heckman.

The founders combined world-class expertise in digital media architecture, and blockchain innovation, to create the only large-scale, Web3-powered media platform - purpose-built for professional publishers and content networks.

Heckman founded and led Arena, which grew into a nine-figure public company powering publishing, distribution, and monetization for more than 300 brands, including Sports Illustrated, Maxim, History.com, and TheStreet. He previously served as Head of Global Media Strategy at Yahoo!, where he designed the landmark ad platform and coalition between MSN, Yahoo!, and AOL. As Chief Strategy Officer at Fox Interactive, Heckman created the first social-targeted ad platform for MySpace and architected the ~

Roundtable's founder has created and taken public and/or sold to major digital media, ten large scale ventures, including Rivals.com (acquired by Yahoo!), Scout.com (acquired by Fox), 5to1.com (public, acquired by Yahoo!), NFL Exclusive and Arena. Remarkably, each and every business he founded succeeded to sustainability and major industry scale.

Visionary Partners and Board Members

Roundtable co-founders and strategic partners include: incoming Chair Walton Comer, XBTO co-founder, Lucid Holdings co-founder, which sold to CINT for over

Merger Details

A definitive agreement has been signed by the parties. Closing remains subject to shareholder approval and standard regulatory review. Upon closing of the merger:

- James Heckman will become CEO

- Walton Comer will become Chairman, leading board of 7

- George Oliva will remain as EVP/Finance and Chief Accounting Officer, reporting to Heckman

- The company will change its name to RTB Digital, Inc., doing business as “Roundtable”

- Six directors will be appointed by RTB, and independent director Brett Moyer retained; all other incumbent directors of RYVYL will step down.

About Roundtable (RTB Digital, Inc.)

Roundtable is a Web3, digital media SaaS platform company, providing white-label, full stack distribution, community, publishing and monetization for professional media brands, and professional journalists - fortified and powered by a Bitcoin liquidity pool integrated into the platform. Visit RTB.io.

About RYVYL

RYVYL Inc. (NASDAQ: RVYL) operates a digital payment processing business enabling transactions around the globe. By leveraging electronic payment technology for diverse international markets, RYVYL provides payment solutions for underserved markets. RYVYL has developed applications enabling an end-to-end suite of turnkey financial products with enhanced security and data privacy, world-class identity theft protection, and rapid speed to settlement. www.ryvyl.com

Cautionary Note Regarding Forward-Looking Statements

This press release includes information that constitutes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on the Company’s current beliefs, assumptions and expectations regarding future events, which in turn are based on information currently available to the Company. Such forward-looking statements include statements that are characterized by future or conditional words such as "may," "will," "expect," "intend," "anticipate," “believe," "estimate" and "continue" or similar words. You should read statements that contain these words carefully because they discuss future expectations and plans, which contain projections of future results of operations or financial condition or state other forward-looking information.

By their nature, forward-looking statements address matters that are subject to risks and uncertainties. A variety of factors could cause actual events and results to differ materially from those expressed in or contemplated by the forward-looking statements. Risk factors affecting the Company are discussed in detail in the Company’s filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by applicable laws. These forward-looking statements include, but are not limited to, statements regarding the proposed merger between the Company and the target (the “Parties”), the expected closing of the proposed merger and the timing thereof and as adjusted descriptions of the post-transaction company and its operations, strategies and plans, including the management team and board of directors of the Company following the consummation of the merger (the “Combined Company”). There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this press release. These include: the risk that the Parties’ businesses will not be integrated successfully and the risk that cost savings, synergies and growth from the proposed merger may not be fully realized or may take longer to realize than expected; the possibility that stockholders of the Company may not approve the issuance of new shares of Company common stock in the merger or that stockholders of the Company may not approve the merger; the risk that a condition to the closing of the merger may not be satisfied, that either party may terminate the definitive agreement or that the closing of the merger might be delayed or may not occur at all; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the merger; the risk that the parties do not receive regulatory or other approvals of the merger; the occurrence of any other event, change, or other circumstances that could give rise to the termination of the merger agreement or changes to the transactions; the risk that changes in the Company’s capital structure and governance could have adverse effects on the market value of its securities; the ability of the Parties to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on the Parties’ operating results and business generally; the risk the merger could distract the respective managements of the Parties from ongoing business operations or cause the Parties to incur substantial costs; impacts on the Parties’ plans for value creation and strategic advantages, market size and growth opportunities, regulatory conditions, competitive position and the interest of other corporations in similar business strategies, technological and market trends, future financial condition and performance and expected financial impacts of the merger; the risk that the Parties may be unable to reduce expenses or access financing or liquidity; the impact of any economic downturn; the risk of changes in governmental regulations or enforcement practices; and other important factors that could cause actual results to differ materially from those projected and those risk factors discussed in documents of the Company filed, or to be filed, with the SEC that are or will be available on the Company’s website at www.ryvyl.com and on the website of the SEC at www.sec.gov.

Additional Information and Where to Find It

RYVYL intends to file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (as may be amended, the “Registration Statement”), which will include a preliminary proxy statement of RYVYL connection with the proposed merger between RYVYL and RTB pursuant to the definitive merger agreement. The definitive proxy statement and other relevant documents will be mailed to stockholders of RYVYL as of a record date to be established for voting on the proposed merger. STOCKHOLDERS OF RYVYL AND OTHER INTERESTED PARTIES ARE URGED TO READ, WHEN AVAILABLE, THE PRELIMINARY PROXY STATEMENT, AND AMENDMENTS THERETO, AND THE DEFINITIVE PROXY STATEMENT IN CONNECTION WITH RYVYL’S SOLICITATION OF PROXIES FOR THE SPECIAL MEETING OF ITS STOCKHOLDERS TO BE HELD TO APPROVE THE PROPOSED MERGER BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT RYVYL, RTB AND THE PROPOSED Merger. Stockholders will also be able to obtain copies of the Registration Statement and the proxy statement/prospectus, without charge, once available, on the SEC’s website at www.sec.gov or by directing a request to:

RYVYL IR Contact:

Richard Land, Alliance Advisors Investor Relations

973-873-7686 ryvylinvestor@allianceadvisors.com

Roundtable PR Contact:

Mehab Qureshi, RTB Digital Inc.

+91 90289 77198, mehab@roundtable.io