CEO T.J. Rodgers on Solar ITC Loss

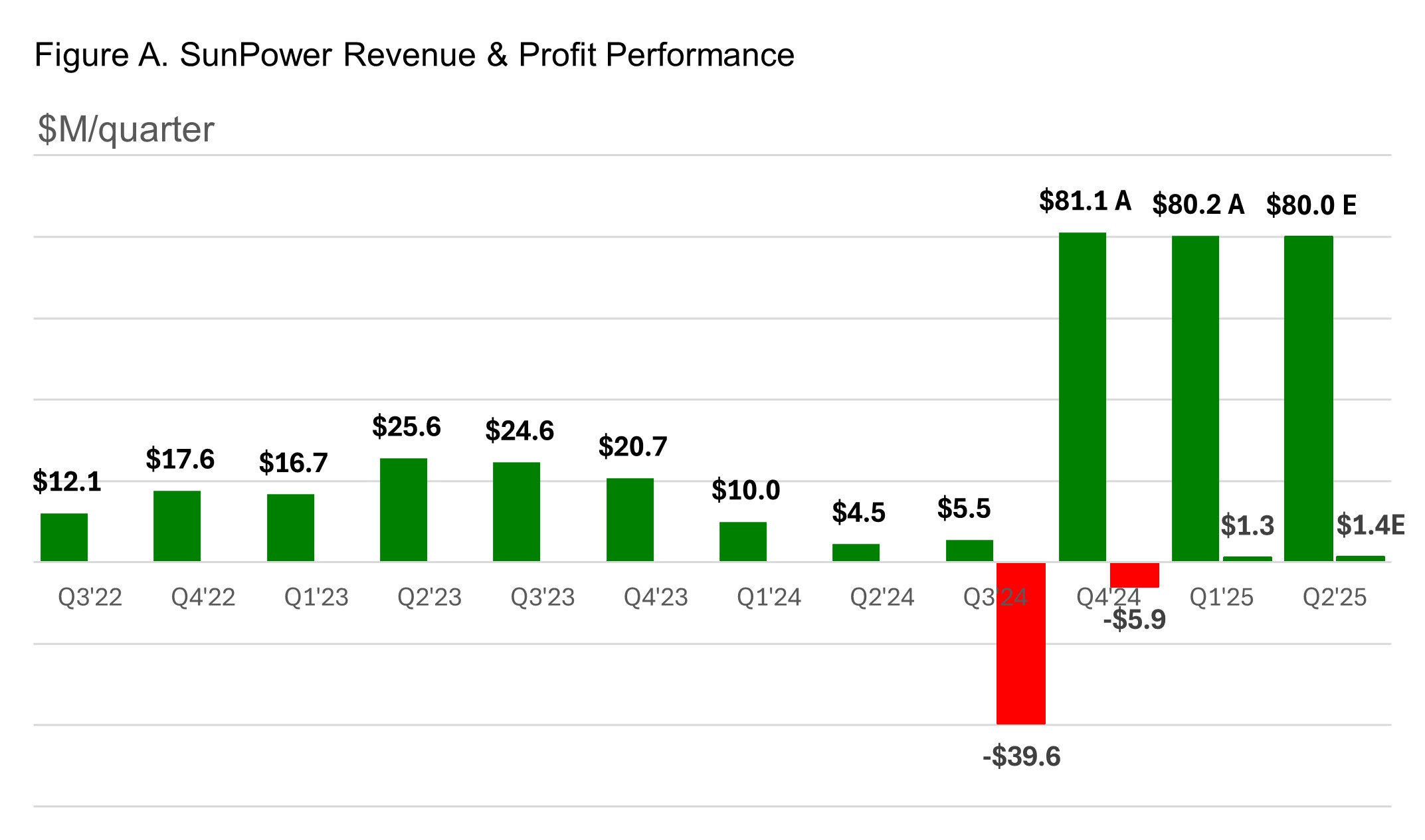

- Achieved first profitable quarter ($1.3M) in four years during Q1'25

- Successfully integrated 1,000 SunPower employees and key assets post-bankruptcy

- Can maintain profitability even if revenue drops to $74.3M quarterly

- Projects continued profitability in Q2'25

- Company's breakeven point expected to improve from $72M to $65M with planned cost reductions

- Potential market contraction due to ITC removal could reduce revenue by 7.2%

- Stock trading at low 0.5x sales multiple, below industry average

- Still carries 'going concern' status affecting valuation

- Facing lawsuit from major builder over payment disputes

- Potential financial troubles with an unnamed financial partner

Insights

Rodgers forecasts minimal impact from ITC elimination, with SunPower remaining profitable despite projected 7.2% revenue drop.

T.J. Rodgers, SunPower's CEO, has issued a surprisingly optimistic assessment of the pending legislation to eliminate the 30% solar Investment Tax Credit (ITC). His analysis suggests the company will remain profitable even after the tax credit disappears, presenting financial models to support this claim.

The most striking revelation is that SunPower's breakeven quarterly revenue point sits at

Rodgers' market analysis suggests solar prices will rise from

The company's recent financial turnaround is remarkable. After emerging from bankruptcy, SunPower transformed from a

Rodgers acknowledges several near-term risks, including potential financial troubles at a funding partner and ongoing legal disputes with a major builder over payment issues. The company also maintains a "going concern" rating that management aims to eliminate by year-end.

This communication represents a bold strategic stance: embracing the elimination of government subsidies while positioning the company as financially viable without them. Rodgers' argument that government subsidies ultimately harm industries through inefficiency and regulatory burden represents an unusual perspective in an industry that has traditionally lobbied for continued government support.

“Free at last. Thank God Almighty we are free at last”

OREM, Utah, June 09, 2025 (GLOBE NEWSWIRE) -- SunPower (aka Complete Solaria, Inc.) (“SunPower” or the “Company”) (Nasdaq: SPWR), a solar technology, services, and installation company – today T.J. Rodgers, Chairman and CEO, issued the following statement regarding pending legislation to cancel or wind down the

The soaring Martin Luther King quote is appropriate to describe the great opportunity now offered to the solar industry and to SunPower, in particular to get the federal government out of our lives. In the chip business, I survived two waves of government subsidies, Sematech (1987-1997) and the CHIPS and Science Act (2022- ). These subsidies followed a downward spiral path of 1) free money (here called welfare), 2) money with added political strings, and finally 3) money with numbing speed- and profit-killing regulations. My direct experience is that, like tariffs, government subsidies are bad and always harm the industry they intend to help. That’s because the strings force companies to build factories where they don’t want them, to follow building codes that dramatically increase cost and slow down building schedules, to adopt wage and work rules that make the workforce expensive and inflexible, and to cause the subsidized industry to get used to living on welfare and to become unable to compete with lean un-subsidized companies.

That downward spiral is clearly demonstrated in my recent Wall Street Journal op-ed (link here), which describes the cradle‑to‑grave record of the Sematech chip welfare program, now being replicated by the new CHIPS Act, which is giving away

Sematech was launched with its first

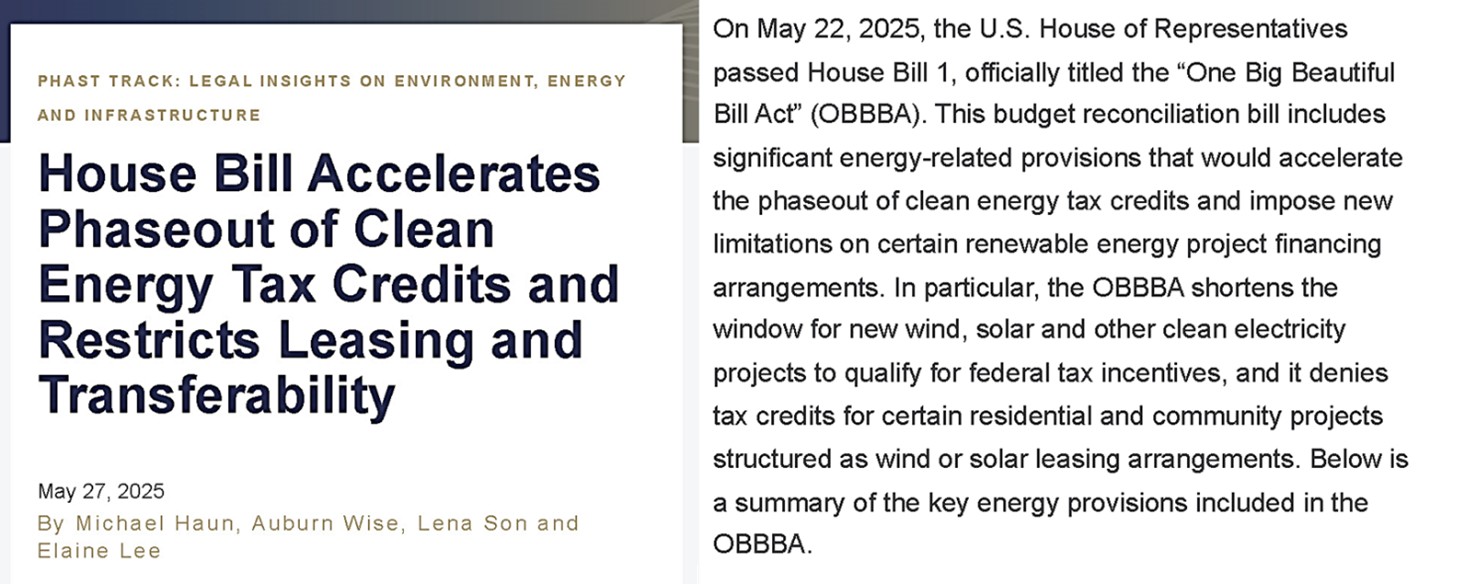

Last week we read that the congress worked “all night” on a bill to eliminate the solar investment tax credit (ITC). This type of erratic oversight has undermined the solar industry since at least 1978. Why would anyone spend years and vast sums to build a business that could be shut down by some ill-conceived government mandate, like tariff proposals that change weekly or congressional plans cooked up in all-night sessions? Washington’s exit from solar will be a great benefit to our industry, which should be lobbying for free markets, not subsidies. Yes, there will be a one-time hurdle, our customers’ loss of the

SunPower (1985)

SunPower was founded in 1985 and has survived every crash – dot-com, Black Friday, the 2008 housing crisis – for 40 years with the big, Chapter 11 black mark on its ledger in 2024. In my opinion after working on the SunPower bankruptcy problems, the failure was – as always – one of management, not controlling costs and demanding profitability, but this bad behavior is enabled by the federal government and its ITC solar welfare program which provided subsidies to private companies to install solar inefficiently, and induced banks to make poor quality loans to harvest the ITC welfare.

I was the chairman of SunPower in 2005 when it raised

SunPower survived that mismanagement and the other crises, but succumbed when its relentless losses had piled up almost

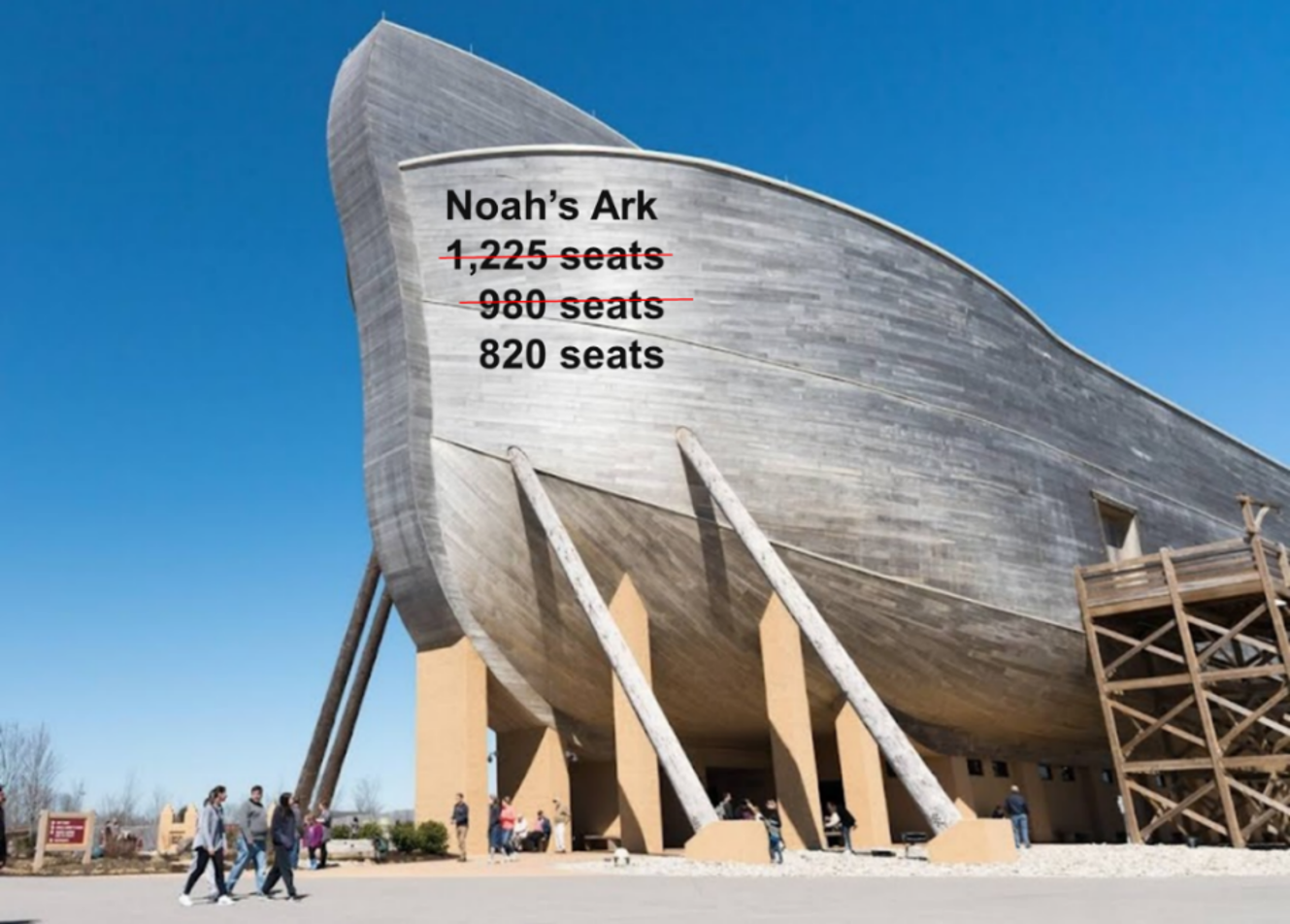

About 1,000 of old-SunPower’s employees were hired by my startup solar company, Complete Solar (Nasdaq: CSLR), which we called the Ark – that is, a good place to be when the rains start, because we were a public company and had cash. We bought key SunPower assets, including its name and three businesses units. New SunPower emerged as a company with

Noah’s Ark Startup Strategy

This Complete Solar strategy for SunPower was approved by the old-SunPower board and presented a “stalking horse” plan to the bankruptcy asset auction, which we won with a

Our Ark merger strategy is nothing but a typical Silicon Valley startup plan in disguise. Instead of trying to save a big company in trouble by borrowing a lot of money (old-SunPower asked for a

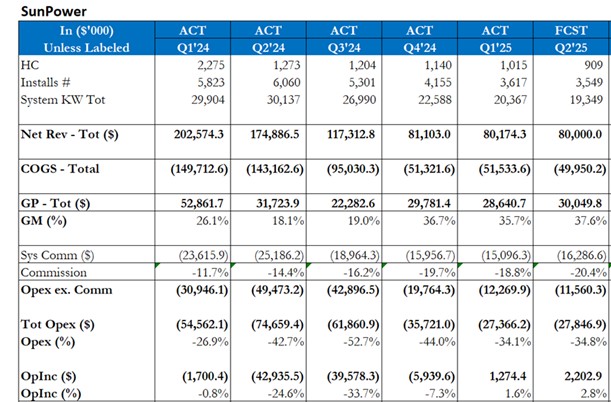

After taking control of the assets on September 30, 2024, the newly combined SunPower focused on becoming quickly profitable at its new revenue point of

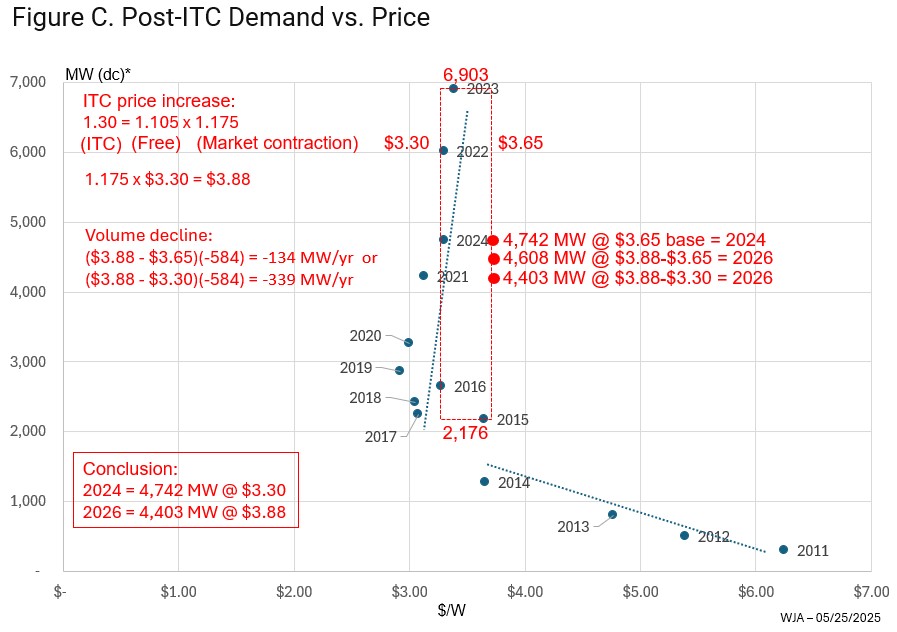

Effect of ITC Loss on Solar Market

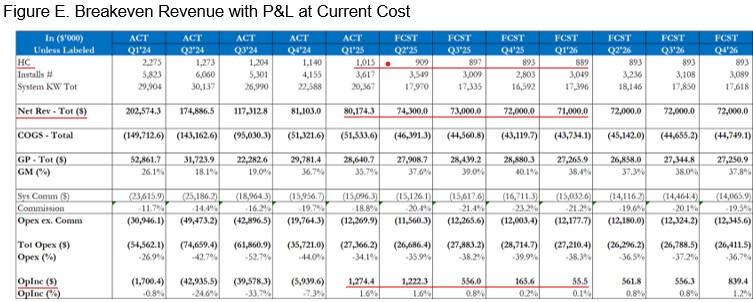

In this analysis, we use the worst-case ITC scenario with an abrupt cutoff in the end of Q4’25, and model the financial impact on SunPower. Our models give us a seven-quarter snapshot of various scenarios at one point in time and do not constitute our guidance. However, for business as usual under various stresses, they do predict our breakeven revenue, which is currently about

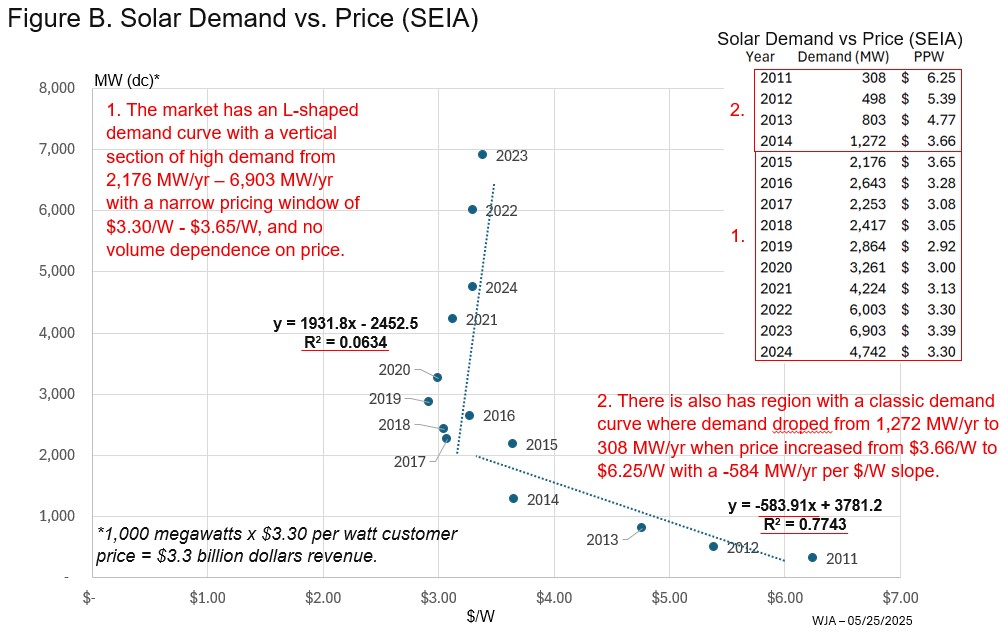

Before modeling SunPower, we project scenarios for what might happen to the solar market when the ITC dries up and we compete in a market with higher prices and lower volume.

Solar Market Analysis

As shown in the data chart in Figure C, the last six years were the best ever in solar volume with shipments of 2,176 MW to 6,953 MW in 2015-2024 at relatively flat prices from

Thus, our analysis predicts a price rise from

Figure D. P&L for

The model for our current company predicts if we can make

Figure E. Breakeven Revenue with P&L at Current Cost

Our revenue can drop to

The Figure shows our profit will return to the

Why is our stock price so low?

The Greentech company index shows a P/S ratio (defined as market cap/annualized revenue) of 2.6x declining to 2.1x over the last two years. The solar industry has been hit harder. Solar leader SunRun dropped from 1.6x to 0.9x sales, while SPWR has remained anomalously low at about 0.5x sales during the whole period – despite our record of rapid accomplishments during our first two quarters as a public company: buying SPWR assets, integrating 1,000 SPWR employees, rebranding as SunPower and reducing operating income losses from

In my detailed examination of our statement of Risk Factors in our 10Q report, on the day of the share price drop related to our 10Q, we actually wrote in the 10Q Risk Factors section that “we may never be profitable” on the very same day we had reported an operating profit for the first time in four years. Our Risk Factors need to be better done, but the root cause fix must be to get rid of the “going concern” rating – and that’s exactly what we have been working on since taking over SunPower. Our goal is to get rid of the “going concern” rating by year-end.

A Media Snippet accompanying this announcement is available in this link.

No Late Breaking News

The solar industry is somewhat in a turmoil right now. While we don’t have enough solid data to modify our guidance, rumors are starting to flow: 1) a financial company (not among our top two) may be in financial trouble, and 2) we have been sued by a major builder because we’re shutting down its systems for 90-day-plus late payment (true). Finally, if the market contraction sets in a reaction to the ITC news, it may impact our revenue as early as this quarter, not in Q1’26.

The solar industry, ethical heir to the aluminium siding industry, provides a test of character per week. I have had to pass many of those tests to start creating a long-term record that we can be proud of. What I do know is that we are going to be profitable again this quarter and I’ll deal with the other problems as they come up.

About SunPower

The Company has been a leading residential solar services provider in North America since 1985. The Company’s digital platform and installation services support energy needs for customers wishing to make the transition to a more energy-efficient lifestyle. For more information visit www.sunpower.com.

Forward Looking Statements

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “focus,” “forecast,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Forward-looking statements in this presentation include, without limitation, our future quarterly revenue projections, our expectations regarding our future fiscal financial performance, including with respect to our future quarterly and fiscal combined revenues and profit before tax loss, expectations and plans relating to further headcount reduction, cost control efforts, and our expectations with respect to stock price and when we achieve breakeven operating income and positive operating income, including our models about achieving operating income breakeven or profitability. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, our expectations relating to the ITC phase out and its impacts on our business and market demand, our ability to implement further headcount reductions and cost controls, our ability to integrate and operate the combined business with the SunPower assets, our ability to achieve the anticipated benefits of the SunPower acquisition, global market conditions, changes to domestic or foreign tariffs or tax incentives, any adjustments, changes or revisions to our financial results arising from our financial closing procedures, and other risks and uncertainties applicable to our business. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our annual report on Form 10-K filed with the SEC on April 30, 2025, our quarterly reports on Form 10-Q filed with the SEC and other documents that we have filed with, or will file with, the SEC. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements in this presentation speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and SunPower assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Company Contacts:

| Dan Foley CFO daniel.foley@sunpower.com (858) 212-9594 | Sioban Hickie VP, Investor Relations sioban.hickie@sunpower.com (801) 477-5847 |

Source: SunPower

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/fa2107e4-45f5-4c99-963a-db9f08f79a98

https://www.globenewswire.com/NewsRoom/AttachmentNg/d5c271ca-3d4d-480e-9793-c7f795ae6a44

https://www.globenewswire.com/NewsRoom/AttachmentNg/f5e1bf84-5e57-4805-828a-07347f9bb5bf

https://www.globenewswire.com/NewsRoom/AttachmentNg/2bfa3e6f-df36-4b45-87c3-279f47edd213

https://www.globenewswire.com/NewsRoom/AttachmentNg/7f6ddb3b-e17a-4c76-8fed-a0824aa25110

https://www.globenewswire.com/NewsRoom/AttachmentNg/ca868762-4e76-4e8b-bcd4-75b10baeb4cf

https://www.globenewswire.com/NewsRoom/AttachmentNg/301c5d7e-67c7-40b6-855b-30c13971bdd5

https://www.globenewswire.com/NewsRoom/AttachmentNg/4e0385b7-58e4-4275-9d88-485f696f0ebb

https://www.globenewswire.com/NewsRoom/AttachmentNg/442eecf7-f331-488f-90e1-dbe3c37afc35

https://www.globenewswire.com/NewsRoom/AttachmentNg/40a06e10-5a3b-44ff-a5c5-e38bf1e323f0