MCB Real Estate Proposes to Acquire Whitestone REIT for $15.20 Per Share

Rhea-AI Summary

MCB Real Estate proposed to acquire Whitestone REIT (NYSE: WSR) for $15.20 per share in cash on November 4, 2025, backed by fully committed equity and debt financing with a Wells Fargo financing letter. The offer represents a 21.0% premium to the current share price and 25.0% premium to the 30‑day VWAP as of November 3, 2025, implying a 14.0x price to consensus NTM FFO.

MCB, a 9.2% Whitestone holder, says Whitestone has underperformed peers on valuation and operating metrics and urges the board to engage or start a public strategic alternatives process; MCB will vote against the board if no engagement occurs.

Positive

- $15.20 per share all‑cash offer

- 21.0% premium to Whitestone share price

- 25.0% premium to 30‑day VWAP (Nov 3, 2025)

- Fully committed equity plus Wells Fargo financing letter

- 9.2% ownership by MCB (4,690,000 shares)

Negative

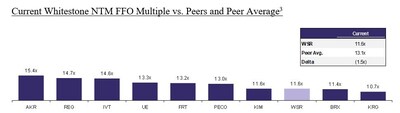

- Whitestone NTM FFO multiple 11.6x vs peers 13.1x

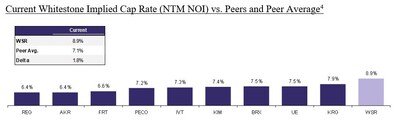

- Implied cap rate 8.9% vs peer average 7.1%

- Negative total shareholder return of ~6.6% since Oct 30, 2024

- Whitestone TSR +1.8% since June 3, 2024 vs peer +13.0%

News Market Reaction

On the day this news was published, WSR gained 4.94%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Whitestone has Failed to Create Value Since MCB Withdrew

Reiterates Opportunity to Unlock Value and Deliver Compelling Premium to Shareholders

Urges Shareholders to Demand the Whitestone Board Engage with MCB or Initiate Public Strategic Alternatives Process to Maximize Value

Commits to Voting Against Whitestone Board

Below is the letter to Whitestone shareholders:

November 4, 2025

Dear Fellow Whitestone REIT Shareholders,

MCB Real Estate ("MCB") is the largest actively managed shareholder of Whitestone REIT ("Whitestone" or the "Company"), with ownership of 4,690,000 shares representing

MCB's

at an Attractive Premium, to all Whitestone Shareholders

Under MCB's proposal, Whitestone shareholders would receive

MCB's

We are prepared to move forward expeditiously toward a mutually beneficial transaction.

Whitestone has Failed To Deliver and Will Never Close its Value Gap

Across multiple standard industry metrics, Whitestone's discounted valuation is evident.

1. Whitestone's current NTM FFO multiple of 11.6x compares to an average of 13.1x for its peers.2

(See Figure 1)

2.

Whitestone's implied cap rate (based on NTM NOI4) of

(See Figure 2)

3. Whitestone management has failed to execute against a business plan that will address its persistent valuation discount to the strip center peers.

When the Whitestone Board of Trustees rejected our prior

-

- Whitestone's fiscal year ("FY") 2025 Same Store NOI growth guidance of

4.00% (midpoint) is down from the5.10% delivered in FY 2024 and trails the peer average guidance for FY 2025 of4.20% 2; - While Whitestone's peers delivered an average FFO per share CAGR of

6.3% since 20212, Whitestone turned in a sub-average5.5% over the same period6; and - Whitestone's 2025 Core FFO per share growth implied by its third quarter earnings guidance,

4.0% , also trails the peer average5.5% 2, 6

- Whitestone's fiscal year ("FY") 2025 Same Store NOI growth guidance of

Whitestone has delivered negative total shareholder returns of approximately

In summary, the performance of Whitestone's stock demonstrates that the Company's small capitalization and trading float, bloated G&A spending, limited growth prospects and weaker overall asset quality relative to peers – and the market's lack of confidence in the Company's management and standalone prospects – severely limit the Company's ability to close its valuation gap. A sale of the Company is the only way to maximize value for Whitestone's shareholders.

MCB Is Willing and Able to Purchase Whitestone at

MCB proposed to acquire all outstanding shares of Whitestone for

Notably, since MCB submitted its initial offer on June 3, 2024, Whitestone shares have delivered a total shareholder return of (+

Despite the management team's failure and continued destruction of value, MCB remains committed to its proposal to acquire the Company. MCB is once again requesting that the Board immediately engage with us on our proposal to acquire the Company or commence a public strategic alternatives process, including soliciting other acquisition proposals. We continue to have the financial resources, transactional experience and industry knowledge to quickly complete due diligence and finalize committed financing to complete the proposed transaction.

We encourage all Whitestone shareholders to urge the Board to engage with MCB to complete the proposed transaction or initiate a public strategic alternatives process.

If Whitestone Fails To Engage, MCB Believes Change is Needed on the Whitestone Board

Given the Company's lagging valuation and entrenched Board, MCB is considering all options. At a minimum, MCB intends to vote against the entire Whitestone Board at next year's Annual Meeting of Shareholders. While we would prefer to work collaboratively with the Board to maximize the value of Whitestone, and hope a transaction will occur before the next Annual Meeting, we believe we have no choice left but to express our frustration and disappointment publicly, and ultimately to register our displeasure at the ballot box.

The Board has a narrow window now to do the right thing by meeting MCB at the negotiating table or entering into a public strategic alternatives process. We will continue engaging with our fellow shareholders to build support for change, and are committed to seeing this through to a successful conclusion that maximizes value for all shareholders.

Sincerely,

/s/ P. David Bramble

P. David Bramble, Managing Partner

Advisors

MCB has engaged Vinson & Elkins LLP as lead counsel and Wells Fargo is serving as financial advisor to MCB. Joele Frank, Wilkinson Brimmer Katcher is serving as strategic communications advisor to MCB.

About MCB Real Estate

Founded in 2007, MCB Real Estate is a community-centric, privately held national commercial real estate investment management and development firm headquartered in

Additional Information

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal which MCB has made to acquire all of the outstanding shares of the Company. In furtherance of this proposal and subject to future developments, MCB (and, if a negotiated transaction is agreed, the Company) may file one or more proxy statements, tender offer or other documents with the

This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, MCB and its executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Additional information regarding the interests of such potential participants will be included in one or more proxy statements, tender offer documents or other documents filed with the SEC if and when they become available. INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. These documents (if and when available) may be obtained free of charge from the SEC's website at http://www.sec.gov.

Media Contacts

Andrew Siegel / Lyle Weston

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

1 NTM FFO based on consensus estimates per FactSet as of 11/3/2025. Defined as strip center transactions since 2022 with a transaction value of

2 Peers defined as AKR, BRX, FRT, IVT, KIM, KRG, PECO, REG and UE.

3 S&P Capital IQ Pro. Market Data as of 11/3/2025.

4 Peers' implied cap rate per Green Street. WSR implied cap rate per NTM NOI consensus estimate of

5 Whitestone REIT, October 30, 2024, Whitestone REIT Responds to MCB Indication of Interest, Press Release. https://ir.whitestonereit.com/news-and-events/news/news-details/2024/Whitestone-REIT-Responds-to-MCB-Indication-of-Interest/default.aspx#:~:text=Whitestone%20REIT%20is%20well%2Dpositioned,momentum%20while%20driving%20shareholder%20value.

6 Represents FFO per Share CAGR from 2021A to 2024A. FFO per Share metrics for the peers utilize core/modified FFO per share where available (AKR, IVT, KRG, PECO, REG, UE) and otherwise uses reported NAREIT FFO per Share (BRX, FRT, KIM).

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/mcb-real-estate-proposes-to-acquire-whitestone-reit-for-15-20-per-share-302604022.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/mcb-real-estate-proposes-to-acquire-whitestone-reit-for-15-20-per-share-302604022.html

SOURCE MCB Real Estate