Vox Royalty Acquires Cash-Flowing Kanmantoo Copper-Gold Royalty in South Australia

Vox Royalty Corp. (NASDAQ:VOXR) has acquired a cash-flowing royalty over the Kanmantoo copper-gold mine in South Australia for $11.7 million. The transaction includes a 2.5% NSR royalty (stepping down to 0.50% NSR after 85,000t copper production) from the producing underground mine operated by Hillgrove Resources.

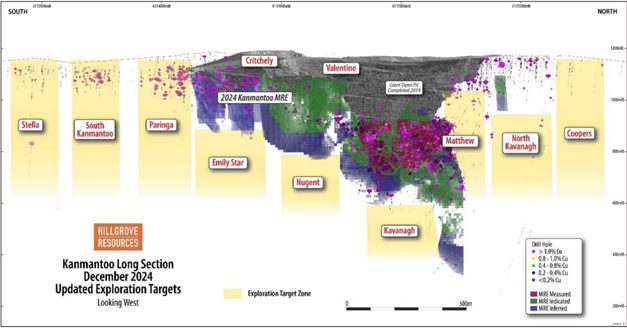

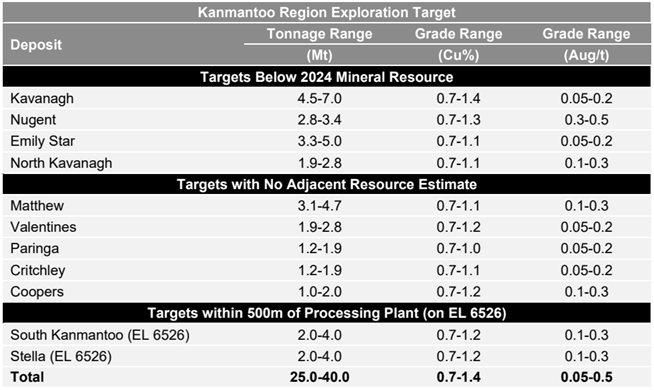

The mine is expected to generate over $3 million in annualized royalty revenue for 2025, with projected production of 12,000-14,000t copper. The facility includes a 3.6Mtpa processing plant currently at 40% utilization, with significant expansion potential supported by a 60,000m drilling program in 2025. The mine's current resources comprise 8.8Mt @ 0.81% Cu, 0.13g/t Au (Measured & Indicated) and 10.1Mt @ 0.73% Cu, 0.14g/t Au (Inferred), with an exploration target of 25-40Mt.

Vox Royalty Corp. (NASDAQ:VOXR) ha acquisito una rendita da flusso di cassa sulla miniera di rame e oro Kanmantoo nel Sud Australia per 11,7 milioni di dollari. L'operazione include una royalty NSR del 2,5% (che si riduce allo 0,50% NSR dopo la produzione di 85.000 tonnellate di rame) dalla miniera sotterranea in attività gestita da Hillgrove Resources.

La miniera dovrebbe generare oltre 3 milioni di dollari di ricavi da royalty annualizzati per il 2025, con una produzione prevista di 12.000-14.000 tonnellate di rame. L'impianto dispone di uno stabilimento di lavorazione da 3,6 milioni di tonnellate all'anno, attualmente utilizzato al 40%, con un significativo potenziale di espansione supportato da un programma di perforazione di 60.000 metri nel 2025. Le risorse attuali della miniera comprendono 8,8 milioni di tonnellate a 0,81% Cu, 0,13 g/t Au (Misurate e Indicate) e 10,1 milioni di tonnellate a 0,73% Cu, 0,14 g/t Au (Inferred), con un obiettivo di esplorazione di 25-40 milioni di tonnellate.

Vox Royalty Corp. (NASDAQ:VOXR) ha adquirido una regalía con flujo de caja sobre la mina de cobre y oro Kanmantoo en el sur de Australia por 11,7 millones de dólares. La transacción incluye una regalía NSR del 2,5% (que disminuye al 0,50% NSR después de producir 85.000 toneladas de cobre) de la mina subterránea en operación, gestionada por Hillgrove Resources.

Se espera que la mina genere más de 3 millones de dólares en ingresos anuales por regalías para 2025, con una producción proyectada de 12.000-14.000 toneladas de cobre. La instalación cuenta con una planta de procesamiento de 3,6 millones de toneladas por año, actualmente utilizada al 40%, con un considerable potencial de expansión respaldado por un programa de perforación de 60.000 metros en 2025. Los recursos actuales de la mina comprenden 8,8 millones de toneladas con 0,81% Cu, 0,13 g/t Au (Medidos e Indicados) y 10,1 millones de toneladas con 0,73% Cu, 0,14 g/t Au (Inferidos), con un objetivo de exploración de 25-40 millones de toneladas.

Vox Royalty Corp. (NASDAQ:VOXR)는 호주 남부에 위치한 Kanmantoo 구리-금 광산에 대해 1,170만 달러에 현금 흐름이 발생하는 로열티를 인수했습니다. 이번 거래에는 Hillgrove Resources가 운영하는 생산 중인 지하 광산에서 2.5% NSR 로열티(구리 생산량 85,000톤 이후 0.50% NSR로 감소)가 포함되어 있습니다.

이 광산은 2025년에 연간 300만 달러 이상의 로열티 수익을 창출할 것으로 예상되며, 예상 생산량은 12,000-14,000톤의 구리입니다. 이 시설에는 연간 360만 톤 처리 능력을 갖춘 가공 공장이 있으며 현재 40% 가동 중이고, 2025년 60,000미터 굴착 프로그램을 통해 상당한 확장 가능성을 보유하고 있습니다. 광산의 현재 자원은 8.8백만 톤 @ 0.81% 구리, 0.13g/t 금 (측정 및 확정)과 10.1백만 톤 @ 0.73% 구리, 0.14g/t 금 (추정)을 포함하며, 탐사 목표는 2,500만에서 4,000만 톤입니다.

Vox Royalty Corp. (NASDAQ:VOXR) a acquis une redevance générant des flux de trésorerie sur la mine de cuivre et d’or Kanmantoo en Australie-Méridionale pour 11,7 millions de dollars. La transaction comprend une redevance NSR de 2,5% (réduite à 0,50% NSR après une production de 85 000 tonnes de cuivre) provenant de la mine souterraine en activité exploitée par Hillgrove Resources.

La mine devrait générer plus de 3 millions de dollars de revenus annuels de redevances en 2025, avec une production prévue de 12 000 à 14 000 tonnes de cuivre. L’installation comprend une usine de traitement d’une capacité de 3,6 millions de tonnes par an, actuellement utilisée à 40%, avec un potentiel d’expansion important soutenu par un programme de forage de 60 000 mètres en 2025. Les ressources actuelles de la mine comprennent 8,8 millions de tonnes à 0,81% Cu, 0,13 g/t Au (mesurées et indiquées) et 10,1 millions de tonnes à 0,73% Cu, 0,14 g/t Au (inférées), avec un objectif d’exploration de 25 à 40 millions de tonnes.

Vox Royalty Corp. (NASDAQ:VOXR) hat eine Cashflow-generierende Lizenzgebühr auf die Kanmantoo Kupfer-Gold-Mine in Südaustralien für 11,7 Millionen US-Dollar erworben. Die Transaktion umfasst eine 2,5% NSR-Lizenzgebühr (die nach einer Kupferproduktion von 85.000 Tonnen auf 0,50% NSR sinkt) von der produzierenden Untertage-Mine, die von Hillgrove Resources betrieben wird.

Die Mine wird voraussichtlich über 3 Millionen US-Dollar an jährlichen Lizenzgebühren im Jahr 2025 erwirtschaften, mit einer prognostizierten Produktion von 12.000-14.000 Tonnen Kupfer. Die Anlage umfasst eine 3,6 Mio. Tonnen pro Jahr Verarbeitungsanlage, die derzeit zu 40 % ausgelastet ist, mit erheblichem Expansionspotenzial, unterstützt durch ein Bohrprogramm von 60.000 Metern im Jahr 2025. Die aktuellen Ressourcen der Mine umfassen 8,8 Mio. Tonnen mit 0,81% Cu, 0,13 g/t Au (gemessen und angezeigt) und 10,1 Mio. Tonnen mit 0,73% Cu, 0,14 g/t Au (inferred), mit einem Erkundungsziel von 25-40 Mio. Tonnen.

- Immediate cash flow generation with $3M expected annualized royalty revenue for 2025

- Strong production outlook of 12,000-14,000t copper in 2025

- Significant expansion potential with processing plant at only 40% utilization

- Record quarterly copper production achieved in Q1 2025 (2,952t Cu)

- Substantial exploration upside with 25-40Mt target @ 0.7-1.4% Cu

- First ore from high-grade Nugent deposit expected in Q4-2025

- Transaction fully financed through credit facility with Bank of Montreal

- Royalty rate steps down from 2.5% to 0.50% NSR after reaching 85,000t copper production

- Additional debt taken on through $11.7M credit facility drawdown

Insights

Vox adds immediate cash flow with $11.7M Kanmantoo royalty acquisition, projected to generate $3M annual revenue with significant upside potential.

Vox Royalty's

The transaction valuation appears favorable when examining the recent operational momentum at Kanmantoo. Hillgrove achieved record quarterly copper production in Q1 2025 with 2,952t copper (a

What makes this acquisition particularly compelling is the significant upside potential beyond the current reserves. While the current reserves support a relatively modest mine life (2,800kt at 0.91% Cu), the total resource base is substantially larger at 18.9Mt combined (Measured, Indicated, and Inferred). More importantly, Hillgrove has identified a regional exploration target of 25-40Mt at 0.7-1.4% Cu, potentially extending the mine life significantly.

The currently underutilized processing infrastructure (

This transaction aligns with Vox's strategy of acquiring royalties in tier-one jurisdictions with meaningful near-term cash flow and exploration upside. The company has financed the acquisition through its credit facility with Bank of Montreal, leveraging low-cost debt while maintaining balance sheet flexibility. The immediate revenue contribution will enhance Vox's financial profile while providing shareholders with exposure to both copper production growth and exploration optionality at Kanmantoo.

DENVER, CO / ACCESS Newswire / May 15, 2025 / Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) (" Vox " or the " Company "), a returns focused mining royalty company, is pleased to announce today that it has completed the acquisition of an immediately cash-flowing royalty over the producing Kanmantoo copper-gold mine in South Australia (the " Kanmantoo Royalty "), from a private company, for total cash consideration of

Kyle Floyd, Chief Executive Officer stated: "We are pleased to announce this accretive acquisition of the cash-flowing Kanmantoo Royalty in South Australia, operated by the experienced management team at Hillgrove. Based on Hillgrove's production forecasts for 2025, the Kanmantoo

https://hillgroveresources.com.au/uploads/downloads/546/MD%20Presentation%20for%20the%20AGM_1.pdf

Transaction Highlights

Fully operational underground copper-gold mine in South Australia that is expected to produce 12,000t - 14,000t copper in 2025 with meaningful gold and silver byproduct credits;

The Kanmantoo underground mine is located 55km from Adelaide and successfully operated as a series of open pits from 2010 to 2020, producing around 137,000t of copper and over 55,000 oz of gold. Mining from the underground operation commenced in May 2023, with commercial production declared in July 2024;

Extensive established infrastructure in place following initial capital investment of A

$200 million between 2010 and 2020, with significant expansion potential with 3.6Mtpa processing plant currently ~40% utilized;Provides Vox shareholders with immediate copper revenue exposure and further strengthens Vox's industry-leading proportionate weighting of royalty assets to Australia;

Current total resource as at September 30, 2024 comprises 8.8Mt @

0.81% Cu, 0.13g/t Au Measured & Indicated and 10.1Mt @0.73% Cu, 0.14g/t Au Inferred (1)Significant exploration upside potential, as demonstrated by the Kanmantoo Region JORC-2012 Exploration Target (1) of 25Mt - 40Mt @

0.7% -1.4% Cu and 0.05 - 0.5g/t Au as of February 13, 2025;60,000m drilling program for 2025 well underway, which is expected to yield an updated mineral reserves and resource estimate later in 2025, potentially supportive of a mine life extension;

Contractors currently at site to commence an accelerated development of the gold-dominant Nugent deposit underground decline, as part of the company's production growth strategy for 2025, with first ore from Nugent expected in Q4-2025. Underground grade control drilling at Nugent returned the following results (4) :

18.55m @

5.69% Cu + 1.02g/t Au (uncut) from 187m downhole (hole 24KVUG0476); and16.00m @

2.96% Cu + 0.42g/t Au (uncut) from 197m downhole (hole 24KVUG0503)

https://announcements.asx.com.au/asxpdf/20250213/pdf/06fgq9fmk6qknq.pdf

Kanmantoo - Asset Overview

The Kanmantoo mine is located in South Australia, 55 km southeast from the city of Adelaide, and is operated by ASX-listed Hillgrove Resources. The mine has a rich history originally dating back to 1846. From 2010 to 2020, open pit mining at Kanmantoo yielded approximately 137kt Cu and 55koz Au. During this period, Hillgrove invested approximately A

In April 2022, Hillgrove commenced underground development and operations, declaring first underground copper concentrate production and commercial production in Q1 and Q2 2024, respectively. The transition to an underground operation marked a significant shift in the mine's operational strategy, with an intended focus on deeper, higher-grade orebodies previously inaccessible via the open pits.

Hillgrove is currently mining the Kavanagh zone and has stated plans to delineate and access deeper and higher-grade Nugent ore in the near term. On April 24, 2025, Hillgrove announced that contractors had been mobilized to start the underground decline at Nugent as part of its Stage 1 production expansion strategy, with first ore scheduled for Q4-2025 to enable a

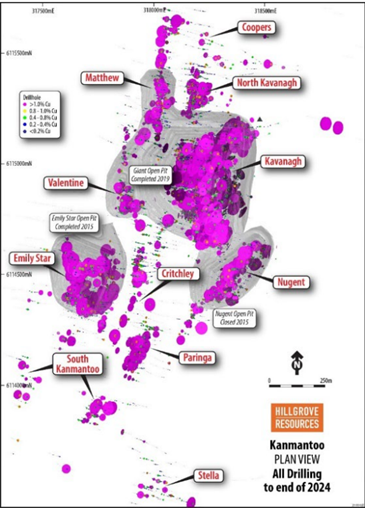

Various exploration targets have been identified, including but not limited to Emily Star, North Kavanagh, Matthew, Valentines, Paringa, Critchley and Coopers. On April 22, 2025, Hillgrove announced that it had identified new mineralisation at the Valentine zone, below the Valentine Open Pit, approximately 180m below previously mined areas, and 300m away from existing underground infrastructure, confirming the potential for new copper mineralization within the existing mining lease. A third diamond drill rig has also been mobilized, expected to accelerate exploration and resource expansion at Kanmantoo, as part of Hillgrove's 60,000m drilling program.

The latest mineral resources statement is as follows (as at September 30, 2024) (1) :

Mine Area | JORC Classification | Tonnage (kt) | Cu | Au | Ag | Bi (ppm) | Cu Metal (kt) | Au Metal (koz) |

Kavanagh | Measured | 3,200 | 0.94 | 0.04 | 2.9 | 190 | 30 | 4 |

Indicated | 3,400 | 0.77 | 0.1 | 2.4 | 97 | 26 | 11 | |

Inferred | 6,300 | 0.7 | 0.11 | 2.4 | 110 | 44 | 22 | |

North Kavanagh | Indicated | 230 | 0.78 | 0.17 | 3 | 140 | 2 | 1 |

Inferred | 110 | 0.77 | 0.21 | 3.3 | 130 | 1 | 1 | |

Nugent | Indicated | 2,300 | 0.74 | 0.36 | 1.7 | 66 | 17 | 26 |

Inferred | 1,100 | 0.71 | 0.35 | 1.6 | 40 | 8 | 13 | |

Emily Star | Inferred | 2,600 | 0.77 | 0.08 | 1.6 | 110 | 20 | 7 |

The mineral reserves statement is as follows (as at September 30, 2024) (1) :

Mine Area | JORC Classification | Tonnes (kt) | Cu (%) | Au (ppm) | Ag (ppm) | Bi (ppm) | Cu Metal (kt) | Au Metal (koz) |

Kavanagh | Proved | 1100 | 1.01 | 0.04 | 2.82 | 220 | 12 | 1 |

Probable | 1000 | 0.88 | 0.15 | 2.7 | 140 | 9 | 5 | |

Proved + Probable | 2100 | 0.95 | 0.09 | 2.76 | 180 | 21 | 6 | |

Nugent | Probable | 670 | 0.76 | 0.33 | 1.44 | 79 | 5 | 7 |

Proved + Probable | 670 | 0.76 | 0.33 | 1.44 | 79 | 5 | 7 | |

Total Ore Reserve | Proved | 1200 | 1.01 | 0.04 | 2.82 | 220 | 12 | 1 |

Probable | 1700 | 0.83 | 0.22 | 2.21 | 110 | 14 | 12 | |

Proved + Probable | 2,800 | 0.91 | 0.15 | 2.45 | 160 | 26 | 14 |

Hillgrove achieved its highest-ever quarterly copper production in Q1 2025, reporting 2,952t Cu produced, representing a

Hillgrove's JORC-2012 exploration target (February 13, 2025) (1) is distributed across the following lodes as follows:

https://www.hillgroveresources.com.au/uploads/downloads/570/2849116.pdf

https://announcements.asx.com.au/asxpdf/20250213/pdf/06fgq9fmk6qknq.pdf

Transaction Closing

The transaction is expected to close within a week. Monthly royalty revenue will accrue to Vox's account from May 1, 2025 onwards.

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties spanning six jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 30 separate transactions to acquire over 60 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

Spencer Cole | Kyle Floyd |

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the " CIM ") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the " CIM Definition Standards ").

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the " SEC ") has adopted amendments to its disclosure rules (the " SEC Modernization Rules ") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, as amended, the U.S. Securities Exchange Act of 1934, as amended, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, summaries of operator updates provided by management and the potential impact on the Company of such operator updates, statements regarding expectations for the timing of commencement of development, construction at and/or resource production at Kanmantoo, expectations regarding the size, quality and exploitability of the resources at Kanmantoo, future operations and work programs of Hillgrove or any other operator of Kanmantoo, the receipt of expected and potential royalty payments derived from Kanmantoo and other royalty assets of Vox, anticipated future cash flows and future financial reporting by Vox and requirements for and operator ability to receive regulatory approvals.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions, including international trade and tariffs; the absence of control over mining operations from which Vox will purchase precious metals or from which it will receive royalty payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related to Vox's dividend policy; epidemics, pandemics or other public health crises, including the global outbreak of the novel coronavirus, geopolitical events and other uncertainties, such as the changes to United States tariff and import/export regulations, as well as those factors discussed in the section entitled "Risk Factors" in Vox's annual information form for the financial year ended December 31, 2024 available at www.sedarplus.ca and the SEC's website at www.sec.gov (as part of Vox's Form 40-F).

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

None of the TSX, its Regulation Services Provider (as that term is defined in policies of the TSX) or The Nasdaq Stock Market LLC accepts responsibility for the adequacy or accuracy of this press release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than

References & Notes:

Hillgrove Resources - 2025 Kanmantoo Exploration Target Update - Dated February 13, 2025: https://announcements.asx.com.au/asxpdf/20250213/pdf/06fgq9fmk6qknq.pdf

The Kanmantoo mineral resource has not been updated for mining depletion.

Hillgrove Resources - Mining Contractors Mobilised to Accelerate Nugent - Dated April 24, 2025:

https://www.hillgroveresources.com.au/uploads/downloads/602/2881210.pdfIllustrative annualized royalty revenue based on midpoint of 12,000t - 14,000t copper production guidance for 2025 from Hillgrove in its report dated 21 January 2025, multiplied by 2025 consensus copper forecast price of

$4.24 /lb and2.5% NSR royalty rate, with gold and silver credits approximately offsetting NSR deductions. After reaching cumulative production of 85,000t, using the same simplified assumptions, illustrative annualized royalty revenue is expected to be ~$600,000. Full results from Nugent grade control drilling are reported in the table in Appendix A of the Hillgrove Quarterly Report dated 21 January 2025.

Hillgrove Resources Presentation at RRS Gather Round Conference dated April 9, 2025:

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02934634-2A1590408&v=7bc42bd11d853ed5e8c28f2ffcd6a069ee5cd6b4

SOURCE: Vox Royalty Corp.

View the original press release on ACCESS Newswire