Whitestone REIT Acquires Grocer-Anchored Ashford Village in Houston

Rhea-AI Summary

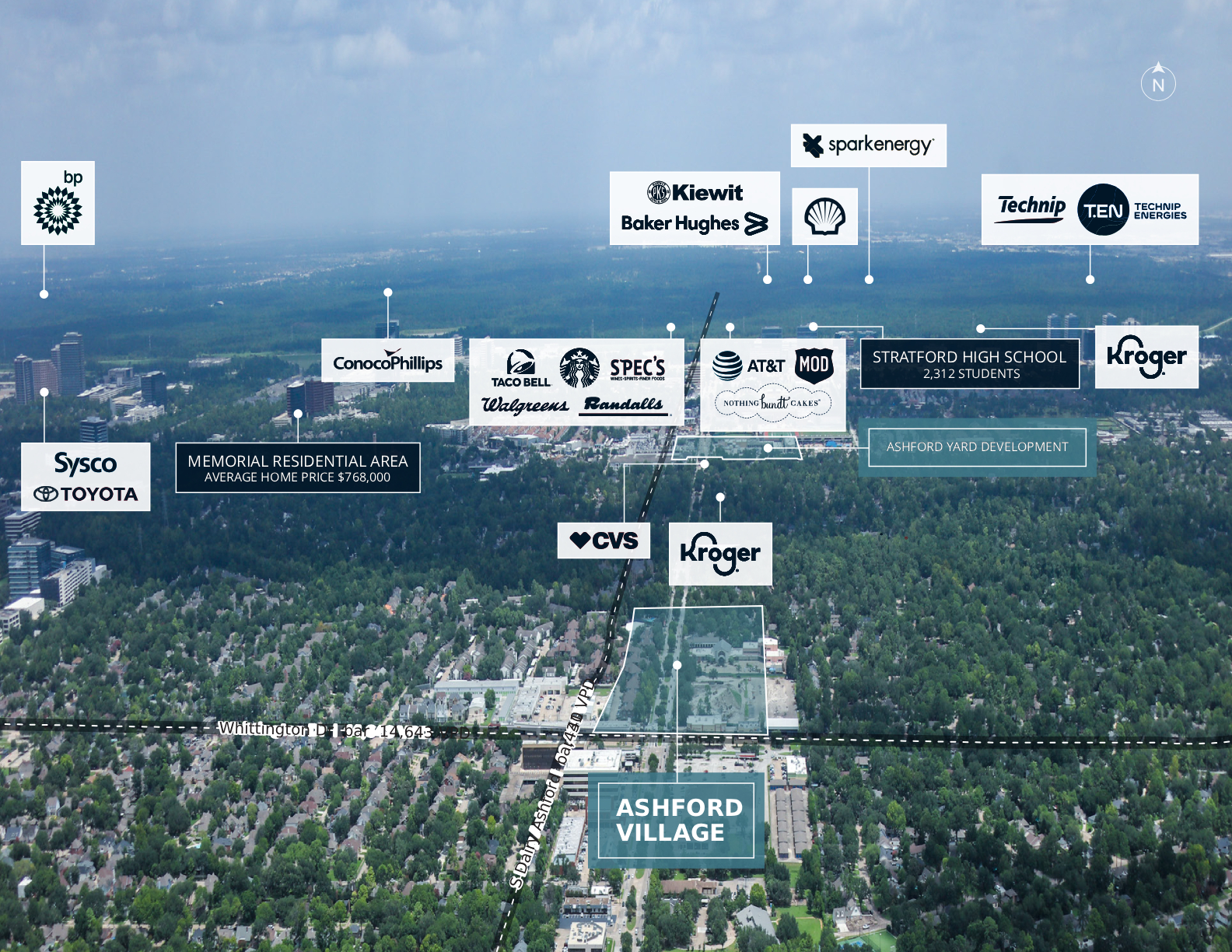

Whitestone REIT (NYSE: WSR) announced on November 3, 2025 the acquisition of Ashford Village, an 81,407 square-foot, grocer-anchored shopping center in Houston located between Interstate 10 and the Westpark Tollway at South Dairy Ashford Road and Whittington Drive.

The center is anchored by Seiwa Market (the city's largest Japanese grocery), features a strong restaurant and retail lineup, and sits in an area with ~32,500 vehicles per day and an estimated 3-mile average household income of $113,979 across ~72,860 households. This marks Whitestone’s 10th neighborhood shopping center in Houston and its third Houston acquisition since 2022.

Positive

- 81,407 sqft grocery-anchored acquisition

- 10th neighborhood shopping center in Houston for WSR

- $113,979 average household income within 3 miles

- 32,500 vehicles/day traffic at the nearby intersection

- Seiwa Market anchor, largest Japanese grocery in Houston

Negative

- None.

News Market Reaction

On the day this news was published, WSR gained 0.16%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Center’s location near Houston’s Energy Corridor, anchored by 8 Fortune 500 companies, provides a consistent stream of repeat traffic

Property features a strong restaurant and retail lineup, including Seiwa Market, the largest Japanese grocery in the city

HOUSTON, Nov. 03, 2025 (GLOBE NEWSWIRE) -- Whitestone REIT (NYSE: WSR), a neighborhood-focused owner and operator of open-air shopping centers in Texas and Arizona, today announced the acquisition of the 81,407 square-foot, grocery-anchored Ashford Village. Situated between Interstate 10 and the Westpark Tollway at the intersection of South Dairy Ashford Road and Whittington Drive (approximately 32,500 vehicles per day), the center is home to Seiwa Market, the largest Japanese grocery in the city, which serves the area's large Asian community. The strategic acquisition of Ashford Village, which marks Whitestone’s 10th neighborhood shopping center in Houston, allows Whitestone to capitalize on the strong fundamentals of the area. The area houses the headquarters or major offices for more than 1,500 companies spanning multiple industries: energy, engineering, technology and retail.

“Given our large footprint in Houston and our familiarity with the market, we have been actively looking to acquire assets like Ashford Village that align with our investment criteria and would benefit from our proven value-enhancing operational platform,” commented Christine Mastandrea, President and COO of Whitestone REIT. “Like Lion Square in the International Management District, this asset serves Houston’s thriving Asian community, and we feel our familiarity with the culture and expertise in tailoring diversified tenant lineups will allow us to realize Ashford Village’s true potential.”

Ashford Village’s convenient location – less than a 5-minute drive from the transformational Ashford Yard mixed-use development currently under development on the former Schlumberger campus – and strong restaurant and retail lineup provide the high number of office workers in the immediate area with a centralized, dynamic one-stop shopping destination that fulfills many of their demands. In addition to Seiwa Market, other tenants at Ashford Village include Thanjai Mess, Ramen Bar Ichi, Japan House, Dollar Tree, Giggles and Fun and Salon Village.

The average household income within a 3-mile radius of Ashford Village is

Dave Holeman, CEO of Whitestone REIT, said, “By adding Ashford Village to our existing Houston portfolio, we feel we have assembled one of the strongest collections of neighborhood shopping centers in this top performing market. We look forward to continuing to look for opportunities in both Houston and elsewhere in the sunbelt that will further elevate the quality of our portfolio and boost shareholder value.”

Ashford Village is Whitestone’s third acquisition in Houston since 2022. The company acquired Lake Woodlands in late 2022 and Garden Oaks in early 2024.

About Whitestone REIT

Whitestone REIT (NYSE: WSR) is a community-centered real estate investment trust (REIT) that acquires, owns, operates, and develops open-air, retail centers located in some of the fastest growing markets in the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio. Our centers are convenience focused: merchandised with a mix of service-oriented tenants providing food (restaurants and grocers), self-care (health and fitness), services (financial and logistics), education and entertainment to the surrounding communities. The Company believes its strong community connections and deep tenant relationships are key to the success of its current centers and its acquisition strategy. For additional information, please visit the Company's investor relations website.

Forward-Looking Statements

This Report contains forward-looking statements within the meaning of the federal securities laws, including discussion and analysis of our financial condition and results of operations, statements related to our expectations regarding the performance of our business, and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on its knowledge and understanding of our business and industry. Forward-looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “potential,” “predicts,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” or the negative of such terms and variations of these words and similar expressions, although not all forward-looking statements include these words. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements.

Factors that could cause actual results to differ materially from any forward-looking statements made in this Report include: the imposition of federal income taxes if we fail to qualify as a real estate investment trust (“REIT”) in any taxable year or forego an opportunity to ensure REIT status; uncertainties related to the national economy, the real estate industry in general and in our specific markets; legislative or regulatory changes, including changes to laws governing REITs; adverse economic or real estate developments or conditions in Texas or Arizona, Houston and Phoenix in particular, including the potential impact of public health emergencies, such as COVID-19, on our tenants’ ability to pay their rent, which could result in bad debt allowances or straight-line rent reserve adjustments; increases in interest rates, including as a result of inflation operating costs or general and administrative expenses; our current geographic concentration in the Houston and Phoenix metropolitan area makes us susceptible to local economic downturns and natural disasters, such as floods and hurricanes, which may increase as a result of climate change, increasing focus by stakeholders on environmental, social, and governance matters, financial institution disruption; availability and terms of capital and financing, both to fund our operations and to refinance our indebtedness as it matures; decreases in rental rates or increases in vacancy rates; harm to our reputation, ability to do business and results of operations as a result of improper conduct by our employees, agents or business partners; litigation risks; lease-up risks, including leasing risks arising from exclusivity and consent provisions in leases with significant tenants; our inability to renew tenant leases or obtain new tenant leases upon the expiration of existing leases; risks related to generative artificial intelligence tools and language models, along with the potential interpretations and conclusions they might make regarding our business and prospects, particularly concerning the spread of misinformation; our inability to generate sufficient cash flows due to market conditions, competition, uninsured losses, changes in tax or other applicable laws; geopolitical conflicts, such as the ongoing conflict between Russia and Ukraine, the conflict in the Gaza Strip and unrest in the Middle East; the need to fund tenant improvements or other capital expenditures out of operating cash flow; the extent to which our estimates regarding Pillarstone REIT Operating Partnership LP's financial condition and results of operations differ from actual results; and the risk that we are unable to raise capital for working capital, acquisitions or other uses on attractive terms or at all and other factors detailed in the Company's most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents the Company files with the Securities and Exchange Commission from time to time.

Contacts:

For Whitestone REIT – Investors

David Mordy

(713) 435-2219

ir@whitestonereit.com

For Whitestone REIT – Media:

Matthew Chudoba

WhitestonePR@icrinc.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/33a045f9-d643-47fe-913f-686c8250b7da

https://www.globenewswire.com/NewsRoom/AttachmentNg/757faff1-d527-4d53-a74a-4755e280f327