Alamos Gold Reports Mineral Reserves and Resources for the Year-Ended 2025

Rhea-AI Summary

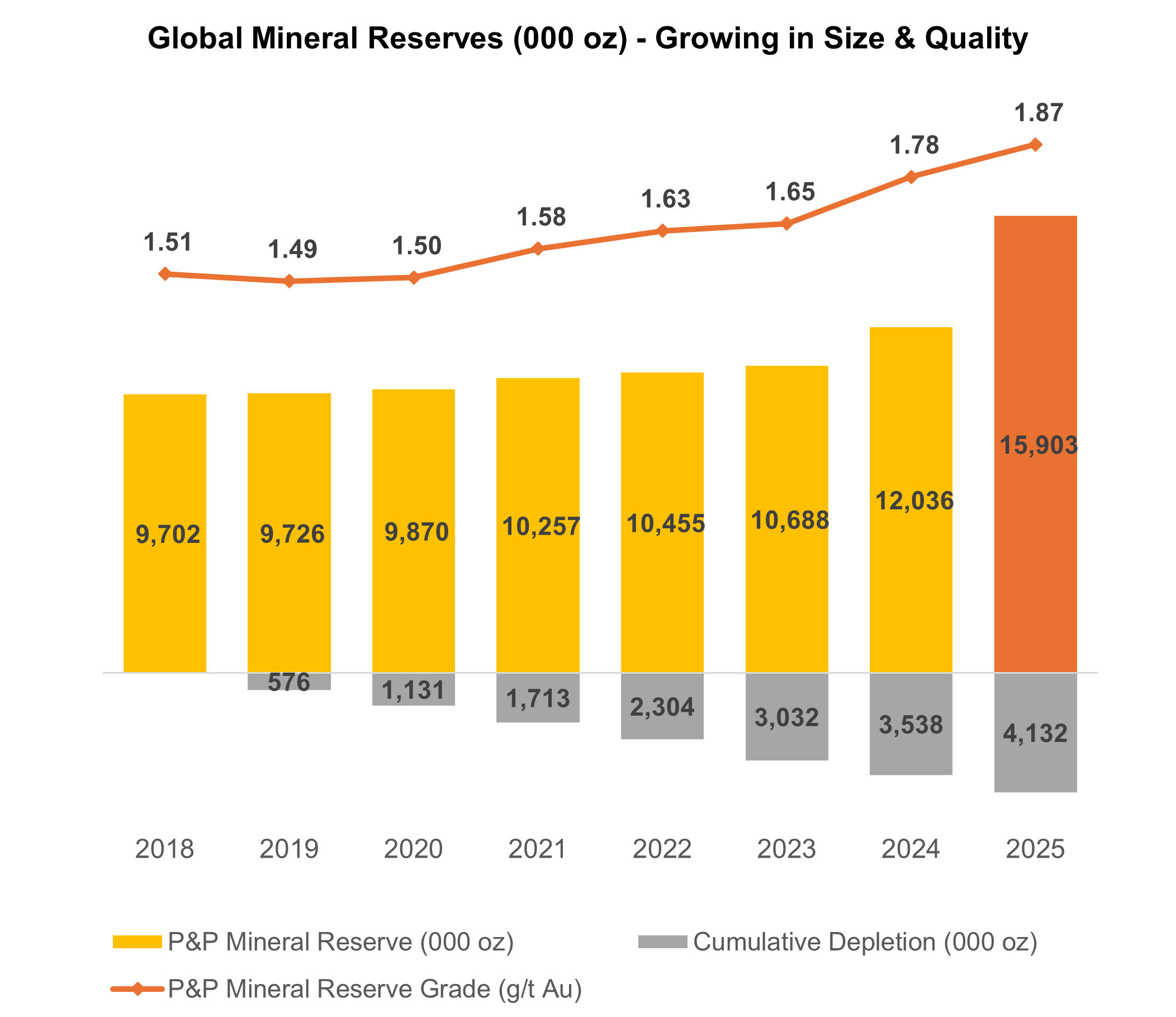

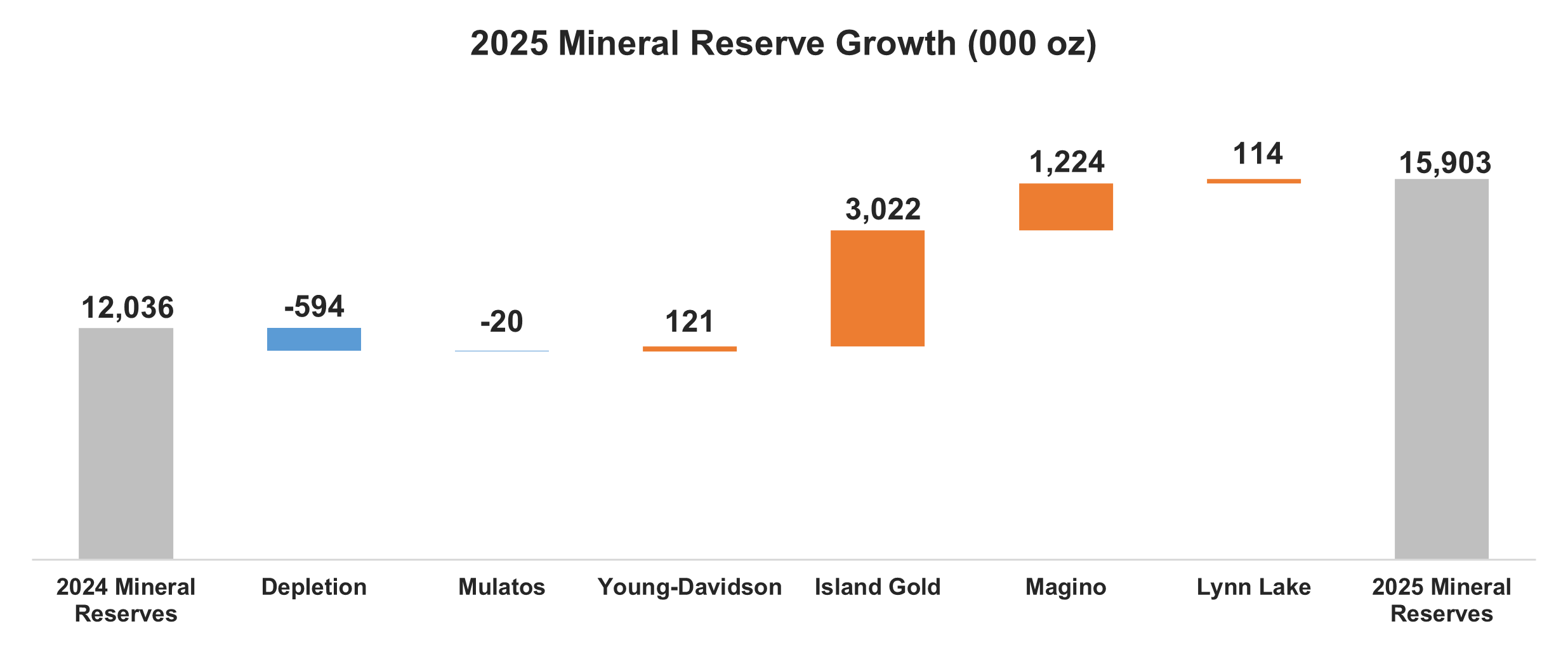

Alamos Gold (TSX:AGI, NYSE:AGI) reported year-end 2025 Mineral Reserves and Resources showing material growth: Proven and Probable Reserves +32% to 15.9 Moz at 1.87 g/t Au, driven by a 125% increase at Island Gold to 5.1 Moz (15.1 mt at 10.61 g/t).

Global Measured & Indicated Resources rose 6% to 5.5 Moz; Inferred Resources fell 63% to 2.0 Moz. Alamos set a record $97M 2026 exploration budget and announced an Island Gold District expansion to 20,000 tpd targeting 534,000 oz/year at $1,025/oz AISC post-2028.

Positive

- Proven & Probable Reserves +32% to 15.9 million ounces

- Island Gold Reserves +125% to 5.1 million ounces at 10.61 g/t

- Record exploration budget of $97 million for 2026 (+37%)

- Planned Island Gold expansion to 20,000 tpd targeting 534,000 oz/year at $1,025/oz AISC

Negative

- Inferred Mineral Resources -63% to 2.0 million ounces

- Mulatos Mineral Reserves decreased 14% to 1.2 million ounces (depletion at La Yaqui Grande)

- Island Gold grade decreased 7% to 10.61 g/t Au (mix of additions)

Key Figures

Market Reality Check

Peers on Argus

AGI is up 7.25% while peers show mixed moves: PAAS -0.3%, RGLD -0.05%, KGC +1.36%, AU +1.36%, CDE +1.73%. This points to a stock‑specific reaction to the reserve update rather than a broad gold‑sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Feb 04 | Three-year guidance | Positive | +5.7% | Updated 2026–2028 guidance showing 46% production growth and lower AISC. |

| Feb 03 | Expansion study | Positive | +4.0% | Island Gold District expansion to 20,000 tpd with strong NPV and IRR metrics. |

| Feb 02 | Exploration results | Positive | -0.2% | High‑grade Island Gold and Cline‑Pick drilling including 178 g/t Au over 3.54 m. |

| Jan 30 | Exploration update | Positive | -12.4% | Higher‑grade hanging wall mineralization near infrastructure at Young‑Davidson. |

| Jan 28 | Exploration update | Positive | +1.8% | Lynn Lake reserve growth and high‑grade intercepts plus Qiqavik district potential. |

Recent positive growth and expansion news has often led to positive price reactions, though some exploration updates saw negative or muted moves, indicating occasional divergences.

Over recent weeks, Alamos Gold has released a series of growth‑oriented updates. On Jan 28, exploration at Lynn Lake and Qiqavik highlighted high‑grade upside, followed by higher‑grade zones at Young‑Davidson on Jan 30. Early February brought Island Gold exploration results (Feb 2), a major district expansion study (Feb 3), and three‑year guidance with substantial production growth on Feb 4. Today’s reserve and resource increase builds directly on that exploration and expansion narrative.

Market Pulse Summary

This announcement highlights substantial reserve and resource growth, with global Proven and Probable Mineral Reserves reaching 15.9 million oz, up 32%, and Island Gold reserves climbing to 5.1 million oz at 10.61 g/t Au. It builds on recent expansion and exploration updates across Island Gold, Magino, Young‑Davidson and Lynn Lake. Investors may focus on how the record $97 million 2026 exploration budget, updated gold price assumptions, and future technical studies translate into sustainable production, costs, and mine life.

Key Terms

proven and probable mineral reserves technical

measured and indicated mineral resources technical

inferred mineral resources technical

all-in sustaining costs financial

tonnes per day technical

underground exploration drift technical

AI-generated analysis. Not financial advice.

Global Mineral Reserves Increase

All amounts are in United States dollars, unless otherwise stated.

TORONTO, Feb. 17, 2026 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported its updated Mineral Reserves and Resources as of December 31, 2025. For a detailed summary by asset, refer to the tables below.

Highlights

- Global Proven and Probable Mineral Reserves increased

32% to 15.9 million ounces of gold (265 million tonnes (“mt”)) with grades also increasing5% to 1.87 grams per tonne of gold (“g/t Au”). This was driven by the successful conversion of a large portion of the Island Gold District’s Mineral Resource base into Mineral Reserves- Island Gold’s Mineral Reserves more than doubled, increasing

125% to 5.1 million ounces (15.1 mt grading 10.61 g/t Au), reflecting the conversion of existing and newly defined Mineral Resources to Mineral Reserves - Magino’s Mineral Reserves increased

56% to 3.1 million ounces (113 mt grading 0.86 g/t Au), primarily reflecting the successful conversion of Mineral Resources to Mineral Reserves

- Island Gold’s Mineral Reserves more than doubled, increasing

- Global Measured and Indicated Mineral Resources increased

6% to 5.5 million ounces of gold (119 mt grading 1.44 g/t Au), driven by additions at Young-Davidson, Lynn Lake and Mulatos, more than offsetting Mineral Resource conversion at Magino - Global Inferred Mineral Resources decreased

63% to 2.0 million ounces of gold (35.0 mt grading 1.82 g/t Au), reflecting the successful conversion of Inferred Mineral Resources at both Island Gold and Magino to Mineral Reserves - Gold price assumption of

$1,800 per ounce used for estimating Mineral Reserves and$2,000 per ounce for estimating Mineral Resources, up from$1,600 and$1,800 per ounce, respectively, in 2024, reflecting the significantly higher gold price environment. Both remain conservative relative to the three-year trailing average gold price of approximately$2,592 per ounce - Record global exploration budget of

$97 million in 2026, up37% from the$71 million spent in 2025 with expanded programs at the Island Gold District, Young-Davidson and Lynn Lake. The expanded exploration budget is underpinned by broad-based success across the Company’s asset base in 2025

“Our long-term investment in exploration continues to create value with another substantial increase in Mineral Reserves to 16 million ounces, and at higher grades. The majority of this growth was within the Island Gold District, with the larger Mineral Reserve serving as the foundation for the Island Gold District Expansion announced earlier this month. This marks the seventh consecutive year of growth, with grades increasing

| Proven and Probable Gold Mineral Reserves1 | ||||||||||

| 2025 | 2024 | % Change | ||||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | ||

| (000’s) | (g/t Au) | (000’s) | (000’s) | (g/t Au) | (000’s) | (000’s) | (g/t Au) | (000’s) | ||

| Island Gold | 15,072 | 10.61 | 5,141 | 6,232 | 11.40 | 2,285 | - | |||

| Magino | 113,141 | 0.86 | 3,141 | 68,400 | 0.91 | 2,008 | - | |||

| Total Island Gold District | 128,212 | 2.01 | 8,282 | 74,632 | 1.79 | 4,293 | ||||

| Young-Davidson | 42,184 | 2.20 | 2,983 | 41,756 | 2.26 | 3,030 | - | - | ||

| La Yaqui Grande | 3,293 | 1.35 | 143 | 7,710 | 1.34 | 331 | - | - | ||

| Puerto Del Aire | 6,050 | 5.45 | 1,060 | 6,050 | 5.45 | 1,060 | - | - | - | |

| Total Mulatos | 9,343 | 4.00 | 1,203 | 13,760 | 3.14 | 1,391 | - | - | ||

| MacLellan | 41,158 | 1.31 | 1,732 | 39,379 | 1.35 | 1,711 | - | |||

| Gordon | 10,440 | 2.02 | 679 | 10,006 | 2.09 | 671 | - | |||

| Burnt Timber | 13,934 | 1.00 | 449 | 14,352 | 1.02 | 469 | - | - | - | |

| Linkwood | 19,906 | 0.90 | 576 | 16,318 | 0.90 | 472 | ||||

| Total Lynn Lake | 85,438 | 1.25 | 3,436 | 80,056 | 1.29 | 3,322 | - | |||

| Alamos – Total | 265,176 | 1.87 | 15,903 | 210,203 | 1.78 | 12,036 | ||||

| Measured and Indicated Gold Mineral Resources (exclusive of Mineral Reserves)1 | ||||||||||

| Island Gold | 2,093 | 8.77 | 590 | 2,133 | 8.76 | 601 | - | - | ||

| Magino | 56,798 | 0.79 | 1,439 | 62,689 | 0.94 | 1,905 | - | - | - | |

| Total Island Gold District | 58,891 | 1.07 | 2,029 | 64,823 | 1.20 | 2,506 | - | - | - | |

| Young-Davidson – Surface | 1,739 | 1.24 | 69 | 1,739 | 1.24 | 69 | - | - | - | |

| Young-Davidson – Underground | 12,970 | 3.40 | 1,420 | 11,114 | 3.13 | 1,117 | ||||

| Total Young-Davidson | 14,708 | 3.15 | 1,489 | 12,852 | 2.87 | 1,186 | ||||

| Golden Arrow | 6,442 | 1.19 | 246 | 6,442 | 1.19 | 246 | - | - | - | |

| Mulatos Mine | 8,190 | 0.96 | 252 | 6,772 | 0.98 | 214 | - | |||

| La Yaqui Grande | 1,462 | 0.81 | 38 | 1,523 | 0.78 | 38 | - | |||

| Puerto Del Aire | 2,403 | 3.49 | 269 | 2,403 | 3.49 | 269 | - | - | - | |

| Cerro Pelon | 1,391 | 4.28 | 192 | 720 | 4.49 | 104 | - | |||

| Carricito | 3,356 | 0.74 | 80 | 1,355 | 0.83 | 36 | - | |||

| Total Mulatos | 16,802 | 1.54 | 831 | 12,772 | 1.61 | 661 | - | |||

| Lynn Lake | 21,735 | 1.27 | 885 | 16,189 | 1.13 | 587 | ||||

| Alamos – Total | 118,578 | 1.44 | 5,480 | 113,077 | 1.43 | 5,186 | ||||

| Inferred Gold Mineral Resources1 | ||||||||||

| Island Gold | 2,867 | 11.51 | 1,061 | 7,106 | 16.52 | 3,774 | - | - | - | |

| Magino | 14,045 | 0.75 | 338 | 40,383 | 0.91 | 1,177 | - | - | - | |

| Total Island Gold District | 16,912 | 2.57 | 1,398 | 47,488 | 3.24 | 4,950 | - | - | - | |

| Young-Davidson – Surface | 31 | 0.99 | 1 | 31 | 0.99 | 1 | - | - | - | |

| Young-Davidson – Underground | 1,382 | 3.73 | 166 | 1,880 | 3.25 | 197 | - | - | ||

| Total Young-Davidson | 1,413 | 3.67 | 167 | 1,911 | 3.22 | 198 | - | - | ||

| Golden Arrow | 2,028 | 1.07 | 70 | 2,028 | 1.07 | 70 | - | - | - | |

| Mulatos Mine | 761 | 0.91 | 22 | 641 | 0.91 | 19 | - | |||

| La Yaqui Grande | 41 | 2.17 | 3 | 74 | 1.74 | 4 | - | - | ||

| Puerto Del Aire | 281 | 4.07 | 37 | 281 | 4.07 | 37 | - | - | - | |

| Cerro Pelon | 83 | 3.99 | 11 | - | - | - | - | - | - | |

| Carricito | 1,499 | 0.60 | 29 | 900 | 0.74 | 22 | - | |||

| Total Mulatos | 2,665 | 1.18 | 101 | 1,896 | 1.34 | 82 | - | |||

| Lynn Lake | 11,939 | 0.80 | 308 | 5,682 | 0.94 | 171 | - | |||

| Alamos – Total | 34,958 | 1.82 | 2,044 | 59,005 | 2.88 | 5,471 | - | - | - | |

1. The Türkiye assets and Quartz Mountain were sold in 2025 and have been excluded from the 2024 year-end Mineral Reserves and Mineral Resources for comparative reporting purposes.

Mineral Reserves

Global Proven and Probable Mineral Reserves totalled 15.9 million ounces of gold as of December 31, 2025, a

The strong growth in Mineral Reserves more than outpaced mining depletion of 594,000 ounces in 2025. This marked the seventh consecutive year Mineral Reserves have increased for a cumulative increase of

Island Gold was the largest driver of the increase with underground Mineral Reserves increasing

Magino’s open pit Mineral Reserves also increased

Young-Davidson’s Mineral Reserves were largely unchanged at 3.0 million ounces grading 2.20 g/t Au, with additions to Mineral Reserves offsetting the majority of depletion. Mulatos Mineral Reserves decreased to 1.2 million ounces grading 4.00 g/t Au reflecting depletion at La Yaqui Grande. With limited drilling completed at PDA, Mineral Reserves at the higher-grade underground project were unchanged. Combined Mineral Reserves at the Lynn Lake project increased slightly to 3.4 million ounces grading 1.25 g/t Au, driven by additions at the Linkwood satellite deposit.

A detailed summary of Proven and Probable Mineral Reserves as of December 31, 2025, is presented in Table 1 at the end of this press release.

Mineral Resources

Global Measured and Indicated Mineral Resources (exclusive of Mineral Reserves) increased

Detailed summaries of the Company’s Measured and Indicated Mineral Resources and Inferred Mineral Resources as of December 31, 2025, are presented in Tables 3 and 4, respectively, at the end of this press release.

Island Gold District

Island Gold underground

Island Gold’s long-term track record of growth continued in 2025 with total Mineral Reserves and Resources increasing

The primary focus of the 2025 exploration program at Island Gold was on delineation drilling to convert the large Inferred Mineral Resource base to Mineral Reserves. The program was highly successful with Mineral Reserves increasing

Grades decreased

Measured and Indicated Mineral Resources decreased 11,000 ounces to 590,000 ounces with grades unchanged at 8.77 g/t Au. Inferred Mineral Resources decreased

Magino open pit

Magino’s Mineral Reserves increased

Measured and Indicated Mineral Resources decreased

Island Gold District Expansion – significant exploration upside

On February 3, 2026, the results of the Island Gold District Expansion Study (“IGD Expansion”) were announced. The study incorporated the significant growth in underground and open pit Mineral Reserves defined within the Island Gold District over the past year, supporting an expansion of the operation to 20,000 tonnes per day (“tpd”). The expansion is expected to create one of the largest, longest life, and most profitable gold operations in Canada. Following the completion of the expansion in 2028, average annual production is expected to increase to 534,000 ounces over the first 10 years at mine-site all-in sustaining costs (“AISC”) of

Given ongoing exploration success and with significant exploration potential across the Island Gold District, there are excellent opportunities for further growth and upside. This includes within the main Island Gold deposit, which remains open laterally and at depth, as well as within multiple higher-grade regional targets in proximity to the Magino mill. The North Shear and past producing Cline-Pick mines represent opportunities for further production upside as potential sources of additional higher-grade mill feed within the expanded mill. Each will be an exploration focus in 2026.

A total of

The 2026 budget includes 50,000 metres ("m") of underground exploration drilling focused on defining new Mineral Reserves and Mineral Resources in proximity to existing production horizons and infrastructure. This includes drilling across the strike extent of the main Island Gold deposit (E1E and C-Zones), as well as within a growing number of newly defined hanging wall and footwall zones. To support the underground exploration program, 1,090 m of underground exploration drift development is planned to extend drill platforms on multiple levels.

Additionally, 48,000 m of surface exploration drilling has been budgeted targeting the area between the Island Gold and Magino deposits, as well as the down-plunge extension of the Island Gold deposit, below a depth of 1,500 m.

Included within sustaining capital at Island Gold is 27,000 m of underground delineation drilling. The focus of the delineation drilling at Island Gold is the ongoing conversion of Mineral Resources to Mineral Reserves.

The regional exploration program at the Island Gold District includes 16,000 m of surface drilling. The focus of the regional program will be following up on high-grade mineralization intersected in the 2025 drill program at Cline-Pick, located approximately seven kilometres (“km”) northeast of the Island Gold mine. Drilling will also be completed at the historic Edwards Mine, located in proximity to the Cline-Pick mines with the objective of extending mineralization beyond historically mined areas. Drilling will also be undertaken at the Island Gold North Shear target, and to the east and along strike from the Island Gold mine to test the extension of the E1E-zone.

Young-Davidson

Mineral Reserves at Young-Davidson decreased 47,000 ounces to 3.0 million ounces at slightly lower grades of 2.20 g/t Au, with Mineral Reserve additions offsetting the majority of mining depletion over the past year.

Measured and Indicated Mineral Resources increased

A total of

The second is to test and expand on higher grade gold mineralization that has been intersected within two areas of focus in the hanging wall of the deposit as outlined in a press release issued on January 30, 2026. This new style of higher-grade mineralization is located in close proximity to the existing mid-mine infrastructure, with grades intersected well above the current Mineral Reserve grade.

To support the underground exploration program, 200 m of underground exploration development is planned which includes further extension of the 9620-level hanging wall exploration drift that was completed in 2025. The regional program includes 10,000 m of drilling focused on evaluating several targets including the Otisse NE and Biralger targets, located approximately 3 km and 17 km northeast of Young-Davidson, respectively.

Based on underground mining rates of 8,000 tonnes per day, the Mineral Reserve life of the Young-Davidson mine remains at 14 years as of December 31, 2025. Young-Davidson has sustained at least a 13‑year Mineral Reserve life since 2011, reflecting a strong track record of Mineral Resource conversion. With the deposit open at depth and to the west, and new hanging‑wall zones continuing to be defined, there is excellent potential for this track record to continue.

Mulatos District

Total Mulatos District Mineral Reserves decreased

Mineral Reserves at PDA were not updated from a year ago (1.1 million ounces grading 5.45 g/t Au) as limited exploration drilling was completed with the focus shifting to development of the project. Exploration and Mineral Resource expansion drilling will recommence at PDA once underground drill platforms have been established to allow for more efficient exploration drill testing below unmineralized cover rock. With the deposit open in multiple directions, there is excellent potential for PDA to continue to grow. Based on current Mineral Reserves, PDA has a nine year mine life with significant exploration upside potential.

A bigger focus of the exploration program in 2025 was on extending and defining higher-grade sulphide mineralization as sources of additional mill feed for the PDA project. The program was successful in defining additional Mineral Resources at Cerro Pelon and a new discovery at Halcon.

Total Measured and Indicated Mineral Resources increased

The PDA project will include the construction of a 2,000 tpd mill to process higher-grade sulphide ore from PDA, opening up new opportunities to define and incorporate additional sulphide ore from across the District. PDA remains on track for initial production mid-2027. Cerro Pelon, Halcon and other targets across the District, including La Yaqui Grande, represent upside to the PDA project as potential sources of additional higher-grade sulphide ore.

A total of

Lynn Lake District

Total Mineral Reserves for the Lynn Lake District increased

Measured and Indicated Mineral Resources increased by 0.3 million ounces to 0.9 million ounces, reflecting growth across all four deposits. Inferred Mineral Resources increased by 0.1 million ounces to 0.3 million ounces.

A total of

Qualified Persons

Chris Bostwick, FAusIMM, Alamos Gold’s Senior Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Chris Bostwick is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101 (“NI 43-101”). The Qualified Persons for the National Instrument 43-101 compliant Mineral Reserve and Resource estimates are detailed in the following table.

| Mineral Resources QP | Company | Project | |||

| Jeffrey Volk, CPG, FAusIMM | Director - Reserves and Resources, Alamos Gold Inc. | Young-Davidson, Lynn Lake, Golden Arrow, Magino | |||

| Tyler Poulin, P.Geo | Geology Superintendent - Island Gold, Alamos Gold Inc. | Island Gold | |||

| Marc Jutras, P.Eng | Principal, Ginto Consulting Inc. | Mulatos Pits, PDA, La Yaqui Grande, Cerro Pelon, Carricito | |||

| Mineral Reserves QP | Company | Project | |||

| Chris Bostwick, FAusIMM | SVP Technical Services, Alamos Gold Inc. | Young-Davidson, PDA | |||

| Francis McCann, P.Eng | Director – Technical Services, Alamos Gold Inc. | Magino, Lynn Lake | |||

| Nathan Bourgeault, P.Eng | Technical Services Superintendent - Island Gold, Alamos Gold Inc. | Island Gold | |||

| Herb Welhener, SME-QP | VP, Independent Mining Consultants Inc. | La Yaqui Grande |

With the exception of Mr. Volk, Mr. Bostwick, Mr. McCann, Mr. Poulin, and Mr. Bourgeault, each of the foregoing individuals are independent of Alamos Gold.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operations in North America. This includes the Island Gold District and Young-Davidson mine in northern Ontario, Canada, and the Mulatos District in Sonora State, Mexico. Additionally, the Company has a strong portfolio of growth projects including the IGD Expansion, and the Lynn Lake project in Manitoba, Canada. Alamos employs more than 2,400 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Scott K. Parsons | |

| Senior Vice President, Corporate Development & Investor Relations | |

| (416) 368-9932 x 5439 | |

| Khalid Elhaj | |

| Vice President, Business Development & Investor Relations | |

| (416) 368-9932 x 5427 | |

| ir@alamosgold.com |

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note regarding Forward-Looking Statements

This news release contains or incorporates by reference “forward-looking statements” and “forward-looking information” as defined under applicable Canadian and U.S. securities laws. All statements in this news release other than statements of historical fact, which address events, results, outcomes or developments that Alamos expects to occur are, or may be deemed to be, forward-looking statements. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as "expect", “anticipate”, assume”, "plan", “continue”, “ongoing”, “trend”, "estimate", “target”, “budget”, “prospective”, “opportunity”, or “potential” or variations of such words and phrases and similar expressions or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved or the negative connotation of such terms. Forward-looking statements contained in this news release are based on expectations, estimates and projections as at the date of this news release.

Forward-looking statements in this news release include, without limitation, information, expectations and guidance as to strategy, plans, future financial and operating performance, such as statements, expectations and guidance regarding: planned exploration programs, focuses, targets and budgets; exploration potential; potential drilling results and related expectations; expected underground mining rates; gold production, production rates and production potential, including expected increases in gold production from Island Gold over the longer term; sustaining capital, costs and expenditures (including mine-site AISC); project economics; value of operations; gold price assumptions; ongoing construction of the Phase 3+ Expansion Project at Island Gold; the Island Gold District Expansion; construction of the Lynn Lake Project; Construction of the Puerto Del Aire Project and timing of initial production; Mineral Resources at Cerro Pelon and the discovery at Halcon; potential for underground mining opportunities below the Gordon and MacLellan open pits at the Lynn Lake project; projected ore grades; Mineral Reserve and Resource growth; Mineral Resource conversion rates; mine life; Mineral Reserve life; and other information that is based on forecasts and projections of future operational, geological or financial results, estimates of amounts not yet determinable and assumptions of management.

Exploration results that include geophysics, sampling, and drill results on wide spacings may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of Mineral Resource. A Mineral Resource that is classified as "Inferred" or "Indicated" has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an "Indicated Mineral Resource" or "Inferred Mineral Resource" will ever be upgraded to a higher category of Mineral Resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into Proven and Probable Mineral Reserves.

Alamos cautions that forward-looking statements are necessarily based upon several factors and assumptions that, while considered reasonable by management at the time of making such statements, are inherently subject to significant business, economic, technical, legal, political and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements, and undue reliance should not be placed on such statements and information.

Such factors and assumptions include (without limitation): the actual results of current exploration activities; changes to current estimates of mineral reserves and mineral resources; conclusions of economic and geological evaluations; changes in project parameters as plans continue to be refined; operations may be exposed to illness, disease, epidemic or pandemic which may impact, among other things, the broader market; state and federal orders or mandates (including with respect to mining operations generally or auxiliary businesses or services required for the Company’s operations) in Canada, Mexico and other jurisdictions in which the Company does or may conduct business; the duration of regulatory responses to any illness, disease, epidemic or pandemic; changes in national and local government legislation, controls or regulations; failure to comply with environmental and health and safety laws and regulations; labour and contractor availability (and being able to secure the same on favourable terms); ability to sell or deliver gold doré bars; disruptions in the maintenance or provision of required infrastructure and information technology systems; fluctuations in the price of gold or certain other commodities such as, diesel fuel, natural gas, and electricity; operating or technical difficulties in connection with mining or development activities, including geotechnical challenges and changes to production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing and recovery rate estimates and may be impacted by unscheduled maintenance); changes in foreign exchange rates (particularly the Canadian dollar, U.S. dollar, and Mexican peso); the impact of inflation; the potential impact of any tariffs, trade barriers and/or regulatory costs; employee and community relations; litigation and administrative proceedings; disruptions affecting operations; risks associated with the startup of new mines; availability of and increased costs associated with mining inputs and labour; delays in the development or updating of mine plans; delays in implementing improvement initiatives; delays in construction, including the Phase 3+ expansion project, the Island Gold District Expansion, the PDA project, and the Lynn Lake project; inherent risks and hazards associated with mining and mineral processing including industrial accidents; environmental hazards including, without limitation, fires, floods, seismic activity, unusual or unexpected formations, pressures and cave-ins; the risk that the Company’s mines may not perform as planned; uncertainty with the Company's ability to secure additional capital to execute its business plans; the speculative nature of mineral exploration and development, risks in obtaining and maintaining necessary licenses, permits and authorizations, contests over title to properties; expropriation or nationalization of property; political or economic developments in Canada or Mexico and other jurisdictions in which the Company does or may carry on business in the future; increased costs and risks related to the potential impact of climate change; the costs and timing of exploration, construction and development of new deposits; risk of loss due to sabotage, protests and other civil disturbances; the impact of global liquidity and credit availability and the values of assets and liabilities based on projected future cash flows; and business opportunities that may be pursued by the Company.

For a more detailed discussion of such risks and other factors that may affect the Company's ability to achieve the expectations set forth in the forward-looking statements contained in this news release, see the Company’s latest 40-F/Annual Information Form and Management’s Discussion and Analysis, each under the heading “Risk Factors”, available on the SEDAR+ website at www.sedarplus.ca or on EDGAR at www.sec.gov. The foregoing should be reviewed in conjunction with the information and risk factors and assumptions found in this news release.

The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether written or oral, or whether as a result of new information, future events or otherwise, except as required by applicable law.

Note to U.S. Investors – Mineral Reserve and Resource Estimates

Unless otherwise indicated, all Mineral Resource and Mineral Reserve estimates included in this news release have been prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Exchange Act of 1934, as amended. The U.S. Securities and Exchange Commission (the “SEC”) has adopted final rules, to replace SEC Industry Guide 7 with new mining disclosure rules under sub-part 1300 of Regulation S-K of the U.S. Securities Act (“Regulation S-K 1300”) which became mandatory for U.S. reporting companies beginning with the first fiscal year commencing on or after January 1, 2021. Under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards.

Investors are cautioned that while the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under Regulation S-K 1300 and the CIM Standards. Accordingly, there is no assurance any Mineral Reserves or Mineral Resources that the Company may report as “Proven Mineral Reserves”, “Probable Mineral Reserves”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under NI 43-101 would be the same had the Company prepared the Mineral Reserve or mineral resource estimates under the standards adopted under Regulation S-K 1300. U.S. investors are also cautioned that while the SEC recognizes “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under Regulation S-K 1300, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of Mineral Resources or into Mineral Reserves. Mineralization described using these terms has a greater degree of uncertainty as to its existence and feasibility than mineralization that has been characterized as Reserves. Accordingly, investors are cautioned not to assume that any Measured Mineral Resources, Indicated Mineral Resources, or Inferred Mineral Resources that the Company reports are or will be economically or legally mineable.

Cautionary non-GAAP Measures and Additional GAAP Measures

Note that for purposes of this section, GAAP refers to IFRS. The Company believes that investors use certain non-GAAP and additional GAAP measures as indicators to assess gold mining companies. They are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared with GAAP. “Sustaining capital” are expenditures that do not increase annual gold ounce production at a mine site and excludes all expenditures at the Company’s development projects. “Total cash costs per ounce”, “all-in sustaining costs per ounce”, “mine-site all-in sustaining costs”, and “all-in costs per ounce” as used in this analysis are non-GAAP terms typically used by gold mining companies to assess the level of gross margin available to the Company by subtracting these costs from the unit price realized during the period. These non-GAAP terms are also used to assess the ability of a mining company to generate cash flow from operations. There may be some variation in the method of computation of these metrics as determined by the Company compared with other mining companies. In this context, “total cash costs” reflects mining and processing costs allocated from in-process and doré inventory and associated royalties with ounces of gold sold in the period. Total cash costs per ounce are exclusive of exploration costs. “All-in sustaining costs per ounce” include total cash costs, exploration, corporate and administrative, share based compensation and sustaining capital costs. “Mine-site all-in sustaining costs” include total cash costs, exploration, and sustaining capital costs for the mine-site, but exclude an allocation of corporate and administrative and share based compensation.

Additional GAAP measures that are presented on the face of the Company’s consolidated statements of comprehensive income and are not meant to be a substitute for other subtotals or totals presented in accordance with IFRS but rather should be evaluated in conjunction with such IFRS measures. This includes “Earnings from operations”, which is intended to provide an indication of the Company’s operating performance and represents the amount of earnings before net finance income/expense, foreign exchange gain/loss, other income/loss, and income tax expense. Non-GAAP and additional GAAP measures do not have a standardized meaning prescribed under IFRS and therefore may not be comparable to similar measures presented by other companies. A reconciliation of historical non-GAAP and additional GAAP measures are detailed in the Company’s Management’s Discussion and Analysis available at www.alamosgold.com.

Table 1: Total Proven and Probable Mineral Reserves as of December 31, 2025

| PROVEN AND PROBABLE GOLD RESERVES (as at December 31, 2025) | |||||||||

| Proven Reserves | Probable Reserves | Total Proven and Probable | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | |

| Island Gold | 1,123 | 11.50 | 415 | 13,949 | 10.54 | 4,726 | 15,072 | 10.61 | 5,141 |

| Magino | 42,437 | 0.80 | 1,097 | 70,704 | 0.90 | 2,044 | 113,141 | 0.86 | 3,141 |

| Total Island Gold District | 43,559 | 1.08 | 1,512 | 84,653 | 2.49 | 6,769 | 128,212 | 2.01 | 8,282 |

| Young-Davidson | 12,457 | 2.18 | 873 | 29,727 | 2.21 | 2,109 | 42,184 | 2.20 | 2,983 |

| La Yaqui Grande | 127 | 0.90 | 4 | 3,166 | 1.37 | 139 | 3,293 | 1.35 | 143 |

| Puerto Del Aire | 946 | 4.78 | 145 | 5,104 | 5.57 | 914 | 6,050 | 5.45 | 1,060 |

| Total Mulatos | 1,073 | 4.32 | 149 | 8,270 | 3.96 | 1,054 | 9,343 | 4.00 | 1,203 |

| MacLellan | 16,840 | 1.64 | 886 | 24,318 | 1.08 | 846 | 41,158 | 1.31 | 1,732 |

| Gordon | 4,347 | 2.29 | 320 | 6,093 | 1.83 | 359 | 10,440 | 2.02 | 679 |

| Burnt Timber | 4,201 | 1.26 | 170 | 9,733 | 0.89 | 278 | 13,934 | 1.00 | 449 |

| Linkwood | 1,779 | 0.90 | 51 | 18,127 | 0.90 | 525 | 19,906 | 0.90 | 576 |

| Total Lynn Lake | 27,167 | 1.64 | 1,428 | 58,271 | 1.07 | 2,008 | 85,438 | 1.25 | 3,436 |

| Alamos - Total | 84,256 | 1.46 | 3,963 | 180,920 | 2.05 | 11,940 | 265,176 | 1.87 | 15,903 |

| PROVEN AND PROBABLE SILVER MINERAL RESERVES (as at December 31, 2025) | |||||||||

| Proven Reserves | Probable Reserves | Total Proven and Probable | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000's) | (g/t Ag) | (000's) | (000's) | (g/t Ag) | (000's) | (000's) | (g/t Ag) | (000's) | |

| La Yaqui Grande | - | - | - | 3,166 | 14.77 | 1,503 | 3,166 | 14.77 | 1,503 |

| Puerto Del Aire | 946 | 13.31 | 405 | 5,104 | 6.60 | 1,083 | 6,050 | 7.65 | 1,487 |

| MacLellan | 16,840 | 5.25 | 2,840 | 24,318 | 3.48 | 2,719 | 41,158 | 4.20 | 5,559 |

| Alamos - Total | 17,786 | 5.67 | 3,245 | 32,587 | 5.06 | 5,304 | 50,373 | 5.28 | 8,549 |

.

| Table 2: Project Life-of-Mine Mineral Reserve Waste-to-Ore Ratios as of December 31, 2025 | |

| Project | Waste-to-Ore Ratio |

| Magino | 3.6 |

| La Yaqui Grande Pit | 5.2 |

| Lynn Lake Pits | 4.8 |

| Table 3: Total Measured and Indicated Mineral Resources as of December 31, 2025 | |||||||||

| MEASURED AND INDICATED GOLD MINERAL RESOURCES (as at December 31, 2025) | |||||||||

| Measured Resources | Indicated Resources | Total Measured and Indicated | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | |

| Island Gold | 329 | 11.19 | 118 | 1,764 | 8.32 | 472 | 2,093 | 8.77 | 590 |

| Magino | 6,714 | 0.70 | 151 | 50,084 | 0.80 | 1,288 | 56,798 | 0.79 | 1,439 |

| Total Island Gold District | 7,042 | 1.19 | 270 | 51,848 | 1.06 | 1,760 | 58,891 | 1.07 | 2,029 |

| Young-Davidson - Surface | 496 | 1.13 | 18 | 1,242 | 1.28 | 51 | 1,739 | 1.24 | 69 |

| Young-Davidson - Underground | 5,417 | 2.65 | 461 | 7,553 | 3.95 | 959 | 12,970 | 3.40 | 1,420 |

| Total Young-Davidson | 5,913 | 2.52 | 479 | 8,795 | 3.57 | 1,010 | 14,708 | 3.15 | 1,489 |

| Golden Arrow | 3,626 | 1.26 | 147 | 2,816 | 1.09 | 99 | 6,442 | 1.19 | 246 |

| Mulatos | 864 | 0.97 | 27 | 7,326 | 0.96 | 225 | 8,190 | 0.96 | 252 |

| La Yaqui Grande | - | - | - | 1,462 | 0.80 | 38 | 1,462 | 0.81 | 38 |

| Puerto Del Aire | 364 | 3.32 | 39 | 2,039 | 3.52 | 230 | 2,403 | 3.49 | 269 |

| Cerro Pelon | 238 | 4.91 | 38 | 1,153 | 0.00 | 154 | 1,391 | 4.28 | 192 |

| Carricito | - | - | - | 3,356 | 0.75 | 80 | 3,356 | 0.74 | 80 |

| Total Mulatos | 1,466 | 2.20 | 103 | 15,336 | 1.48 | 727 | 16,802 | 1.54 | 831 |

| MacLellan | 892 | 2.87 | 82 | 7,331 | 1.43 | 337 | 8,223 | 1.59 | 419 |

| Gordon | 104 | 5.55 | 19 | 1,148 | 2.36 | 87 | 1,252 | 2.63 | 106 |

| Burnt Timber | 531 | 1.62 | 28 | 6,497 | 0.87 | 181 | 7,028 | 0.92 | 208 |

| Linkwood | 208 | 1.00 | 7 | 5,024 | 0.90 | 145 | 5,232 | 0.90 | 152 |

| Total Lynn Lake | 1,735 | 2.42 | 135 | 20,000 | 1.17 | 750 | 21,735 | 1.27 | 885 |

| Alamos - Total | 19,782 | 1.78 | 1,135 | 98,795 | 1.37 | 4,346 | 118,578 | 1.44 | 5,480 |

| MEASURED AND INDICATED SILVER MINERAL RESOURCES (as at December 31, 2025) | |||||||||

| Measured Resources | Indicated Resources | Total Measured and Indicated | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000's) | (g/t Ag) | (000's) | (000's) | (g/t Ag) | (000's) | (000's) | (g/t Ag) | (000's) | |

| La Yaqui Grande | - | - | - | 1,462 | 9.93 | 467 | 1,462 | 9.93 | 467 |

| Puerto Del Aire | 364 | 14.69 | 172 | 2,039 | 9.16 | 601 | 2,403 | 10.00 | 772 |

| Cerro Pelon | 238 | 75.25 | 577 | 1,153 | 43.93 | 1,628 | 1,391 | 49.29 | 2,205 |

| Carricito | - | - | - | 3,356 | 0.61 | 66 | 3,356 | 0.61 | 66 |

| MacLellan | 892 | 10.53 | 302 | 7,331 | 4.00 | 942 | 8,223 | 4.71 | 1,244 |

| Alamos - Total | 1,494 | 21.87 | 1,050 | 15,340 | 7.51 | 3,704 | 16,834 | 8.78 | 4,754 |

| Table 4: Total Inferred Mineral Resources as of December 31, 2025 | |||

| INFERRED GOLD MINERAL RESOURCES (as at December 31, 2025) | |||

| Tonnes | Grade | Ounces | |

| (000's) | (g/t Au) | (000's) | |

| Island Gold | 2,867 | 11.51 | 1,061 |

| Magino | 14,045 | 0.75 | 338 |

| Total Island Gold District | 16,912 | 2.57 | 1,398 |

| Young-Davidson - Surface | 31 | 0.99 | 1 |

| Young-Davidson - Underground | 1,382 | 3.73 | 166 |

| Total Young-Davidson | 1,413 | 3.67 | 167 |

| Golden Arrow | 2,028 | 1.07 | 70 |

| Mulatos | 761 | 0.91 | 22 |

| La Yaqui Grande | 41 | 2.17 | 3 |

| Puerto Del Aire | 281 | 4.07 | 37 |

| Cerro Pelon | 83 | 3.99 | 11 |

| Carricito | 1,499 | 0.60 | 29 |

| Total Mulatos | 2,665 | 1.18 | 101 |

| MacLellan | 9,085 | 0.77 | 225 |

| Gordon | 222 | 1.23 | 9 |

| Burnt Timber | 1,379 | 0.81 | 36 |

| Linkwood | 1,253 | 0.93 | 37 |

| Total Lynn Lake | 11,939 | 0.80 | 308 |

| Alamos - Total | 34,958 | 1.82 | 2,044 |

| INFERRED SILVER MINERAL RESOURCES (as at December 31, 2025) | |||

| Tonnes | Grade | Ounces | |

| (000's) | (g/t Ag) | (000's) | |

| La Yaqui Grande | 41 | 3.69 | 5 |

| Puerto Del Aire | 281 | 11.30 | 102 |

| Cerro Pelon | 83 | 20.86 | 55 |

| Carricito | 1,499 | 0.53 | 26 |

| MacLellan | 9,085 | 1.60 | 466 |

| Alamos - Total | 10,989 | 1.85 | 655 |

Notes to Mineral Reserve and Resource Tables:

- The Company’s Mineral Reserves and Mineral Resources as at December 31, 2025 are classified in accordance with the Canadian Institute of Mining Metallurgy and Petroleum’s “CIM Standards on Mineral Resources and Reserves, Definition and Guidelines” as per Canadian Securities Administrator’s NI 43-101 requirements.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resources are exclusive of Mineral Reserves.

- Mineral Reserve cut-off grade for the La Yaqui Pit is determined as a net of process value of

$0.10 per tonne for each model block. - All Measured, Indicated and Inferred open pit Mineral Resources are pit constrained.

- With the exceptions noted below, Mineral Reserve estimates assumed a gold price of

$1,800 per ounce and Mineral Resource estimates assumed a gold price of$2,000 per ounce. - Metal prices, cut-off grades and metallurgical recoveries are set out in the table below.

| Mineral Resources | Mineral Reserves | ||||

| Gold Price | Cut-off | Gold Price | Cut-off | Met Recovery | |

| Island Gold | 3.75 | 3.78 | |||

| Magino | 0.28 | 0.30 | 90 | ||

| Young-Davidson - Surface | 0.5 | n/a | n/a | n/a | |

| Young-Davidson - Underground | 1.39 | 1.57 | |||

| Golden Arrow | 0.64 | n/a | n/a | ||

| Mulatos: | |||||

| Mulatos Main Open Pit | 0.5 | n/a | n/a | n/a | |

| PDA Underground | 2.5 | 3.0 | |||

| La Yaqui Grande | 0.3 | see notes | |||

| Cerro Pelon | 2.5 | n/a | n/a | n/a | |

| Carricito | 0.3 | n/a | n/a | n/a | |

| Lynn Lake - MacLellan | 0.30 | 0.33 | 91 | ||

| Lynn Lake - Gordon | 0.41 | 0.45 | |||

| Lynn Lake - Burnt Timber | 0.36 | 0.40 | 91 | ||

| Lynn Lake - Linkwood | 0.36 | 0.40 | 91 | ||

Figure 1: Island Gold Mine Main Structure (C/E1E Zone) & Magino Longitudinal – 2025 Mineral Reserves & Resources

Figure 2: Island Gold Mine Main Structure (C/E1E Zone) Longitudinal – Higher-Grade Mineral Reserves in Island East Driving Growth

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/4a6acba7-929f-4d3a-8d4a-687bddad2f58

https://www.globenewswire.com/NewsRoom/AttachmentNg/fb3386e2-50a0-4760-a417-302a776a8d8a

https://www.globenewswire.com/NewsRoom/AttachmentNg/b2651154-7227-4bce-afc7-380909c544f4

https://www.globenewswire.com/NewsRoom/AttachmentNg/73734493-4a89-4754-b342-7184ec3ee0cd

https://www.globenewswire.com/NewsRoom/AttachmentNg/a2c2dbd0-d8a4-4c46-b0b9-6a4e0916076d