Safe and Green Development Corporation Obtains 25% Pricing Increase on Recurring Compost Purchase Orders

Rhea-AI Summary

Safe and Green Development Corporation (NASDAQ: SGD) announced a 25% price increase on recurring weekly compost purchase orders at its Myakka, Florida facility, effective with orders from the consistent high-volume customer who maintained order volume after the change.

The company said the pricing boost directly contributes to gross revenue and improves unit economics while aligning with operational upgrades, including newly delivered equipment and planned integration of a Microtec mill. SGD also will publish a monthly third-party inventory flyover report for the Myakka site on sgdevco.com/media to increase transparency.

Positive

- Price increase of 25% on recurring compost orders

- Customer maintained volume after price change

- Price change directly contributes to gross revenue

- Planned Microtec mill integration to support higher-value products

Negative

- Price increase tied to a single high-volume customer

- No quantified revenue or timing for Microtec mill commercialization

News Market Reaction

On the day this news was published, SGD declined 6.31%, reflecting a notable negative market reaction. Argus tracked a peak move of +14.3% during that session. Argus tracked a trough of -17.1% from its starting point during tracking. Our momentum scanner triggered 14 alerts that day, indicating notable trading interest and price volatility. This price movement removed approximately $136K from the company's valuation, bringing the market cap to $2M at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Pre-news, SGD was up 0.93% while peers were mixed: XIN +3.17%, LRE +3.87%, GBR flat, JFB -6.8%, AEI -12.42%, suggesting stock-specific drivers rather than a broad sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 09 | Equipment expansion | Positive | -57.3% | Announced Micotec Mill delivery and fully operational upstream systems at Myakka. |

| Nov 25 | New customer orders | Positive | +4.2% | Secured new wood fines purchase orders from a large agricultural distributor. |

| Nov 14 | Q3 earnings spike | Positive | -9.8% | Reported ~4,200% YoY revenue growth and higher gross margin but ongoing losses. |

| Oct 30 | Debt retired | Positive | +8.0% | Announced full satisfaction and retirement of all outstanding convertible debt. |

| Oct 22 | Capacity upgrade | Positive | -4.3% | Deployed new shredding and grinding equipment to boost throughput in Florida. |

Recent history shows largely positive operational and financial updates, but share reactions have been mixed, with several positive news events followed by negative price moves.

Over the last few months, Safe and Green Development reported record Q3 2025 revenue of $3.5 million (+~4,200% YoY) and gross profit of $0.9 million, while still posting a Q3 net loss of $(4.35) million. The company expanded capacity with Komptech and Diamond Z equipment and secured new weekly wood fines orders of about $9,000. It also retired all outstanding convertible debt. Despite this, the stock fell 57.3% after the Micotec Mill update and 9.84% after Q3 results, showing a tendency for volatile or skeptical reactions to positive news.

Regulatory & Risk Context

An active preliminary Form S-3 covers resale of up to 91,115,703 shares held by selling stockholders. The company would not receive proceeds from resales and only up to $9.0 million if warrants are exercised for cash, though the filing notes cashless exercise is likely. The prospectus highlights potential substantial dilution from Series B conversions, anti-dilution resets, and dividend share issuances.

Market Pulse Summary

The stock moved -6.3% in the session following this news. A negative reaction despite the announced 25% price increase on recurring compost orders would fit a pattern where prior positive updates, such as Q3 revenue growth to $3.5 million, saw weak share responses. Investors may be focused on balance-sheet and dilution risks, including the registered resale of up to 91,115,703 shares under the preliminary S-3. Such overhangs could temper enthusiasm for incremental operational improvements.

AI-generated analysis. Not financial advice.

MIAMI, FL, Dec. 16, 2025 (GLOBE NEWSWIRE) -- Safe and Green Development Corporation (NASDAQ: SGD) (“SGD” or the “Company”) today announced that it has successfully implemented a

The pricing adjustment reflects strong underlying demand for the Company’s compost products and demonstrates increasing pricing power across its materials processing platform. The increased pricing contributes directly to gross revenue and supports improved unit economics while maintaining consistent recurring order volumes.

The higher pricing aligns with the Company’s broader operational strategy, including ongoing enhancements designed to improve throughput, material consistency, and reliability. These initiatives include the deployment of newly delivered equipment and the planned integration of the Company’s Microtec mill, which is expected to support the development of higher-value engineered soil and compost-based product offerings.

“The ability to increase pricing on a recurring, high-volume customer without impacting demand reflects the operational progress we have made at the Myakka site,” said David Villarreal, Chief Executive Officer of Safe and Green Development Corporation. “As we continue to enhance throughput, consistency, and reliability across the platform, we believe these improvements position the Company to deliver stronger unit economics and more durable recurring revenues."

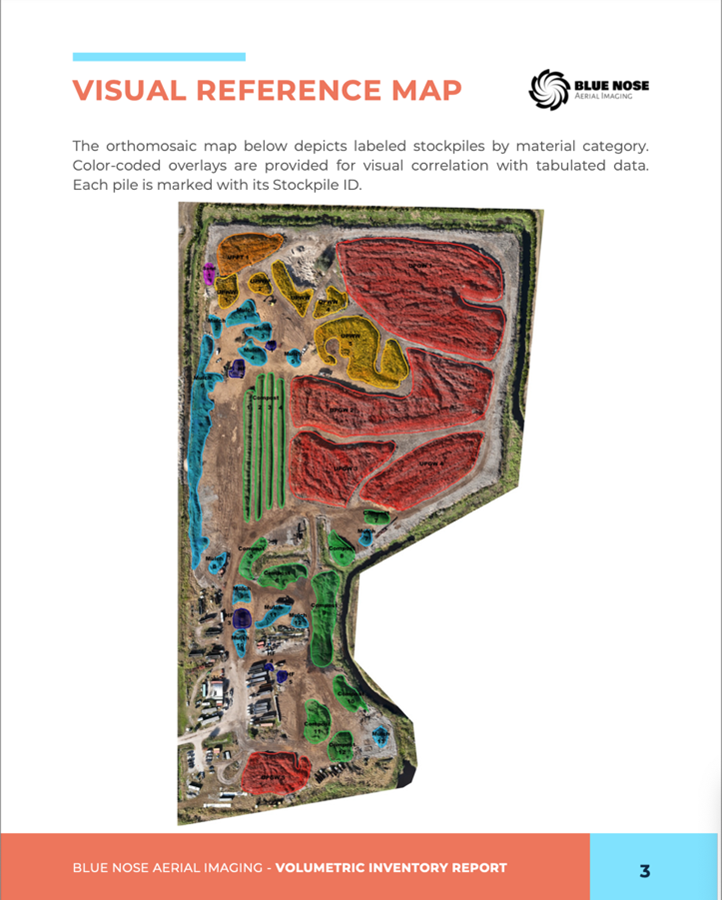

Third-party aerial flyover of Safe and Green Development Corporation’s compost processing facility in Myakka City, Florida

Third-party aerial flyover of Safe and Green Development Corporation’s compost processing facility in Myakka City, Florida

In addition, the Company announced that it intends to begin publishing a monthly third-party inventory flyover report of its Myakka site, which will be made available at sgdevco.com/media.This initiative is part of the Company’s ongoing effort to enhance shareholder transparency into day-to-day operations and inventory activity.

About Safe and Green Development Corporation

Safe and Green Development Corporation is a real estate development and environmental solutions company. Formed in 2021 as Safe and Green Development Corporation, the Company focuses primarily on the direct acquisition and indirect investment in properties across the United States that are intended for future development into green single-family or multifamily housing projects.

The Company wholly owns Resource Group US Holdings LLC, an environmental and logistics subsidiary operating a permitted 80+ acre organics processing facility in Florida. Resource processes source-separated green waste and is expanding into the production of sustainable, high-margin potting media and soil substrates through advanced milling technology. Its operations also include a logistics platform that provides transportation services across biomass, solid waste, and recyclable materials, supporting both in-house and third-party infrastructure needs.

Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are or may be deemed to be forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “should,” “potential,” “continue,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” and similar expressions and include statements regarding the strong underlying demand for the Company’s compost products, the Company’s increasing pricing power across its materials processing platform, , the planned integration of the Company’s Microtec mill, ts, the ability to increase pricing without impacting demand, continuing to enhance throughput, consistency, and reliability across the platform, the improvements positioning the Company to deliver stronger unit economics and more durable recurring revenues and the Company’s ability to strengthen unit economics, and the publication of a monthly third-party inventory flyover report .

These forward-looking statements are based on certain assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions, and expected future developments, as well as other factors the Company believes are appropriate under the circumstances. Important factors that could cause actual results to differ materially from current expectations include, among others, the Company’s ability to sustain higher pricing levels without impacting customer demand or order volumes; the Company’s ability to increase throughput and material consistency; the Company’s ability to successfully integrate and operate new and planned equipment, including the Microtec Mill; supply chain conditions; market demand for compost, soil, and environmental products; the Company’s ability to deliver stronger unit economics and more durable recurring revenues; regulatory considerations; the Company’s ability to publish a monthly third-party inventory flyover report; the Company’s ability to maintain adequate liquidity and working capital; the Company’s ability to execute on its operational and strategic initiatives; and other risks detailed from time to time in the Company’s filings with the Securities and Exchange Commission. All forward-looking statements are qualified in their entirety by this cautionary statement, and the Company undertakes no obligation to revise or update this press release to reflect events or circumstances after the date hereof.

For investor inquiries, please email

info@sgdevco.com

Attachment