New Insurance Industry Report: Reduced Catastrophe Losses Drive Continued Industry Improvements

Rhea-AI Summary

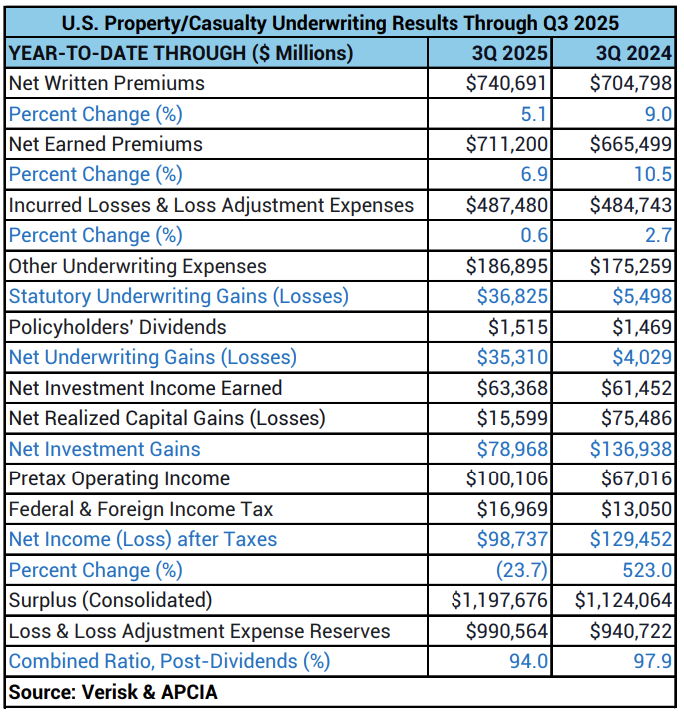

Verisk (Nasdaq: VRSK) with APCIA reports a stronger U.S. property/casualty industry through Q3 2025, driven by premium growth and reduced extreme weather losses. Key metrics: $35.3B underwriting gain, 94% combined ratio, net written premiums of $740.7B, and policyholders' surplus of $1.20T.

Realized capital gains fell to $15.6B, and figures cover ~97.9% of U.S. P/C business written.

Positive

- Underwriting gain of $35.3 billion through nine months of 2025

- Combined ratio improved to 94%, first sub-95 through Q3 in a decade

- Net written premiums rose 5.1% to $740.7 billion

- Policyholders' surplus increased to $1.20 trillion

Negative

- Realized capital gains dropped to $15.6 billion from $75.5 billion year-earlier

- Mid-year incurred losses and LAE increased 5.4% at June 30, 2025

News Market Reaction

On the day this news was published, VRSK declined 3.02%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

VRSK is down 2.55% while peers are mixed: EFX up 4.48%, HURN up 3.64%, FCN up 0.74%, BAH down 0.34%, CPRT down 1.09%, indicating stock-specific pressure rather than a broad sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Feb 03 | Catastrophe loss estimate | Neutral | -10.1% | Modeled insured loss estimate for Winter Storm Fern using Verisk storm model. |

| Jan 21 | Earnings date notice | Neutral | -0.9% | Announced timing and access details for Q4 and full-year 2025 results. |

| Jan 08 | Business divestiture | Positive | +0.9% | Sale of Marketing Solutions unit to sharpen focus on global insurance analytics. |

| Dec 29 | Deal termination | Positive | +2.0% | Ended AccuLynx acquisition and moved to redeem related notes, preserving flexibility. |

| Dec 10 | Cyber collaboration | Positive | -0.7% | Expanded KYND collaboration to add cyber risk intelligence to Rulebook platform. |

Recent headlines show mixed but often negative next-day reactions, including a -10.11% move on an insured-loss estimate and smaller moves around strategic and collaboration news.

Over the last few months, Verisk news has centered on industry analytics, strategic portfolio shaping, and capital allocation. On Dec 10, 2025, it expanded a cyber-risk collaboration, followed by ending the AccuLynx acquisition on Dec 29, 2025 and selling its Marketing Solutions business on Jan 8, 2026 to focus on global insurance data and analytics. A winter storm loss estimate on Feb 3, 2026 drew a sharp negative reaction. Today’s industry report reinforces Verisk’s positioning as a key data and analytics provider to property/casualty insurers.

Market Pulse Summary

This announcement underscores strengthening U.S. property/casualty industry fundamentals, including a $35.3 billion underwriting gain, a 94 percent combined ratio, and policyholders’ surplus rising to $1.20 trillion. For Verisk, it reinforces the relevance of its analytics in an environment of improved pricing and moderated catastrophe losses. In context of recent strategic divestitures, collaboration deals, and prior volatile reactions to catastrophe modeling news, investors may watch upcoming earnings and further industry data for how demand and pricing trends translate into Verisk’s own results.

Key Terms

underwriting gain financial

combined ratio financial

incurred losses financial

loss adjustment expenses financial

policyholders’ surplus financial

realized capital gains financial

reinsurers financial

residual market insurers financial

AI-generated analysis. Not financial advice.

Verisk and APCIA report

JERSEY CITY, N.J., Feb. 06, 2026 (GLOBE NEWSWIRE) -- Verisk (Nasdaq: VRSK), a leading strategic data analytics and technology partner to the global insurance industry, and the American Property Casualty Insurance Association (APCIA), the primary national trade association for home, auto and business insurers, today announced improvements in U.S. industry performance through the first nine months of 2025. Continued premium growth and reduced extreme weather losses were among the factors contributing to a

Underwriting Results Through Third Quarter 2025

- Written premiums: Net written premiums grew 5.1 percent to

$740.7 billion , compared to$704.8 billion during the same period in 2024. This increase reflects a shift toward adequate pricing and stable demand across most commercial and personal lines. - Earned premiums: Net earned premiums rose 6.9 percent to

$711.2 billion , compared to$665.5 billion in 2024. - Underwriting gain: The U.S. insurance industry posted an estimated net underwriting gain of

$35.3 billion , a sharp improvement over the$4 billion gain through the first nine months of 2024. - Incurred losses and loss adjustment expenses: Incurred losses and loss adjustment expenses increased just 0.6 percent, compared to a 2.7 percent rise in 2024. The combined ratio improved to 94 percent, down from 97.9 percent from the same time last year. This marks the first time in a decade that the combined ratio has fallen below 95 through the third quarter, signaling stronger underwriting performance.

- Surplus: Policyholders’ surplus increased to

$1.20 trillion from$1.12 trillion during the same period in 2024. - Realized capital gains: Realized capital gains continued to decline to

$15.6 billion , compared to$75.5 billion during the same period in 2024. Adjusting for the capital gains realized by one insurer in 2024, overall investment gains were stable during this period.

Note: The results above are based on annual statements filed with insurance regulators by private property/casualty insurers domiciled in the United States, including reinsurers, excess and surplus insurers, and domestic insurers owned by foreign parents, and excluding state funds for workers' compensation and other residual market insurers, the National Flood Insurance Program, and foreign insurers. The figures are consolidated estimates based on reports accounting for about 97.9 percent of all business written by U.S. property/casualty insurers. All figures are net of reinsurance unless otherwise noted and occasionally may not balance due to rounding.

2025 Mid-Year Adjustments

Following adjustments to previously reported first-half results, underwriting gains for the first six months of 2025 were finalized at

Verisk’s Underwriting & Rating Solutions helps global insurers, reinsurers and other stakeholders modernize their processes, reduce operating costs and underwrite risks quickly and precisely. These solutions support (re)insurers across multiple lines of business, including personal & commercial property, personal & commercial auto, small commercial and general liability programming to streamline forms, rules, loss costs and rating-related information.

###

About Verisk

Verisk (Nasdaq: VRSK) is a leading strategic data analytics and technology partner to the global insurance industry. It empowers clients to strengthen operating efficiency, improve underwriting and claims outcomes, combat fraud and make informed decisions about global risks, including climate change, catastrophic events, sustainability and political issues. Through advanced data analytics, software, scientific research and deep industry knowledge, Verisk helps build global resilience for individuals, communities and businesses. With teams across more than 20 countries, Verisk consistently earns certification by Great Place to Work and fosters an inclusive culture where all team members feel they belong. For more, visit Verisk.com and the Verisk Newsroom.

About APCIA

The American Property Casualty Insurance Association (APCIA) is the primary national trade association for home, auto, and business insurers. APCIA promotes and protects the viability of private competition for the benefit of consumers and insurers, with a legacy dating back 150 years. APCIA members represent all sizes, structures, and regions protecting families, communities, and businesses in the U.S. and across the globe.

Morgan Hurley Verisk 551-655-7858 morgan.hurley@verisk.com