Sarama Resources Completes Mt Venn Gold Project Acquisition

Rhea-AI Summary

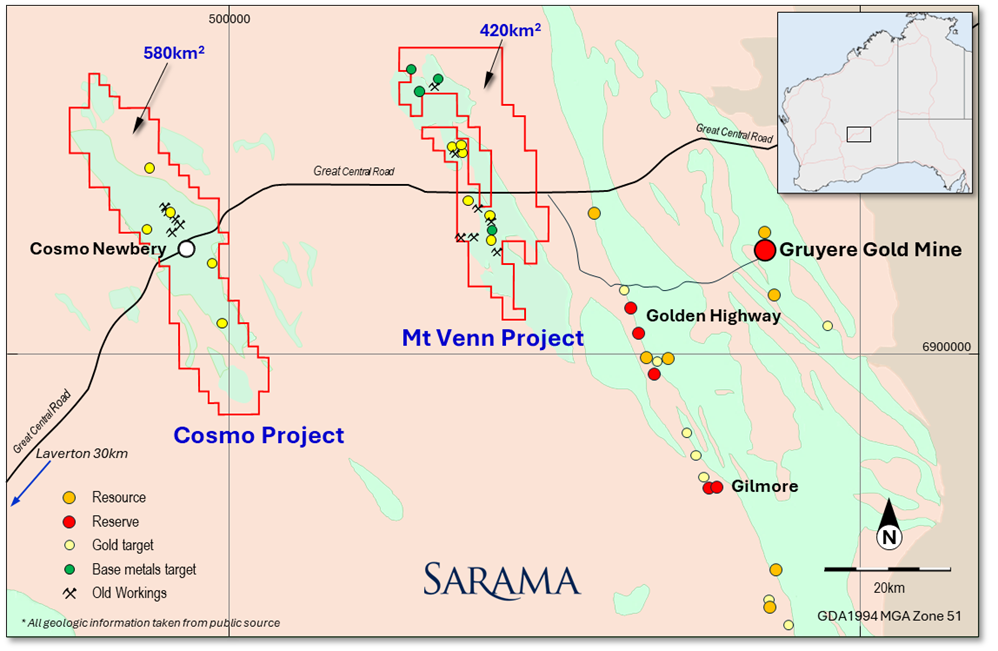

Sarama Resources (SRMMF) has completed the acquisition of an 80% majority interest in the 420km² Mt Venn Gold Project in Western Australia's Eastern Goldfields. The acquisition, combined with their December 2024 Cosmo Gold Project purchase, creates a significant 1,000km² landholding in the Laverton Gold District.

The transaction consideration includes 12 million Chess Depository Instruments (CDIs), a A$20,000 exclusivity fee, and approximately A$39,900 in project fees. The Mt Venn Project, located 35km from the producing Gruyere Gold Mine, features a 50km strike length regional shear zone and includes historical high-grade gold discoveries from the 1920s.

The project operates under a joint venture with Cazaly Resources Limited maintaining a 20% interest. Sarama recently raised A$2.7M to advance initial exploration activities.

Positive

- Acquisition creates substantial 1,000km² landholding in the prolific Laverton Gold District

- Project located strategically near producing Gruyere Gold Mine (4.8Moz Au Measured & Indicated)

- Historical high-grade gold discoveries and broad drill-defined mineralization present

- Recent A$2.7M equity raise secured for initial exploration

- Favorable 80-20 joint venture structure with free-carry period until Pre-Feasibility Study

Negative

- Project is still in early exploration phase with no defined resources

- Additional funding may be required beyond the A$2.7M raised

- 12 million CDIs issued for acquisition causing shareholder dilution

Landholdings Increased to 1,000km² Over Two Belt-Scale Projects in Laverton Gold District

PERTH, AUSTRALIA AND VANCOUVER, BC / ACCESS Newswire / July 22, 2025 / Sarama Resources Ltd. (" Sarama " or the " Company ") (ASX:SRR, TSX-V:SWA) is pleased to advise that it has completed the previously announced acquisition (the " Transaction ") of a majority interest (1) in the under-explored, belt-scale 420km² Mt Venn Project (the " Project ") (2), located in the Eastern Goldfields of Western Australia.

This follows Sarama's acquisition of a majority interest (3) in the nearby Cosmo Gold Project in December 2024. Together, these acquisitions create a 1,000km² landholding covering two well-positioned and underexplored greenstone belts in the Laverton Gold District, an area which is known for prolific gold endowment and significant recent discoveries (refer Figure 1).

Highlights

Completion of Transaction for Sarama to acquire a majority interest (1) in, and control of, the Mt Venn Gold Project in Western Australia

Located in the prolific Laverton Gold District, 35km from the producing Gruyere Gold Mine and less than 20km from Gold Road's Golden Highway Deposit

Project covers 420km² and features a favourable litho-structural setting, primarily in greenstone rocks

Includes regional shear zone of ~50km strike length and 1-3km width extending full length of greenstone belt

Advanced gold targets generated through historical exploration, including broad drill-defined gold mineralisation

Creates 1,000km² exploration position in the Laverton Gold District, capturing 100km of strike length

Mt Venn is 40km from Sarama's Cosmo Project (3) that is target-rich and hosts approximately 45km strike of gold trends up to 1.8km in width (6) .

Initial exploration to be advanced by the recent equity raise of A

$2.7M

Sarama's Executive Chairman, Andrew Dinning commented:

"We are very pleased to have completed the acquisition of a majority interest in the Mt Venn Project, significantly expanding our footprint in the Laverton Gold District and consolidating a 1,000km² landholding with strong discovery potential, in a region that has delivered multiple high-quality gold deposits, including the nearby Gruyere Deposit.

Mt Venn lies just 40km from our Cosmo Gold Project (3) , with both showing strong gold anomalism. Cosmo hosts approximately 45km of mineralised gold trends up to 1.8km wide (6) , while Mt Venn's soil sampling, historic workings, early drilling, and polymetallic nature highlight potential for a large-scale mineralized system. We see considerable exploration upside across both projects and with compelling targets already identified, we look forward to unlocking their value through focused and systematic exploration."

Mt Venn Project

The Project is comprised of 3 contiguous exploration tenements covering approximately 420km² in the Eastern Goldfields of Western Australia, approximately 110km north-east of Laverton and 35km west of the regionally- significant Gruyere Gold Mine (4). The Project is readily accessible via the Great Central Road which services the regional area east of Laverton.

The Project captures the majority of the underexplored Jutson Rocks Greenstone Belt over a strike length of ~50km. Rocks within the belt feature a diverse sequence of volcanic lithologies of varying composition, together with pyroclastics and metasediments. Several internal intrusive units have been identified throughout the Project and are commonly associated with local structural features. A regionally extensive shear zone, spanning 1-3km in width, extends the entire length of the belt with subordinate splays interpreted in the southern area of the Project which provides a favourable structural setting for mineralisation.

Gold mineralisation was first discovered in the 1920's with sampling returning very high grades and prompting the commencement of small-scale mining operations in the mid 1920's. Multiple gold occurrences have since been identified throughout the Project, demonstrating the prospectivity of the system. Despite the identification of several km-scale gold-in-soil anomalies by soil geochemistry and auger drilling, many of these targets are yet to be properly tested. Encouragingly, drilling by Cazaly Resources Limited (" Cazaly ") (ASX: CAZ) at the Project intersected broad, gold mineralisation over several fences in weathered and fresh rock at the Three Bears Prospect, presenting a priority target for exploration (Cazaly news release 27 February 2017: " Widespread Gold & Zinc Mineralisation Defined" ).

In addition to the attractiveness of the Project for gold, it is considered prospective for base metals and platinum group elements. Historical exploration work including auger geochemistry and geophysical surveys identified numerous targets for copper, nickel and zinc mineralisation. Several of these targets remain untested due to historical funding and land access constraints. Exploration in the belt to the immediate south of the Project area is noted to have intersected copper mineralisation of significant grade over a significant strike length (5) .

In summary, the Project is located within a prolific gold district and has a favourable lithological and structural setting. A solid database of base-level historical exploration work by previous operators, including generation of drill-ready targets, provides a good platform for Sarama to advance the Project in conjunction with its activities at the Cosmo Project. The size and prospectivity of the landholding that Sarama has in the Laverton Gold District significantly enhances the chances of making an economic discovery, particularly given the infrastructure and proliferation of mines in the region which will have a favourable impact on the size threshold for finding something of economic value.

Figure 1 - Mt Venn and Cosmo Project Locations, Eastern Goldfields, Western Australia

Transaction & Joint Venture Summary

Transaction Details

Pursuant to the binding Asset Sale and Purchase Agreement executed by Sarama and a

As consideration for the assignment of its interests in the JV, Orbminco, or its nominee, has received 12,000,000 Chess Depository Instruments (" CDI s") in Sarama (the " Consideration Securities "). Each Consideration Security issued to Orbminco, or its nominee, in connection with the Transaction will rank equally with existing Sarama CDIs and each Consideration Security will represent a beneficial interest of 1 common share in Sarama.

The following information is provided for exchange compliance purposes:

The Transaction's Asset Sale & Purchase Agreement was executed 26 February 2025 and was announced via news release disseminated on TSX-V newswire services and Australian Securities Exchange (" ASX ") platform on 27 February 2025. The Transaction is being conducted at arm's length and no finders' fees are payable.

In consideration for Sarama, via a

100% -owned subsidiary, acquiring all of Orbminco's80% interest in the Project, Sarama has provided the following consideration:Cash payment of A

$20,000 for exclusivity fee to Orbminco;Issuance to Orbminco of the Consideration Securities; and

Cash payments on behalf of Orbminco for project annual exploration licence government rental fees totalling approximately A

$39,900.

Sarama advises it has issued news releases in relation to the acquisition of an interest in the Project on 13 January 2025, 27 February 2025 and 30 June 2025.

Project Joint Venture Structure

The Project is currently in exploration phase and is now operated by Sarama's subsidiary as an unincorporated joint venture in which Sarama and Cazaly hold interests of

Sarama's subsidiary is responsible for all costs incurred by the JV until the completion of a Pre-Feasibility Study on the Project (the " Free Carry Period "). At that point, Cazaly may elect to start contributing its pro-rata share of future JV expenditure to maintain its

Following the end of the Free Carry Period and in the event Cazaly has elected to contribute its pro rata share of Project costs, the JV participants will be subject to industry standard 'contribute or dilute' provisions in respect of their interests. In the event a JV participant's interest falls below

The JV agreement includes customary protections for the participants associated with, but not limited to, surrender of mineral tenements, disposals of JV property and assets, material revisions to approved work programs and budgets, change of operatorship and decision to mine.

For further information, please contact:

Sarama Resources Ltd

Andrew Dinning or Paul Schmiede

e: info@saramaresources.com

t: +61 8 9363 7600

FOOTNOTES

The Mt Venn Project's Exploration Licences are held

80% by Sarama (via a subsidiary) and20% by Cazaly, reflecting the parties' joint venture interests.The Project is comprised of the following contiguous Exploration Licences: E38/3111, E38/3150 and E38/3581 covering approximately 420km².

The Cosmo Project's Exploration Licences are held

80% by Sarama (via a subsidiary) with the exception of E38/2274 for which Sarama holds an effective60% interest. The tenements in which Sarama has acquired an80% interest account for approximately80% of the total area of the Project. For a period of 2-years following completion of the transaction in relation to Sarama's acquisition of an interest in the Cosmo Project, Sarama has the right to acquire the vendors remaining20% interest, which would result in Sarama having an aggregate100% interest, in all the Project's Exploration Licences (with the exception of Exploration Licence E38/2274 which would be held75% by Sarama and25% by an existing joint tenement holder in the event that Sarama exercises the option to acquire the vendor's remaining interest in the Project).Gruyere Project Mineral Resources December 2023: 113.3Mt @ 1.32g/t Au for 4.8Moz Au (Measured & Indicated) and 68.6Mt @ 1.44g/t Au for 3.2Moz (Inferred) (December 2023 Quarterly Report, Gold Road Resources Limited, 29 January 2024).

Cosmo Metals Limited News Release 4 November 2022.

Sarama Resources News Release 10 June 2025.

CAUTION REGARDING FORWARD LOOKING INFORMATION

Information in this news release that is not a statement of historical fact constitutes forward-looking information. Such forward-looking information includes, but is not limited to, statements regarding the prospectivity of the Mt Venn and Cosmo Projects, information with respect to Sarama's planned exploration activities, having or acquiring mineral interests in areas which are considered highly prospective for gold and other commodities and which remain underexplored, costs and timing of future exploration, making an economic discovery, completion of a Pre-Feasibility Study, maintaining an ownership interest in the JV, granting an NSR, Cazaly electing to contribute its pro rata share of Project costs, and the potential for exploration discoveries and generation of targets. Actual results, performance or achievements of the Company may vary from the results suggested by such forward-looking statements due to known and unknown risks, uncertainties and other factors. Such factors include, among others, that the business of exploration for gold and other precious minerals involves a high degree of risk and is highly speculative in nature; Mineral Resources are not mineral reserves, they do not have demonstrated economic viability, and there is no certainty that they can be upgraded to mineral reserves through continued exploration; few properties that are explored are ultimately developed into producing mines; geological factors; the actual results of current and future exploration; changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company's publicly filed documents.

There can be no assurance that any mineralisation that is discovered will be proven to be economic, or that future required regulatory licensing or approvals will be obtained. However, the Company believes that the assumptions and expectations reflected in the forward-looking information are reasonable. Assumptions have been made regarding, among other things, the Company's ability to carry on its exploration activities, the sufficiency of funding, the timely receipt of required approvals, the price of gold and other precious metals, that the Company will not be affected by adverse political and security-related events, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain further financing as and when required and on reasonable terms. Readers should not place undue reliance on forward-looking information. Sarama does not undertake to update any forward-looking information, except as required by applicable laws.

QUALIFIED PERSON'S STATEMENT

Scientific or technical information in this disclosure that relates to exploration is based on information compiled or approved by Paul Schmiede. Paul Schmiede is an employee of Sarama Resources Ltd and is a Fellow in good standing of the Australasian Institute of Mining and Metallurgy. Paul Schmiede has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Paul Schmiede consents to the inclusion in this news release of the information in the form and context in which it appears.

This announcement has been authorised by the Board of Sarama Resources. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. |

Notice under section 708A(5)(e) of the Corporations Act 2001 (Cth )

This notice is given by Sarama Resources Ltd. (ARBN 143 964 649) (the " Company ") under section 708A(5)(e) of the Corporations Act 2001 (" Corporations Act ") as modified by ASIC Corporations (Offers of CHESS Depository Interests) Instrument 2025/180 (" Instrument ").

The CDIs were issued without disclosure to investors under Part 6D.2 of the Corporations Act.

This notice is being given under section 708A(5)(e) of the Corporations Act.

The Company, as at the date of this notice, has complied with:

the provisions of section 601CK of the Corporations Act as they apply to the Company; and

sections 674 and 674A of the Corporations Act.

As at the date of this notice, there is no information, for the purposes of section 708A(7) and 708A(8):

that has been excluded from a continuous disclosure notice in accordance with the ASX Listing Rules; and

that investors and their professional advisers would reasonably require for the purpose of making an informed assessment of:

the assets and liabilities, financial position and performance, profits and losses and prospects of the Company; or

the rights and liabilities attaching to the CDIs.

Where applicable, references in this notice to sections of the Corporations Act are to those sections as modified by the Instrument.

SOURCE: Sarama Resources Ltd.

View the original press release on ACCESS Newswire