BLAQclouds Unveils ApolloCASH — A Breakthrough Settlement Protocol Connecting Global Cash Apps to Web3 Liquidity

Rhea-AI Summary

BLAQclouds (OTC: BCDS) launched ApolloCASH, a zero-knowledge settlement protocol linking global cash apps to on-chain liquidity via single-use liquidity pools (SULPs).

ApolloCASH verifies fiat payments with zkTLS/zkEmail/ApolloID, mints ZXUSD, creates a SULP per transaction, and enables instant redemption to fiat, ZXUSD, or other crypto. The company cites a ~US$887 billion 2024 remittance market and average 1–5 day settlement windows; ApolloCASH targets near-instant settlement and lower costs.

Beta is live for select partners; ecosystem-wide rollout is scheduled for 5:00pm MTN December 15, 2025, with integrations planned in Q1 2026.

Positive

- Beta live for select partners

- Ecosystem-wide rollout set for Dec 15, 2025

- Targets ~US$887B 2024 global remittance market

- Aims to reduce 1–5 day settlement to minutes

- Deployed across 6 BLAQclouds platforms

Negative

- Currently limited to beta access for select partners

- Full developer and enterprise integrations planned for later Q1 2026

News Market Reaction

On the day this news was published, BCDS gained 12.20%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

BCDS showed no pre-news price change while real estate peers were mixed, with moves from 0% (BRST, MNGGF) to +17.65% (TDRK) and -0.02% (ZDPY), suggesting stock-specific rather than sector-driven dynamics.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 09 | Podcast studio launch | Positive | +2.9% | Opened broadcast-grade podcast studio to feature high-utility crypto projects. |

| Dec 03 | Brand and stablecoin update | Positive | -9.1% | Unified brands under Apollo and announced APUSD stablecoin rollout. |

| Dec 01 | Protocol launch | Positive | +12.2% | Launched ApolloCASH zero-knowledge settlement protocol using SULPs. |

| Nov 25 | Filing and share update | Negative | +37.0% | Addressed Yield Sign, amended filing, disclosed 200M prior-share issuance. |

| Nov 17 | Strategic partnership | Positive | -25.0% | Signed Web3 partnership with Metavesco including revenue-sharing smart contract. |

Recent news has produced mixed reactions, with 3 divergence events versus 2 aligned moves, indicating inconsistent price response to generally positive disclosures.

Over the last month, BCDS issued several updates, from a Nov 17 strategic Web3 partnership with Metavesco and a Nov 25 filing correction around an OTC Markets Yield Sign, to the Dec 1 ApolloCASH launch and a Dec 3 brand unification with a new stablecoin. A Dec 9 podcast studio launch followed. Price reactions alternated between strong gains and selloffs, showing no consistent pattern of response.

Market Pulse Summary

The stock surged +12.2% in the session following this news. A strong positive reaction aligns with prior enthusiasm around ApolloCASH, which previously saw a 12.2% move on related news. However, BCDS traded well below its $0.01 200-day MA before this announcement, highlighting longer-term technical pressure. Past events show 3 divergences versus 2 aligned moves, so sharp gains have not always persisted following upbeat product and partnership updates.

Key Terms

zero-knowledge settlement protocol technical

zero-knowledge proof verification technical

zkEmail technical

liquidity pool technical

atomic blockchain operations technical

zero-knowledge compliance architecture technical

AI-generated analysis. Not financial advice.

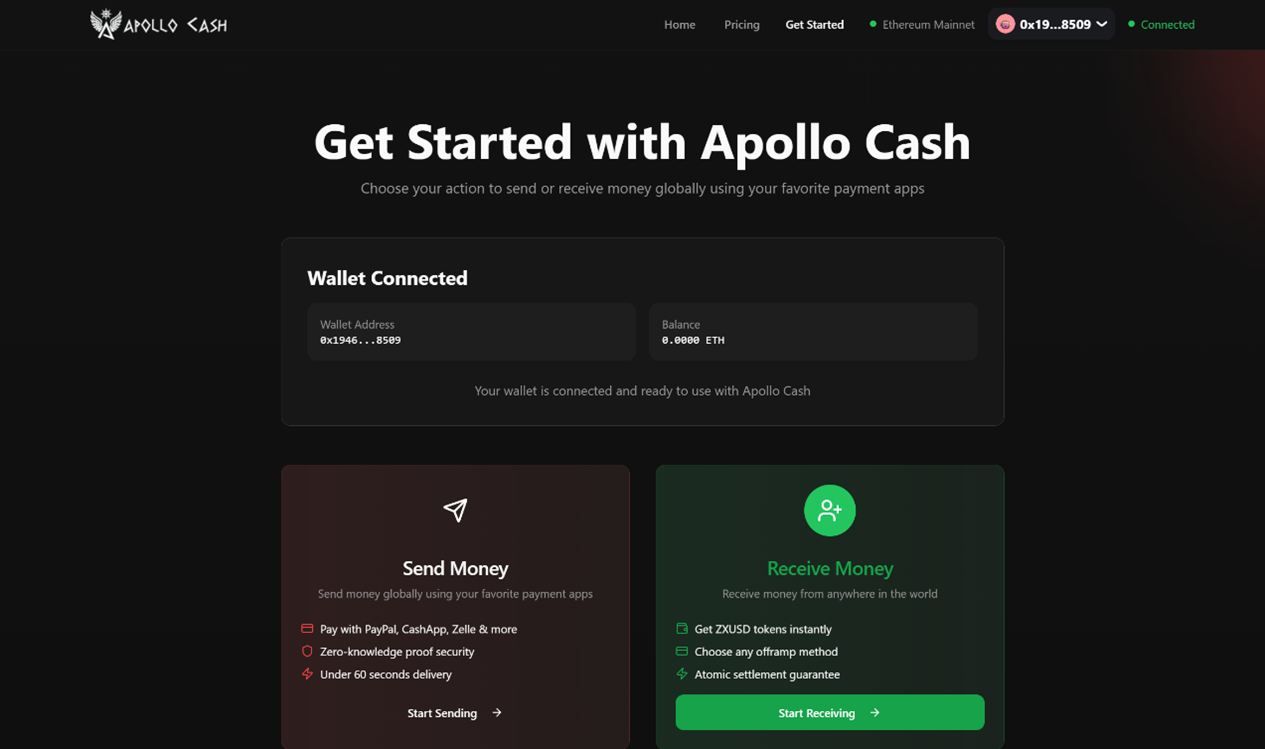

ROBESONIA, Pa., Dec. 01, 2025 (GLOBE NEWSWIRE) -- BLAQclouds, Inc. (OTC: BCDS), a leading Web3 infrastructure company, today announced the official launch of ApolloCASH, a revolutionary zero-knowledge settlement protocol designed to connect global cash payment platforms with blockchain-based liquidity. ApolloCASH introduces a new financial standard built on its core architecture:

Autonomous Protocol for One-Time Liquidity & Ledger Operations using CASH Rails

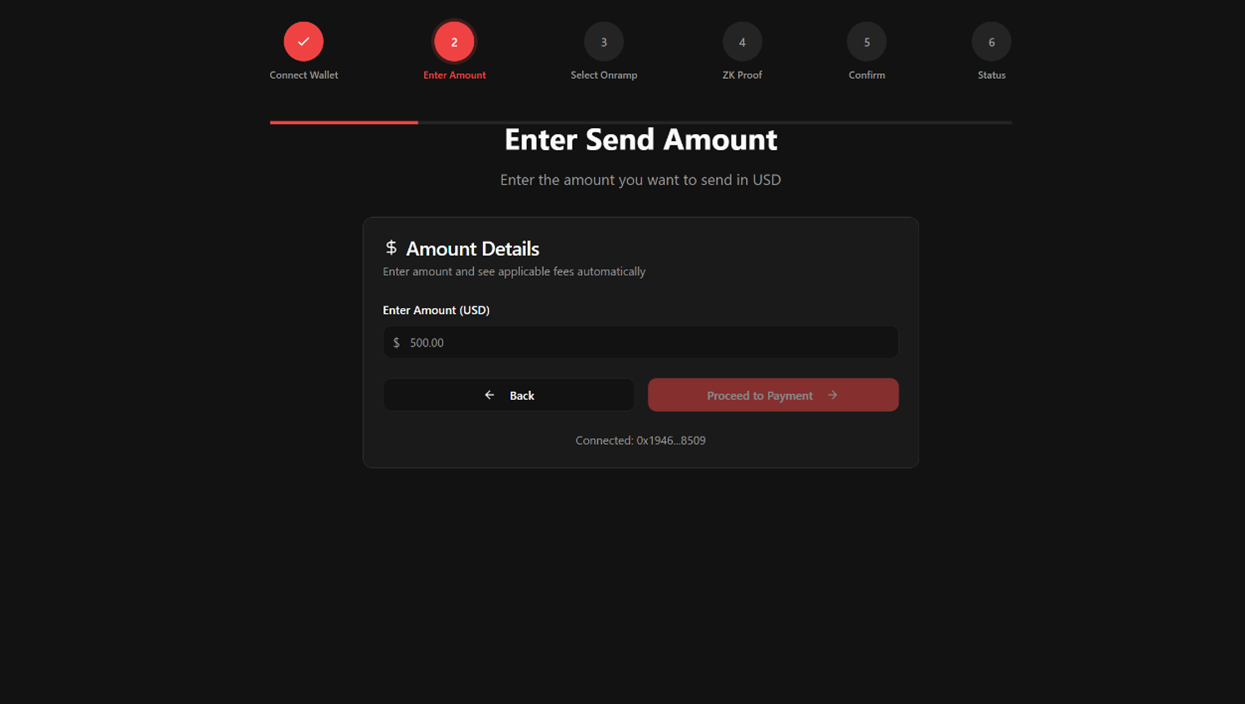

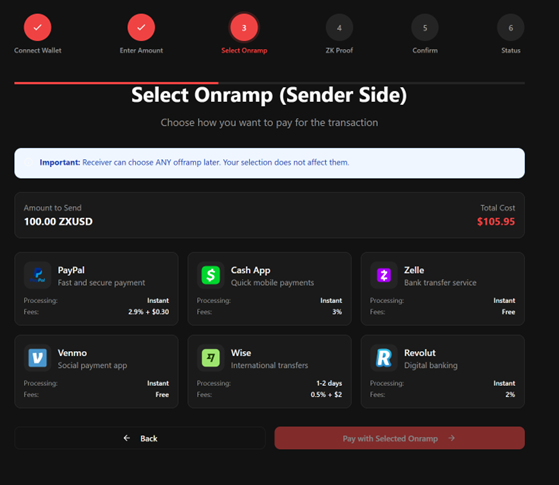

ApolloCASH enables users across the world to instantly convert payments made through familiar fiat applications—such as Cash App, PayPal, Venmo, Zelle, Wise, and Revolut—into on-chain settlement liquidity through automated, single-use liquidity pools (SULPs). By combining traditional payment rails with zero-knowledge proof verification and atomic blockchain operations, ApolloCASH provides a secure, private, and trustless alternative to outdated banking and remittance systems.

A New Standard for Global Settlement

ApolloCASH verifies fiat payments using cutting-edge cryptography including zkTLS, zkEmail and ApolloID producing immutable proofs that confirm a transaction occurred without revealing user data.

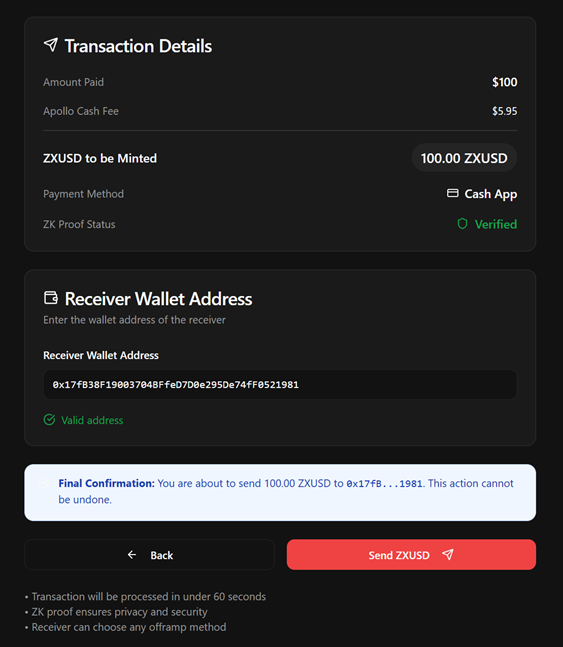

Once verified:

1. ZXUSD is minted

2. A unique Single-Use Liquidity Pool (SULP) is created

3. LP ownership is transferred to the receiver

4. The receiver may redeem instantly for fiat, ZXUSD, or other crypto assets

This “one pool per transaction” design eliminates liquidity fragmentation, slippage, custody risk, and other vulnerabilities inherent in traditional pooled-liquidity models.

“ApolloCASH brings together the speed and familiarity of Web2 payments with the automation and security of Web3 infrastructure. It introduces a modern settlement layer that transforms how money moves globally—without requiring users to change their sending habits. Imagine sitting in Colorado on a Sunday and needing to send

ApolloCASH Simple Send and Receive UI

Why is this important?

According to BBVA, global remittance flows (money sent worldwide, across countries) were estimated to reach roughly US

ApolloCASH reduces this latency by:

- Bypassing multi-bank intermediary chains.

- Using blockchain and liquidity-pool mechanisms for instant minting and redemption.

- Providing on/off-ramp via Cash Rails + crypto rails, which — in many cases — can settle in minutes to near-instant, far faster than traditional 1–5 day windows.

This speed advantage — combined with lower cost — becomes a major differentiator vs legacy remittance platforms.

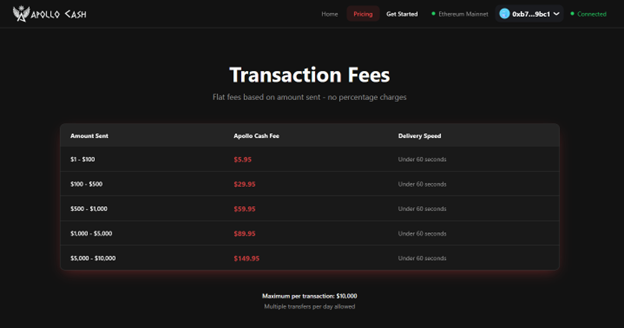

ApolloCASH Transaction Cost

Powering the BLAQclouds Ecosystem

ApolloCASH is being deployed across the full suite of BLAQclouds platforms, including:

- ShopWithCrypto.io

- APEwithCrypto.io

- ZEUSxPay.io

- ApolloWallet.io

- DeployLaunchpad.com

- ZEUS / Olympus Chain Protocols

With ApolloCASH, all BLAQclouds products now operate on a unified, compliant, cryptographically verified settlement engine.

“Designed for Compliance, Built for Scale”

ApolloCASH is engineered to meet the needs of consumers, merchants, enterprises, and institutions:

For Consumers

- Use familiar payment apps

- No exchange account required

- Private, secure, near-instant settlement

For Merchants

- Zero chargebacks

- Instant settlement and conversion

- Reduce reliance on traditional payment processors

For Institutions & Partners

- Zero-knowledge compliance architecture

- Full auditability

- Compatible with regulated financial environments

“ApolloCASH is the missing link between global cash rails and decentralized financial infrastructure,” added Shannon Hill. “We believe it positions BLAQclouds to compete directly with legacy remittance networks and global payment processors.”

Official Launch Date:

ApolloCASH is currently live in beta for select partners, with ecosystem-wide rollout at 5:00pm MTN December 15, 2025. BLAQclouds will open the first wave of developer and enterprise integrations later Q1.

About BLAQclouds, Inc.

BLAQclouds bridges traditional finance and decentralized ecosystems, building seamless, real-world blockchain applications that simplify commerce and payments. Its mission is to make spending crypto as easy, trusted, and usable as traditional currency.

Flagship consumer applications include:

- ShopWithCrypto.io – Crypto-to-gift card commerce

- ZEUSxPay.io – Web3 payments and merchant plugins

- DEX.ZEUSx.io – EVM-compatible decentralized exchange

- ApolloWallet.io – Secure, consumer-grade blockchain wallet

For a full list of platforms and solutions from BLAQclouds Nevada and Wyoming, visit: www.blaqclouds.io. For official BLAQclouds updates and information, please join https://www.thealley.io/group/blaqclouds-inc/discussion

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, which are intended to be covered by the safe harbors created thereby. Investors are cautioned that, all forward-looking statements involve risks and uncertainties, including without limitation, the ability of Blaqclouds, Inc. to accomplish its stated plan of business. Blaqclouds, Inc. believes that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore, there can be no assurance that the forward-looking statements included in this press release will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by Blaqclouds Inc. or any other person.

This press release also contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve certain risks and uncertainties that may cause actual results to differ materially. BLAQclouds, Inc. assumes no obligation to update or revise any forward-looking statements.

Media Contact

BLAQclouds, Inc.

c/o www.theAlley.io

Email: hello@blaqclouds.io

Phone: 610-621-4804

Website: www.blaqclouds.io

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/16039d29-fa5c-48de-9092-d48c63438598

https://www.globenewswire.com/NewsRoom/AttachmentNg/0854fc45-b6c4-415f-ae10-e722edb24005

https://www.globenewswire.com/NewsRoom/AttachmentNg/ed669b9c-f389-4a18-addc-040952f2f30e

https://www.globenewswire.com/NewsRoom/AttachmentNg/9442bd5b-0996-45ac-bbfe-b64ed2dfc57a

https://www.globenewswire.com/NewsRoom/AttachmentNg/68b38446-cb2d-43be-afa5-d3a7bcb29738

https://www.globenewswire.com/NewsRoom/AttachmentNg/7cda6673-053b-4be1-8285-9e060c516676