SLAM Reports Copper, Nickel and Cobalt Assays and Extends Farquharson Zone Strike Length to 360 Meters at Goodwin

Rhea-AI Summary

SLAM (OTC:SLMXF) released assay results from the first three holes of its 2025 Goodwin diamond drilling campaign in New Brunswick on December 3, 2025. Key intercepts include 2.40% CuEq over 4.50 m in GW25-16 and 0.97% CuEq over 48.00 m in GW25-17, using assumed 90% recoveries and metal prices dated November 29, 2025. The company completed 10 holes totaling 2,603 m, with one hole on the Granges Zone and nine on the Farquharson Zone. The Farquharson Zone strike was extended to 360 m and remains open in both directions. The company is requesting quotes for airborne and down-hole EM surveys ahead of 2026 drilling. Reported lengths are drilled core intervals; true widths are undetermined.

Positive

- Intercept of 2.40% CuEq over 4.50 m in GW25-16

- Intercept of 0.97% CuEq over 48.00 m in GW25-17

- Completed 10 holes (2,603 m) in 2025 Goodwin campaign

- Farquharson strike extended to 360 m and open both directions

- Company seeking airborne and down-hole EM surveys for 2026

Negative

- True widths not determined, limiting immediate resource interpretation

- CuEq uses assumed 90% recoveries and Nov 29, 2025 metal prices, which may change economics

- Only first three hole assays released; rest of campaign results pending

Key Figures

Market Reality Check

Peers on Argus

While SLMXF showed a -3.78% move, peers were mixed: VAUCF and GSTMF were up, ORFDF and RYES were down, and OSCI was flat. This points to stock-specific dynamics rather than a uniform sector move.

Market Pulse Summary

This announcement detailed new assay results from the 2025 Goodwin drilling campaign, including Cu-equivalent grades up to 2.40% over 4.50 meters and a Farquharson Zone strike length of 360 meters. The company completed 10 NQ core holes totaling 2,603 meters and is planning additional geophysical work ahead of the 2026 program. Investors may track future assay releases, updated interpretations of mineralization, and any changes in exploration scope or timelines.

Key Terms

copper equivalent technical

ppm technical

utm technical

electromagnetic surveys technical

qa-qc technical

over-limit technical

assay technical

multi-element analysis technical

AI-generated analysis. Not financial advice.

Drilling For Critical Elements In The Mineral-Rich Province Of New Brunswick, Canada

MIRAMICHI, NB / ACCESS Newswire / December 3, 2025 / SLAM Exploration Ltd. (TSXV:SXL) ("SLAM" or the "Company") is pleased to announce assay results from the first three of ten holes drilled in the 2025 diamond drilling campaign on its wholly owned Goodwin claims, located 35 kilometers southwest of the Caribou Mine in the mineral-rich Bathurst Mining Camp of New Brunswick.

Highlights include:

2.40% copper equivalent over 4.50 meters in hole GW24-16 on the Granges Zone; and0.97% copper equivalent over 48.00 meters in hole GW-17 on the Farquharson Zone.

The copper equivalent values assume mill recoveries of

Hole Number | From M | To M | Length Meters | Copper % | Nickel % | Cobalt | Gold ppm | Silver ppm | Cu Eq % |

GW25-16 | 10.63 | 11.15 | 0.52 | 1.90 | 1.36 | 0.12 | 0.21 | 11.10 | 4.12 |

GW25-16 | 72.00 | 73.00 | 1.00 | 1.44 | 0.30 | 0.02 | 0.07 | 10.00 | 1.96 |

GW25-16 | 77.50 | 80.68 | 3.18 | 0.39 | 0.81 | 0.05 | 0.06 | 4.73 | 1.60 |

GW25-16 | 69.50 | 80.68 | 11.18 | 0.45 | 0.36 | 0.03 | 0.10 | 4.73 | 1.11 |

GW25-16 | 124.50 | 125.90 | 1.40 | 1.59 | 0.59 | 0.05 | 0.06 | 10.20 | 2.53 |

GW25-16 | 124.50 | 129.00 | 4.50 | 0.97 | 0.96 | 0.07 | 0.04 | 5.66 | 2.40 |

GW25-17 | 98.00 | 135.50 | 37.50 | 0.50 | 0.43 | 0.04 | 1.11 | ||

GW25-17 | 98.00 | 146.00 | 48.00 | 0.44 | 0.37 | 0.04 | 0.97 | ||

GW25-17 | 160.40 | 165.50 | 5.10 | 0.51 | 0.17 | 0.02 | 0.72 | ||

GW25-18 | 46.75 | 62.50 | 15.75 | 0.56 | 0.10 | 0.01 | 0.66 | ||

GW25-18 | 103.90 | 117.40 | 13.50 | 0.50 | 0.11 | 0.01 | 0.62 |

Copper equivalent (Cu Eq%) values are "recovered grades" with assumed recoveries of

Hole_ID | East_UTM | North_UTM | Elev | Az | Dip | Length_m |

GW2516 | 697208 | 5238922 | 447 | 115 | -70 | 308 |

GW2517 | 698053 | 5238576 | 490 | 45 | -70 | 452 |

GW2518 | 698036 | 5238616 | 483 | 42 | -70 | 170 |

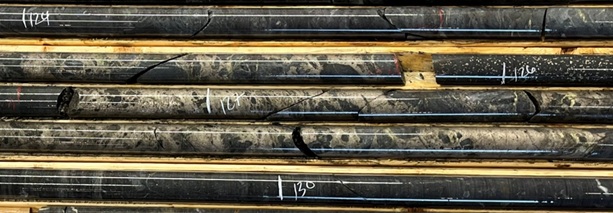

Figure 1 DDH GW125-16 From 124 to 130 Meters

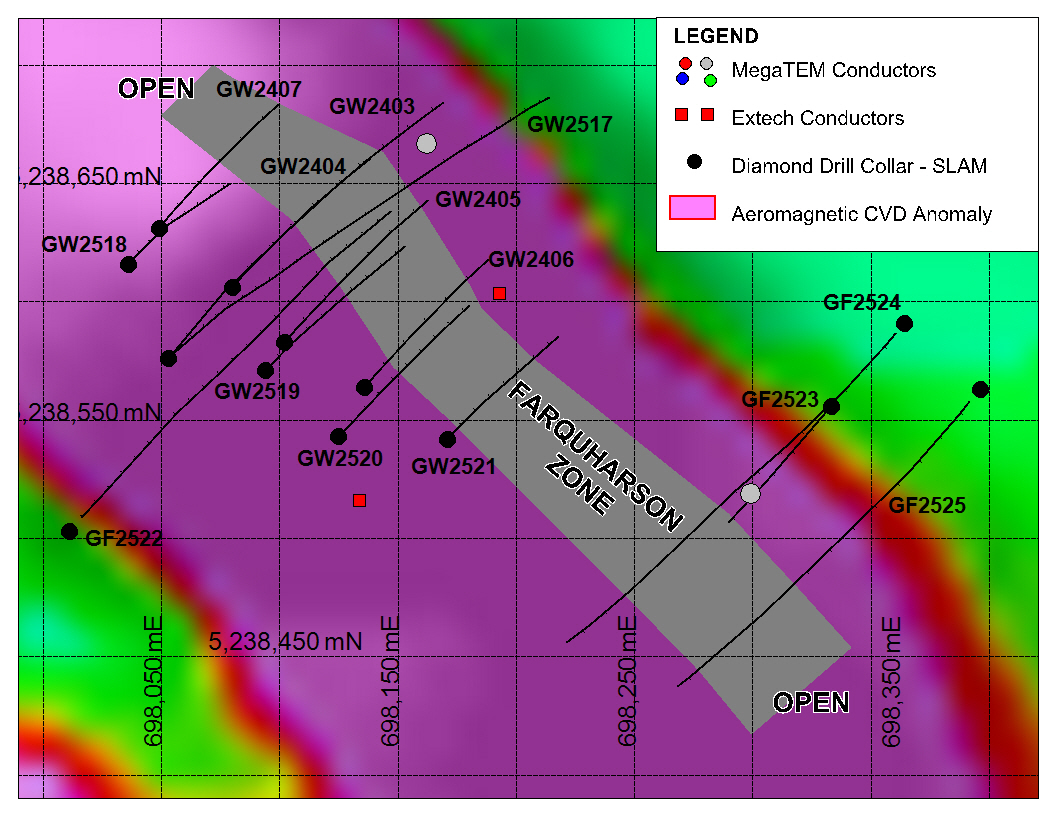

The Company completed 10 holes of NQ size core drilling for a total of 2,603 meters in the 2025 Goodwin drilling campaign. This included one hole on the Granges Zone and nine holes on the Farquharson Zone. The strike length of the Farquharson Zone was extended to 360 meters and is open in both directions as shown on Figure 2.

Figure 2 Farquharson Zone Diamond Drilling Plan - Aeromagnetic Calculated Vertical Gradient (CVD)

The Company has requested quotes from geophysics contractors for airborne and down-hole electromagnetic surveys, to be conducted in preparation for the 2026 drilling campaign at Goodwin.

QA-QC Procedures: Core was collected from the drill in trays and delivered to a secure logging facility in Bathurst, New Brunswick. After logging, samples were sawn using a diamond blade. Sawn half-core samples were numbered, collected in bags, tagged and delivered to Activation Laboratories Ltd. ("Actlabs") in Fredericton. Actlabs will perform multi-element analysis using assay method UT7. Samples returning over-limit results (greater than

About SLAM Exploration Ltd: SLAM Exploration Ltd. is a publicly listed resource company with a 40,000-hectare portfolio of mineral claim holdings in the mineral-rich province of New Brunswick. Diamond drilling is in progress on the Goodwin copper-nickel-cobalt project in the Bathurst Mining Camp ("BMC") of New Brunswick. The drilling program follows significant copper, nickel and cobalt intercepts from 15 diamond drill holes reported by the Company in 2024 on the Goodwin project. These include a 64.90 meter core interval, grading

The Company launched its 2025 exploration program with two new gold discoveries on its wholly-owned Jake Lee claims. SLAM reported eight grab samples with assays ranging from 7.42 grams per tonne ("g/t") to 94.80 g/t gold in the initial discovery on July 9, 2025. A second discovery comprised quartz float grading 16.20 and 3.78 g/t gold respectively 100 meters southwest of the initial discovery as reported August 28, 2025.The Jake Lee claims are located 25 kilometers southeast of the Clarence Stream gold deposit where Galway Metals Inc. is working on an indicated resource estimated at 922,000 oz at a grade of 2.31 g/t gold plus an inferred resource of 1,334,000 oz at a grade of 2.60 g/t gold. (Reference: "Updated Mineral Resource Statement, Clarence Stream Deposits, New Brunswick, Canada, by SLR Consulting (Canada) Ltd., March 31, 2022"). SLAM's exploration team recently mobilized back to Jake Lee.

SLAM reported gold bearing core intervals including 162.5 g/t gold over 0.2 m and 56.90 g/t gold over 0.5 m from the Maisie vein in news releases on December 13, 2021 and November 22, 2022. The Company had previously reported a core interval grading 3,955 g/t (127oz) gold Au over 0.1m from the No. 18 vein. These veins are associated with a soil geochemical anomaly that stretches for 3,000 meters along strike. Assays are pending on 900 additional samples to expand the soil coverage and further define the target on this extensive vein system.

The Company is a project generator and expects to receive significant cash and share payments in 2025. SLAM received 1,200,000 shares plus cash from Nine Mile Metals Inc. (NINE) on February 28, 2025 pursuant to the Wedge project agreement. On March 29, 2025, the Company received a cash payment of

To view SLAM's corporate presentation, click SXL-Presentation. Additional information is available on SLAM's website and on SEDAR+ at www.sedarplus.ca. Follow us on X @SLAMGold.Join our company newsletter by clicking SXL-News to receive timely company updates and press releases relating to SLAM Exploration.

Qualifying Statements: Mike Taylor P.Geo, President and CEO of SLAM Exploration Ltd., is a qualified person as defined by National Instrument 43-101, and has approved the contents of this news release.

CONTACT INFORMATION:

Mike Taylor, President & CEO

Contact: 506-623-8960

mike@slamexploration.com

Jimmy Gravel, Vice-President

Contact 902-273-2387

jimmy@slamexploration.com

SEDAR+: 00012459

Forward-Looking Statements

This news release contains "forward-looking statements" and "forward-looking information" within the meaning of applicable Canadian securities laws. Forward-looking statements are not historical facts but instead represent management's expectations, estimates and projections regarding future events or circumstances. Forward-looking statements are often, but not always, identified by words such as "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential," "may," "could," "would," "might," or "will," and similar expressions.

Forward-looking statements in this news release include, but are not limited to: statements regarding the Company's exploration plans at the Goodwin Project, the anticipated scope, timing and results of the current and future drill programs, the potential extension of mineralized zones, and the potential to identify additional mineral resources.

Forward-looking statements are based on reasonable assumptions made by the Company as of the date of this release, including assumptions that geological interpretations and mineralization continuity are reasonable; that planned drill and geophysical programs can be completed as scheduled; that equipment, contractors and personnel will be available on acceptable terms; that assay and geophysical results will be received within expected timeframes; that commodity prices and economic conditions will remain generally supportive; and that required permits and approvals will be obtained in a timely manner.

These forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to differ materially from those expressed or implied. Such risks and uncertainties include, without limitation: exploration results that may not confirm current interpretations or expectations; geophysical survey results that may not define viable drill targets; delays in exploration programs; availability of drill equipment, contractors, and personnel; increases in costs; changes in commodity prices; availability of financing on acceptable terms; general economic, market and business conditions; regulatory changes; environmental risks; operating hazards; delays or inability to obtain required approvals; and other risk factors described in the Company's most recently filed Management's Discussion and Analysis and other filings with Canadian securities regulators.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not undertake to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: SLAM Exploration Ltd.

View the original press release on ACCESS Newswire