SoFi Reports Fourth Quarter 2025 With Record Net Revenue of $1.0 Billion, Record Member and Product Growth, Net Income of $174 Million

Key Terms

adjusted ebitda financial

fee-based revenue financial

rule of 40 financial

net interest margin financial

basis points financial

non-gaap financial

contribution margin financial

stablecoin technical

Adjusted Net Revenue up

Adjusted EBITDA up

Fee-based Revenue up

Member growth up

Product growth up

Management announces 2026 guidance and medium term outlook

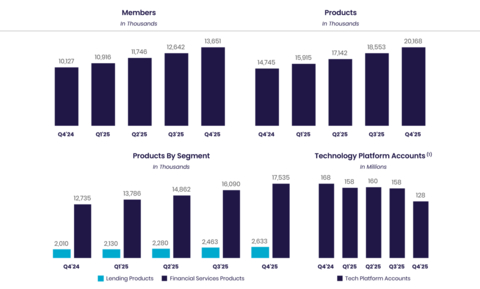

Note: For additional information on our company metrics, including the definitions of "Members", "Total Products" and "Technology Platform Total Accounts", see Table 6 in the “Financial Tables” herein. New member and new product addition metrics for the relevant period reflect actual growth or declines in members and products that occurred in that period whereas the total number of members and products reflects not only the growth or decline of each metric in the current period but also additions or deletions due to prior period factors, if any. (1) The company includes SoFi accounts on the Galileo platform-as-a-service in its total Technology Platform accounts metric to better align with the presentation of Technology Platform segment revenue.

“2025 was a tremendous year and the fourth quarter was nothing short of exceptional, delivering more than

Consolidated Results Summary |

||||||||||||||||||

|

|

Three Months Ended

|

|

% Change |

|

Year Ended

|

|

% Change |

||||||||||

($ in thousands, except per share amounts) |

|

2025 |

|

2024 |

|

|

2025 |

|

2024 |

|

||||||||

Consolidated – GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Total net revenue |

|

$ |

1,025,051 |

|

$ |

734,125 |

|

40 |

% |

|

$ |

3,613,354 |

|

$ |

2,674,859 |

|

35 |

% |

Net income |

|

|

173,549 |

|

|

332,473 |

|

(48 |

)% |

|

|

481,320 |

|

|

498,665 |

|

(3 |

)% |

Net income attributable to common stockholders – diluted |

|

|

173,893 |

|

|

332,473 |

|

(48 |

)% |

|

|

482,700 |

|

|

434,776 |

|

11 |

% |

Earnings per share attributable to common stockholders – diluted |

|

$ |

0.13 |

|

$ |

0.29 |

|

(55 |

)% |

|

$ |

0.39 |

|

$ |

0.39 |

|

— |

% |

Consolidated – Non-GAAP(1) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Adjusted net revenue |

|

$ |

1,012,835 |

|

$ |

739,112 |

|

37 |

% |

|

$ |

3,591,411 |

|

$ |

2,606,170 |

|

38 |

% |

Adjusted EBITDA |

|

|

317,597 |

|

|

197,957 |

|

60 |

% |

|

|

1,053,898 |

|

|

666,480 |

|

58 |

% |

Adjusted net income |

|

|

173,549 |

|

|

61,030 |

|

184 |

% |

|

|

481,320 |

|

|

227,222 |

|

112 |

% |

Adjusted net income attributable to common stockholders – diluted |

|

|

173,893 |

|

|

61,030 |

|

185 |

% |

|

|

482,700 |

|

|

163,333 |

|

196 |

% |

Adjusted earnings per share – diluted |

|

$ |

0.13 |

|

$ |

0.05 |

|

160 |

% |

|

$ |

0.39 |

|

$ |

0.15 |

|

160 |

% |

| (1) | For more information and reconciliations of these non-GAAP measures to the most comparable GAAP measures, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein. |

Product Highlights

-

Delivering the Largest New Members and Products Increase in Company History. SoFi added a record 1.0 million new members in the fourth quarter, leading to a

35% year-over-year increase to 13.7 million members and added a record 1.6 million new products in the fourth quarter, up37% from the prior year to 20.2 million products. -

Achieving Record Revenue and Increased Profitability. Quarterly Adjusted Net Revenue surpassed

$1 billion $1.01 3 billion37% year-over-year. SoFi demonstrated the strength of its diversified business by achieving a Rule of 401 score of68% , reaching record Adjusted EBITDA of$318 million 60% year-over-year, representing a31% Adjusted EBITDA margin. -

Accelerating Growth and Visibility of SoFi's One-Stop Shop. SoFi’s one-stop shop drove exceptional cross-buy, with

40% of new products opened by existing members - a nearly 7-percentage point increase year-over-year. This strength was supported by continued investment in brand building, which drove SoFi's unaided brand awareness to an all-time high of9.6% . -

Demonstrating Successful Diversification with Record Fee-Based Revenue. Total fee-based revenue across the business surged to a record of

$443 million 50% year-over-year, now generating nearly$1.8 billion $194 million 15% from the third quarter and 2.9x from the prior year. LPB is now running at an annualized pace of$15 billion $774.6 million - Leading the Way in Bank-Grade Crypto Innovation. In the fourth quarter, SoFi became the first nationally chartered bank to launch crypto trading for consumers and to launch its own stablecoin, SoFiUSD, on public, permissionless blockchain. SoFi also delivered blockchain-powered international remittances across 30+ countries. These innovations improved money-movement capabilities and established SoFi’s position as the first company providing crypto and blockchain products backed by the bank-grade safety and stability of a nationally chartered bank.

-

Increasing Loan Originations to Record-Highs. Total originations reached a record of

$10.5 billion 46% year-over-year. This record was driven by strong performance across all lending segments with record personal loan originations of$7.5 billion 43% year-over-year, student loan originations of$1.9 billion 38% year-over-year, and record home loan originations of over$1.1 billion - Strong and Consistent Credit Performance. Credit performance remained in-line with expectations, with personal-loan charge-offs down 57 basis points year-over-year and demonstrated continued resilience across a diversified portfolio.

1 |

Rule of 40 is calculated as the quarterly year-over-year change in adjusted net revenue plus quarterly adjusted EBITDA margin. Adjusted net revenue and adjusted EBITDA margin are non-GAAP financial measures. See “Non-GAAP Financial Measures” section for detailed explanations and definitions. |

Consolidated Results

SoFi reported a number of record financial achievements. For the fourth quarter of 2025, record GAAP net revenue of

For the fourth quarter of 2025, total fee-based revenue reached a record of

Net interest income of

The average rate paid on deposits in the fourth quarter was 181 basis points lower than that paid on warehouse facilities, which translates to approximately

Fourth quarter record adjusted EBITDA of

SoFi reported its ninth consecutive quarter of GAAP profitability. For the fourth quarter of 2025, GAAP net income reached

Equity grew by

Member and Product Growth

Continued growth in both total members and products in the fourth quarter is the result of our continued investments in innovation and brand building and reflects the benefits of our broad product suite and unique Financial Services Productivity Loop (FSPL) strategy.

SoFi added a record 1,027,000 members in the fourth quarter of 2025, bringing total members to 13.7 million, up

SoFi also achieved record product additions of 1.6 million in the fourth quarter of 2025, bringing total products to nearly 20.2 million, up

Financial Services products increased by

Lending products increased by

Technology Platform enabled accounts decreased

Financial Services Segment Results

For the fourth quarter of 2025, Financial Services segment net revenue of

In the fourth quarter, SoFi's Loan Platform Business added

In addition to our Loan Platform Business, SoFi continued to see healthy growth in interchange fee revenue in the fourth quarter, up

Contribution profit for the fourth quarter of 2025 reached

Financial Services – Segment Results of Operations |

||||||||||||||||||||||

|

|

Three Months Ended

|

|

|

|

Year Ended

|

|

|

||||||||||||||

($ in thousands) |

|

2025 |

|

2024 |

|

% Change |

|

2025 |

|

2024 |

|

% Change |

||||||||||

Net interest income |

|

$ |

207,810 |

|

|

$ |

160,337 |

|

|

30 |

% |

|

$ |

777,991 |

|

|

$ |

573,422 |

|

|

36 |

% |

Noninterest income |

|

|

248,931 |

|

|

|

96,183 |

|

|

159 |

% |

|

|

764,025 |

|

|

|

248,089 |

|

|

208 |

% |

Total net revenue – Financial Services |

|

|

456,741 |

|

|

|

256,520 |

|

|

78 |

% |

|

|

1,542,016 |

|

|

|

821,511 |

|

|

88 |

% |

Provision for credit losses |

|

|

(5,460 |

) |

|

|

(6,852 |

) |

|

(20 |

)% |

|

|

(30,329 |

) |

|

|

(31,659 |

) |

|

(4 |

)% |

Directly attributable expenses |

|

|

(220,493 |

) |

|

|

(134,813 |

) |

|

64 |

% |

|

|

(718,778 |

) |

|

|

(482,845 |

) |

|

49 |

% |

Contribution profit – Financial Services |

|

$ |

230,788 |

|

|

$ |

114,855 |

|

|

101 |

% |

|

$ |

792,909 |

|

|

$ |

307,007 |

|

|

158 |

% |

Contribution margin – Financial Services(1) |

|

|

51 |

% |

|

|

45 |

% |

|

|

|

|

51 |

% |

|

|

37 |

% |

|

|

||

| (1) | Contribution margin is defined for each of our reportable segments as contribution profit divided by net revenue. |

By continuously innovating with new and relevant offerings, features and rewards for members, SoFi grew total Financial Services products by 4.8 million, or

Monetization continues to improve with annualized revenue per product of

In the fourth quarter of 2025, total deposits grew

Financial Services – Products |

|

December 31, |

|

|

|||

|

|

2025 |

|

2024 |

|

% Change |

|

Money(1) |

|

6,791,108 |

|

5,094,785 |

|

33 |

% |

Invest |

|

3,244,143 |

|

2,525,059 |

|

28 |

% |

Credit Card |

|

435,722 |

|

279,360 |

|

56 |

% |

Referred loans(2) |

|

149,872 |

|

85,205 |

|

76 |

% |

Relay |

|

6,687,259 |

|

4,636,755 |

|

44 |

% |

At Work |

|

163,411 |

|

113,917 |

|

43 |

% |

Crypto(3) |

|

63,441 |

|

— |

|

n/m |

|

Total financial services products |

|

17,534,956 |

|

12,735,081 |

|

38 |

% |

| (1) | Includes checking and savings accounts held at SoFi Bank, and cash management accounts. |

|

(2) |

Limited to loans wherein we provide third party fulfillment services as part of our Loan Platform Business. |

|

(3) |

Product counts for Crypto for the fourth quarter of 2025 reflect activity from our product launch on December 22, 2025 through December 31, 2025 and are therefore not representative of a full quarter of performance. |

Technology Platform Segment Results

Technology Platform segment net revenue of

Technology Platform – Segment Results of Operations |

||||||||||||||||||||||

|

|

Three Months Ended

|

|

|

|

Year Ended

|

|

|

||||||||||||||

($ in thousands) |

|

2025 |

|

2024 |

|

% Change |

|

2025 |

|

2024 |

|

% Change |

||||||||||

Net interest income |

|

$ |

394 |

|

|

$ |

473 |

|

|

(17 |

)% |

|

$ |

1,505 |

|

|

$ |

2,158 |

|

|

(30 |

)% |

Noninterest income |

|

|

121,979 |

|

|

|

102,362 |

|

|

19 |

% |

|

|

448,706 |

|

|

|

393,020 |

|

|

14 |

% |

Total net revenue – Technology Platform |

|

|

122,373 |

|

|

|

102,835 |

|

|

19 |

% |

|

|

450,211 |

|

|

|

395,178 |

|

|

14 |

% |

Directly attributable expenses |

|

|

(74,439 |

) |

|

|

(70,728 |

) |

|

5 |

% |

|

|

(305,798 |

) |

|

|

(268,223 |

) |

|

14 |

% |

Contribution profit |

|

$ |

47,934 |

|

|

$ |

32,107 |

|

|

49 |

% |

|

$ |

144,413 |

|

|

$ |

126,955 |

|

|

14 |

% |

Contribution margin – Technology Platform(1) |

|

|

39 |

% |

|

|

31 |

% |

|

|

|

|

32 |

% |

|

|

32 |

% |

|

|

||

| (1) | Contribution margin is defined for each of our reportable segments as contribution profit divided by net revenue. |

Technology Platform total enabled client accounts decreased

Technology Platform |

|

December 31, |

|

|

|||

|

|

2025 |

|

2024 |

|

% Change |

|

Total accounts |

|

128,461,873 |

|

167,713,818 |

|

(23 |

)% |

Lending Segment Results

For the fourth quarter of 2025, Lending segment GAAP net revenue of

Lending segment performance in the fourth quarter was driven by net interest income, which rose

Lending segment fourth quarter contribution profit of

Lending – Segment Results of Operations |

||||||||||||||||||||||

|

|

Three Months Ended

|

|

|

|

Year Ended

|

|

|

||||||||||||||

($ in thousands) |

|

2025 |

|

2024 |

|

% Change |

|

2025 |

|

2024 |

|

% Change |

||||||||||

Net interest income |

|

$ |

444,763 |

|

|

$ |

345,210 |

|

|

29 |

% |

|

$ |

1,606,032 |

|

|

$ |

1,207,226 |

|

|

33 |

% |

Noninterest income |

|

|

53,919 |

|

|

|

72,586 |

|

|

(26 |

)% |

|

|

242,917 |

|

|

|

277,996 |

|

|

(13 |

)% |

Total net revenue – Lending |

|

|

498,682 |

|

|

|

417,796 |

|

|

19 |

% |

|

|

1,848,949 |

|

|

|

1,485,222 |

|

|

24 |

% |

Servicing rights – change in valuation inputs or assumptions |

|

|

(12,224 |

) |

|

|

4,962 |

|

|

n/m |

|

|

|

(22,013 |

) |

|

|

(6,280 |

) |

|

251 |

% |

Residual interests classified as debt – change in valuation inputs or assumptions |

|

|

8 |

|

|

|

25 |

|

|

(68 |

)% |

|

|

70 |

|

|

|

108 |

|

|

(35 |

)% |

Directly attributable expenses |

|

|

(214,811 |

) |

|

|

(176,825 |

) |

|

21 |

% |

|

|

(810,106 |

) |

|

|

(588,507 |

) |

|

38 |

% |

Contribution profit – Lending |

|

$ |

271,655 |

|

|

$ |

245,958 |

|

|

10 |

% |

|

$ |

1,016,900 |

|

|

$ |

890,543 |

|

|

14 |

% |

Contribution margin – Lending(1) |

|

|

54 |

% |

|

|

59 |

% |

|

|

|

|

55 |

% |

|

|

60 |

% |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Adjusted net revenue – Lending (non-GAAP)(2) |

|

$ |

486,466 |

|

|

$ |

422,783 |

|

|

15 |

% |

|

$ |

1,827,006 |

|

|

$ |

1,479,050 |

|

|

24 |

% |

Adjusted contribution margin – Lending (non-GAAP)(2) |

|

|

56 |

% |

|

|

58 |

% |

|

|

|

|

56 |

% |

|

|

60 |

% |

|

|

||

| (1) | Contribution margin is defined for each of our reportable segments as contribution profit divided by net revenue. |

|

(2) |

For more information and a reconciliation of these non-GAAP financial measures to the most comparable GAAP measure, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein. |

|

Lending – Loans At Fair Value |

|

|

|

|

|

|

|

||||

($ in thousands) |

Personal Loans |

|

Student Loans |

|

Home Loans |

|

Total |

||||

December 31, 2025 |

|

|

|

|

|

|

|

||||

Unpaid principal |

$ |

20,243,217 |

|

$ |

12,875,440 |

|

$ |

1,133,329 |

|

$ |

34,251,986 |

Accumulated interest |

|

151,079 |

|

|

58,277 |

|

|

4,888 |

|

|

214,244 |

Cumulative fair value adjustments(1) |

|

1,146,372 |

|

|

723,861 |

|

|

66,898 |

|

|

1,937,131 |

Total fair value of loans(2)(3) |

$ |

21,540,668 |

|

$ |

13,657,578 |

|

$ |

1,205,115 |

|

$ |

36,403,361 |

September 30, 2025 |

|

|

|

|

|

|

|

||||

Unpaid principal |

$ |

19,456,198 |

|

$ |

11,143,322 |

|

$ |

713,727 |

|

$ |

31,313,247 |

Accumulated interest |

|

141,384 |

|

|

49,228 |

|

|

2,730 |

|

|

193,342 |

Cumulative fair value adjustments(1) |

|

1,118,035 |

|

|

635,437 |

|

|

40,260 |

|

|

1,793,732 |

Total fair value of loans(2)(3) |

$ |

20,715,617 |

|

$ |

11,827,987 |

|

$ |

756,717 |

|

$ |

33,300,321 |

| (1) | During the three months ended December 31, 2025, the cumulative fair value adjustments for personal loans were impacted by a higher unpaid principal balance, a lower weighted average discount rate and a lower weighted average conditional prepayment rate, partially offset by a higher weighted average annual default rate. The lower discount rate was primarily driven by an 8 basis point decrease in benchmark rates. The cumulative fair value adjustments for student loans were impacted by a higher unpaid principal balance, a lower weighted average discount rate, and a lower weighted average conditional prepayment rate, partially offset by lower weighted average coupon and higher weighted average default rate. |

|

(2) |

Each component of the fair value of loans is impacted by charge-offs during the period. Our fair value assumption for annual default rate incorporates fair value markdowns on loans beginning when they are 10 days or more delinquent, with additional markdowns at 30, 60 and 90 days past due. |

|

(3) |

Student loans are classified as loans held for investment, and personal loans and home loans are classified as loans held for sale. |

The following table summarizes the significant inputs to the fair value model for personal and student loans:

|

Personal Loans |

|

Student Loans |

|||||||||

|

December 31, 2025 |

|

September 30, 2025 |

|

December 31, 2025 |

|

September 30, 2025 |

|||||

Weighted average coupon rate(1) |

13.11 |

% |

|

13.11 |

% |

|

5.87 |

% |

|

5.89 |

% |

|

Weighted average annual default rate |

4.46 |

% |

|

4.33 |

% |

|

0.68 |

% |

|

0.67 |

% |

|

Weighted average conditional prepayment rate |

26.87 |

% |

|

26.90 |

% |

|

11.21 |

% |

|

11.27 |

% |

|

Weighted average discount rate |

4.46 |

% |

|

4.55 |

% |

|

3.89 |

% |

|

3.90 |

% |

|

Benchmark rate(2) |

3.31 |

% |

|

3.39 |

% |

|

3.40 |

% |

|

3.35 |

% |

|

(1) |

Represents the average coupon rate on loans held on balance sheet, weighted by unpaid principal balance outstanding at the balance sheet date. |

|

(2) |

Corresponds with two-year SOFR for personal loans, and four-year SOFR for student loans. |

For the fourth quarter of 2025, record origination volume of

Record personal loan originations of

Capital markets activity in the fourth quarter of 2025 was very strong. Overall, SoFi sold, or transferred through our Loan Platform Business, more than

In addition to our personal and home loan sales, SoFi executed a

Credit performance remained strong in the fourth quarter, in-line with expectations. The personal loan annualized charge-off rate increased to

Had SoFi not sold late stage delinquent loans, it is estimated that, including recoveries, the all-in annualized net charge-off rate for personal loans would have been approximately

The student loan annualized charge-off rate increased to 76 basis points from 69 basis points in the prior quarter, driven by seasonality and the impact from a student loan repurchase that concluded during the fourth quarter.

The on-balance sheet 90-day delinquency rates for both personal loans and student loans were consistent with the prior year.

The data continues to support a 7–

Recent vintages, originated from the fourth quarter of 2022 to first quarter of 2025 have net cumulative losses of

Over the medium term, management expects to deliver compounded annual growth in adjusted net revenue of at least

Additionally, of the first quarter of 2020 through the third quarter of 2025 originations,

Lending – Originations and Average Balances |

||||||||||||||||||

|

|

Three Months Ended

|

|

% Change |

|

Year Ended

|

|

% Change |

||||||||||

|

|

2025 |

|

2024 |

|

|

2025 |

|

2024 |

|

||||||||

Origination volume ($ in thousands, during period) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Personal loans(1) |

|

$ |

7,501,068 |

|

$ |

5,251,949 |

|

43 |

% |

|

$ |

27,495,534 |

|

$ |

17,614,985 |

|

56 |

% |

Student loans |

|

|

1,861,421 |

|

|

1,348,970 |

|

38 |

% |

|

|

5,537,934 |

|

|

3,780,752 |

|

46 |

% |

Home loans |

|

|

1,127,705 |

|

|

577,362 |

|

95 |

% |

|

|

3,388,995 |

|

|

1,820,213 |

|

86 |

% |

Total |

|

$ |

10,490,194 |

|

$ |

7,178,281 |

|

46 |

% |

|

$ |

36,422,463 |

|

$ |

23,215,950 |

|

57 |

% |

Average loan balance ($, as of period end)(2) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Personal loans |

|

$ |

25,810 |

|

$ |

25,377 |

|

2 |

% |

|

|

|

|

|

|

|||

Student loans |

|

|

43,371 |

|

|

42,960 |

|

1 |

% |

|

|

|

|

|

|

|||

Home loans |

|

|

243,916 |

|

|

279,321 |

|

(13 |

)% |

|

|

|

|

|

|

|||

| ____________________ | ||

(1) |

Inclusive of origination volume related to our Loan Platform Business. |

|

(2) |

Within each loan product category, average loan balance is defined as the total unpaid principal balance of the loans divided by the number of loans that have a balance greater than zero dollars as of the reporting date. Average loan balance includes loans on our balance sheet, as well as transferred loans and referred loans with which SoFi has continuing involvement through our servicing agreements. |

|

Lending – Products |

|

December 31, |

|

|

|||

|

|

2025 |

|

2024 |

|

% Change |

|

Personal loans(1) |

|

1,935,607 |

|

1,405,928 |

|

38 |

% |

Student loans |

|

644,225 |

|

568,612 |

|

13 |

% |

Home loans |

|

53,354 |

|

35,814 |

|

49 |

% |

Total lending products |

|

2,633,186 |

|

2,010,354 |

|

31 |

% |

| ____________________ | ||

(1) |

Includes loans which we originate as part of our Loan Platform Business. |

|

Guidance and Outlook

Looking forward to 2026, for the full year, management expects to increase total members by at least

In the first quarter of 2026, management expects to deliver adjusted net revenue of approximately

Management will further address guidance on the quarterly earnings conference call. Management has not reconciled forward-looking non-GAAP measures to their most directly comparable GAAP measures. This is because the company cannot predict with reasonable certainty and without unreasonable efforts the ultimate outcome of certain GAAP components of such reconciliations due to market-related assumptions that are not within our control as well as certain legal or advisory costs, tax costs or other costs that may arise. For these reasons, management is unable to assess the probable significance of the unavailable information, which could materially impact the amount of the future directly comparable GAAP measures.

Earnings Webcast

SoFi’s executive management team will host a live audio webcast beginning at 8:00 a.m. Eastern Time (5:00 a.m. Pacific Time) today to discuss the quarter’s financial results and business highlights. All interested parties are invited to listen to the live webcast at https://investors.sofi.com. A replay of the webcast will be available on the SoFi Investor Relations website for 30 days. Investor information, including supplemental financial information, is available on SoFi’s Investor Relations website at https://investors.sofi.com.

Cautionary Statement Regarding Forward-Looking Statements

Certain of the statements above are forward-looking and as such are not historical facts. This includes, without limitation, statements regarding our expectations for the first quarter of 2026 and full year 2026 adjusted net revenue, annual growth rate, adjusted EBITDA, adjusted EBITDA margin, GAAP net income, GAAP EPS, tangible book value, and new members, our expectations regarding our ability to deliver compounded annual growth in adjusted net revenue and compounded annual growth in adjusted earnings per share from 2025 to 2028, our expectations regarding our ability to continue to grow our business, deliver superior financial returns, build our brand and launch new business lines and products, our ability to continue to drive momentum, deepen member engagement, and increase cross-buy, our expectations regarding the size of our market opportunity, our ability to continue to attract and execute deals, our ability to continue to improve our financials and increase our member, product and total accounts count, our ability to achieve diversified and more durable growth, including our ability to continue to grow our Loan Platform Business, our ability to continue the momentum seen in prior financial periods, our ability to have loss rates below

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

Non-GAAP Financial Measures

This press release presents information about certain non-GAAP financial measures provided as supplements to the results provided in accordance with accounting principles generally accepted in

Reconciliations of these non-GAAP measures to the most directly comparable GAAP financial measures are provided in Table 2 to the “Financial Tables” herein.

About SoFi

SoFi Technologies (NASDAQ: SOFI) is a one-stop shop for digital financial services on a mission to help people achieve financial independence to realize their ambitions. 13.7 million members trust SoFi to borrow, save, spend, invest, and protect their money – all in one app – and get access to financial planners, exclusive experiences, and a thriving community. Fintechs, financial institutions, and brands use SoFi’s technology platform Galileo to build and manage innovative financial solutions across 128.5 million global accounts. For more information, visit www.sofi.com or download our iOS and Android apps.

Availability of Other Information About SoFi

Investors and others should note that we communicate with our investors and the public using our website (https://www.sofi.com), the investor relations website (https://investors.sofi.com), and on social media (X and LinkedIn), including but not limited to investor presentations and investor fact sheets, Securities and Exchange Commission filings, press releases, public conference calls and webcasts. The information that SoFi posts on these channels and websites could be deemed to be material information. As a result, SoFi encourages investors, the media, and others interested in SoFi to review the information that is posted on these channels, including the investor relations website, on a regular basis. This list of channels may be updated from time to time on SoFi’s investor relations website and may include additional social media channels. The contents of SoFi’s website or these channels, or any other website that may be accessed from its website or these channels, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

FINANCIAL TABLES

(Unaudited)

- Condensed Consolidated Statements of Operations and Comprehensive Income

- Reconciliation of GAAP to Non-GAAP Financial Measures

- Condensed Consolidated Balance Sheets

- Average Balances and Net Interest Earnings Analysis

- Company Metrics

- Segment Financials

- Fee-Based Revenue

- Analysis of Charge-Offs

- Regulatory Capital

Table 1 |

|||||||||||||||

SoFi Technologies, Inc. |

|||||||||||||||

Condensed Consolidated Statements of Operations and Comprehensive Income |

|||||||||||||||

(Unaudited) |

|||||||||||||||

(In Thousands, Except for Per Share Data) |

|||||||||||||||

|

Three Months Ended

|

|

Year Ended

|

||||||||||||

|

2025 |

|

2024 |

|

2025 |

|

2024 |

||||||||

Interest income |

|

|

|

|

|

|

|

||||||||

Loans and securitizations |

$ |

864,402 |

|

|

$ |

688,723 |

|

|

$ |

3,146,296 |

|

|

$ |

2,601,988 |

|

Other |

|

63,019 |

|

|

|

55,214 |

|

|

|

228,903 |

|

|

|

205,829 |

|

Total interest income |

|

927,421 |

|

|

|

743,937 |

|

|

|

3,375,199 |

|

|

|

2,807,817 |

|

Interest expense |

|

|

|

|

|

|

|

||||||||

Securitizations and warehouses |

|

8,181 |

|

|

|

23,022 |

|

|

|

95,824 |

|

|

|

112,398 |

|

Deposits |

|

290,511 |

|

|

|

238,596 |

|

|

|

1,014,043 |

|

|

|

930,154 |

|

Corporate borrowings |

|

11,196 |

|

|

|

12,039 |

|

|

|

45,723 |

|

|

|

48,346 |

|

Other |

|

254 |

|

|

|

111 |

|

|

|

653 |

|

|

|

438 |

|

Total interest expense |

|

310,142 |

|

|

|

273,768 |

|

|

|

1,156,243 |

|

|

|

1,091,336 |

|

Net interest income |

|

617,279 |

|

|

|

470,169 |

|

|

|

2,218,956 |

|

|

|

1,716,481 |

|

Noninterest income |

|

|

|

|

|

|

|

||||||||

Loan origination, sales, securitizations and servicing |

|

53,856 |

|

|

|

72,597 |

|

|

|

242,947 |

|

|

|

278,114 |

|

Technology products and solutions |

|

93,963 |

|

|

|

88,376 |

|

|

|

360,903 |

|

|

|

350,810 |

|

Loan platform fees |

|

190,859 |

|

|

|

63,235 |

|

|

|

575,911 |

|

|

|

141,608 |

|

Other |

|

69,094 |

|

|

|

39,748 |

|

|

|

214,637 |

|

|

|

187,846 |

|

Total noninterest income |

|

407,772 |

|

|

|

263,956 |

|

|

|

1,394,398 |

|

|

|

958,378 |

|

Total net revenue |

|

1,025,051 |

|

|

|

734,125 |

|

|

|

3,613,354 |

|

|

|

2,674,859 |

|

Provision for credit losses |

|

5,407 |

|

|

|

6,877 |

|

|

|

30,319 |

|

|

|

31,712 |

|

Noninterest expense |

|

|

|

|

|

|

|

||||||||

Technology and product development |

|

172,836 |

|

|

|

148,986 |

|

|

|

648,332 |

|

|

|

551,787 |

|

Sales and marketing |

|

305,614 |

|

|

|

229,261 |

|

|

|

1,095,412 |

|

|

|

796,293 |

|

Cost of operations |

|

161,618 |

|

|

|

128,155 |

|

|

|

608,998 |

|

|

|

461,633 |

|

General and administrative |

|

194,244 |

|

|

|

160,922 |

|

|

|

704,436 |

|

|

|

600,089 |

|

Total noninterest expense |

|

834,312 |

|

|

|

667,324 |

|

|

|

3,057,178 |

|

|

|

2,409,802 |

|

Income before income taxes |

|

185,332 |

|

|

|

59,924 |

|

|

|

525,857 |

|

|

|

233,345 |

|

Income tax (expense) benefit |

|

(11,783 |

) |

|

|

272,549 |

|

|

|

(44,537 |

) |

|

|

265,320 |

|

Net income |

$ |

173,549 |

|

|

$ |

332,473 |

|

|

$ |

481,320 |

|

|

$ |

498,665 |

|

|

|

|

|

|

|

|

|

||||||||

Earnings per share |

|

|

|

|

|

|

|

||||||||

Earnings per share – basic |

$ |

0.14 |

|

|

$ |

0.31 |

|

|

$ |

0.42 |

|

|

$ |

0.46 |

|

Earnings per share – diluted |

$ |

0.13 |

|

|

$ |

0.29 |

|

|

$ |

0.39 |

|

|

$ |

0.39 |

|

Weighted average common stock outstanding – basic |

|

1,222,750 |

|

|

|

1,087,863 |

|

|

|

1,150,140 |

|

|

|

1,050,219 |

|

Weighted average common stock outstanding – diluted |

|

1,346,110 |

|

|

|

1,151,047 |

|

|

|

1,251,767 |

|

|

|

1,101,390 |

|

Table 2

Non-GAAP Financial Measures

(Unaudited)

Adjusted Net Revenue

Adjusted net revenue is a non-GAAP measure. Adjusted net revenue is defined as total net revenue, adjusted to exclude the fair value changes in servicing rights and residual interests classified as debt due to valuation inputs and assumptions changes, which relate only to our Lending segment, as well as gains and losses on extinguishment of debt. We adjust total net revenue to exclude these items, as they are non-cash charges that are not realized during the period or not indicative of our core operating performance, and therefore positive or negative changes do not impact the cash available to fund our operations. Management believes this measure is useful because it enables management and investors to assess our underlying operating performance and cash available to fund our operations. In addition, management uses this measure to better decide on the proper expenses to authorize for each of our operating segments, to ultimately help achieve target contribution profit margins.

The following table reconciles adjusted net revenue to total net revenue, the most directly comparable GAAP measure:

|

|

Three Months Ended

|

|

Year Ended

|

||||||||||||

($ in thousands) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

||||||||

Total net revenue (GAAP) |

|

$ |

1,025,051 |

|

|

$ |

734,125 |

|

|

$ |

3,613,354 |

|

|

$ |

2,674,859 |

|

Servicing rights – change in valuation inputs or assumptions(1) |

|

|

(12,224 |

) |

|

|

4,962 |

|

|

|

(22,013 |

) |

|

|

(6,280 |

) |

Residual interests classified as debt – change in valuation inputs or assumptions(2) |

|

|

8 |

|

|

|

25 |

|

|

|

70 |

|

|

|

108 |

|

Gain on extinguishment of debt(3) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(62,517 |

) |

Adjusted net revenue (non-GAAP) |

|

$ |

1,012,835 |

|

|

$ |

739,112 |

|

|

$ |

3,591,411 |

|

|

$ |

2,606,170 |

|

| ____________________ | ||

(1) |

Reflects changes in fair value inputs and assumptions on servicing rights, including conditional prepayment, default rates and discount rates. These assumptions are highly sensitive to market interest rate changes and are not indicative of our performance or results of operations. Moreover, these non-cash charges are unrealized during the period and, therefore, have no impact on our cash flows from operations. |

|

(2) |

Reflects changes in fair value inputs and assumptions on residual interests classified as debt, including conditional prepayment, default rates and discount rates. When third parties finance our consolidated securitization VIEs by purchasing residual interests, we receive proceeds at the time of the closing of the securitization and, thereafter, pass along contractual cash flows to the residual interest owner. These residual debt obligations are measured at fair value on a recurring basis, but they have no impact on our initial financing proceeds, our future obligations to the residual interest owner (because future residual interest claims are limited to contractual securitization collateral cash flows), or the general operations of our business. |

|

(3) |

Reflects gain on extinguishment of debt. Gains and losses are recognized during the period of extinguishment for the difference between the net carrying amount of debt extinguished and the fair value of equity securities issued. |

|

The following table reconciles adjusted net revenue for the Lending segment to total net revenue, the most directly comparable GAAP measure for the Lending segment:

|

|

Three Months Ended

|

|

Year Ended

|

||||||||||||

($ in thousands) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

||||||||

Lending |

|

|

|

|

|

|

|

|

||||||||

Total net revenue – Lending (GAAP) |

|

$ |

498,682 |

|

|

$ |

417,796 |

|

|

$ |

1,848,949 |

|

|

$ |

1,485,222 |

|

Servicing rights – change in valuation inputs or assumptions(1) |

|

|

(12,224 |

) |

|

|

4,962 |

|

|

|

(22,013 |

) |

|

|

(6,280 |

) |

Residual interests classified as debt – change in valuation inputs or assumptions(2) |

|

|

8 |

|

|

|

25 |

|

|

|

70 |

|

|

|

108 |

|

Adjusted net revenue – Lending (non-GAAP) |

|

$ |

486,466 |

|

|

$ |

422,783 |

|

|

$ |

1,827,006 |

|

|

$ |

1,479,050 |

|

| ____________________ | ||||||||||||||||

(1) |

See footnote (1) to the table above. |

|

(2) |

See footnote (2) to the table above. |

Adjusted Noninterest Income

Adjusted noninterest income is a non-GAAP measure. Adjusted noninterest income is defined as noninterest income, adjusted to exclude the fair value changes in servicing rights and residual interests classified as debt due to valuation inputs and assumptions changes, which relate only to our Lending segment, as well as gains and losses on extinguishment of debt. We adjust noninterest income to exclude these items, as they are non-cash charges that are not realized during the period or not indicative of our core operating performance, and therefore positive or negative changes do not impact the cash available to fund our operations. Management believes this measure is useful because it enables management and investors to assess our underlying operating performance and cash available to fund our operations.

The following table reconciles adjusted noninterest income to noninterest income, the most directly comparable GAAP measure:

|

|

Three Months Ended

|

|

Year Ended

|

||||||||||||

($ in thousands) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

||||||||

Noninterest income (GAAP) |

|

$ |

407,772 |

|

|

$ |

263,956 |

|

|

$ |

1,394,398 |

|

|

$ |

958,378 |

|

Servicing rights – change in valuation inputs or assumptions(1) |

|

|

(12,224 |

) |

|

|

4,962 |

|

|

|

(22,013 |

) |

|

|

(6,280 |

) |

Residual interests classified as debt – change in valuation inputs or assumptions(2) |

|

|

8 |

|

|

|

25 |

|

|

|

70 |

|

|

|

108 |

|

Gain on extinguishment of debt(3) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(62,517 |

) |

Adjusted noninterest income (non-GAAP) |

|

$ |

395,556 |

|

|

$ |

268,943 |

|

|

$ |

1,372,455 |

|

|

$ |

889,689 |

|

| ____________________ | ||

(1) |

Reflects changes in fair value inputs and assumptions on servicing rights, including conditional prepayment, default rates and discount rates. These assumptions are highly sensitive to market interest rate changes and are not indicative of our performance or results of operations. Moreover, these non-cash charges are unrealized during the period and, therefore, have no impact on our cash flows from operations. |

|

(2) |

Reflects changes in fair value inputs and assumptions on residual interests classified as debt, including conditional prepayment, default rates and discount rates. When third parties finance our consolidated securitization VIEs by purchasing residual interests, we receive proceeds at the time of the closing of the securitization and, thereafter, pass along contractual cash flows to the residual interest owner. These residual debt obligations are measured at fair value on a recurring basis, but they have no impact on our initial financing proceeds, our future obligations to the residual interest owner (because future residual interest claims are limited to contractual securitization collateral cash flows), or the general operations of our business. |

|

(3) |

Reflects gain on extinguishment of debt. Gains and losses are recognized during the period of extinguishment for the difference between the net carrying amount of debt extinguished and the fair value of equity securities issued. |

|

The following table reconciles adjusted noninterest income for the Lending segment to noninterest income, the most directly comparable GAAP measure for the Lending segment:

|

|

Three Months Ended

|

|

Year Ended

|

||||||||||||

($ in thousands) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

||||||||

Lending |

|

|

|

|

|

|

|

|

||||||||

Noninterest income – Lending (GAAP) |

|

$ |

53,919 |

|

|

$ |

72,586 |

|

|

$ |

242,917 |

|

|

$ |

277,996 |

|

Servicing rights – change in valuation inputs or assumptions(1) |

|

|

(12,224 |

) |

|

|

4,962 |

|

|

|

(22,013 |

) |

|

|

(6,280 |

) |

Residual interests classified as debt – change in valuation inputs or assumptions(2) |

|

|

8 |

|

|

|

25 |

|

|

|

70 |

|

|

|

108 |

|

Adjusted noninterest income – Lending (non-GAAP) |

|

$ |

41,703 |

|

|

$ |

77,573 |

|

|

$ |

220,974 |

|

|

$ |

271,824 |

|

| ____________________ | ||

(1) |

See footnote (1) to the table above. |

|

(2) |

See footnote (2) to the table above. |

|

Adjusted Contribution Margin and Incremental Adjusted Contribution Margin — Lending

Adjusted contribution margin and incremental adjusted contribution margin are non-GAAP measures and relate only to our Lending segment. Adjusted contribution margin is defined as segment contribution profit for the Lending segment, divided by adjusted net revenue for the Lending segment, a non-GAAP measure. Incremental adjusted contribution margin is defined as the change in segment contribution profit for our Lending segment, divided by change in adjusted net revenue for the Lending segment. See ‘Adjusted Net Revenue’ above for a reconciliation of Lending segment adjusted net revenue.

Management believes adjusted contribution margin metrics are useful because they enable management and investors to assess the underlying operating performance of our Lending segment, by removing the impact of changes in volume over periods to present a comparable view of segment contribution profit, which is a measure of the direct profitability of each of our reportable segments, as a percentage of segment adjusted net revenue for the Lending segment during each period.

The following table presents a reconciliation of adjusted contribution margin and incremental adjusted contribution margin for our reportable Lending segment:

|

|

Three Months Ended

|

|

2025 vs 2024 |

|

Year Ended

|

|

2025 vs 2024 |

||||||||||||||

($ in thousands) |

|

2025 |

|

2024 |

|

$ Change |

|

2025 |

|

2024 |

|

$ Change |

||||||||||

Lending |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Contribution profit – Lending (GAAP) |

|

$ |

271,655 |

|

|

$ |

245,958 |

|

|

$ |

25,697 |

|

$ |

1,016,900 |

|

|

$ |

890,543 |

|

|

$ |

126,357 |

Net revenue – Lending (GAAP) |

|

|

498,682 |

|

|

|

417,796 |

|

|

|

80,886 |

|

|

1,848,949 |

|

|

|

1,485,222 |

|

|

|

363,727 |

Contribution margin – Lending (GAAP)(1) |

|

|

54 |

% |

|

|

59 |

% |

|

|

|

|

55 |

% |

|

|

60 |

% |

|

|

||

Incremental contribution margin – Lending (GAAP)(1) |

|

|

32 |

% |

|

|

|

|

|

|

35 |

% |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Adjusted net revenue – Lending (non-GAAP)(2) |

|

$ |

486,466 |

|

|

$ |

422,783 |

|

|

$ |

63,683 |

|

$ |

1,827,006 |

|

|

$ |

1,479,050 |

|

|

$ |

347,956 |

Adjusted contribution margin – Lending (non-GAAP) |

|

|

56 |

% |

|

|

58 |

% |

|

|

|

|

56 |

% |

|

|

60 |

% |

|

|

||

Incremental adjusted contribution margin – Lending (non-GAAP) |

|

|

40 |

% |

|

|

|

|

|

|

36 |

% |

|

|

|

|

||||||

| ____________________ | ||

(1) |

Contribution margin is defined for each of our reportable segments as contribution profit divided by net revenue. Incremental contribution margin for each of our reportable segments is defined as the change in segment contribution profit divided by change in net revenue. |

|

(2) |

Refer to ‘Adjusted Net Revenue’ above for reconciliation of this non-GAAP measure. |

|

Adjusted EBITDA, Adjusted EBITDA Margin and Incremental Adjusted EBITDA Margin

Adjusted EBITDA, adjusted EBITDA margin and incremental adjusted EBITDA margin are non-GAAP measures. Adjusted EBITDA is defined as net income, adjusted to exclude, as applicable: (i) corporate borrowing-based interest expense (our adjusted EBITDA measure is not adjusted for warehouse or securitization-based interest expense, nor deposit interest expense and finance lease liability interest expense, as these are direct operating expenses), (ii) income tax expense (benefit), (iii) depreciation and amortization, (iv) share-based expense (inclusive of equity-based payments to non-employees), (v) restructuring charges, (vi) impairment expense (inclusive of goodwill impairments and property, equipment and software abandonments), (vii) transaction-related expenses, (viii) foreign currency impacts related to operations in highly inflationary countries, (ix) fair value changes in each of servicing rights and residual interests classified as debt due to valuation assumptions, (x) gain on extinguishment of debt, and (xi) other charges, as appropriate, that are not expected to recur and are not indicative of our core operating performance.

Adjusted EBITDA margin is computed as adjusted EBITDA divided by adjusted net revenue. Incremental adjusted EBITDA margin is defined as the change in adjusted EBITDA, divided by change in adjusted net revenue. See ‘Adjusted Net Revenue’ above for a reconciliation of this non-GAAP measure.

Management believes adjusted EBITDA, adjusted EBITDA margin and incremental adjusted EBITDA margin are useful measures for period-over-period comparisons of our business. These measures enable management and investors to assess our core operating performance or results of operations by removing the effects of certain non-cash items and charges, as well as the impact of changes in volume over periods as applicable. In addition, management uses these measures to help evaluate cash flows generated from operations and the extent of additional capital, if any, required to invest in strategic initiatives.

The following table reconciles adjusted EBITDA to net income, the most directly comparable GAAP measure, and presents the computations of adjusted EBITDA margin and incremental adjusted EBITDA margin:

|

|

Three Months Ended

|

|

2025 vs 2024 |

|

Year Ended

|

|

2025 vs 2024 |

||||||||||||||||

($ in thousands) |

|

2025 |

|

2024 |

|

$ Change |

|

2025 |

|

2024 |

|

$ Change |

||||||||||||

Net income (GAAP) |

|

$ |

173,549 |

|

|

$ |

332,473 |

|

|

$ |

(158,924 |

) |

|

$ |

481,320 |

|

|

$ |

498,665 |

|

|

$ |

(17,345 |

) |

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Interest expense – corporate borrowings(1) |

|

|

11,196 |

|

|

|

12,039 |

|

|

|

(843 |

) |

|

|

45,723 |

|

|

|

48,346 |

|

|

|

(2,623 |

) |

Income tax expense (benefit)(2) |

|

|

11,783 |

|

|

|

(272,549 |

) |

|

|

284,332 |

|

|

|

44,537 |

|

|

|

(265,320 |

) |

|

|

309,857 |

|

Depreciation and amortization |

|

|

62,880 |

|

|

|

53,545 |

|

|

|

9,335 |

|

|

|

234,151 |

|

|

|

203,498 |

|

|

|

30,653 |

|

Share-based expense |

|

|

68,577 |

|

|

|

66,367 |

|

|

|

2,210 |

|

|

|

262,058 |

|

|

|

246,152 |

|

|

|

15,906 |

|

Restructuring charges(3) |

|

|

20 |

|

|

|

255 |

|

|

|

(235 |

) |

|

|

948 |

|

|

|

1,530 |

|

|

|

(582 |

) |

Foreign currency impact of highly inflationary subsidiaries(4) |

|

|

1,808 |

|

|

|

840 |

|

|

|

968 |

|

|

|

7,104 |

|

|

|

1,683 |

|

|

|

5,421 |

|

Transaction-related expense(5) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

615 |

|

|

|

(615 |

) |

Servicing rights – change in valuation inputs or assumptions(6) |

|

|

(12,224 |

) |

|

|

4,962 |

|

|

|

(17,186 |

) |

|

|

(22,013 |

) |

|

|

(6,280 |

) |

|

|

(15,733 |

) |

Residual interests classified as debt – change in valuation inputs or assumptions(7) |

|

|

8 |

|

|

|

25 |

|

|

|

(17 |

) |

|

|

70 |

|

|

|

108 |

|

|

|

(38 |

) |

Gain on extinguishment of debt(8) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(62,517 |

) |

|

|

62,517 |

|

Total adjustments |

|

|

144,048 |

|

|

|

(134,516 |

) |

|

|

278,564 |

|

|

|

572,578 |

|

|

|

167,815 |

|

|

|

404,763 |

|

Adjusted EBITDA (non-GAAP) |

|

$ |

317,597 |

|

|

$ |

197,957 |

|

|

$ |

119,640 |

|

|

$ |

1,053,898 |

|

|

$ |

666,480 |

|

|

$ |

387,418 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Total net revenue (GAAP) |

|

$ |

1,025,051 |

|

|

$ |

734,125 |

|

|

$ |

290,926 |

|

|

$ |

3,613,354 |

|

|

$ |

2,674,859 |

|

|

$ |

938,495 |

|

Net income margin (GAAP) |

|

|

17 |

% |

|

|

45 |

% |

|

|

|

|

13 |

% |

|

|

19 |

% |

|

|

||||

Incremental net income margin (GAAP) |

|

|

(55 |

)% |

|

|

|

|

|

|

(2 |

)% |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Adjusted net revenue (non-GAAP)(9) |

|

$ |

1,012,835 |

|

|

$ |

739,112 |

|

|

$ |

273,723 |

|

|

$ |

3,591,411 |

|

|

$ |

2,606,170 |

|

|

$ |

985,241 |

|

Adjusted EBITDA margin (non-GAAP) |

|

|

31 |

% |

|

|

27 |

% |

|

|

|

|

29 |

% |

|

|

26 |

% |

|

|

||||

Incremental adjusted EBITDA margin (non-GAAP) |

|

|

44 |

% |

|

|

|

|

|

|

39 |

% |

|

|

|

|

||||||||

| ____________________ | ||

(1) |

Our adjusted EBITDA measure adjusts for corporate borrowing-based interest expense, as these expenses are a function of our capital structure. Corporate borrowing-based interest expense includes interest on our revolving credit facility, as well as interest expense and the amortization of debt discount and debt issuance costs on our convertible notes. |

|

(2) |

The income tax expense recognized in 2025 is primarily attributable to the Company’s profitability, partially offset by discrete tax benefits for stock compensation recorded in each quarter. |

|

(3) |

Restructuring charges relate to legal entity restructuring. |

|

(4) |

Foreign currency charges reflect the impacts of highly inflationary accounting for our operations in |

|

(5) |

Transaction-related expense in the 2024 periods included financial advisory and professional services costs associated with our acquisition of Wyndham. |

|

(6) |

Reflects changes in fair value inputs and assumptions, including market servicing costs, conditional prepayment, default rates and discount rates. This non-cash change is unrealized during the period and, therefore, has no impact on our cash flows from operations. As such, these positive and negative changes in fair value attributable to assumption changes are adjusted out of net income to provide management and financial users with better visibility into the earnings available to finance our operations. |

|

(7) |

Reflects changes in fair value inputs and assumptions, including conditional prepayment, default rates and discount rates. When third parties finance our consolidated VIEs through purchasing residual interests, we receive proceeds at the time of the securitization close and, thereafter, pass along contractual cash flows to the residual interest owner. These obligations are measured at fair value on a recurring basis, which has no impact on our initial financing proceeds, our future obligations to the residual interest owner (because future residual interest claims are limited to contractual securitization collateral cash flows), or the general operations of our business. As such, these positive and negative non-cash changes in fair value attributable to assumption changes are adjusted out of net income to provide management and financial users with better visibility into the earnings available to finance our operations. |

|

(8) |

Reflects gain on extinguishment of debt. Gains and losses are recognized during the period of extinguishment for the difference between the net carrying amount of debt extinguished and the fair value of equity securities issued. |

|

(9) |

Refer to 'Adjusted Net Revenue' above for reconciliation of this non-GAAP measure. |

|

Tangible Book Value and Tangible Book Value per Common Share

Beginning in the fourth quarter of 2024, the Company modified the presentation of its tangible book value and tangible book value per share, which are non-GAAP measures. Tangible book value is defined as permanent equity, adjusted to exclude goodwill and intangible assets, net of related deferred tax liabilities. Tangible book value per common share represents tangible book value at period-end divided by common stock outstanding at period-end. Prior periods were revised to conform with this presentation.

These measures are utilized by management in assessing our use of equity and capital adequacy. We believe that tangible book value presents a meaningful measure of net asset value, and tangible book value per share provides additional useful information to investors to assess capital adequacy.

The following table reconciles tangible book value to permanent equity, the most directly comparable GAAP measure, and presents the computation of permanent equity per common share and tangible book value per common share for the periods presented:

($ and shares in thousands, except per share amounts) |

|

December 31,

|

|

December 31,

|

||||

Permanent equity (GAAP) |

|

$ |

10,489,495 |

|

|

$ |

6,525,134 |

|

Non-GAAP adjustments: |

|

|

|

|

||||

Goodwill |

|

|

(1,393,505 |

) |

|

|

(1,393,505 |

) |

Intangible assets |

|

|

(231,919 |

) |

|

|

(297,794 |

) |

Related deferred tax liabilities |

|

|

44,045 |

|

|

|

60,088 |

|

Tangible book value (as of period end) (non-GAAP) |

|

$ |

8,908,116 |

|

|

$ |

4,893,923 |

|

|

|

|

|

|

||||

Common stock outstanding (as of period end) |

|

|

1,270,569 |

|

|

|

1,095,358 |

|

|

|

|

|

|

||||

Book value per common share (GAAP) |

|

$ |

8.26 |

|

|

$ |

5.96 |

|

Tangible book value per common share (non-GAAP) |

|

$ |

7.01 |

|

|

$ |

4.47 |

|

Adjusted Net Income, Adjusted Net Income Margin, Incremental Adjusted Net Income Margin and Adjusted EPS

Adjusted net income, adjusted net income margin, incremental adjusted net income margin and adjusted diluted earnings per share are non-GAAP measures. Adjusted net income is defined as net income, adjusted to exclude, as applicable, goodwill impairment expense and certain income tax benefits that are not expected to recur and are not indicative of our core operating performance.

Adjusted diluted earnings per share (“adjusted EPS”) is a non-GAAP financial measure that adjusts GAAP diluted earnings per share. Adjusted EPS is computed by dividing net income attributable to common stockholders, adjusted to exclude, as applicable, goodwill impairment expense and certain income tax benefits that are not expected to recur and are not indicative of our core operating performance, by the diluted weighted average number of shares of common stock outstanding during the period, excluding the dilutive impact of the 2026 and 2029 convertible notes under the if-converted method for which the 2026 and 2029 capped call transactions, respectively, would deliver cash or shares to offset dilution.

Adjusted net income margin is computed as adjusted net income divided by adjusted net revenue. Incremental adjusted net income margin is defined as the change in adjusted net income, divided by change in adjusted net revenue. See ‘Adjusted Net Revenue’ above for a reconciliation of this non-GAAP measure.

Management believes adjusted net income, adjusted net income margin, incremental adjusted net income margin and adjusted EPS are useful because they enable management and investors to assess our core operating performance or results of operations, by removing the effects of certain non cash items and charges to present a comparable view for period over period comparisons of our business.

The following table: (i) reconciles adjusted net income to net income, the most directly comparable GAAP measure, (ii) reconciles adjusted EPS to diluted earnings per share, the most directly comparable GAAP measure, and (iii) presents the computations of adjusted net income margin and incremental adjusted net income margin.

|

|

Three Months Ended

|

|

2025 vs 2024 |

|

Year Ended

|

|

2025 vs 2024 |

||||||||||||||||

($ and shares in thousands, except per share amounts)(1) |

|

2025 |

|

2024 |

|

$ Change |

|

2025 |

|

2024 |

|

$ Change |

||||||||||||

Net income (GAAP) |

|

$ |

173,549 |

|

|

$ |

332,473 |

|

|

$ |

(158,924 |

) |

|

$ |

481,320 |

|

|

$ |

498,665 |

|

|

$ |

(17,345 |

) |

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Income tax benefit from release of tax valuation allowance |

|

|

— |

|

|

|

(258,401 |

) |

|

|

258,401 |

|

|

|

— |

|

|

|

(258,401 |

) |

|

|

258,401 |

|

Income tax benefit from restructuring |

|

|

— |

|

|

|

(13,042 |

) |

|

|

13,042 |

|

|

|

— |

|

|

|

(13,042 |

) |

|

|

13,042 |

|

Goodwill impairment expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Adjusted net income (non-GAAP) |

|

$ |

173,549 |

|

|

$ |

61,030 |

|

|

$ |

112,519 |

|

|

$ |

481,320 |

|

|

$ |

227,222 |

|

|

$ |

254,098 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Net income attributable to common stockholders – diluted (GAAP)(2) |

|

$ |

173,893 |

|

|

$ |

332,473 |

|

|

|

|

$ |

482,700 |

|

|

$ |

434,776 |

|

|

|

||||

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Income tax benefit from release of tax valuation allowance |

|

|

— |

|

|

|

(258,401 |

) |

|

|

|

|

— |

|

|

|

(258,401 |

) |

|

|

||||

Income tax benefit from restructuring |

|

|

— |

|

|

|

(13,042 |

) |

|

|

|

|

— |

|

|

|

(13,042 |

) |

|

|

||||

Adjusted net income attributable to common stockholders – diluted (non-GAAP) |

|

$ |

173,893 |

|

|

$ |

61,030 |

|

|

|

|

$ |

482,700 |

|

|

$ |

163,333 |

|

|

|

||||

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Weighted average common stock outstanding – diluted |

|

|

1,346,110 |

|

|

|

1,151,047 |

|

|

|

|

|

1,251,767 |

|

|

|

1,101,390 |

|

|

|

||||

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Dilutive impact of convertible notes(3) |

|

|

(20,402 |

) |

|

|

(24,857 |

) |

|

|

|

|

(23,377 |

) |

|

|

(6,214 |

) |

|

|

||||

Adjusted weighted average common stock outstanding — diluted (non-GAAP) |

|

|

1,325,707 |

|

|

|

1,126,190 |

|

|

|

|

|

1,228,390 |

|

|

|

1,095,176 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Earnings per share – diluted (GAAP)(2) |

|

$ |

0.13 |

|

|

$ |

0.29 |

|

|

|

|

$ |

0.39 |

|

|

$ |

0.39 |

|

|

|

||||

Impact of adjustments per share |

|

|

— |

|

|

|

(0.24 |

) |

|

|

|

|

— |

|

|

|

(0.24 |

) |

|

|

||||

Adjusted earnings per share – diluted (non-GAAP)(2) |

|

$ |

0.13 |

|

|

$ |

0.05 |

|

|

|

|

$ |

0.39 |

|

|

$ |

0.15 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Net income margin (GAAP) |

|

|

17 |

% |

|

|

45 |

% |

|

|

|

|

13 |

% |

|

|

19 |

% |