Signature Resources Announces Findings from Spring Field Program

Rhea-AI Summary

Signature Resources (OTCQB: SGGTF) has announced results from its spring 2025 field program at the Lingman Lake Gold Mine. The program, which collected 111 samples across five key areas, revealed that nearly 25% of samples returned gold values of 0.10 g/t Au or higher.

Notable findings include a grab sample of 8.26 g/t Au in Area 1 near a previous sample of 11.52 g/t Au, and three grab samples in Area 2 returning values up to 9.91 g/t Au. The company also amended a related party loan agreement, extending the maturity date to September 30, 2025, and increasing the loan amount to $350,000 for general corporate activities.

Positive

- Nearly 25% of samples returned gold values of 0.10 g/t Au or greater

- High-grade grab samples discovered, including 8.26 g/t Au in Area 1 and 9.91 g/t Au in Area 2

- Interest-free loan secured for $350,000 to support ongoing operations

Negative

- Surface gold grades are generally lower due to weathering effects

- Additional detailed mapping and sampling programs still required

- Company requires interim funding through loan for general corporate activities

News Market Reaction

On the day this news was published, SGGTF declined 11.63%, reflecting a significant negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

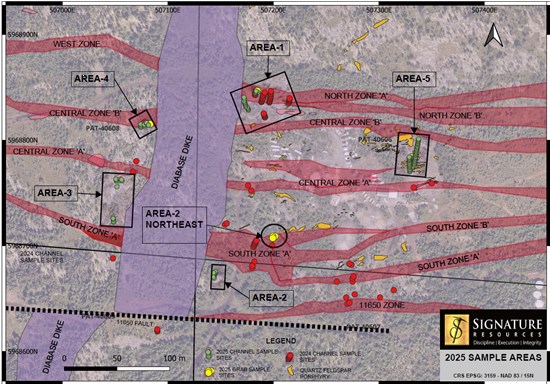

Toronto, Ontario--(Newsfile Corp. - August 19, 2025) - Signature Resources Ltd. (TSXV: SGU) (OTCQB: SGGTF) (FSE: 3S30) ("Signature" or the "Company") is pleased to announce the results of the spring field program conducted in May, 2025. The field program focused on five locations (Figure 1. 2025 Sampling Program Areas) within the defined Lingman Lake Gold Mine. These surface programs continue to help delineate surface expressions of mineralization on the property. These programs are very cost effective and beneficial for further developing our understanding of the deposit and designing future exploration activity. The company collected 111 samples during this program and nearly a quarter of the samples returned assay values of 0.10 grams per tonne of gold ("g/t Au") or greater. Table 1, Sampling Results, provides sample locations and assay results.

Figure 1. 2025 Sampling Program Areas

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/263079_e7146d66a4bae910_001full.jpg

Area 1

The program in Area 1 sampled the North Gold Zone immediately east of the north-south trending diabase dike which bisects the Lingman Lake property. This work was following up on the 2024 sampling program and to investigate a possible mineralized envelope between Central Zone 'B' and North Zone 'A'. A 14 metre ("m") transect, adjacent to the eastern contact of the dike, consisted of 13 channel cuts. The two most northerly samples returned gold values of 0.14 grams per tonne of gold (g/t Au) and 0.21 g/t Au and appear to be in the North Zone mineralized envelope. A grab sample returned a value of 8.26 g/t Au. This sample was near the north edge of the outcrop area and 1 m northeast of a 2024 channel sample that yielded a value of 11.52 g/t Au. The northern edge of this outcrop appears to delineate the southern edge of the North Zone. In this area it appears to occupy a trough, marked by heavy vegetation and likely relates to recessive weathering of the North Zone. The trough can be traced 600 m to the east and 400 m to the west and can be a useful topographic linear for prospecting.

Area 2

This area was selected to investigate the section between the South Zone and 11650 Zone immediately east of the dike. Seven channel samples were collected in the vicinity of old trenches. Values were generally low, however channel samples of 0.8 m and 1.0 m in length yield gold values of 0.24 g/t au and 0.54 g/t Au. 60 m northeast of where the channels were collected, within the South Zone, three grab samples returned gold values of 0.67, 4.31 and 9.91 g/t Au in silicified mafic volcanics, see Area 2 Northeast.

Area 3

Located adjacent to the west contract of the diabase dike, Area 3 investigated the strike projection of the South Zone west of the dike. In our 2024 drill program holes LM 24-09 and LM 24-10 intersected gold mineralization of 1.81 g/t Au over 51 m and 1.80 g/t Au over 34 m respectively. In an attempt to locate the surface expression of these drill hole intercepts, outcrop exposure in the general area was prospected and sampled. Much like the North Zone, actual location of the South Zone appears to be located where the southern edge of the outcrop dives into a recessively weathered trough suggesting that sulphide oxidation weathered down the exposure. Channel samples were collected immediately north of the trough and returned low gold values.

Area 4

Area 4 is located adjacent to the West contact of the transecting dike and was selected to follow-up on a 2024 sample that yielded 5.45 g/t Au as well as a small channel cut reporting 2.31 g/t Au. Eleven channel samples were collected across a 4 m wide outcrop of which four returned values ranging from 0.11 to 1.63 g/t Au. This is a new target area warranting further work as it is interpreted to represent a surface expression of the Central Zone "B".

Area 5

This section of exposed outcrop lies 66 metres northeast of the shaft. Sampling efforts focused on the space between Central Zone 'A' and Central Zone 'B", aiming to assess gold distribution across the interzonal corridor. Outcrop is the typical mixture of mafic volcanic rocks which are variably rusty and/or carbonatized with intercalated narrow quartz-feldspar porphyry ("QFP"). This large area is characterized by a complicated network of narrow QFP dikes and sills within the mafic volcanic rocks. The QFP are often folded with fold noses plunging moderately to the west. Two north-sough transects consisting of 42 individual samples, measuring between 0.5 and 1.0 metre in length were collected across a 33 m wide area. Of these, eight samples returned gold grades ranging from 0.13 to 1.27 g/t Au. A detailed mapping and sampling program is warranted for this area to work out the structural elements within the Lingman Lake deposit.

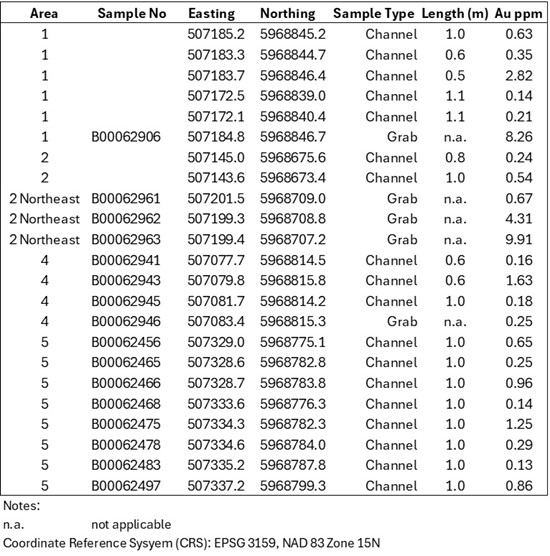

Table 1. Sampling Results >0.10 g/t Au

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/263079_table1.jpg

The field program was very successful in advancing our knowledge of the identified gold zones within the Lingman Lake Gold Project. It is not surprising to have lower reported gold grades at the surface, especially with the recessive nature of the weathered zones in Area 1 and Area 3. Field work continues to add to the database providing refined surface placement of the zones and their projections along strike. This has direct implications on drill hole placement and geophysical tracing of the zones.

Amended Related Party Loan

The Company also announces that it has amended the loan agreement with a related party to provide interim funding for general corporate activities dated January 2, 2025. The loan maturity date has been extended to September 30, 2025 and loan amount increased to

The Company anticipates repaying the loan through future equity financings. The company confirms that the loan agreement meets the exemption requirements and complies with TSXV Policy 5.9 and MI61-101. The transaction remains subject to the approval of the TSX Venture Exchange.

Qualified Person

The scientific and technical content of this press release have been reviewed and approved by Mr. Walter Hanych, P. Geo, consultant and Head Geologist, is a Qualified Persons under NI 43-101 regulations.

Quality Assurance and Quality Control

Signature Resources maintains an industry standard Quality Assurance / Quality Control (QA/QC) program at the Lingman Lake Project to ensure sampling and analysis of all exploration work is conducted in accordance with best practices. John Siriunas, P. Eng. is the independent Qualified Person under 43-101 who monitors and scrutinizes the results of the QA/QC program.

Assay results from SGS's Red Lake lab for gold and the Burnaby lab for gold and multi-element are directly e-mailed to three individuals: Dan Denbow, President and CEO of Signature Resources, Walter Hanych, P. Geo. consultant to the company, and John Siriunas, P. Eng. independent consultant to the company.

SGS a certified laboratory and also have internal quality control ("QC") programs that include insertion of reagent blanks, reference materials, and pulp duplicates. The Corporation inserts QC samples (blanks and reference materials) at regular intervals to monitor laboratory performance.

About Signature Resources Ltd.

The Lingman Lake gold property (the "Property") consists of 1,274 single-cell and 13 multi-cell staked claims, four freehold fully patented claims and 14 mineral rights patented claims totaling approximately 24,821 hectares. The Property includes what has historically been referred to as the Lingman Lake Gold Mine, an underground substructure consisting of a 126.5-metre shaft, and 3-levels at depths of 46-metres, 84-metres and 122-metres. There has been over 43,222 metres of drilling done on the Property and four 500-pound bulk samples that averaged 19 grams per tonne of gold. In November 2023, Wataynikaneyap Power energized a new 115kV high tension transmission line within 40 km of the historic Lingman Lake Mine (https://www.wataypower.ca/).

To find out more about Signature, visit www.signatureresources.ca or contact:

Dan Denbow

Chief Executive Officer

(800) 259-0150

info@signatureresources.ca

or contact:

Renmark Financial Communications Inc.

John Boidman: jboidman@renmarkfinancial.com

Tel: (416) 644-2020 or (212) 812-7680

www.renmarkfinancial.com

Cautionary Notes

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This news release contains forward-looking statements which are not statements of historical fact. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions and risks associated with infectious diseases and global geopolitical events. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to changes in general economic and financial market conditions, failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263079