AlphaTON Capital Exits SEC “Baby-Shelf Rules” and Files $420.69 Million Shelf Registration Statement

Rhea-AI Summary

AlphaTON Capital (NASDAQ: ATON) announced it has exited the SEC’s "baby shelf" limitations and filed a $420.69 million shelf registration statement on Dec. 4, 2025.

The company said it intends to use the shelf to finance rapid expansion of GPU/AI and HPC infrastructure to support Telegram's Cocoon AI network, pursue mergers and acquisitions of revenue-producing Telegram ecosystem businesses, and maintain a digital asset treasury including TON and GAMEE tokens. AlphaTON cited existing partnerships with CUDO Compute and AtNorth and prior deployment of Nvidia B200 GPUs as foundations for scaling operations across Telegram's user base of over 1 billion monthly active users.

Positive

- $420.69 million shelf registration filed

- Targets revenue-producing Telegram acquisitions to add cash flow

- Plans to scale GPU/HPC infrastructure supporting Cocoon AI network

- Partnerships with CUDO Compute and AtNorth

Negative

- Large shelf filing could lead to significant shareholder dilution if used

- Business concentrated in Telegram ecosystem and related digital assets

- Digital asset treasury exposes company to TON/GAMEE market volatility

News Market Reaction

On the day this news was published, ATON gained 8.18%, reflecting a notable positive market reaction. Argus tracked a peak move of +9.3% during that session. Argus tracked a trough of -2.0% from its starting point during tracking. Our momentum scanner triggered 4 alerts that day, indicating moderate trading interest and price volatility. This price movement added approximately $986K to the company's valuation, bringing the market cap to $13M at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

ATON was down 14.29% while peers showed mixed moves: EQS up 0.45%, RMCO up 2.1%, BCG down 11.54%, and others near flat, indicating a stock-specific move rather than a sector trend.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 09 | Investor conferences | Positive | -4.5% | CEO outlined 2026 roadmap and revenue initiatives at global finance events. |

| Dec 08 | AI infrastructure | Positive | +6.7% | Deployed NVIDIA H200 GPUs and launched #OwnYourNode fractional GPU program. |

| Dec 05 | Investor outreach | Positive | -4.1% | Announced inaugural technical AMA to present 2026 roadmap and monetization plan. |

| Dec 04 | Shelf filing | Positive | +8.2% | Exited baby-shelf limits and filed $420.69M shelf for AI and M&A growth. |

| Dec 01 | AI deployment | Positive | -9.5% | Deployed first Nvidia B200 GPU fleet to Cocoon AI, adding new revenue stream. |

Recent news has often been positive while price reactions skew negative, with 3 negative and 2 positive moves on upbeat announcements.

Over the last weeks, AlphaTON Capital reported several AI and infrastructure milestones, including deployment of Nvidia B200 and H200 GPUs to Telegram's Cocoon AI network and launch of the #OwnYourNode program. It also promoted a 2026 roadmap and technical AMA. On Dec 4, 2025, the company announced exiting SEC “baby-shelf” limits and filing a $420.69 million shelf to fund GPU/HPC expansion, M&A within the Telegram ecosystem, and a digital asset treasury tied to over 1 billion users.

Regulatory & Risk Context

An active Form F-3 shelf filed on Nov 6, 2025 registers up to 189,719 ordinary shares for resale by an existing shareholder, with no proceeds to the company. The shelf is not yet effective and has seen at least one related usage via a 424B5 prospectus supplement filed on Nov 25, 2025.

Market Pulse Summary

The stock moved +8.2% in the session following this news. A strong positive reaction aligns with the company framing the $420.69 million shelf as growth capital for GPU and HPC infrastructure and Telegram ecosystem acquisitions. Historical data show mixed reactions to positive news, with 3 prior upbeat events followed by declines. Investors have also seen an active Form F-3 shelf and an ATM program, so prior and potential future equity issuance could temper how durable any sharp upside move becomes.

Key Terms

baby shelf rules regulatory

shelf registration statement regulatory

high-performance computing (HPC) technical

graphics processing unit (GPU) technical

decentralized AI computing technical

digital asset treasury financial

AI-generated analysis. Not financial advice.

Company Positions for Aggressive Growth Supporting Telegram's Cocoon AI Network and Revenue-Generating Telegram Ecosystem Acquisitions

New York, New York, Dec. 04, 2025 (GLOBE NEWSWIRE) -- AlphaTON Capital Corp (NASDAQ: ATON), the world's leading technology public company scaling the Telegram super app, with an addressable market of 1 billion monthly active users, today announced that it has exited the SEC’s “baby shelf rules,” which prohibit companies with a public float of less than

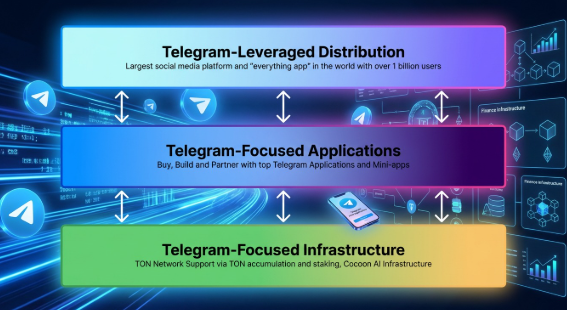

Once effective, the shelf registration statement will provide AlphaTON Capital with significant financing flexibility to execute on its dual-pronged growth strategy: expanding its position as a critical infrastructure provider for decentralized AI computing and building a portfolio of cash-flow positive businesses operating within Telegram's rapidly growing user base of over 1 billion monthly active users.

"Exiting the SEC’s “baby-shelf” limitations on raising capital marks an important milestone in AlphaTON Capital's transformation into a leading infrastructure provider for the next generation of decentralized AI," said Brittany Kaiser, Chief Executive Officer of AlphaTON Capital. "Once effective this shelf registration statement gives us the financing flexibility to move quickly and decisively on transformational opportunities. We are seeing exceptional demand for GPU compute power within the Cocoon AI network, and simultaneously, we're identifying high-quality revenue-generating businesses in the Telegram ecosystem that align perfectly with our strategic vision."

Strategic Areas:

- Telegram Distribution:

- Forge partnerships with premier Telegram distribution applications and platforms across the fintech, gaming, health, and sports sectors to cultivate strategic revenue streams.

- Telegram Applications (Mergers & Acquisitions):

- Mergers and Acquisitions: The company has identified numerous high-potential acquisition targets currently generating revenue within the Telegram ecosystem. These targets encompass entities focused on payments, content distribution, and blockchain-enabled services. These strategic acquisitions are projected to deliver immediate cash flow while substantially expanding AlphaTON Capital's operational footprint across Telegram's diverse business verticals.

- Infrastructure:

- AI/High-Performance Computing (HPC) Infrastructure Expansion: AlphaTON Capital intends to deploy capital strategically to scale its Graphics Processing Unit (GPU) infrastructure in support of Telegram's Cocoon AI network. This effort builds upon its existing partnerships with CUDO Compute and AtNorth data centers, and its prior deployment of Nvidia B200 GPUs. The company is committed to establishing itself as a foundational infrastructure provider for decentralized AI computing, thereby capitalizing on the prevailing shift toward distributed GPU networks.

- Digital Asset Treasury for the Telegram / TON (The Open Network) Ecosystem: Maintain a policy of acquiring TON tokens and other associated digital assets, such as GAMEE, within the Telegram ecosystem to provide sustained support for the TON / Telegram / Cocoon network.

About AlphaTON Capital Corp (Nasdaq: ATON)

AlphaTON Capital Corp (NASDAQ: ATON) is the world's leading technology public company scaling the Telegram super app, with an addressable market of 1 billion monthly active users while managing a strategic reserve of digital assets. The Company implements a comprehensive M&A and treasury strategy that combines direct token acquisition, validator operations, and strategic ecosystem investments to generate sustainable returns for shareholders. Through its operations, AlphaTON Capital provides public market investors with institutional-grade exposure to the TON ecosystem and Telegram's billion-user platform while maintaining the governance standards and reporting transparency of a Nasdaq-listed company. Led by Chief Executive Officer Brittany Kaiser, Executive Chairman, Chief Investment Officer Enzo Villani, and Chief Business Development Officer Yury Mitin, the Company's activities span network validation and staking operations, development of Telegram-based applications, and strategic investments in TON-based decentralized finance protocols, gaming platforms, and business applications.

AlphaTON Capital Corp is incorporated in the British Virgin Islands and trades on Nasdaq under the ticker symbol "ATON". AlphaTON Capital, through its legacy business, is also advancing potentially first-in-class therapies that target known checkpoint resistance pathways to potentially achieve durable treatment responses and improve patients' quality of life. AlphaTON Capital actively engages in the drug development process and provides strategic counsel to guide development of novel immunotherapy assets and asset combinations. To learn more, please visit https://alphatoncapital.com/.

Forward-Looking Statements

All statements in this press release, other than statements of historical facts, including without limitation, statements regarding the Company’s business strategy, plans and objectives of management for future operations and those statements preceded by, followed by or that otherwise include the words “believe,” “expects,” “anticipates,” “intends,” “estimates,” “will,” “may,” “plans,” “potential,” “continues,” or similar expressions or variations on such expressions are forward-looking statements. As a result, forward-looking statements are subject to certain risks and uncertainties, including, but not limited to: risks related to the development and adoption of AI technologies, risks related to cryptocurrency market volatility, regulatory developments, technical challenges in infrastructure deployment, the risk that the Company may not secure additional financing, the uncertainty of the Company’s investment in TON, the operational strategy of the Company, risks from Telegram’s platform and ecosystem, uncertainties regarding the Company’s ability to remain out of “baby shelf” status, the potential impact of markets and other general economic conditions, the Company’s failure to realize the anticipated benefits of its financing and strategic transaction plans, the risk that the Company may not be able to repay its loan, risks related to debt service obligations, the impact of indebtedness on the Company’s financial condition and other factors set forth in “Item 3 – Key Information-Risk Factors” in the Company’s Annual Report on Form 20-F for the year ended March 31, 2025 and included in the Company’s Form 6-K filed with the Securities and Exchange Commission on September 3, 2025. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them as actual results may differ materially from these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof, and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, except as required by law.

Investor Relations:

AlphaTON Capital Corp

AlphaTON@icrinc.com

(203) 682-8200

Media Inquiries:

Richard Laermer

RLM PR

AlphaTON@rlmpr.com

(212) 741-5106 X 216

Richard Laermer AlphaTON (at) rlmpr.com