Spring Valley Gold Mine Approved for Production

Sailfish Royalty Corp. (OTCQX: SROYF) announced that the U.S. Bureau of Land Management has approved the Spring Valley Gold Mine Project in Pershing County, Nevada. The project, operated by Solidus Resources, will include an open-pit gold mine with a 21-year total life span, comprising 2 years of construction, 11 years of mining, 3 years of ore processing, and 5 years of reclamation.

The project will employ 130 contractors during construction and 250 full-time employees during operations. Sailfish holds various net smelter return (NSR) royalties on the project, including up to 3% NSR on the majority of the open pit area. The approved operations plan allows for 33% more throughput than outlined in the 2025 feasibility study, which was based on a gold price of $1,800/oz.

Sailfish Royalty Corp. (OTCQX: SROYF) ha annunciato che l'U.S. Bureau of Land Management ha approvato il progetto della miniera d'oro Spring Valley nella contea di Pershing, Nevada. Il progetto, gestito da Solidus Resources, prevede una miniera d'oro a cielo aperto con una durata complessiva di 21 anni, comprendente 2 anni di costruzione, 11 anni di estrazione, 3 anni di lavorazione del minerale e 5 anni di bonifica.

Durante la fase di costruzione saranno impiegati 130 appaltatori, mentre nelle operazioni operative saranno presenti 250 dipendenti a tempo pieno. Sailfish detiene diverse royalty sul progetto basate sul rendimento netto di fusione (NSR), inclusa una quota fino al 3% NSR sulla maggior parte dell'area della miniera a cielo aperto. Il piano operativo approvato consente un 33% di capacità produttiva in più rispetto a quanto previsto nello studio di fattibilità del 2025, basato su un prezzo dell'oro di 1.800 dollari l'oncia.

Sailfish Royalty Corp. (OTCQX: SROYF) anunció que la Oficina de Administración de Tierras de EE. UU. ha aprobado el Proyecto de la Mina de Oro Spring Valley en el condado de Pershing, Nevada. El proyecto, operado por Solidus Resources, incluirá una mina de oro a cielo abierto con una vida útil total de 21 años, que comprende 2 años de construcción, 11 años de minería, 3 años de procesamiento del mineral y 5 años de restauración.

El proyecto empleará a 130 contratistas durante la construcción y 250 empleados a tiempo completo durante las operaciones. Sailfish posee diversas regalías basadas en el rendimiento neto de fundición (NSR) en el proyecto, incluyendo hasta un 3% NSR en la mayoría del área de la mina a cielo abierto. El plan operativo aprobado permite un 33% más de capacidad de procesamiento que lo establecido en el estudio de factibilidad de 2025, el cual se basó en un precio del oro de $1,800 por onza.

Sailfish Royalty Corp. (OTCQX: SROYF)는 미국 토지 관리국(U.S. Bureau of Land Management)이 네바다주 퍼싱 카운티에 위치한 스프링 밸리 금광 프로젝트를 승인했다고 발표했습니다. 이 프로젝트는 Solidus Resources가 운영하며, 노천 금광으로 총 21년의 수명을 가지며, 2년의 건설 기간, 11년의 광산 운영, 3년의 광석 처리, 5년의 복구 기간으로 구성됩니다.

프로젝트는 건설 기간 동안 130명의 계약자를 고용하고, 운영 기간 동안 250명의 정규 직원을 고용할 예정입니다. Sailfish는 프로젝트 내에서 여러 순 제련 수익(NSR) 로열티를 보유하고 있으며, 노천 광산 대부분 지역에 대해 최대 3% NSR를 포함합니다. 승인된 운영 계획은 2025년 타당성 조사에서 제시된 것보다 33% 더 많은 처리량을 허용하며, 이 타당성 조사는 온스당 1,800달러의 금 가격을 기준으로 했습니다.

Sailfish Royalty Corp. (OTCQX: SROYF) a annoncé que le Bureau de gestion des terres des États-Unis a approuvé le projet de mine d'or Spring Valley dans le comté de Pershing, Nevada. Le projet, exploité par Solidus Resources, comprendra une mine d'or à ciel ouvert avec une durée totale de vie de 21 ans, incluant 2 ans de construction, 11 ans d'exploitation minière, 3 ans de traitement du minerai et 5 ans de réhabilitation.

Le projet emploiera 130 entrepreneurs pendant la construction et 250 employés à temps plein pendant les opérations. Sailfish détient diverses redevances nettes sur le rendement de fusion (NSR) sur le projet, y compris jusqu'à 3% NSR sur la majorité de la zone de la mine à ciel ouvert. Le plan d'exploitation approuvé permet un débit 33% supérieur à celui prévu dans l'étude de faisabilité de 2025, qui était basée sur un prix de l'or de 1 800 $ l'once.

Sailfish Royalty Corp. (OTCQX: SROYF) gab bekannt, dass das US Bureau of Land Management das Spring Valley Gold Mine Projekt im Pershing County, Nevada genehmigt hat. Das von Solidus Resources betriebene Projekt umfasst eine Tagebau-Goldmine mit einer Gesamtlaufzeit von 21 Jahren, bestehend aus 2 Jahren Bauzeit, 11 Jahren Bergbau, 3 Jahren Erzverarbeitung und 5 Jahren Rekultivierung.

Während der Bauphase werden 130 Auftragnehmer beschäftigt und während des Betriebs 250 Vollzeitmitarbeiter. Sailfish hält verschiedene Net Smelter Return (NSR) Lizenzgebühren auf das Projekt, darunter bis zu 3% NSR auf den Großteil des Tagebaugebiets. Der genehmigte Betriebsplan erlaubt eine 33% höhere Durchsatzmenge als im Machbarkeitsstudie 2025 angegeben, die auf einem Goldpreis von 1.800 USD pro Unze basierte.

- None.

- First 500,000 ounces of gold recovered are not subject to NSR royalty payment

- Complex royalty structure with varying rates (0.5% to 3%) across different areas

Tortola, British Virgin Islands--(Newsfile Corp. - July 16, 2025) - Sailfish Royalty Corp. (TSXV: FISH) (OTCQX: SROYF) (the "Company" or "Sailfish") is pleased to announce that on July 15, 2025, the United States Bureau of Land Management ("BLM") approved Solidus Resources, LLC's (the "Operator") Spring Valley Gold Mine Project ("Spring Valley") located in Pershing County, Nevada. The Operator is approved to construct, operate and maintain an open-pit gold mine, three waste rock facilities, and a heap leach facility.

Spring Valley will employ a contractor workforce of approximately 130 employees during the initial two-year construction and approximately 250 full-time employees for the operations period. The total life of the project would be 21 years, including two years of construction, 11 years of mining, three additional years of ore processing, and five years of reclamation and closure activities.

Paolo Lostritto, CEO, stated, "The record of decision providing final approval for construction and eventual operations at Spring Valley is a major milestone for Sailfish as the expected cash flow from this asset should be a material step change from our current base of operations. This approval grants the Operator the ability to start construction on Spring Valley immediately with a view to generating the first gold production within the next two to three years. Sailfish has an up-to

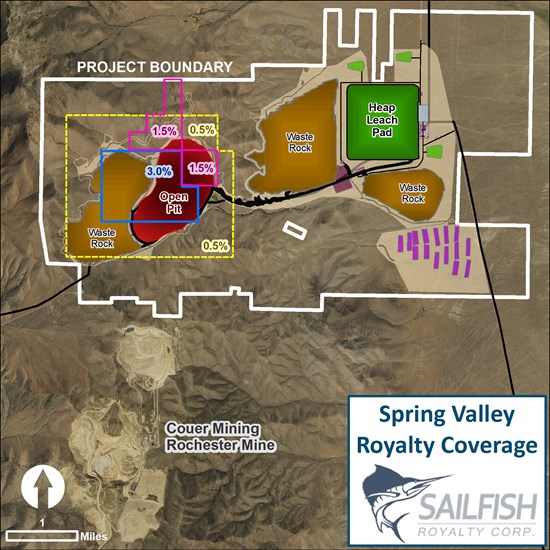

The Company's current royalty portfolio on Spring Valley covers

Sailfish holds the following Spring Valley royalty assets:

- up to a

3% NSR1 on a majority of the acres included in the proposed open pit at Spring Valley (royalty boundary in blue); - a

1.5% NSR on a portion of the proposed open pit at Spring Valley (royalty boundary in pink); and - a

0.5% NSR on a portion of the proposed open pit at Spring Valley (royalty boundary in yellow2).

Figure 1 - Sailfish Royalty Corp.'s various Spring Valley royalty holdings (boundaries are approximate).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5699/258979_0d2fe08904fb8b75_001full.jpg

1 For clarity, the up to

2 Excluding the areas included in the blue and pink boundaries.

About Sailfish

Sailfish is a precious metals royalty and streaming company. Within Sailfish's portfolio are three main assets in the Americas: a gold stream equivalent to a

Sailfish is listed on the TSX Venture Exchange under the symbol "FISH" and on the OTCQX under the symbol "SROYF". Please visit the Company's website at www.sailfishroyalty.com for additional information.

For further information: Paolo Lostritto, CEO, tel. 416-602-2645 or Akiba Leisman, Executive Chairman of the Board, tel. 917-558-5289.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary statement regarding forward-looking information

Certain disclosures in this release constitute "forward-looking information" within the meaning of Canadian securities legislation. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by words such as the following: expects, plans, anticipates, believes, intends, estimates, projects, assumes, potential and similar expressions. Forward-looking statements also include reference to events or conditions that will, would, may, could or should occur, including, without limitation, statements regarding: the expectation that Sailfish's shareholders will be positively impacted by an increase in Sailfish's cash-flow as a result of the positive record of decision and optimization of Spring Valley for the current gold price environment and the expectation that production on Spring Valley will start in the next two to three years. In making the forward-looking statements in this news release, the Company has applied certain factors and assumptions that the Company believes are reasonable, including, without limitation: that Sailfish's shareholders will be positively impacted by an increase in Sailfish's cash-flow as a result of the positive record of decision and optimization of Spring Valley for the current gold price environment and the expectation that production on Spring Valley will start in the next two to three years. However, the forward-looking statements in this news release are subject to numerous risks, uncertainties and other factors that may cause future results to differ materially from those expressed or implied in such forward-looking statements, including without limitation: that Sailfish's NSR on Spring Valley will not positively impact Sailfish's cashflow as expected by Sailfish's management; that Sailfish's shareholders will not be positively impacted by an increase in Sailfish's cash-flow as a result of the positive record of decision and optimization of Spring Valley for the current gold price environment and the expectation that production on Spring Valley will start in the next two to three years as expected by management or at all; and those applicable risks, uncertainties and factors set forth in the Company's disclosure record under the Company's profile on SEDAR+ at www.sedarplus.ca.There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/258979