CreditRiskMonitor Announces Third Quarter Results

Rhea-AI Summary

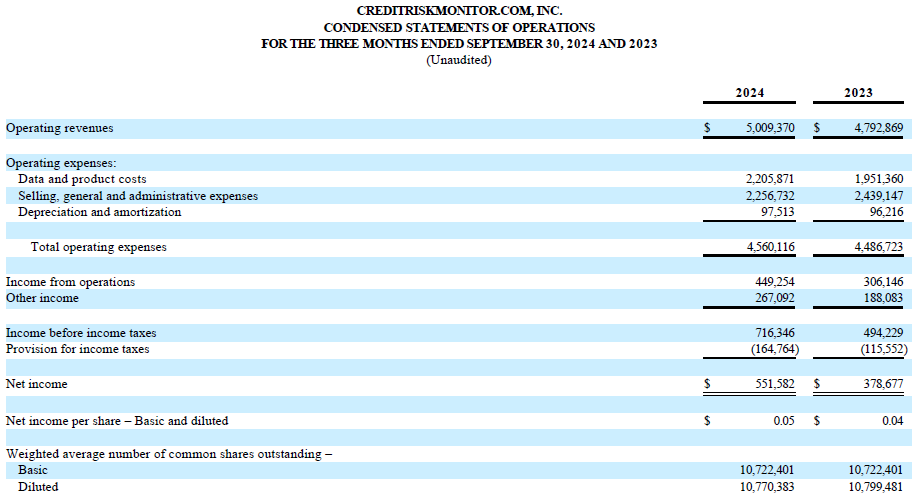

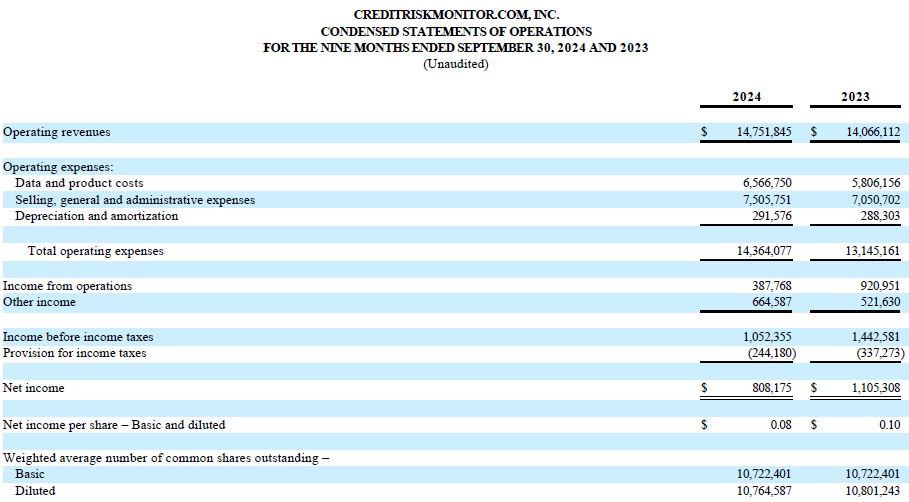

CreditRiskMonitor (OTCQX:CRMZ) reported Q3 2024 operating revenues of $5.0 million, up 5% year-over-year, with pre-tax income reaching $716 thousand, an increase of $222 thousand compared to Q3 2023. The improved profitability was attributed to reduced salary expenses, lower customer acquisition costs, and increased interest income.

The company expects short-to-medium term profitability to decrease due to increased investments in data, technology, and employee upskilling. Their SupplyChainMonitor™ platform continues to gain new clients and was recognized as a top provider of financial risk analytics by Spend Matters. The company is also enhancing its news systems with new natural language techniques to improve content tagging and analysis.

Positive

- Revenue increased by 5% YoY to $5.0 million in Q3 2024

- Pre-tax income grew by $222 thousand to $716 thousand in Q3 2024

- Reduced operational costs through decreased salary expenses and lower customer acquisition costs

- Recognition as top provider by Spend Matters in Fall 2024 SolutionMap rankings

Negative

- Expected decrease in profitability in short-to-medium term due to increased spending

- Higher expenses anticipated for data, technology, and employee training investments

News Market Reaction

On the day this news was published, CRMZ gained 2.53%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VALLEY COTTAGE, NY / ACCESSWIRE / November 14, 2024 / CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) reported operating revenues of

Mike Flum, CEO, said, "We continue our optimization initiatives to achieve higher efficiency for our teams. While our operating results have improved quarter over quarter, we still expect lower profitability in the short-to-medium term as we increase spending for data, technology, and employee upskilling. We expect these investments will support higher revenue growth and higher profitability in the long term.

Our Confidential Financial Statements Solution continues to receive positive feedback from prospects and customers as it gains momentum. We are making minor tweaks to the process based on user input as we refine product market fit. The add-on helps to address the private company coverage problem without resorting to the firmographic/technographic models used in thin file situations, which we feel provide a false sense of security.

We also continue to gain new clients for our SupplyChainMonitor™ platform and were excited to be rated as a top provider of financial risk analytics for supply chain risk management and third-party risk management by Spend Matters in their Fall 2024 SolutionMap rankings. There is a clear need for financial risk analysis in supply chain management and the movement from one-time onboarding checks to more robust continuous monitoring supports our value proposition.

Finally, we are working to improve our news systems with new natural language techniques to support better content tagging, fewer duplicated stories, and clear materiality to our subscribers. These steps will further support extracting more useful signals from news, improving our reports and counterparty relationship identification. Ultimately, this data will aid our long-term ambitions to offer lower-cost digital twin models leveraging our analytics to surface financial risk contagions within n-tier supply chains.

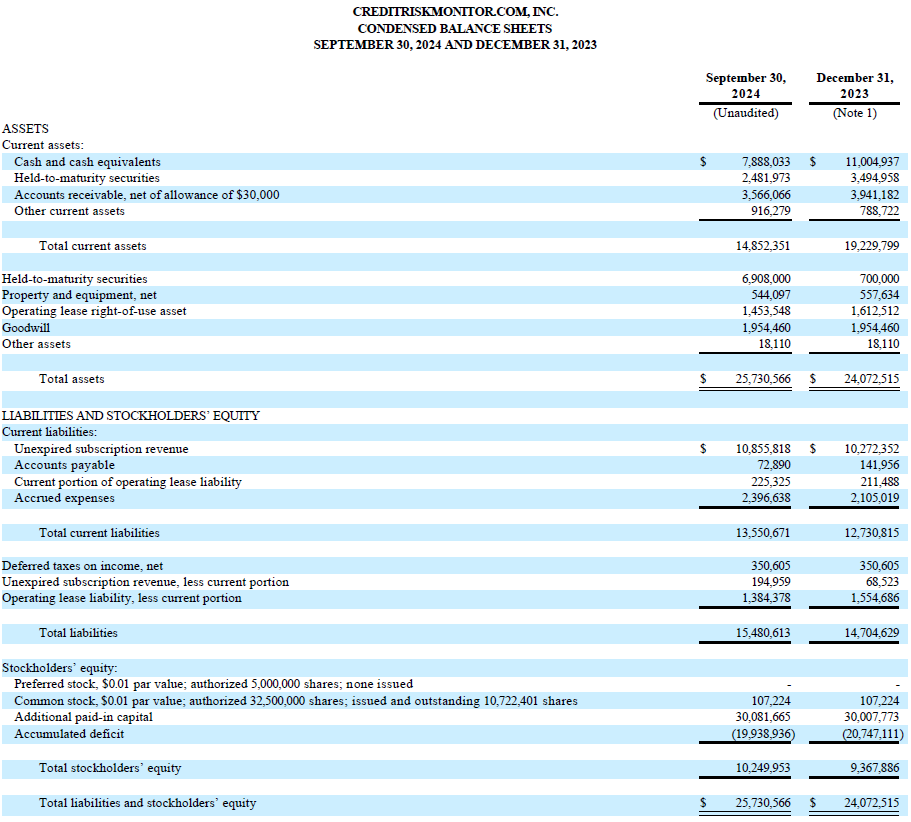

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor (creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. The products help corporate credit and supply chain professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively.

The Company's newest platform, SupplyChainMonitor™, leverages its financial risk analytics expertise to create a risk management solution built specifically for procurement, supply chain, sourcing, and finance personnel involved in the supplier lifecycle, risk assessment, and ongoing risk monitoring. Users can assess counterparty risks at the aggregate and granular levels under a variety of categories including geography and industry, as well as customized, customer-specific configurations. The platform features mapping capabilities with real-time weather/natural disaster event overlays as well as customizable news notifications, reports, and charts.

Our subscribers, including nearly

The Company, through its Trade Contributor Program, receives confidential accounts receivables data from hundreds of subscribers and non-subscribers every month. This trade receivable data is parsed, processed, aggregated, and finally reported to summarize the invoice payment behavior of B2B counterparties, without disclosing the specific contributors of this information. The Trade Contributor Program's current trade credit file processes approximately

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, CEO & President

(845) 230-3037

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View the original press release on accesswire.com