Theralase(R) Releases 3Q2025 Financial Statements

Rhea-AI Summary

Theralase (OTCQB:TLTFF) released unaudited condensed consolidated interim 3Q2025 financial statements and will host a conference call on Nov 19, 2025 at 11:00 am ET. For the nine months ended Sept 30, 2025 versus 2024: total revenue was $590,573 (down 5%), cost of sales $299,743 (51% of revenue, down 10%), and gross margin $290,830 (49% of revenue). Net loss was $3,435,145, a 3% increase, which included $708,521 in non-cash charges. Operational items: a $672,627 private placement (3,363,134 units at $0.20), extension of 1,840,000 warrants, and $280,000 short-term loans (15% interest).

Clinical: Study II is 97.8% enrolled (88/90); interim responses show CR 64.3%, Total Response 72.6%, and 40% CR durability at 450 days. Company expects enrollment complete in 4Q2025 and data lock/regulatory submissions in 1Q2027.

Positive

- Study II enrollment at 97.8% of 90-patient target

- Complete Response 64.3% (54/84) interim result

- Total Response 72.6% (61/84) interim result

- $672,627 raised via July 28, 2025 private placement

Negative

- Cost of sales declined 10% while remaining 51% of revenue

- Administrative expenses increased 12% year-over-year

- Short-term loans of $280,000 bear 15% interest, $100,000 related party

- Warrant extension: 1,840,000 warrants extended to Sept 30, 2028

News Market Reaction 1 Alert

On the day this news was published, TLTFF gained 1.10%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Toronto, Ontario--(Newsfile Corp. - November 10, 2025) - Theralase® Technologies Inc. (TSXV:TLT) (OTCQB:TLTFF) ("Theralase®" or the "Company"), a clinical stage pharmaceutical pioneering light, radiation, sound and drug-activated therapeutics for the treatment of cancer, bacteria and viruses has released the Company's unaudited condensed consolidated interim 3Q2025 financial statements ("Financial Statements").

Theralase® will be hosting a conference call on Wednesday, November 19th at 11:00 am ET, which will include a presentation of the financial and operational results for the fiscal quarter ending September 30th, 2025. Questions are welcome. To ensure we have time to review and properly address them during the call, please send them in advance to mperraton@theralase.com.

| Zoom Meeting Link: | https://us02web.zoom.us/j/81044841120 Webinar ID: 810 4484 1120 |

| Conference Call in: | 1-647-558-0588 (Canada) / 1-646-558-8656 (US) - not required for those attending by Zoom |

An archived version will be available on the website following the conference call.

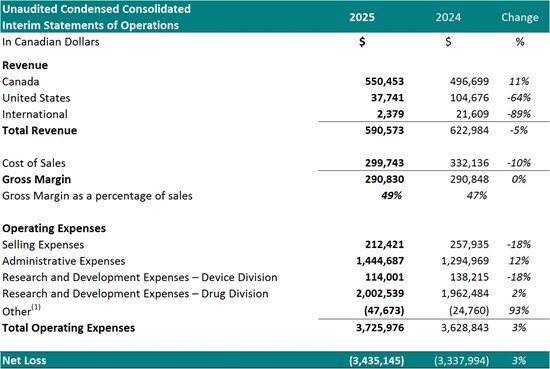

Financial Summary:

For the nine-month period ended September 30th:

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2786/273702_theralasetable.jpg

1 Other represents foreign exchange, interest accretion on lease liabilities and / or interest income

Financial Highlights

For the nine-month period ended September 30, 2025 versus September 30, 2024:

- Total revenue decreased

5% to$590,573 from$622,984 - Cost of sales decreased

10% to$299,743 (51% of revenue) from$332,136 (53% of revenue) - Gross margin decreased slightly to

$290,830 (49% of revenue) from$290,848 (47% of revenue) - Selling expenses decreased

18% to$212,421 from$257,935 - Administrative expenses increased

12% to$1,444,687 from$1,294,969 , driven primarily by increases in general and administrative expenses, professional fees and stock-based compensation - Research and development expenses increased

1% to$2,116,540 from$2,100,699 , reflecting increased activity to support Study II progress - Net loss for the period increased

3% to$3,435,145 from$3,337,994. T his included$708,521 in non-cash charges such as amortization and stock-based compensation.

Operational Highlights

Private Placements:

On July 28, 2025, the Company completed a non-brokered private placement, issuing 3,363,134 units at

Warrant Extension:

On August 29, 2025, the Company extended the expiry date of 1,840,000 warrants, all of which are exercisable at

Short Term Loans:

As of November 7, 2025, the Company had outstanding short-term loans totaling

The Company continues to explore additional equity and non-dilutive funding opportunities to support its clinical and commercial milestones.

Study II Update:

As of November 7, 2025:

- 88 patients have been treated with the primary Study Procedure, representing

97.8% of the total targeted enrollment of 90 patients. - 72 patients have completed the clinical study, being assessed at all assessment visits or have been prematurely removed from the clinical study by the principal investigator for lack of response

- 16 additional patients are pending study completion.

Interim clinical results indicate:

64.3% (54/84) patients achieved a Complete Response ("CR") at any point in time72.6% (61/84) achieved a Total Response (CR + Indeterminate Response ("IR")) (IR = negative cystoscopy with positive urine cytology, without a confirmatory bladder biopsy)- At the 450-day assessment,

40% (18/45) of patients maintained a CR, indicating strong durability of treatment effect, with42.2% (19/45) of patients maintaining a TR.

Theralase® remains on track to complete enrollment in 4Q2025, with data lock and regulatory submissions expected in 1Q2027.

For additional information, please refer to the Company's Management's Discussion and Analysis ("MD&A") available at www.sedarplus.ca.

About Ruvidar®:

Ruvidar® (TLD-1433) is a small molecule, able to be activated by light, radiation, sound and other drugs, intended for the safe and effective destruction of cancer, bacteria and viruses.

About Theralase® Technologies Inc.:

Theralase® is a clinical stage pharmaceutical company dedicated to the research and development of light, radiation, sound and drug-activated small molecule compounds and their associated formulations with a primary objective of efficacy and a secondary objective of safety in the destruction of cancer, bacteria and viruses, with minimal impact on surrounding healthy tissue.

Additional information is available at www.theralase.com and www.sedarplus.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements:

This news release contains Forward-Looking Statements ("FLS") within the meaning of applicable Canadian securities laws. Such statements include; but, are not limited to statements regarding the Company's proposed development plans with respect to small molecules and their drug formulations. FLS may be identified by the use of the words "may, "should", "will", "anticipates", "believes", "plans", "expects", "estimate", "potential for" and similar expressions; including, statements related to the current expectations of the Company's management regarding future research, development and commercialization of the Company's small molecules; their drug formulations; preclinical research; clinical studies and regulatory approvals.

These statements involve significant risks, uncertainties and assumptions; including, the ability of the Company to fund and secure the regulatory approvals to successfully complete various clinical studies in a timely fashion and implement its development plans. Other risks include: the ability of the Company to successfully commercialize its small molecule and drug formulations; the risk that access to sufficient capital to fund the Company's operations may not be available on terms that are commercially favorable to the Company or at all; the risk that the Company's small molecule and drug formulations may not be effective against the diseases tested in its clinical studies; the risk that the Company fails to comply with the terms of license agreements with third parties and as a result loses the right to use key intellectual property in its business; the Company's ability to protect its intellectual property; the timing and success of submission, acceptance and approval of regulatory filings. Many of these factors that will determine actual results are beyond the Company's ability to control or predict.

Readers should not unduly rely on these FLS, which are not a guarantee of future performance. There can be no assurance that FLS will prove to be accurate as such FLS involve known and unknown risks, uncertainties and other factors which may cause actual results or future events to differ materially from the FLS.

Although the FLS contained in the press release are based upon what management currently believes to be reasonable assumptions, the Company cannot assure prospective investors that actual results, performance or achievements will be consistent with these FLS.

All FLS are made as of the date hereof and are subject to change. Except as required by law, the Company assumes no obligation to update such FLS.

For investor information on the Company, please feel to reach out Investor Inquiries - Theralase Technologies.

For More Information:

1.866.THE.LASE (843.5273)

416.699.LASE (5273)

www.theralase.com

Kristina Hachey, CPA

Chief Financial Officer X 224

khachey@theralase.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273702