Broad, High-Grade Assays Infill Tunkillia 'S1' Pit Area

Rhea-AI Summary

Barton Gold (ASX:BGD / OTCQB:BGDFF) reported first assays from Phase 1 infill drilling at the Tunkillia Gold Project S1 'Starter Pit' on 1 December 2025. New results show broad, high-grade intervals including 14m @ 2.78 g/t, 28m @ 2.60 g/t, 47m @ 2.67 g/t and multiple higher-grade internal zones up to 43.2 g/t. The company cites a modelled average grade 1.19 g/t Au, >200,000 oz recovered in year one and an $825m operating profit in the first year. Remaining assays from Phase 1 are expected in December 2025–January 2026, with an updated JORC (2012) Mineral Resource Estimate targeted by March 2026. The infill campaign aims to convert S1/S2 to Measured/Indicated to support project financing.

Positive

- Modelled operating profit of $825m in year one

- Average grade modelled at 1.19 g/t Au

- Over 200,000 oz recoverable in first year

- Multiple broad assays with >2.5 g/t over tens of metres

Negative

- Remaining assays pending through Jan 2026 (data gap)

- Resource upgrade targeted by Mar 2026 (contingent on conversion)

- Modelled outcomes reliant on future JORC conversions and financing

News Market Reaction

On the day this news was published, BGDFF gained 5.28%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers showed mixed moves, with names like RMRDF up 5.64% and AMXEF down 4.03%, suggesting stock-specific rather than broad sector-driven trading for BGDFF.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 01 | High-grade assays | Positive | +5.3% | First Phase 1 infill assays show broad high-grade S1 mineralisation. |

| Nov 24 | Drilling completion | Positive | +12.0% | Phase 1 RC upgrade drilling completed ahead of schedule and under budget. |

| Nov 20 | Conference presentation | Neutral | -7.2% | Swiss Mining Institute investor presentation announced with slide deck access. |

| Nov 10 | Equity financing | Negative | -30.0% | Share Purchase Plan at $1.25 raised $660k alongside a recent $15m placement. |

| Nov 09 | Conference presentation | Neutral | +0.0% | Zurich Precious Metals Summit presentation made available to investors. |

Positive operational updates at Tunkillia have recently coincided with gains, while financing and conference news drew weaker or negative reactions.

Over recent weeks, Barton Gold has focused on the Tunkillia project and funding its development. On 10 Nov 2025, a Share Purchase Plan and prior placement raised capital, but the stock fell 30%. Completion of Phase 1 upgrade drilling on 24 Nov 2025 with 18,893m drilled across 209 holes saw a 12% rise. Conference presentations in early and mid-November had flat to negative reactions. Today’s high-grade S1 assay results on 1 Dec 2025 followed with a 5.28% move higher.

Market Pulse Summary

The stock moved +5.3% in the session following this news. A strong positive reaction aligns with prior trading, where high-impact Tunkillia updates have coincided with gains, such as the 12% move on Phase 1 completion and 5.28% on earlier S1 assays. The pre-news setup showed price above the 200-day MA and still 44.12% below the 52-week high, leaving room within the existing range. Investors should weigh the quality of new grades against financing history, including the recent equity raise that saw a 30% drop.

Key Terms

JORC (2012) regulatory

Measured technical

Indicated technical

Mineral Resource Estimate technical

Competent Person regulatory

g/t Au technical

AI-generated analysis. Not financial advice.

Results emphasise Tunkillia grade potential in key features

HIGHLIGHTS

New assays support higher-grade model for Tunkillia S1 'Starter Pit' mineralisation; infill drilling targeting conversion to JORC (2012) 'Measured' category to underwrite financing 1

Tunkillia 'S1' pit modelled to produce

$825m operating profit in first year of operations from average grade of 1.19 g/t Au - new broad, high-grade assays from this zone include: 2

Hole ID | Interval | Including: |

TKB0267 | 14m @ 2.78 g/t Au from 88 metres | 3m @ 6.97 g/t Au from 98 metres |

TKB0269 | 28m @ 2.60 g/t Au from 129 metres | 2m @ 20.9 g/t Au from 144 metres |

TKB0282 | 27m @ 2.68 g/t Au from 60 metres , and 44m @ 3.68 g/t Au from 103 metres | 2m @ 38.7 g/t Au from 73 metres 3m @ 23.5 g/t Au from 123 metres |

TKB0285 | 47m @ 2.67 g/t Au from 97 metres | 16m @ 5.03 g/t Au from 126 metres |

TKB0292 | 41m @ 2.21 g/t Au from 47 metres | 7m @ 9.61 g/t Au from 47 metres |

TKB0301 | 10m @ 7.37 g/t Au from 65 metres | 1m @ 28.8 g/t Au from 67 metres |

TKB0306 | 10m @ 5.03 g/t Au from 152 metres , and 13m @ 3.75 g/t Au from 165 metres | 1m @ 43.2 g/t Au from 154 metres 1m @ 37.1 g/t Au from 165 metres |

Balance of assays from recent Tunkillia 'Phase 1' upgrade drilling expected during December 2025 and January 2026, with updated JORC (2012) Mineral Resource Estimate by March 2026

ADELAIDE, AU / ACCESS Newswire / December 1, 2025 / Barton Gold Holdings Limited (ASX:BGD)(OTCQB:BGDFF)(FRA:BGD3) ( Barton or Company ) is pleased to announce first assay results from recent drilling at its South Australian Tunkillia Gold Project ( Tunkillia ). These assays confirm broad new intervals of high-grade gold mineralisation which infill the central portion of Tunkillia's S1 'Starter Pit', emphasising the high-value nature of this zone to Tunkillia's development.

Full details are contained in the complete announcement, which can be accessed on the ASX website, the investor section of Barton's website, or directly by clicking here .

Commenting on the new Tunkillia assay results, Barton Managing Director Alexander Scanlon said :

"Tunkillia's S1 pit contains the project's highest grade mineralisation, ideally located in a shallower, central zone. Modelling indicates that this will yield over 200,000 gold ounces, generating over

"This early phase of upgrade drilling was therefore designed to further de-risk this profile by infilling higher-grade mineralisation to underwrite project finance. These results very much appear to support that objective, and also highlight the potential for the Tunkillia system to host very high grades within key structural features.

"We expect the balance of Phase 1 infill drilling assays by January, and are targeting the conversion of Tunkillia's 'S1' and 'S2' optimised open pit mineralisation to JORC 'Measured' and 'Indicated' categories by March 2026."

Authorised by the Managing Director of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

Competent Persons Statement

The information in this announcement that relates to Exploration Results for the Tunkillia Gold Project (including drilling, sampling, geophysical surveys and geological interpretation) is based upon, and fairly represents, information and supporting documentation compiled by Mr Marc Twining BSc (Hons). Mr Twining is an employee of Barton Gold Holdings Ltd and is a Member of the Australasian Institute of Mining and Metallurgy Geoscientists (AusIMM Member 112811) and has sufficient experience with the style of mineralisation, the deposit type under consideration and to the activity being undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves" (The JORC Code). Mr Twining consents to the inclusion in this announcement of the matters based upon this information in the form and context in which it appears.

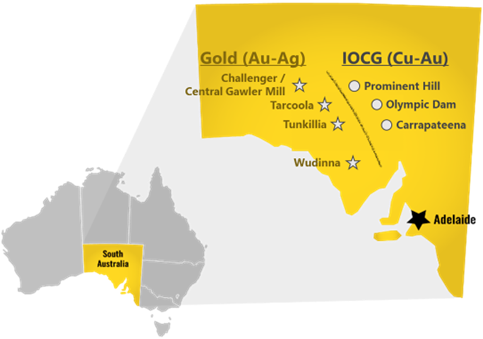

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 2.2Moz Au & 3.1Moz Ag JORC Mineral Resources (79.9Mt @ 0.87g/t Au), brownfield mines, and

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy ( AusIMM ), Australian Institute of Geoscientists ( AIG ) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 ( JORC ).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (above 215mRL) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (below 90mRL) | Mr Dale Sims | AusIMM / AIG | Fellow / Member |

Wudinna Mineral Resource (Clarke Deposit) | Ms Justine Tracey | AusIMM | Member |

Wudinna Mineral Resource (all other Deposits) | Mrs Christine Standing | AusIMM / AIG | Member / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au . The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. In accordance with ASX Listing Rule 5.19.2, the Company further confirms that the material assumptions underpinning any production targets and the forecast financial information derived therefrom continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

* Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 8 September 2025. Total Barton JORC (2012) Mineral Resources include 1,049koz Au (39.7Mt @ 0.82 g/t Au) in Indicated category and 1,186koz Au (40.2Mt @ 0.92 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

1 Refer to ASX announcements dated 18 September, 29 October and 25 November 2025

2 Refer to ASX announcement dated 5 May 2025 and ASX LR 5.19.2 disclosure detailed on the final page of this announcement

SOURCE: Barton Gold Holdings Limited

View the original press release on ACCESS Newswire