Americas Gold and Silver Corporation Provides Q1-2024 Production Results; Appoints Jim Currie as Chief Operating Officer

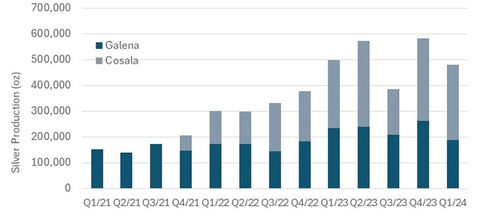

Consolidated Quarterly Attributable Silver Production (Graphic: Americas Gold and Silver Corporation)

- Q1-2024 consolidated attributable silver production of 0.48 million ounces compared with approximately 0.50 million ounces in Q1-2023. The Company also produced 8.0 million attributable pounds of zinc and 4.0 million attributable pounds of lead during Q1-2024.

- Production from the Cosalá Operations was strong as the operation benefitted from above budgeted silver grades and recoveries. The Galena Complex production was slightly below budget as focus during the quarter was re-allocated to lateral development to access the new mining areas in the Upper Country Lead Zone veins between 2400 and 2800 levels. This silver-lead area is expected to be in production in early May and increase production for the next several years.

- Mr. Jim Currie appointed as the Company’s Chief Operating Officer, effective May 6, 2024. Mr. Currie is an engineer with over 40 years of senior management, engineering, and operations experience. Mr. Currie has served as Chief Operating Officer of Equinox Gold Corp., Pretium Resources Inc. and New Gold Inc.

-

The Company is in the documentation phase with a metal trader to provide concentrate prepayment financing for the entire capital requirement at its

100% -owned El Cajón and Zone 120 silver-copper project (“EC120 Project”) at the Cosalá Operations. The Company expects to close on this financing in Q2-2024 with the goal of producing higher-grade silver-copper concentrates at the beginning of 2025.

“The Company had a reasonable start to the year in terms of silver production and anticipates much stronger quarterly silver production for the remainder of the year. Silver production at the Galena Complex is expected to increase immediately with the completion of the development on the 2400 Level, followed by lateral development on both the 3700 Level and 4600/4900 Levels, which will expose new mining areas in the second half of the year. The increases from the Galena Complex, coupled with the expected EC120 silver-copper production from the Cosalá Operations at the beginning of 2025, coincides almost perfectly with the recent and expected further increase in silver and copper prices.” stated Americas President and CEO Darren Blasutti. “We are also very pleased that Jim Currie will join the Company as our new Chief Operating Officer. His wealth of experience and underground mining expertise is expected to have an immediate positive impact at the Galena Complex in terms of both production and profitability.”

“I am thrilled to join Americas Gold and Silver during this exciting silver growth period for the Company while corresponding silver, copper and zinc prices are all trending in a positive direction.” stated Jim Currie, Americas’ Chief Operating Officer. “The Galena Complex has tremendous potential to become one of the three largest primary silver producers in

Consolidated attributable silver production in Q1-2024 was approximately 482,000 ounces compared with approximately 500,000 ounces in Q1-2023. While Q1-2024 silver production was slightly down year-over-year and down quarter-over-quarter, the quarterly silver production has trended in a positive direction over the course of the last three years and the Company expects this trend to continue as noted in the chart. This upward trend in production is expected from increased working faces at the Galena Complex as well as the exploitation of EC120 at the Cosalá Operations which contains high-grade silver and copper mineralization.

The Cosalá Operations produced approximately 295,000 ounces of silver, 2.8 million pounds of lead and 8.0 million pounds of zinc in Q1-2024, compared with approximately 265,000 ounces of silver, 2.7 million pounds of lead and 7.2 million pounds of zinc in Q1-2023. Silver and zinc production increased by over

With the current higher silver and copper price, the Company decided to expedite the development of its

The Company has an agreement in principle and is completing documentation with an international metal trader to provide concentrate prepayment financing options for the capital requirements at the EC120 Project. The Company expects to close on this financing in Q2-2024 and has the goal of completing the required development and preparations to be producing higher-grade silver-copper concentrates from the Project at the beginning of 2025.

Attributable production from the

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in

Technical Information and Qualified Persons

The scientific and technical information relating to the operation of the Company’s material operating mining properties contained herein has been reviewed and approved by Chris McCann, P.Eng., VP Technical Services of the Company. The Company’s current Annual Information Form and the NI 43-101 Technical Reports for its other material mineral properties, all of which are available on SEDAR+ at www.sedarplus.ca, and EDGAR at www.sec.gov, contain further details regarding mineral reserve and mineral resource estimates, classification and reporting parameters, key assumptions and associated risks for each of the Company’s material mineral properties, including a breakdown by category.

All mining terms used herein have the meanings set forth in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), as required by Canadian securities regulatory authorities. These standards differ from the requirements of the SEC that are applicable to domestic

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas’ expectations, intentions, plans, assumptions and beliefs with respect to, among other things, estimated and targeted production rates and results for gold, silver and other metals, the expected prices of gold, silver and other metals, as well as the related costs, expenses and capital expenditures; production from the Galena Complex and Cosalá Operations, including the expected number of producing stopes and production levels; the expected timing and completion of required development and the expected operational and production results therefrom, including the anticipated improvements to production rates and cash costs per silver ounce and all-in sustaining costs per silver ounce ; and statements relating to Americas’ EC120 Project, including expected approvals, prepayment financing availability and timing and capital expenditures required to develop such project and reach production thereat, and expectations regarding its ability to rely in existing infrastructure, facilities, and equipment; and statements regarding management changes at the Company. Guidance and outlook references contained in this press release were prepared based on current mine plan assumptions with respect to production, development, costs and capital expenditures, the metal price assumptions disclosed herein, and assumes no further adverse impacts to the Cosalá Operations from blockades or work stoppages, and completion of the shaft repair and shaft rehab work at the Galena Complex on its expected schedule and budget, the realization of the anticipated benefits therefrom, and is subject to the risks and uncertainties outlined below. The ability to maintain cash flow positive production at the Cosalá Operations, which includes the EC120 Project, through meeting production targets and at the Galena Complex through implementing the Galena Recapitalization Plan, including the completion of the Galena shaft repair and shaft rehab work on its expected schedule and budget, allowing the Company to generate sufficient operating cash flows while facing market fluctuations in commodity prices and inflationary pressures, are significant judgments in the consolidated financial statements with respect to the Company’s liquidity. Should the Company experience negative operating cash flows in future periods, the Company may need to raise additional funds through the issuance of equity or debt securities. Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of

View source version on businesswire.com: https://www.businesswire.com/news/home/20240501811319/en/

Stefan Axell

VP, Corporate Development & Communications

Americas Gold and Silver Corporation

416-874-1708

Darren Blasutti

President and CEO

Americas Gold and Silver Corporation

416‐848‐9503

Source: Americas Gold and Silver Corporation