Vox Royalty Notes Development Decision at The Horseshoe Lights Project and Provides Western Australia Gold Market Update

Rhea-AI Summary

Positive

- Melody Gold secured license to process 500,000 tonnes per annum of gold-bearing materials

- Vox holds an uncapped 3.0% Net Smelter Return royalty over the project

- Production expected to commence in late 2025, generating meaningful annual royalty revenues

- Strong gold market conditions with prices at A$5,228/ounce

- Project is part of a portfolio of nine royalty-linked gold deposits entering production between 2024-2026

Negative

- None.

News Market Reaction – VOXR

On the day this news was published, VOXR declined 3.03%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

DENVER, COLORADO / ACCESS Newswire / June 23, 2025 / Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to provide an update on the Horseshoe Lights copper-gold project in Western Australia, from royalty operator, Horseshoe Metals Limited ("Horseshoe Metals"), and recent gold industry developments in Western Australia.

Spencer Cole, Chief Investment Officer stated: "We're encouraged by the fast-tracking of the Horseshoe Lights gold stockpiles towards production through Melody Gold's toll treatment agreement. This development highlights the unique qualities of Western Australia as a top global mining jurisdiction, where mining operators can leverage efficient permitting, skilled mining labor, available capital and underutilized processing plants to potentially bring mineral deposits into production within three to five years. Horseshoe Lights is expected to be the seventh of nine royalty-linked Western Australian gold deposits to enter production between mid-2024 and mid-2026 - underscoring the sustained momentum in our Australian gold royalty portfolio."

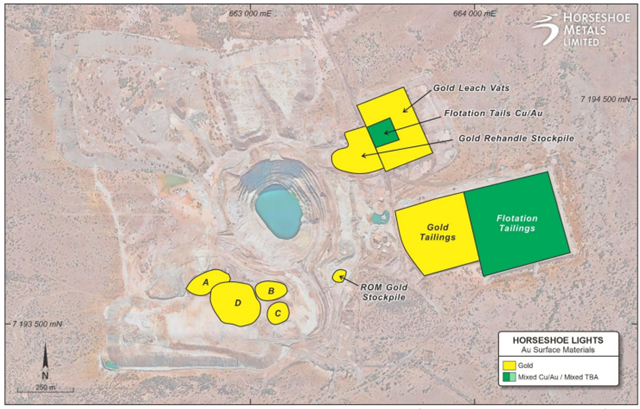

Figure 1 - Gold Surface Materials covered by Option Agreement (colored yellow and green)

(Source: https://horseshoemetals.com.au/wp-content/uploads/2025/06/Option-Exercised-Gold-Surface-Materials-Processing-Rights.pdf)

Horseshoe Lights Option Exercised for Gold Surface Materials Processing

Vox holds an uncapped

3.0% Net Smelter Return royalty over the Horseshoe Lights copper-gold project in Western Australia, operated by Horseshoe Metals.On June 12, 2025, Horseshoe Metals announced that Melody Gold Pty Ltd ("Melody") has exercised its option to secure an exclusive licence to process up to 500,000 tonnes per annum of gold-bearing surface materials at the Horseshoe Lights copper-gold Project. The initial term is three years, with an option to extend. In addition:

The Horseshoe Lights accommodation camp recently recommissioned to support Melody's planned activities and Horseshoe Metals' Direct Shipping Operation ("DSO") copper start-up;

Cash flow from gold processing to support Horseshoe Metals' near-term acceleration of copper exploration, development and DSO start-up at Horseshoe Lights;

Melody has advised it intends to treat up to 500,000 tonnes per annum in its proposed retreatment of the Gold Surface Materials, utilising gravity recovery to produce a gold-copper-silver concentrate; and

Horseshoe Metals' Director, Kate Stoney, commented:

"This is a strategic step forward for the business, as we look to unlock the value of our gold surface materials and capture early cash flow opportunities that will help expedite the re-development of the Horseshoe Lights Copper asset in Western Australia. We look forward to working with Melody and reporting on further operational progress as activity ramps up at Horseshoe Lights over the coming months."

Vox Management Summary: The Horseshoe Lights royalty project is being fast-tracked towards potential first production in late 2025, with the commencement of gold surface materials processing expected to commence by Melody in the coming months. This toll processing licence deal with Melody is a great example of how Western Australian mining projects are able to be fast-tracked into production, relative to other jurisdictions. Once ramped up to the expected 500,000 tonnes per annum gold processing rate, Vox anticipates that the gold stockpile operation will generate meaningful annual royalty revenues and de-risk the development of the larger Horseshoe Lights copper-gold project.

Figure 2 - Horseshoe Lights Project Infrastructure

(Source: https://horseshoemetals.com.au/wp-content/uploads/2025/05/Infrastructure-Recommissioning-Well-Advanced-at-HSL.pdf)

Western Australia ("WA") Gold Mining Market Update

The market for Australian gold developers and producers remains very robust with the spot gold price at A

$5,228 /ounce as of June 19th, 2025. As of May 2025, the WA resources sector hit a new peak in employment, including:135,693 on-site full‑time-equivalent ("FTE") mining positions, plus

4,263 on-site FTE positions in exploration roles, with

Gold mining accounting for ~31,884 FTE positions, up by ~1,800 job growth YoY 2.

There are 107 major national projects, including gold-related initiatives, which were categorized as committed or advanced in feasibility and expected to proceed by 20293.

Specifically, in WA, there are approximately 48 advanced/in‑pipeline projects, which are forecasted to demand ~11,065 new workers by 20293.

High gold prices have accelerated the development of several WA gold royalty projects in 2024 and 2025, and this is expected to continue over the coming year. From mid-2024 to mid-2026, Vox management expects nine royalty-linked gold deposits to commence production, as summarised below:

Gold Deposit (Royalty-linked) | Operator | Year Royalty Acquired | Mining Commenced / Expected to Commence | Processing Plant |

Myhree | Black Cat Syndicate | 2020 | Q3 2024 | Paddington |

Rayjax | Evolution Mining | 2024 | Q3 2024 | Mungari |

Plutonic East UG | Catalyst Metals | 2023 | Q1 2025 | Plutonic |

Boundary | Black Cat Syndicate | 2020 | Q1 2025 | Lakewood |

Castle Hill | Evolution Mining | 2024 | Q2 2025 | Mungari |

Horseshoe Lights (gold stockpiles) | Horseshoe Metals | 2023 | Q4 2025 | Melody Gold (tolling) |

Bruno-Lewis | Genesis Minerals | 2022 | Q4 2025 | Laverton |

Myhree UG | Black Cat Syndicate | 2020 | H1 2026 | Lakewood |

Mt Ida | Aurenne Group | 2020 | H2 2026 | Mt Ida |

Table 1 - Mining Commencement Timing at Royalty-linked WA Gold Deposits

(Source: Vox management, based on operator guidance & filings)

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties spanning six jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 30 separate transactions to acquire over 60 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

Kyle Floyd

Chief Executive Officer

info@voxroyalty.com

(720) 602-4223

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, as amended, the U.S. Securities Exchange Act of 1934, as amended, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, expectations for Vox's inclusion in various Russell indexes and impacts resulting from such inclusion, summaries of operator updates provided by management and the potential impact on the Company of such operator updates, statements regarding expectations for the timing of commencement of development, construction at and/or resource production from various mining projects, expectations regarding the size, quality and exploitability of the resources at various mining projects, future operations and work programs of Vox's mining operator partners, the receipt of expected and potential royalty payments derived from various royalty assets of Vox, anticipated future cash flows and future financial reporting by Vox and requirements for and operator ability to receive regulatory approvals.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions, including international trade and tariffs; the absence of control over mining operations from which Vox will purchase precious metals or from which it will receive royalty payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related to Vox's dividend policy; epidemics, pandemics or other public health crises, including the global outbreak of the novel coronavirus, geopolitical events and other uncertainties, such as the changes to United States tariff and import/export regulations, as well as those factors discussed in the section entitled "Risk Factors" in Vox's annual information form for the financial year ended December 31, 2024 available at www.sedarplus.ca and the SEC's website at www.sec.gov (as part of Vox's Form 40-F).

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

None of the TSX, its Regulation Services Provider (as that term is defined in policies of the TSX) or The Nasdaq Stock Market LLC accepts responsibility for the adequacy or accuracy of this press release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than

References & Notes:

Horseshoe Metals Limited - Horseshoe Lights Gold Processing Update - Dated June 12, 2025: https://horseshoemetals.com.au/wp-content/uploads/2025/06/Option-Exercised-Gold-Surface-Materials-Processing-Rights.pdf

Government of Western Australia - WA resources sector powers ahead with record jobs growth - Dated May 25, 2025:

https://www.wa.gov.au/government/media-statements/Cook%20Labor%20Government/WA-resources-sector-powers-ahead-with-record-jobs-growth-20250525MiningMagazine.com.au - Thousands needed to drive WA resources - Dated September 16, 2024: https://miningmagazine.com.au/thousands-needed-to-drive-wa-resources/

SOURCE: Vox Royalty Corp.

View the original press release on ACCESS Newswire